Table of Contents

The mutual success of open-source blockchains, distributed data-sharing, and digital assets has demonstrated that decentralized internet protocols can profoundly improve socio-economic infrastructure. There are specialized blockchain use cases like Bitcoin (a digital currency), Zcash (a privacy token), and general smart contract networks like Ethereum, with decentralized apps (dApps) for the Ethereum Virtual Machine (EVM).

Nonetheless, these blockchains experience much friction in their operations, such as gross energy inefficiency, low performance, and ineffective governance models. Recommendations to improve Bitcoin scalability, like Segregated-Witness and BitcoinNG, are vertical solutions confined to the capacity of one physical device to verify transactions. On the other hand, the Lightning Network can improve Bitcoin’s transaction throughput by excluding some transactions from the ledger, making it unsuitable for generalized scaling needs.

The ideal solution enables parallel networks to interoperate while maintaining their security features. Evmos is a new frontier that aims to bring Ethereum apps and assets to the interoperable blockchains of the Cosmos ecosystem. This article takes you through the Evmos blockchain, how it works, the EVMOS token, and its ecosystem.

What is Evmos?

Evmos is a proof-of-stake (PoS) network that enables value transfer between Ethereum and Cosmos ecosystems. It is developed using the Cosmos software development kit (SDK). Developers can seamlessly leverage Evmos to run Ethereum smart contracts on app-specific Cosmos networks. In addition, the Cosmos Inter-Blockchain Communication (IBC) protocol empowers Evmos to link decentralized applications (dApps) on various blockchains and benefit from joint liquidity and value transfer.

Evmos makes use of Tendermint Core’s Byzantine Fault Tolerance (more on that later) to distinguish itself from other network application layers. By combining the EVM and Cosmos environments, Evmos also enables developers to create cross-chain dApps faster and more cost-effective. Generally, Evmos strives to give Tendermint developers a flawless experience when using Ethereum tools by offering them an open-source library to facilitate EVM compatibility on the Cosmos ecosystem.

The EVMOS token is vital in securing the Evmos blockchain by incentivizing network validators and developers. Apart from fueling network transactions and validation processes, EVMOS is the second asset on an EVM that facilitates network participation through governance voting. As an EVMOS token holder, you are responsible for navigating the Evmos decentralized autonomous organization (DAO) and shaping the ecosystem’s future.

How Does Evmos Blockchain Work?

Source: EVMOS

Source: EVMOS

Evmos is compatible with the Ethereum Virtual Machine (EVM). But how is this such a big deal? Well, every DeFi project would love to have a share of Ethereum-based apps. The benefits of this PoS mechanism includes faster transaction speeds, low-cost gas fees, and an extensive user base.

DeFi apps can be developed on the Ethereum blockchain due to its maturity and extensive user base, but lagging leads to high operating costs and slow transaction speeds. A layer one chain that is EVM-compatible, like Evmos, allows developers to distribute Ethereum apps to a bigger user base, further increasing the apps’ utility.

Earlier on, we mentioned that Evmos is built using the Cosmos SDK. SDK is a tool for developing PoS or Proof-of-Authority (PoA) networks. It uses a flexible framework instead of a virtual machine-oriented framework. Mastering the difference between those two frameworks will enable you to understand why the Cosmos SDK is ideal for developing interoperable, application-specific networks.

Virtual machine networks like Ethereum apply smart contracts to develop apps. While the framework is ideal for some applications, like rigid command-execution apps, it is almost impossible to build multi-layered apps. The constrained logic of smart contracts hinders the versatility and performance of apps – imagine building the White House with triangular blocks only. SDK lets developers leverage pre-built and tailor-made models and tests them before launch.

We also mentioned that Evmos leverages Tendermint Core’s Byzantine Fault Tolerance (BFT) to distinguish itself from other network application layers. BFT is the ability of a system to continue running even when some of its nodes fail or try to deceive it. The terminology is derived from a hypothetical known as the Byzantine Generals’ Problem (BGP). This hypothesis involves Byzantine generals, each with an army and a location adjacent to a stronghold. They must attack as a group or withdraw. If they make a mutual decision, they become successful. However, if there is a misunderstanding or betrayal, making some generals attack while others withdraw, then they lose the battle.

In a decentralized blockchain with several nodes like Evmos, the nodes act as generals. Therefore, Evmos can continue running even when some nodes fail or act maliciously. Currently, almost all Bitcoin wallets rely on trusted servers for transaction validation as the PoW mechanism demands waiting for multiple confirmations before a transaction becomes irreversible. Unlike such systems, Evmos provides nearly instant and secure mobile-based payment verifications, actualizing trust-minimal and practical payments on mobile phones.

