This article is brought to you and written by FBS.

Ethereum is no longer just crypto — it’s becoming Wall Street’s foundation. From staking to tokenization, the rotation has begun. Peter Thiel is already in. Are you?

Peter Thiel Invested in Ethereum

Peter Thiel made The Wall Street Journal’s headlines. His Founders Fund owns 7.5% of ETHzilla, a biotech company turned Ethereum treasury, and 9.1% of BitMine Immersion Technologies, another firm that has adopted an Ethereum treasury strategy, and he leads a pack of investors piling millions of dollars into Ether (ETH). For billionaire Peter Thiel, that sum is pocket change, but what matters isn’t the size of the trade but the signal: one of Silicon Valley’s sharpest visionaries sees Ethereum as the next big platform.

Thiel is no ordinary investor. As part of the legendary PayPal Mafia, he has a record of spotting paradigm shifts early. He was among the first to back Facebook, he co-founded Palantir, and over a decade ago he called Bitcoin “digital gold” while most of Wall Street laughed it off as a geek fantasy.

His playbook is simple: step in where others hesitate and back the infrastructure of the future. Today, that’s Ethereum — not just a cryptocurrency, but a foundation where Wall Street could launch its next wave of financial products, from ETFs to tokenized bonds. And that’s where the real story begins.

This isn’t just another trade. It’s a marker. If Thiel is paying attention, it means smart money is positioning Ethereum as Wall Street’s platform of choice.

Ethereum as a “Crypto Bond”

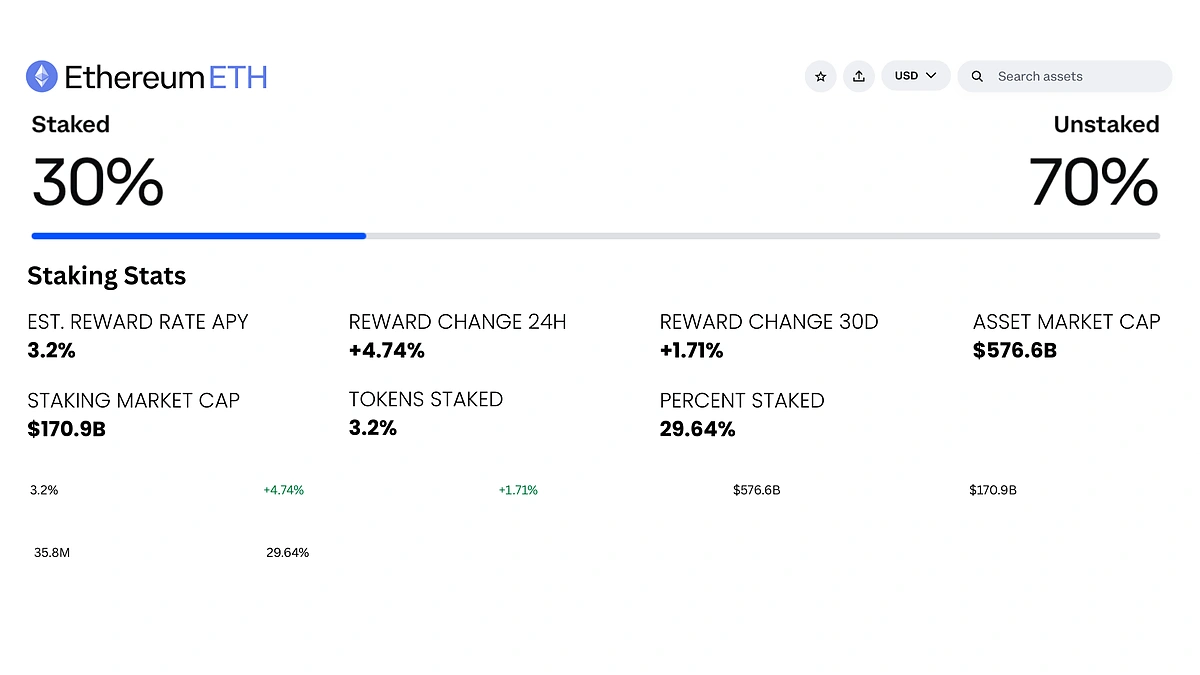

Ethereum has evolved far beyond being just another digital asset — it behaves more like a yield-bearing instrument, something Wall Street instinctively recognizes. Over $170 billion worth of ETH is staked, representing nearly 29% of supply. In return, validators and staking providers earn a yield in the 3–4% range annually.

