Table of Contents

Trading non-fungible tokens (NFTs) can be fun, but it can also be frustrating. If you’re trying to day-trade NFTs like you would other digital assets, there’s a good chance you’ve experienced the pains of poor timing, lack of liquidity, and more.

The amount of liquidity you need—as well as the time spent waiting for locked-up liquidity to unlock—can cost you valuable opportunities. (And a bear market can make things feel even harder.) It’s not good for the whole NFT ecosystem either, since the present state of NFTs makes the markets much more liquidity-inefficient.

Say hello to Sudoswap, the first liquidity-efficient NFT marketplace to run on an automated market maker (AMM) model on Ethereum. We’ll explain what this all means, and how you can benefit, in the sections below.

Let’s get started.

What is Sudoswap?

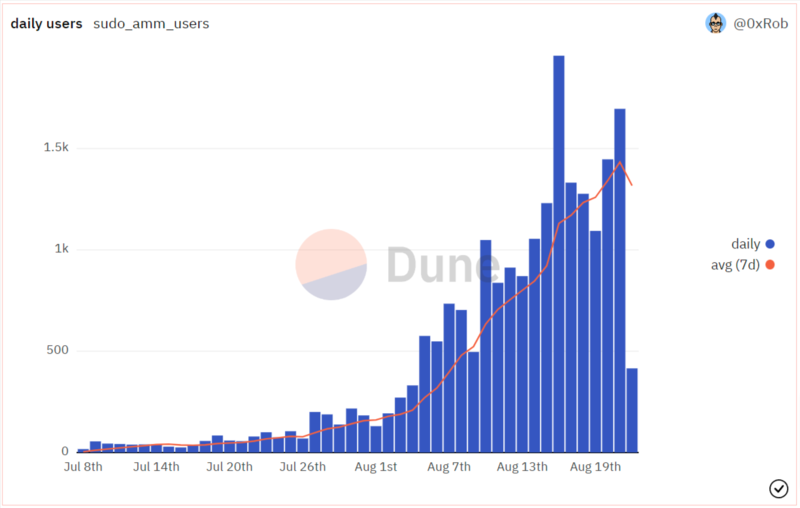

Launched by anonymous developer 0xmons and co-founder StateLayer, Sudoswap is the first decentralized marketplace to offer swaps between NFTs and ETH. And Sudoswap just launched in July 2022, so as the figure of daily users below shows, the growth trajectory has been nothing short of remarkable. It also does say something about the need for such financial instruments on-chain.

© 0xRob | Dune Analytics

© 0xRob | Dune Analytics

0xmons describes the NFT decentralized exchange (DEX) as a “capital-efficient, gas-optimized base-layer protocol for NFT liquidity”. That’s quite a mouthful, so let’s break it down. We’ve already covered capital efficiency. Gas optimization translates to minimal fees for users, and the base layer refers to Ethereum’s Layer 1. That wasn’t so bad, right?

But why do we need Sudoswap in the first place? At present, NFT marketplaces operate based on an order book model. That’s how traditional centralized exchanges run as well. Although these traditional marketplaces purport to offer decentralized services, they actually don’t. And since none of the data is on-chain, they suffer from downtime, as well as a lack of transparency.

On top of being on-chain, Sudoswap offers several other important benefits. We discuss them below.

What are the Benefits of Using Sudoswap?

© Sudoswap

© Sudoswap

1. Sudoswap is on-chain.

We touched on this earlier, but let’s flesh out the implications. What’s really awesome about this benefit is that literally anyone can create a website and display NFTs that are listed on the crypto exchange. And in doing so, they promote further decentralization. (If the marketplace goes down, there will always be other proxy websites you can access. Therefore, the marketplace is never truly “down”.)

Living on-chain also facilitates participation by on-chain collectives including DAOs and multisig groups. Finally, an on-chain marketplace is less subject to censorship of any kind, a vital principle among many blockchain adherents.

2. Users are subjected to minimal fees.

Sudoswap charges a fee of only 0.5%, which is routed to the Sudo treasury. (You can check the treasury wallet here.) Users can also execute bulk purchases and sales of their NFTs, thereby saving heaps on gas.