EVMOS Tokenomics

In the Ethereum whitepaper, the developers describe ETH as the primary internal crypto-fuel of Ethereum for paying transaction fees. The concept of fuel is exciting from the perspective of controlling block space scarcity. However, Evmos developers felt their project would significantly improve on the idea, particularly regarding driving more participation via balanced economics.

Layer 1 (L1) chains basically have three network actors: the developers, users, and block proposers. Each plays an essential role in enhancing and preserving value for any blockchain. Generally, block proposers receive more rewards than users and developers (the most active contributors).

Evmos strives to resolve the above disparity by providing an option to the rent-seeking behavior prevalent in fat protocols. The Evmos blockchain-level rewards active participants and restructures gas fees fairly among deployers of crucial applications and developers of essential network features. The Evmos fees are priced based on blockchain use. Though its gas prices are based on EIP-1559, Evmos redeploys and puts the funds to use instead of burning them.

In a nutshell, EVMOS tokens will be used to:

-

Reward developers and other network participants for their services through an inbuilt joint fee revenue system.

-

Vote on protocol upgrades.

-

Register tokens on the ERC-20 standard for EVM-IBC integration with ERC-20s.

-

Assign use incentivizes Evmos apps.

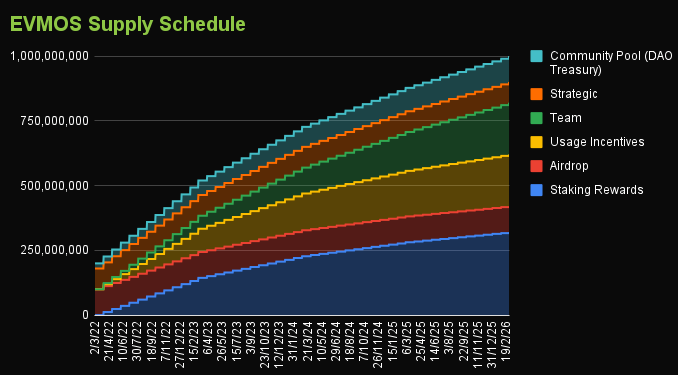

Initially, the EVMOS supply was capped at 200 million, assigned to network contributors, DAO treasury, and strategic reserve.

Source: CoinGecko

Source: CoinGecko

EVMOS is designed to be highly inflationary, with approximately 300 million tokens released within its first year. The tokens will be released using an exponential decay schedule, which minimizes inflation yearly. The project plans to issue a total of 1 billion tokens within four years in a process dubbed “The Half-Life.”

While this makes the project’s long-term theoretically deflationary, the developers see EVMOS as an asset with an uncapped supply. However, the team advises the community to vote for another token supply system after the first four years. For instance, they can recommend a linear or constant system if the rewards become too little.

The dApp Store

In Evmos, gas fees are not burned funds that merely boost the blockchain ownership shares of validators. The platform now divides fees as incentives between developers and validators for their services through an inbuilt, mutual fee revenue mechanism. This revenue mechanism/fee distribution is known as The dApp Store.

You can think of it as an app store, where some income from the app sales is allocated to the store operator and some to the developer. However, in the dApp Store, the setup is an eternal, active service where the operator leases much of the infrastructure necessary to operate a dApp.

The store incentivizes developers based on the value and impact of their dApps, instead of their capacity to accelerate a new governance token. In this regard, developers building on Evmos receive a genuine stake in the development and governance of the platform itself. Initially, the fee is split on a 50/50 basis between deployers and validators but can be changed through a governance proposal.

🔥 $EVMOS IS EVOLVING, DAPP STORE IS COMING!

The network will upgrade to v8.0.0 in 6 days and implement the 𝐟𝐞𝐞𝐬𝐩𝐥𝐢𝐭 module and the 𝐃𝐚𝐩𝐩 𝐒𝐭𝐨𝐫𝐞 – a game changer! 🤯

Everything you need to know in this thread 👇 pic.twitter.com/Q2Ymsj9I1K— Swiss Staking AG (@swiss_staking) August 23, 2022

It’s important to note that transaction costs on Cosmos blockchains are accumulated with the block distribution tokens and sent to network validators and block proposers. The block distribution does not include gas fees since they vary with network activities and gas price market.

Liquidity Mining

Evmos plans to prioritize application incentives that would boost its Total Value Locked (TVL) since that is the ideal way of driving network growth. The concept is to assign more EVMOS tokens from the usage incentives pool to a protocol where users can lock their liquidity pool (LP) positions in the form of ERC-20 tokens.

