Table of Contents

Key Takeaways:

-

Optimism is a scaling Layer 2 solution for Ethereum and works by using optimistic rollups, with around $850 million in TVL.

-

Optimism helps end-users access Ethereum’s dApps with cheaper transactions and a smoother user experience.

The Ethereum Merge has finally taken place. It’s now time for us all to join hands, rejoice, and breathe a breath of fresh air… or so we thought. Then the world watched as the ETH price crashed. And instead of becoming deflationary, the ETH supply actually went up, up, up and away!

But that’s the least of Ethereum’s problems, when one remembers that Scalability is the reason all these upgrades are necessary in the first place. Amid all this chaos, how can one remain optimistic?

With all this going on, it’s hard to stay an optimist these days. But when we look at Layer 2 solutions, we feel slightly better. Today, we look at one of the most popular Layer 2 blockchains: Optimism.

Ready to read all this and turn that frown upside down?

What is Optimism?

Source: Optimism

Optimism is a Layer 2 solution for Ethereum, the most popular Layer 1 blockchain for building dApps. Ethereum, the first blockchain to launch with smart contracts, can get slow and expensive. But we’ll get into that a bit more in the next section.

For now, know that Optimism is a scaling solution for Ethereum, and is a separate blockchain running on top of it. Optimism’s mission? To help end-users like ourselves access Ethereum’s dApps with cheaper transactions and a smoother user experience.

According to DefiLlama, Optimism currently ranks #8 for the most popular chains by TVL, with roughly $850 million locked in. (Aave dominates nearly 50% of this impressive figure.)

Now let’s look at why Ethereum needs Optimism—or any other Layer 2 solution—in the first place.

Scaling Ethereum with Optimism

Source: Ethereum.org

Ethereum was born with a sacrifice; her name was Scalability. In exchange, Ethereum was granted the gifts of Security and Decentralization.

In the Ethereum whitepaper, founder Vitalik Buterin describes this tradeoff as the Blockchain Trilemma. The Trilemma posits that you can have scalability, security, and decentralization, but not all three at the same time.

So Ethereum launched purposefully with a handicap. But since Ethereum was designed on an auction-based model for blockspace, the handicap presented its own set of problems. The most prominent challenge involves network congestion, followed by spikes in user demand. Such spikes fuel bidding wars between users who wish to see their transactions executed over those of others.

Over time, it came to be accepted that Ethereum Layer 2 solutions would lead the charge in the battle for scalability. Therefore, Ethereum’s upgrades would shift focus. The mission thus changed to laying the architectural groundwork for the smooth operation of rollups on top of it.

How Does Optimism Work?

Source: Optimism

Optimism works by using optimistic rollups. These rollups were named thus because they roll up all the transactions and bundle them into a single transaction, to be executed on Layer 1. That way, Optimism’s Layer 2 blockchain inherits all the security features from Ethereum.

By the way, they’re called “optimistic” rollups for a reason. They assume—quite optimistically—that all transactions are valid until challenged and proven otherwise. This philosophical approach is how Optimism is able to provide blazingly fast transactions for its crypto users.

So what happens when a suspicious transaction actually occurs? The system has a 1-week challenge window where such transactions can be contested by running a fault proof.

Formerly known as fraud proofing, it involves running the contested state transition against those of the base layer. If the fault proof is validated, then the batch of transactions is re-run. A neat and simple scheme, no major challenges have presented thus far.

Governance: Token House and Citizens’ House

Source: Optimism

Optimism operates as a Collective, and runs its governance as a dual entity. These two faces include the Token House and the Citizens’ House. Armed with an ambitious goal, the Optimism Collective aims to align the profit motive with the incentive of making a positive impact.

The Collective believes—and rightly so—that current incentivization schemes between these two elements aren’t well aligned. That’s why the Citizens’ House has a loftier mission. This includes voting on matters that encourage greater alignment between impact and profit. In other words, the Citizens’ House votes on public goods funding decisions that encourage doing good.

In contrast, the Token House has responsibilities that involve voting on technical decisions. These include voting on future upgrades, issues, and the like. By the way, this dual governance approach isn’t fully operational just yet, and at present, remains in its proposal phase.