3. Users have many options available.

Say you list an NFT at a specific price, say 1 ETH. Then the floor price surges, say to 2 ETH. Congratulations. Your NFT was purchased at a massive discount. Sudoswap can help you avoid such shortcomings by adjusting your selling price automatically based on its floor price.

What else can you do?

You can create buy and sell pools based on customizable bonding curves. (More on this later.) Lastly, Sudoswap users can earn platform fees by providing both ETH and NFTs. (Passive income, baby!)

Let’s take a closer look at how Sudoswap works below.

How does Sudoswap Work?

Sudoswap offers several services for NFT users. But the ingenuity behind the platform is that 0xmons looked at what was already working in DEXs, and extended the model to include NFTs.

That’s why Sudoswap lets users use liquidity pools to buy and sell NFTs. Specifically, users can provide liquidity to pools to earn trading fees. Users can also create pools configured to buy or sell specific NFT collections along custom bonding curves. Note that a pool is created and run by a sole liquidity provider.

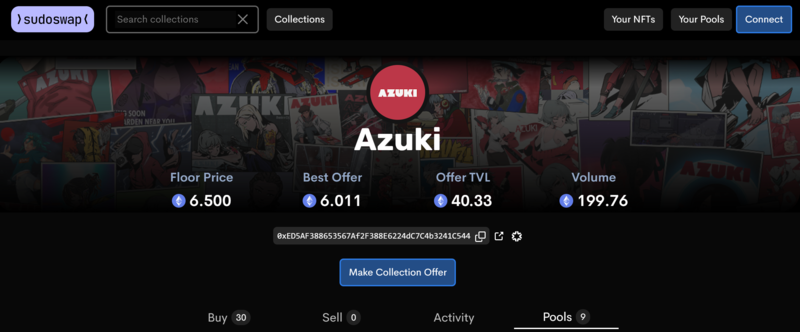

Let’s use the popular Azuki collection as an example to look at bonding curves. Upon browsing Sudoswap’s collections, under the blue “Make Collection Offer” button, you’ll notice a tab labeled “Pools” on the lower-right-hand side.

© Sudoswap

© Sudoswap

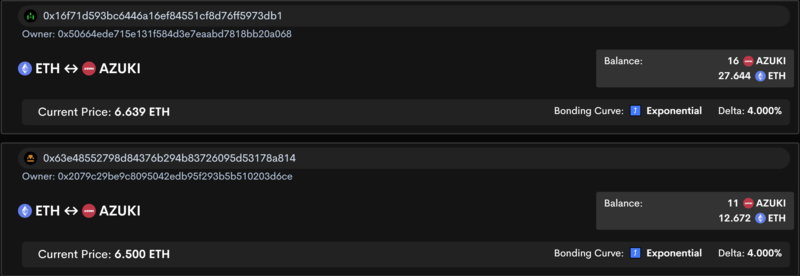

Once you click on it, you’ll be presented with a list of different pools. Let’s use the top pool as an example. The top pool balance is 16 Azuki NFTs, with 27.644 ETH. The current price of an Azuki NFT in the pool is 6.639 ETH. The swap fee is 2.5% (i.e., the percentage of the total value of the NFT the user earns every time an NFT is bought or sold).

© Sudoswap

© Sudoswap

The delta is 4%, which means every time someone buys an Azuki NFT from the pool, the price decreases by 4%. Conversely, every time someone sells an Azuki NFT from the same pool, the price adjusts automatically, increasing by 4%.

Pretty straightforward, right?

Users can create three types of pools: Sell-only, buy-only, and liquidity pools for earning platform fees.

Say you have 5 NFTs, but you don’t want to list them all at the floor price, since some of them are not floor NFTs. In that case, you can create a pool where the price adjusts according to how you’ve configured it. Doing so enables you to exit an NFT collection on autopilot, without having to check prices all the time.

If you want to create a buy-pool instead, you can load the pool up with ETH, and set your purchases on a bonding curve. This way, the price decreases with every purchase, and you can dollar cost average into an NFT position, sweeping at the price ranges you’ve preset.

