What Is USDH?

USDH is Hyperliquid’s planned native stablecoin designed to capture yield revenue for the Hyperliquid ecosystem. It will be created through a competitive bidding process where external issuers compete to build and manage the token.

Key Takeaways

-

USDH is Hyperliquid’s planned native stablecoin, designed to replace the platform’s heavy reliance on bridged assets like USDC and capture hundreds of millions in annual yield revenue for its own ecosystem.

-

A high-stakes “bidding war” is underway, where at least six major stablecoin issuers (Paxos, Ethena, Frax, Sky, Agora, and Native Markets) are competing for the right to issue USDH. The winner will be chosen by a stake-weighted validator vote.

-

The competition includes different approaches to stablecoin design, ranging from regulated, institution-focused models (Paxos) to decentralized, community-governed alternatives (Frax, Sky) and innovative synthetic dollar mechanisms (Ethena).

-

Revenue sharing is the key differentiator, with most bidders pledging to return 95-100% of the yield generated from USDH’s reserves back to the Hyperliquid community, primarily through buybacks of its native HYPE token.

-

The outcome could establish new precedents for how DeFi protocols integrate and monetize stablecoins, potentially marking a shift in the competitive dynamics of the stablecoin market.

Introduction: Why Is Hyperliquid Launching a Stablecoin?

In the decentralized finance (DeFi) landscape, Hyperliquid has emerged as a significant player. As a decentralized exchange (DEX) built on its own Layer 1 blockchain, it has combined the performance characteristics of centralized exchanges with the self-custodial benefits of decentralized systems. The platform holds approximately 70% of the decentralized perpetual futures market share, with monthly derivatives trading volumes approaching $400 billion and monthly revenues exceeding $100 million.

However, this success has been built upon a significant dependency. The platform’s liquidity consists overwhelmingly of external stablecoins, with an estimated $5.6 billion in total stablecoin deposits, 95% of which is Circle’s USD Coin (USDC). This reliance creates three strategic challenges for the protocol.

First is the issue of value leakage. The massive pool of USDC on Hyperliquid is invested by its issuer, Circle, into yield-bearing assets like U.S. Treasuries. The revenue generated from these reserves flows entirely to Circle, with no economic benefit returning to the Hyperliquid ecosystem that created the demand for that capital.

Second is the matter of sovereignty and risk. By building its foundation on a centralized, permissioned asset like USDC, which can be frozen at the issuer level, Hyperliquid exposes itself to potential censorship risk. This creates tension with its goal of fostering a permissionless and decentralized financial system.

Third, a bridged stablecoin introduces additional bridge security risks. USDC is mitigating this by issuing native USDC on Hyperliquid and enabling CCTP (cross-chain transfer protocol which allows transfer of USDC across different blockchain networks without requiring bridging or liquidity pools) after the Hyperliquid team announced USDH.

The decision to launch a native stablecoin represents a strategic pivot. By reserving the USDH ticker, Hyperliquid is moving to create its own native asset designed to internalize the value generated by its ecosystem. This initiative aims to transform the platform from a venue for capital into an economy with its own native currency, where the profits from the ecosystem’s money supply support its own growth.

Introducing USDH

USDH is the official ticker reserved by the Hyperliquid protocol for its future native, dollar-pegged stablecoin. It is designed to serve as a “Hyperliquid-first, Hyperliquid-aligned, and compliant” asset that will function as a core component of the platform’s liquidity and economic model.

Unlike a typical stablecoin project, the final form of USDH—its backing mechanism, governance structure, and revenue model—is not predetermined. Instead Hyperliquid has initiated a competitive bidding process, inviting external teams and established stablecoin issuers to submit proposals for the right to build and manage USDH. The specific characteristics of USDH will be defined by the proposal that wins the community’s approval.

The Selection Process: Validator Vote and Market Impact

The process for selecting the issuer of USDH represents a significant governance event in Hyperliquid. Instead of a top-down decision from the protocol’s founders, the winner will be chosen through a transparent, on-chain vote by the network’s validators. This stake-weighted vote, beginning on September 11 and ending on September 14 2025, is designed to ensure the outcome aligns with the long-term economic interests of the ecosystem’s stakeholders. To maintain neutrality, the Hyperliquid Foundation has pledged to abstain from voting.