EVM holders can choose the Evmos ecosystem application, which is ideal for use in incentives farming. The model is simply a liquidity mining program connected to the base layer but governance-based (like a distributed Avalanche Rush). The pool is estimated to hold 200 million EVMOS tokens within four years. Its size is big since Evmos acknowledges network users as the pillar of its success.

Staking Rewards

As mentioned, validators and delegators are essential in safeguarding the Evmos network by proposing and validating blocks. Their functions could potentially increase to providing oracles, securing bridges, and offering roll-up services to Celestia and other Evmos side chains, making them core contributors. Initially, there were 150 active validators, but the number can be changed through a governance vote in the future.

32% of newly issued tokens are allocated to incentivizing active validators and their delegators evenly based on their EVMOS stakes. Validators impose a small fee to delegators on the staking rewards they generate on their behalf. While validators can place different commission rates, Evmos allows a minimum rate of 5%.

Governance

At a minimum, decentralized public blockchains should have a constitution and a governance system. For example, Bitcoin depends on the Bitcoin Foundation and PoW mining to facilitate upgrades, but the process is slow. On the other hand, Ethereum was divided into Ethereum (ETH) and Ethereum Classic (ETC) after undergoing a hard fork to solve the DAO hack. Typically, that’s because it lacked a social contract and mechanism for solving such weighty issues.

Evmos validators can participate in the daily running of the network by voting on proposals, including changing network parameters and spending funds from the Evmos community pool. Since Evmos uses a ‘one token, one vote’ mechanism, holders can vote on governance proposals without special consideration given to some votes. However, since delegators get the validator’s vote they are staked to if they rarely vote themselves; validators enjoy an outsized vote in a ‘one token, one vote’ model.

To participate in shaping the future of Evmos, you must be a token holder. Your voting power is directly proportional to your token holdings. Governance practices and decisions are communicated via various documents and design artefacts, such as on-chain governance proposals, architecture decision records, and technical standards.

Evmos Ecosystem Developments

Aave

Evmos deployed Aave V3 on its network to expand lending to the Evmos ecosystem and the broader Cosmos world. As mentioned, Evmos acts as a gateway to the Cosmos world for Ethereum users and other EVM chains. It achieves this through developer-focused incentives, interoperability across other Cosmos blockchains, and cross-chain composability. The tokens supported on the Aave-Evmos DEX include EVMOS, AAVE, USDT, USDC, DAI, wBTC, FRAX, and ATOM.

Cevmos

Source: Jon Charbonneau

Source: Jon Charbonneau

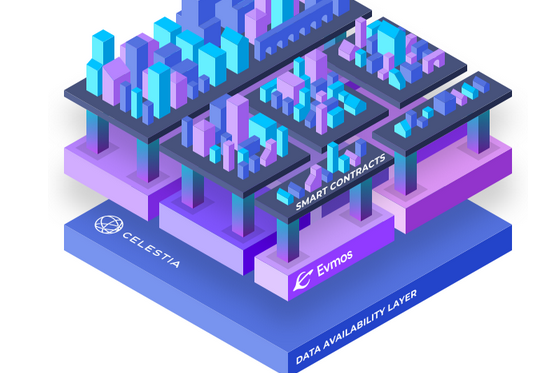

Celestia partnered with Evmos to create a settlement layer for EVM roll-ups. EVM roll-ups enable users to perform transactions off-chain at minimal transaction fees while communicating the transaction details to an on-chain consensus and information accessibility layer for security. Roll-ups give developers and consumers high throughput by performing transactions outside L1 chains, reducing congestion.

Cevmos (obtained from Celestia/EVMos/CosmOS) is an open-source, integrated stack for EVM-based apps using Celestia roll-ups. The Cevmos stack will be based on a boosted settlement chain, executed as a Celestia roll-up using Optimistic Tendermint.

The settlement chain uses Celestia as the information accessibility layer and Evmos applications (smart contracts, interoperability, composability, etc.) to offer a complete EVM-equivalent stack for interoperable smart contracts on Cosmos and EV worlds. Contrary to Ethereum Mainnet, the network is augmented exclusively for roll-ups. As such, roll-ups don’t compete for transaction fees with non-rollup activities, reducing the fees further while increasing throughput.

Final Thoughts

Evmos is championing cross-chain connectivity between the Ethereum and Cosmos worlds. By connecting the two chains, Evmos is helping users to evade the high transaction costs and network congestion afflicting Ethereum. Besides, it enables Cosmos developers to exploit the industry-leading smart contract network (Ethereum boasts the most extensive development community among the smart contract networks) with few limitations.

To learn more, check out what makes Cosmos “The Internet of Blockchains”!