This dual profile—capital gains plus cash flow—is precisely what funds, pensions, and asset managers are built to evaluate. They can model and benchmark it the same way they do with bonds or dividend-paying equities. That makes ETH not just a speculative token, but an asset class that can underpin ETFs, derivatives, and structured products.

In effect, staking has transformed Ethereum into Wall Street’s first crypto bond—a foundation for Wall Street’s next generation of financial products. But bonds alone don’t move markets—they need rails. And that’s where Ethereum’s Layer 2 explosion comes in.

Layer 2: The Operating System for Web3

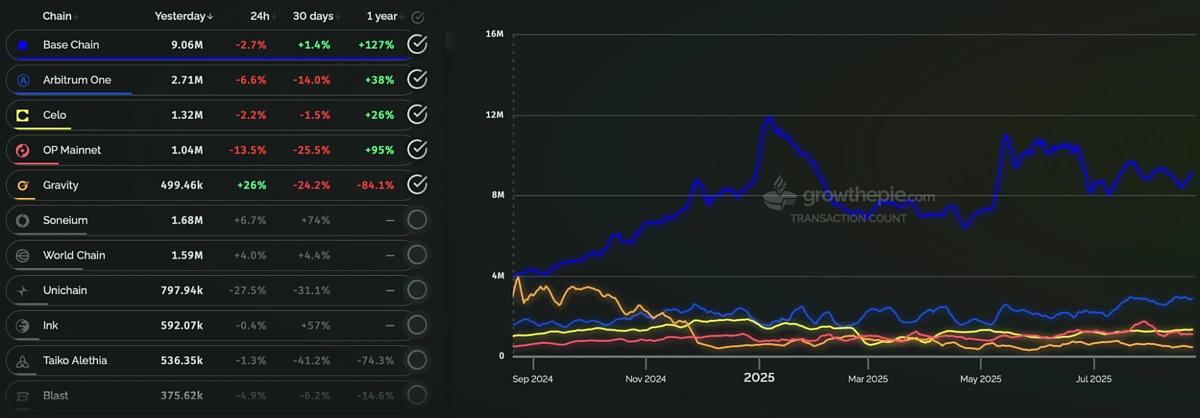

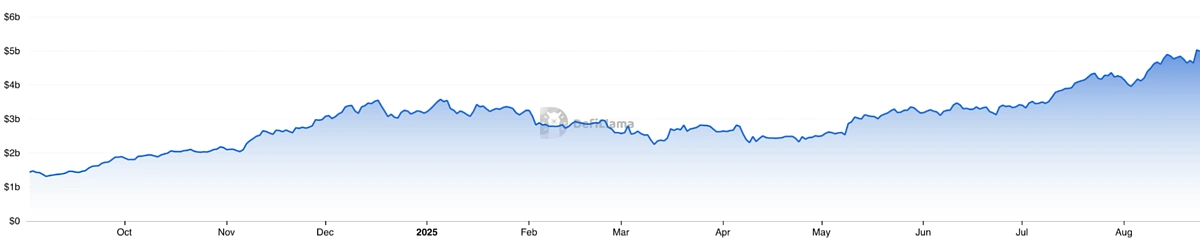

Ethereum’s strength isn’t just yield — it’s scale. Over the past two years, the network has become the backbone of a booming Layer 2 ecosystem that already dwarfs the base chain. L2s now process 12-14 million transactions a day, compared to just over a million on mainnet, and total value locked has surged past $39 billion across Arbitrum, Optimism, and Coinbase’s Base.

This growth isn’t speculation—it’s adoption. Users and liquidity are moving onto faster, cheaper layers while still relying on Ethereum for security. The result is low-cost throughput with institutional-grade trust—not an experiment, but a financial operating system.

Coinbase’s Base network has grown more than 350% since last year, with roughly $5 billion in total value locked. It proves the point: a Nasdaq-listed exchange building its own rails on Ethereum can onboard millions of users. If Coinbase is already scaling here, the leap to Wall Street launching structured products and tokenized assets on the same foundation has become inevitable.

And that’s exactly what traditional finance needs: global rails where products can launch, settle instantly, and scale without layers of costly intermediaries. Legacy systems can’t deliver that. Ethereum—powered by Layer 2s—already does.