While the on-chain vote will be conducted by the network’s validators, the Hyperliquid team encourages users to refer to their validator’s vote decision from September 11 onwards and to switch/redelegate their staked HYPE to a validator that aligns with their vote before September 14. This way, users can make sure that their staked HYPE is weighted towards their preferred USDH issuer in this on-chain vote.

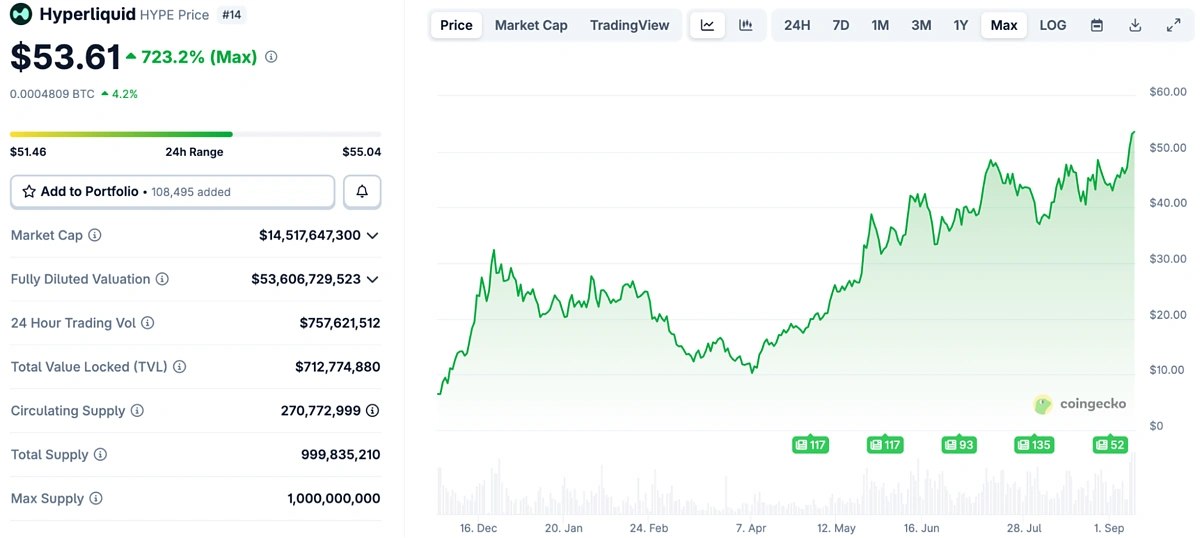

The stakes of this competition are substantial. The winning bidder will gain stewardship over a potential liquidity base of more than $5.5 billion and the revenue it generates. The intensity of the competition has had a direct impact on Hyperliquid’s native token, HYPE. As contenders compete for validator support, they have made increasingly generous proposals centered on using USDH reserve revenue to buy back HYPE on the open market, causing the token’s price to reach repeated all-time highs.

Market Implications

The move poses a direct challenge to incumbents, particularly Circle’s USDC. Hyperliquid’s current holdings of approximately $5.5 billion in USDC represent about 7.5% of the stablecoin’s total circulating supply. A successful migration to USDH could result in a revenue loss for Circle estimated between $150 million and $220 million annually, based on current yield rates on reserves.

In response to this potential disruption, Circle has announced plans to deploy native USDC and its Cross-Chain Transfer Protocol (CCTP) on Hyperliquid, signaling its intent to compete to retain its market share on one of DeFi’s most important venues.

This competitive dynamic represents a shift in the stablecoin market structure. Previously, centralized issuers like Tether and Circle maintain control over 100% of the yield generated from their reserves. In Circle’s case, they pay a significant share of their yield to Coinbase, their distribution partner, which has raised eyeballs for other distributors of USDC.

The Hyperliquid process has created a competitive environment where issuers must offer a generous portion—or even all—of their revenue back to the host ecosystem to win selection. This reframes stablecoin issuance from a product into a service, where providers must compete on their alignment and value proposition to the underlying platform.