Optimism Tokenomics

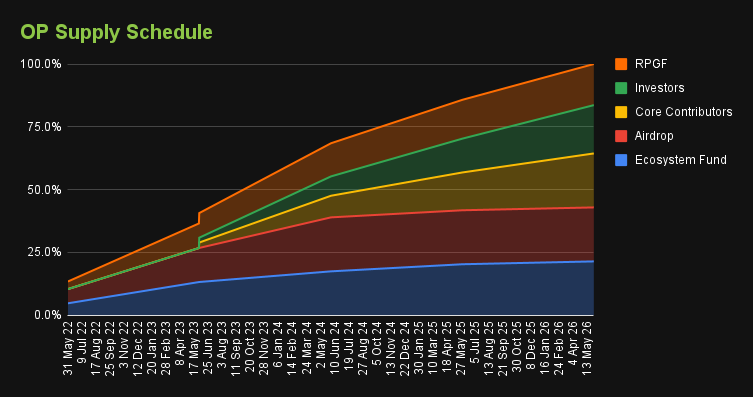

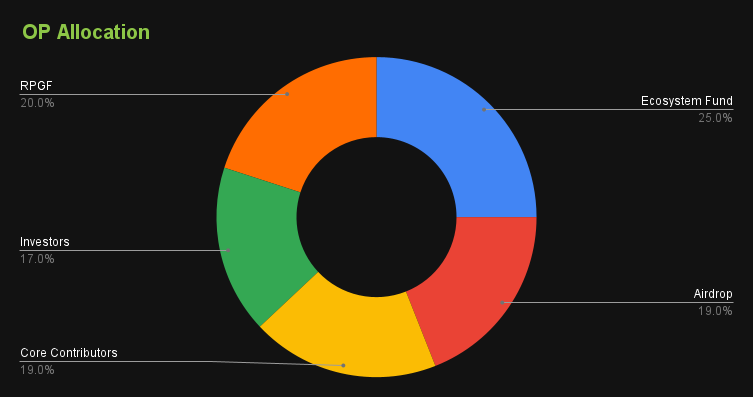

Optimism currently has a market cap of nearly US$200 million. With a total supply capped at 4,294,967,296 tokens, the circulating supply is only slightly over 214 million, with an inflationary rate of 2%.

Of that whole pie, 20% is allocated to retroactive public goods funding, 17% to investors, 19% to core contributors, and 25% to the ecosystem fund. The remaining 19% comprises airdrops, of which 5% was allocated for the first airdrop. The remaining 14% is to be retained for future airdrops.

In Year 1, 30% of this total figure was unlocked to the foundation for distribution. The remaining tokens are vested, with yearly releases planned until Year 4.

Protocols on Optimism

Source: DefiLlama

We can use DefiLlama to look at the most popular protocols on Optimism here. The Total Value Locked (TVL) dashboard shows us that the top 5 dApps on Optimism at the time of writing are…

1. Aave V3 (AAVE)

2. Synthetic (SNX)

3. Curve (CRV)

4. Velodrome (VELO)

5. Uniswap (UNI)

At present, only 70+ dApps are running on Optimism, but do keep in mind that it’s early days. It is surprising, then, that Optimism lags behind its competitors considerably. Arbitrum lags close behind with nearly 120 protocols, but Polygon wins out, boasting more than 300 protocols.

How to Start Using Optimism

Optimism couldn’t be any easier for Ethereum users to start using. In fact, Optimism is way easier to use than its competitors. Here’s an example. If you’ve already got an Ethereum address, your Optimism address is identical. Pretty cool, huh?