By the way, if you were wondering whether Sudoswap has a governance token, the token is XMON. And since Sudoswap is a decentralized trading protocol, a governance token only makes sense. Sure, most projects actually don’t need one, even if they are decentralized. (Just because you can have a project token doesn’t mean you should have one, right?) Time will show us how these tokens will add valuation and further utility to the project.

Sudoswap: An Issue for Creators?

Sudoswap isn’t without its fair share of criticisms. Let’s discuss creator royalty payments for a sec. How is Sudoswap able to provide these low fees to its users? The platform eliminates creator fees (!). See, despite what you might have read, creator royalties aren’t actually baked into smart contracts.

Do you see the problem? When creators are forced out of the picture, we’re not in web3 anymore. We’re back in web2. Some critics have convincingly argued that removing creator fees will have detrimental effects down the line. And it’s hard not to take this point seriously.

Frank, the respected anonymous founder of the DeGods NFT project on Solana, had something to say too.

NFT royalties shouldn’t exist because it’s “the right thing to do”.

It is simply the best alignment of incentives between founders & holders (right now).

If you want to remove royalties, that’s fine. Just don’t be mad when mints become more expensive and more projects rug, lol.

— Frankⓨ (33.3%) (@frankdegods) August 14, 2022

Removing creator fees while attempting to capture platform fees empowers the platform, not the creator. Whatever our thoughts on the matter, it will be interesting to see how this issue develops further.

Step-by-step Guide to Using Sudoswap

There are many ways to use Sudoswap, so let’s start from scratch.

- Head over to Sudoswap.

- Connect your wallet at the top-right corner.

- Click on “Your Pools”.

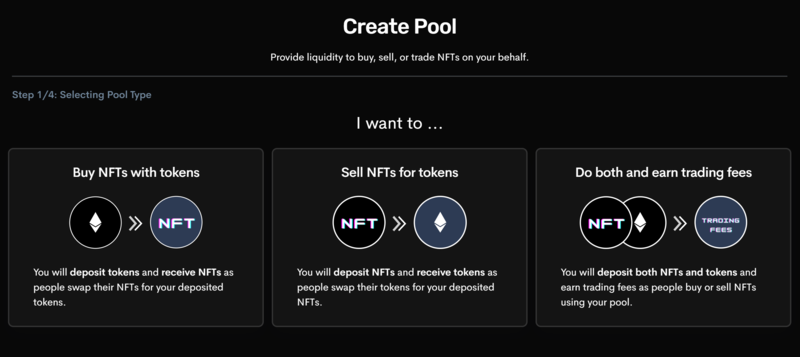

- On a new page, click on “Create New Pool”. At this point, you’ll be presented with several options.

These options are to…

- Buy NFTs with tokens

- Sell NFTs for tokens

- Do both and earn protocol fees

© Sudoswap

© Sudoswap

Clicking on any of the options will take you to a new page. For the token, only ETH is currently available. When the time comes to select an NFT, you may select only NFTs you already hold in your wallet.

On the next page, you set up your pool. Here, what you should pay special attention to are the Bonding Curve and the Delta. The Bonding Curve is either Linear or Exponential, Linear being denoted in ETH, and Exponential being denoted as a percentage value. The Delta connotes the amount of change in price per NFT sold or bought.

In the final step, all you need to do is review your information and then click “Create Pool”. That’s it. You’re done.

If anything, Sudoswap is incredibly user-friendly and intuitive. And its ingenuity is partially in its simplicity. Instead of reinventing the wheel, the platform took what was already working with DEXs and applied the same model to NFTs.

Conclusion

© Sudoswap

© Sudoswap

Sudoswap has experienced tremendous growth since launching its NFT marketplace in July 2022. And it’s showing no signs of slowing. With the rapid proliferation of its NFT pools, combined with its removal of creator fees, Sudoswap is already having a noticeable impact on the ecosystem.

Whether the cumulative effect will be positive or negative remains to be seen. One thing is for sure though: Sudoswap has done wonders for NFT liquidity and for empowering NFT collectors.

To learn more about NFTs, check out the top tips to get early access to NFT drops!