However, in spite of the seemingly adverse implications for USDC on Hyperliquid, the Hyperliquid foundation has stated that they intend to continue to support external stablecoins like USDC, with no intentions of phasing out other non-USDH stablecoins.

The Contenders: Six Approaches to USDH

Thus far, six major contenders have entered the race, each presenting a distinct approach to USDH implementation.

|

Bidder |

Proposed Backing Mechanism |

Revenue Share Model |

Key Differentiators/Incentives |

|

Paxos |

Fiat-Collateralized (U.S. T-bills & Repos) |

95% of interest to HYPE buybacks & ecosystem |

GENIUS/MiCA compliant; institutional scale; zero-fee migration; PayPal ecosystem integrations |

|

Ethena Labs |

Synthetic (USDtb, backed by BlackRock’s BUIDL) |

95% of net revenue to HYPE buybacks & ecosystem |

$75M-$150M incentives; launch of hUSDe; validator “guardian network” |

|

Frax Finance |

Fiat-Collateralized (frxUSD, backed by BUIDL) |

100% of Treasury yield passed through to users |

DeFi-native ethos; zero take-rate; inherits multichain infrastructure |

|

Sky |

Overcollateralized (Crypto & RWAs) |

4.85% direct yield to all USDH holders |

$8B balance sheet; 7-year track record; $2.2B instant liquidity (PSM) |

|

Agora (includes Agora’s institutional stablecoin infrastructure, Rain’s global card and on/offramp coverage, and LayerZero’s interoperability) |

Fiat-Collateralized (U.S. T-bills & Repos) |

100% of net revenue to HYPE buybacks/fund |

Neutral coalition (VanEck, MoonPay); no L1 conflict; $10M seed liquidity |

|

Native Markets |

Fiat-Collateralized (via Stripe Bridge) |

50% to HYPE buybacks, 50% to development/fund |

Hyperliquid-native team; deep ecosystem knowledge |

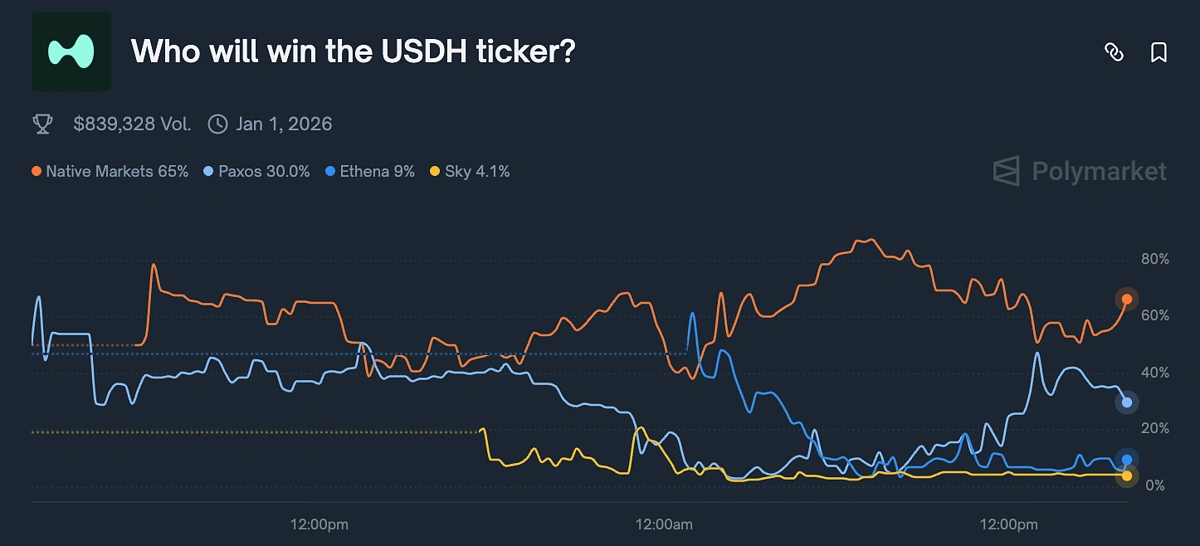

At time of writing, based on Polymarket, Native Markets is leading with 66%, followed by Paxos at around 30%.