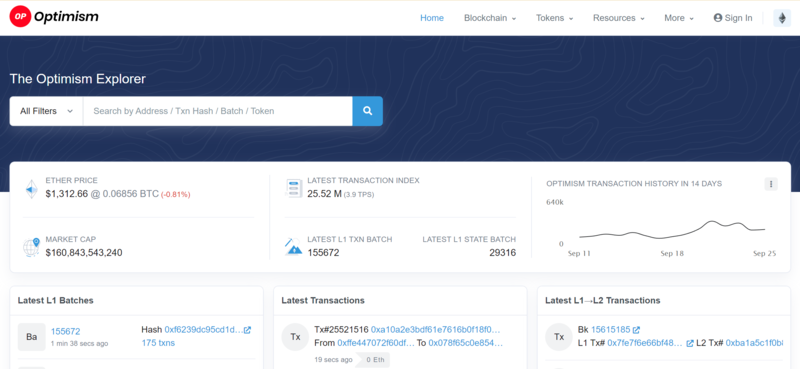

Source: Etherscan

This applies to the blockchain scanner too. Here’s Optimism’s blockchain scanner. Looks familiar, doesn’t it? If you’ve used Etherscan before, you’ll be more than comfortable navigating this interface.

By the way, Optimism already supports your favorite decentralized finance (DeFi) wallets. So let’s use MetaMask, the most popular Ethereum browser wallet for storing your digital assets. If you already have an account set up for your ETH, fantastic! You’re one step ahead.

From here, we have two options. We can…

1. Import the custom OP token

2. Visit a DeFi protocol that already supports Optimism. From here, we simply switch to the Optimism network on the website. Doing so automatically adds the network to your Metamask wallet and swaps to the network for you.

Talk about convenience!

|

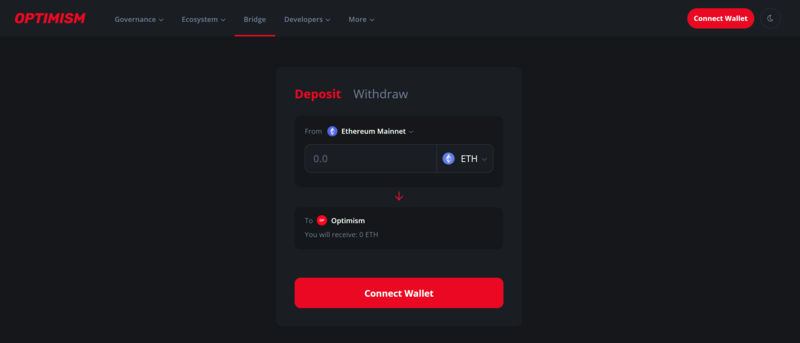

A word of caution: Optimism relies on ETH for transaction fees. That’s why you still need to load up your Optimism wallet with some ETH. This involves transferring ETH from another chain, like Ethereum mainnet. But ignore the alarm bells going off in your head right now. The Optimism bridge is incredibly easy to use, and we’ll look at a few ways to use the bridge toward the end of this guide. |

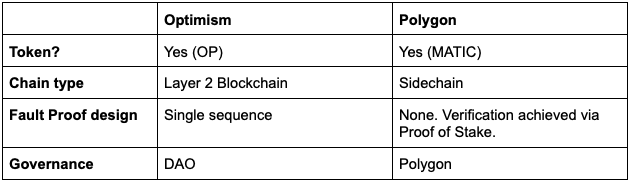

Optimism Vs. Polygon

Polygon is without a doubt the most popular Ethereum Layer 2 solution. But unlike Optimism and Arbitrum, it’s actually not its own blockchain, but a sidechain! This may strike some readers as pedantic semantics. But the differences introduce some crucial implications relating to security.

For instance, a sidechain relies on its own consensus algorithm, independent of the main chain. In this sense, Polygon doesn’t rely on Ethereum’s amazing security feature at all.

Compare this with Layer 2 solutions like Optimism and Arbitrum. Let’s recall that they are their own blockchains operating on top of Ethereum. So on their Layer 2, they bundle all their transactions and submit them as a single transaction to Ethereum mainnet’s Layer 1 for validation.

Thank you, cheaper transaction costs and faster blocks!

But let’s get back to security real quick. Since Polygon is a sidechain that does not submit its transactions to Ethereum mainnet for validation, it does not inherit the awesome security advantages of Ethereum.

But let’s not forget that Polygon has been around a lot longer as a chain. (It even has its own token, MATIC.) In fact, it’s progressed to offer many solutions under its belt. These include different types of zero-knowledge rollups and zero-knowledge (zk) proofs too.

Unlike Optimistic rollups, zk-rollups rely on a different type of cryptographic method. We won’t get into the technicalities here, but know that zk-rollups are more computationally intensive. Hence, they need more time to execute, although arguably they provide greater security, since all proofing is executed on-chain.