ETFs: Ethereum Becomes the “Second Must Have Asset”

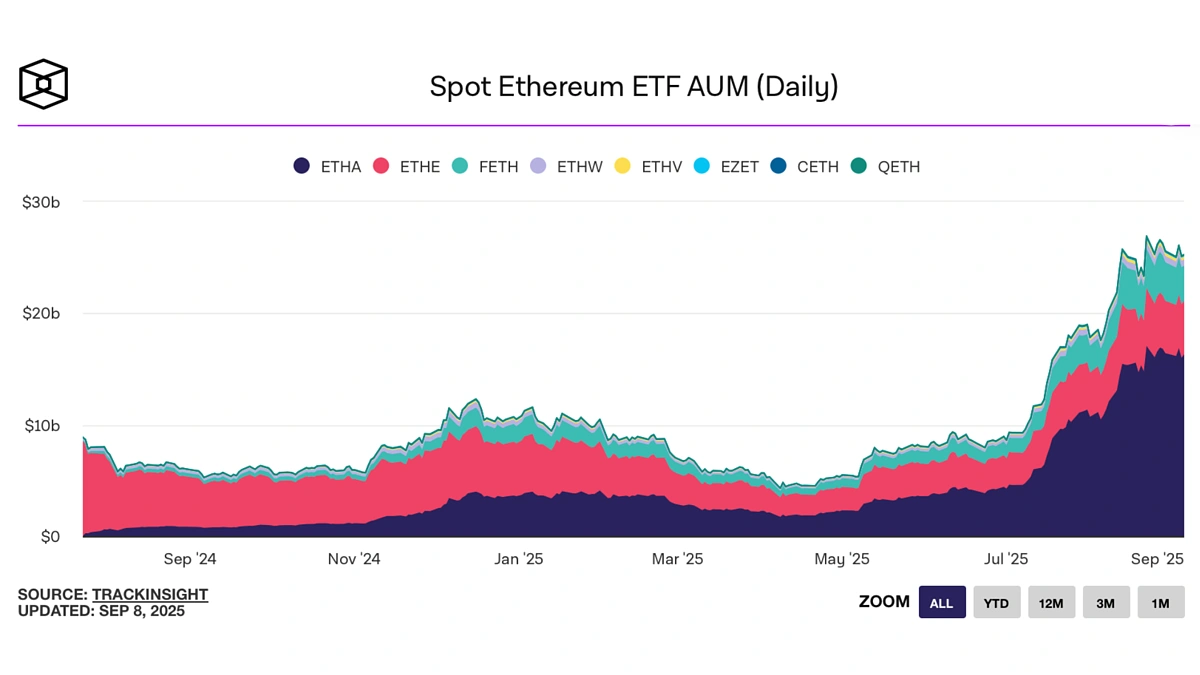

The approval of spot Ethereum ETFs in May 2024 has changed the landscape. In the first year, these funds attracted nearly $30 billion in daily assets under management, making ETH the first altcoin to secure a permanent place on Wall Street’s product shelf. But the real story isn’t just the money coming in — it’s who is buying. These ETFs are not just driven by retail traders chasing the next pump, but also by funds, pensions, and asset managers allocating long-term capital.

That matters because ETFs are the institutional entry point. Once Wall Street can hold ETH in a regulated wrapper, the next step is obvious: build more complex products on top of it. With futures and options already expanding, ETFs open the door to structured notes, derivatives, and yield-linked products.

In other words, ETFs are just the beginning. If Bitcoin ETFs confirmed BTC as “digital gold,” Ethereum ETFs position ETH as the infrastructure for the next generation of financial products—the platform for tokenized bonds and on-chain funds. The natural next step? Full-scale tokenization of real-world assets.