Paxos: The Regulated Institutional Approach

Paxos, a New York-based and regulated financial technology firm, has submitted a proposal centered on compliance and institutional scale. Handled by its Paxos Labs division, the bid promises a USDH that complies with major global regulatory frameworks, including the U.S. GENIUS Act and Europe’s MiCA. Paxos leverages its experience working with financial institutions like PayPal, Mastercard, and Bank of America.

Under its proposal, 95% of the interest generated from USDH’s reserves—held in U.S. Treasury bills and repurchase agreements—would fund buybacks of the HYPE token. Paxos also commits to providing a zero-fee migration path from USDC to USDH and seeding initial liquidity pools.

Paxos has also announced PayPal ecosystem integrations, listing HYPE on PayPal/Venmo, USDH free on/off-ramps, $20 million ecosystem incentives, and global payment integrations. Paxos also promises to take nothing until they reach $1B in TVL, with their take capped at 5% post $5B TVL.

Ethena Labs: The Synthetic Dollar Implementation

Ethena Labs, the issuer of the synthetic dollar USDe, has submitted a comprehensive proposal. It proposes a USDH backed entirely by USDtb, a stablecoin linked to BlackRock’s BUIDL tokenized fund.

Ethena pledges to return 95% of net reserve revenue to the Hyperliquid community through HYPE buybacks and ecosystem funding. Beyond revenue sharing, its proposal includes a $75 million ecosystem incentive fund that could scale to $150 million, coverage of all USDC migration costs, and the launch of a Hyperliquid-native synthetic dollar called hUSDe. To address centralization concerns, Ethena suggests creating a “guardian network” of elected Hyperliquid validators to provide oversight for USDH operations.

Frax Finance: The Community-First Model

Frax Finance offers a proposal based on decentralized finance principles. It plans to back USDH on a 1:1 basis with its own stablecoin, frxUSD, which is collateralized by U.S. Treasuries through institutional partners including BlackRock and Superstate.

The centerpiece of Frax’s proposal is its revenue model: 100% of the underlying Treasury yield would be passed through programmatically and on-chain to Hyperliquid users, with zero fees retained by Frax. If selected, USDH would inherit the existing multichain infrastructure of frxUSD via FraxNet, providing immediate interoperability.

Sky (formerly MakerDAO): The Established Protocol

Sky, formerly known as MakerDAO, brings seven years of operational history and an $8 billion balance sheet. Its proposal would make USDH function similarly to its existing stablecoins, DAI and USDS, backed by a diversified and overcollateralized pool of crypto assets and real-world assets (RWAs).

Rather than revenue-sharing through HYPE buybacks, Sky offers a direct yield of 4.85% to all USDH holders on the Hyperliquid platform—a rate that exceeded U.S. T-bill yields at the time of the proposal. Sky’s advantages include its operational track record through multiple market cycles and deep liquidity, including $2.2 billion in USDC within its Peg Stability Module (PSM) for instant USDH redemptions. The proposal includes a $25 million investment to bootstrap DeFi growth on Hyperliquid.

Agora: The Coalition Approach

Agora, a stablecoin infrastructure startup backed by institutional players like VanEck and MoonPay, has proposed a coalition-based approach. Under this plan, Agora would manage on-chain issuance, while partners like Rain would provide regulated global fiat on-ramps and LayerZero would ensure cross-chain interoperability.

Agora commits to returning 100% of net revenue from USDH reserves (after custodial fees) to the Hyperliquid ecosystem through HYPE buybacks or platform funding. The proposal positions Agora as a neutral, “Hyperliquid-aligned” partner and pledges to seed a minimum of $10 million in initial liquidity.

Native Markets: The Ecosystem-Native Option

Native Markets, founded by prominent Hyperliquid community advocate Max Fiege, proposes utilizing Stripe’s stablecoin payment processor, Bridge, as the issuer for USDH.

The revenue-sharing model proposes a 50/50 split of reserve income, with half dedicated to HYPE buybacks and the other half allocated to platform development and the Assistance Fund. The primary strength of this bid is the team’s understanding of the Hyperliquid ecosystem.