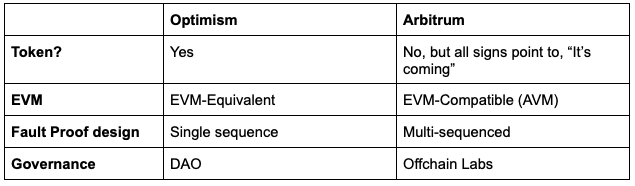

Optimism Vs. Arbitrum

Arguably a “true” alternative to Optimism, Arbitrum comes closest to Optimism as a competitor. They’re both fairly new, and they both rely on optimistic rollups. To be fair, Optimism came first. And since its rollups were open source, Arbitrum merely adopted the code and made certain improvements.

Unlike Polygon, Arbitrum and Optimism are both Layer 2 blockchains, not sidechains. Also unlike Polygon, both enjoy the advantage of being able to provide its developers with the immediate tooling inherited from Ethereum.

So what other important differences are there between these two chains?

Well, for one, Optimism has a token (OP), whereas Arbitrum does not. (Don’t worry. All signs point to “Yes, a token is coming.”)

Second, and more importantly, Optimism’s transactions are all verified on-chain. Moreover, only a single round of fraud proofing is involved. Let’s compare this with Arbitrum. The Optimism competitor uses multi-round fraud proofing, should any suspicious transactions be detected.

The implication is that gas prices on Optimism are restricted to Layer 1 limits. But for Arbitrum, since not all transactions occur on-chain, this isn’t the case.

Lastly (and this is pretty cool), Arbitrum doesn’t rely on the Ethereum Virtual Machine (EVM). Instead, it built its own, the Arbitrum Virtual Machine, which is EVM-compatible.

By comparison, Optimism is EVM-equivalent, which is no bueno. Whenever Ethereum undergoes a major overhaul to its consensus algorithm, Optimism’s state and that of Ethereum will diverge.

That’s why Optimism is currently working on becoming EVM-compatible, as Arbitrum has done. After all, doing so will provide Optimism with the same flexibility and adaptability its newer competitor enjoys.

Where to Buy Optimism

Source: Optimism

The OP token is available from a wide range of centralized crypto exchanges like CoinBase, Binance, and Gate.io. But if you’re comfortable using a bridge, then you’ve got a better option. Optimism’s bridge works seamlessly for deposits too.

For instance, let’s say you’ve already got some ETH sitting in your Metamask. If that’s the case, you can bridge your ETH directly to your Optimism network account from inside Metamask. From there, you can swap it directly for OP tokens.

I’m no math scientist, but that’s like 2 steps!

No ETH? No worries. You can click on “Fiat on-ramp” to access one of their third-party services like Transak. Transak lets you purchase ETH directly on the Optimism network. From there, you can simply swap your ETH on the bridge to OP tokens.

No fiat? No problem. Let’s say you’ve got some stablecoins. Maybe some Binance USD (BUSD) on Binance Smart Chain. Or how about some other currency on another supported chain like Avalanche?

Then we can simply repeat the process and use the bridge to swap the currency over to ETH on the Optimism network. Sure, some chains require the use of third-party services, but still. It’s highly intuitive to use, and it really doesn’t get any easier than this.

Before we close, I’d like to mention the Optimism crypto airdrop. Several people I’ve spoken to were disappointed because they missed the first user airdrop, or because the first airdrop wasn’t coordinated effectively. (People who received the airdrop dumped the tokens immediately, creating a lot of unnecessary sell pressure.)

But the Optimism team isn’t about tokenization with no purpose. In fact, the team came back and stated that they’re going to run several more rounds of airdrops.

So if you’ve been feeling all that FOMO, feel not.

More airdrops are coming. But to qualify, you have to interact with dApps on Optimism. Participating in governance voting won’t hurt your chances either.

So now that you’ve got the tokens to run around and explore protocols on Optimism, pull up your adult pants. It’s time to go explore the wonderful world of Layer 2 without hurting our wallets. And don’t forget to stay optimistic about the future of Ethereum as well as these airdrops!