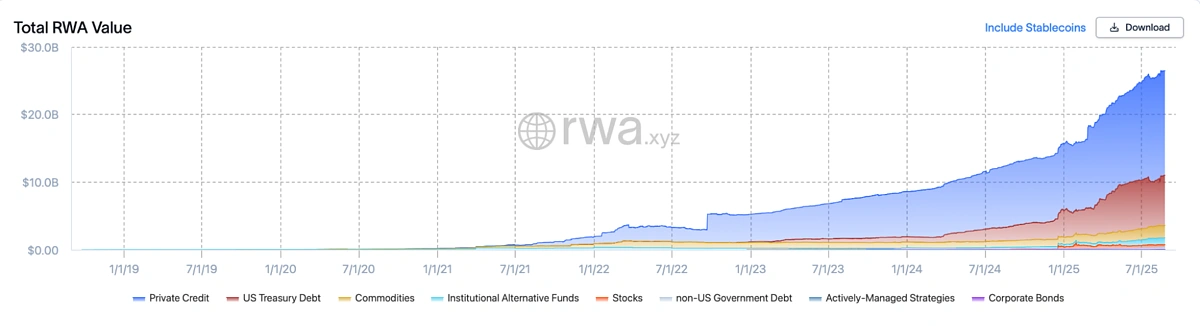

Tokenization: A $24B & Counting Market

If ETFs were the first step, tokenization of real-world assets (RWA) is the endgame—a market that has already crossed $24 billion. Major players like BlackRock, JPMorgan and Citigroup are already building or piloting token platforms—and much of these assets exist on Ethereum. By mid‑2025, the on-chain RWA space is dominated by Ethereum, which captures over half of the tokenized value, including treasury instruments and tokenized gold.

This isn’t crypto theater—it’s capital markets going digital. Traditional finance is not just experimenting with blockchain; it’s moving its core products—bonds, private credit, funds, equity—on-chain.

Ethereum, with its security, scalability, and developer ecosystem, is quickly emerging as the de-facto platform for real-world finance. Once the base layer is secured, capital doesn’t sit still—it rotates. The question for traders is simple: where does it flow next?

Where Capital Flows Next

Ethereum is now securing its place with Wall Street—through staking yields, Layer 2 scale, ETFs, and tokenized assets. But markets never stand still. Once ETH is established as the anchor, capital inevitably rotates further out the curve. That’s why the clearest opportunities now lie in the projects most directly plugged into Ethereum’s growth: scaling rails like Arbitrum, institutional middleware like Chainlink, and yield infrastructure like Lido.

Here are top 3 altcoins to watch after ETH:

Arbitrum (ARB)

The top Layer 2 on Ethereum by Total Value Secured of over $10B and processing volumes that rival mainnet. For institutions, ARB is one of the scaling rails that turns Ethereum into a platform ready for DeFi and tokenization at scale.

ARB is breaking out of its $0.25–0.50 base after retesting the long-term downtrend. RSI is climbing, showing momentum. A clear breakout above $1.23 would confirm reversal and unlock multi-month upside, opening the way to $2.00–2.40.

Chainlink (LINK)

The backbone of real-world asset tokenization, powering bank pilots and BlackRock’s tokenized treasuries. For institutions, LINK is the middleware that connects Ethereum to traditional finance.

LINK is pressing the upper boundary of its multi-year triangle. RSI is rising but still below overbought, leaving room to run. A breakout above the trendline could be the catalyst for LINK’s long-awaited re-rating, pointing first to $38–40, then $50+.

Lido (LDO)

The largest staking protocol on Ethereum with nearly a third of all staked ETH. For institutions, LDO is a pure play on Ethereum’s “crypto bond” economy and yield generation.

LDO has broken out after months of compression near $1.00. RSI is firm but not overbought, suggesting continuation. With ETH staking demand rising, LDO looks primed to outperform as leverage on the ‘crypto bond’ trade. If momentum holds, targets are $2.00 and $3.00–3.50.

Together, ARB, LINK, and LDO form the first wave of rotation beyond ETH. If Ethereum is the anchor, these tokens are the sails catching the wind.

Conclusion

Peter Thiel’s bet on Ethereum is more than a trade—it’s a signal. A visionary who spotted Facebook, Palantir, and Bitcoin early is now pointing at ETH as the foundation for Wall Street’s next financial era. And the evidence is all around: staking yields, exploding Layer 2 scale, ETF inflows, and the first wave of tokenized assets.

Miss this rotation, and you don’t just miss Ethereum—you miss the cycle.

Disclaimer: The opinions expressed in this article are the author’s own and do not necessarily reflect the views of CoinGecko. This content is for informational purposes only and should not be construed as financial, investment, or any other form of advice. CoinGecko does not guarantee the accuracy or completeness of the information presented and is not liable for any decisions made based on this content.