However, the proposal has faced community resistance due to concerns about ceding control to Stripe, a major fintech player developing its own L1 blockchain, Tempo, which critics view as creating potential conflicts of interest.

USDH and the Stablecoin Ecosystem

The choice of issuer will define USDH’s fundamental characteristics and position it within the spectrum of existing stablecoins. Depending on the winning proposal, USDH could resemble a regulated, fiat-backed token like USDC; a decentralized, overcollateralized asset like USDS; or an innovative, crypto-native synthetic dollar like USDE.

|

USDH |

USDC |

||||

|

Backing Mechanism |

TBD (Fiat or Synthetic) |

Fiat-Collateralized |

Fiat-Collateralized |

Delta-Neutral Synthetic |

Crypto/RWA Overcollateralized |

|

Primary Reserve Assets |

TBD (T-bills, BUIDL, or Crypto) |

Cash, T-bills, Repos, Loans, BTC, Gold |

Cash & U.S. T-bills |

Staked ETH, BTC & Short Futures |

ETH, USDC, Tokenized RWAs |

|

Yield Generation |

Passed to ecosystem/holders |

Issuer profits from reserves |

Issuer profits from reserves |

Staking rewards & funding rates |

Stability fees & RWA |

|

Decentralization Level |

TBD (Issuer or DAO) |

Centralized Issuer |

Centralized Issuer |

Protocol-managed (reliant on CEXs) |

DAO Governed |

|

Regulatory Approach |

Decentralized; DAO-governed |

Opaque; faces global scrutiny |

Regulated; frequent audits |

Crypto-native; seeks compliance |

Decentralized; DAO-governed |

Risks and Considerations

While the launch of USDH presents a significant opportunity for Hyperliquid, it is not without risks. The choice of issuer is critical, as each brings a unique set of potential challenges and historical baggage.

-

Issuer-Specific Risks: Validators must weigh the historical track records of each bidder.

-

Paxos faced a Wells notice from the SEC regarding its BUSD stablecoin, though the action was later dropped.

-

Sky (as MakerDAO) has been criticized for perceived centralization in its governance, and its protocol suffered from oracle failures during the March 2020 market crash.

-

Ethena Labs has faced questions around foundation token usage, and its synthetic model carries funding rate risks that have drawn comparisons to the failed Terra/UST.

-

Frax Finance‘s earlier, more algorithmic models were known for volatility, and its governance structure has been described as complex.

-

-

Centralization and Alignment: A central concern has been the risk of misaligned incentives. Community resistance to the Native Markets proposal stemmed from concerns about giving control to Stripe, a potential competitor.

Moreover, concentrating issuance of the platform’s native currency in a single entity creates potential points of failure, and Ethena’s proposed validator “guardian network” attempts to address this through distributed oversight.

-

Liquidity Migration: Moving billions of dollars in liquidity from an established asset like USDC to a new USDH presents technical and adoption challenges. This could lead to liquidity fragmentation, user experience issues, and trader resistance.

Success depends on smooth and incentivized migration processes, which bidders like Paxos have addressed through zero-fee transitions and liquidity seeding commitments.

-

Regulatory Uncertainty: While many proposals aim for compliance with emerging frameworks like the U.S. GENIUS Act and EU’s MiCA, the global regulatory environment for stablecoins continues evolving.

Future legislation could impose new requirements on reserve composition, yield-sharing mechanisms, or issuer licensing that could impact the chosen USDH model’s viability.

Final Thoughts

The creation of USDH represents a significant development for Hyperliquid and provides insights for the broader DeFi industry. It demonstrates how leading protocols are working to achieve economic sovereignty, capture a larger share of value generated by their ecosystems, and build more sustainable economic models.

The outcome of the validator vote will indicate the priorities of the Hyperliquid community regarding the balance between institutional compliance, decentralized governance, and innovative financial mechanisms. The competitive bidding process has already influenced stablecoin market dynamics by establishing expectations that stablecoin issuers must actively compete on alignment and value-sharing rather than simply providing stable assets.

Regardless of which proposal wins, the process has created new precedents for how protocols can approach stablecoin integration and monetization. The story of USDH represents an important development in the ongoing evolution of decentralized finance infrastructure and governance.