What Are Real World Assets (RWA) in Crypto?

Real World Assets (RWA) refers to the process of taking tangible assets from the physical world and representing them as digital tokens on a blockchain.

Imagine owning a small piece of a high-value office building or earning interest from a U.S. government bond, all through a crypto wallet. This is the promise of RWAs – connecting the digital world of blockchain with tangible, real-world asset value, improving the accessibility of previously exclusive investments.

Key Takeaways

-

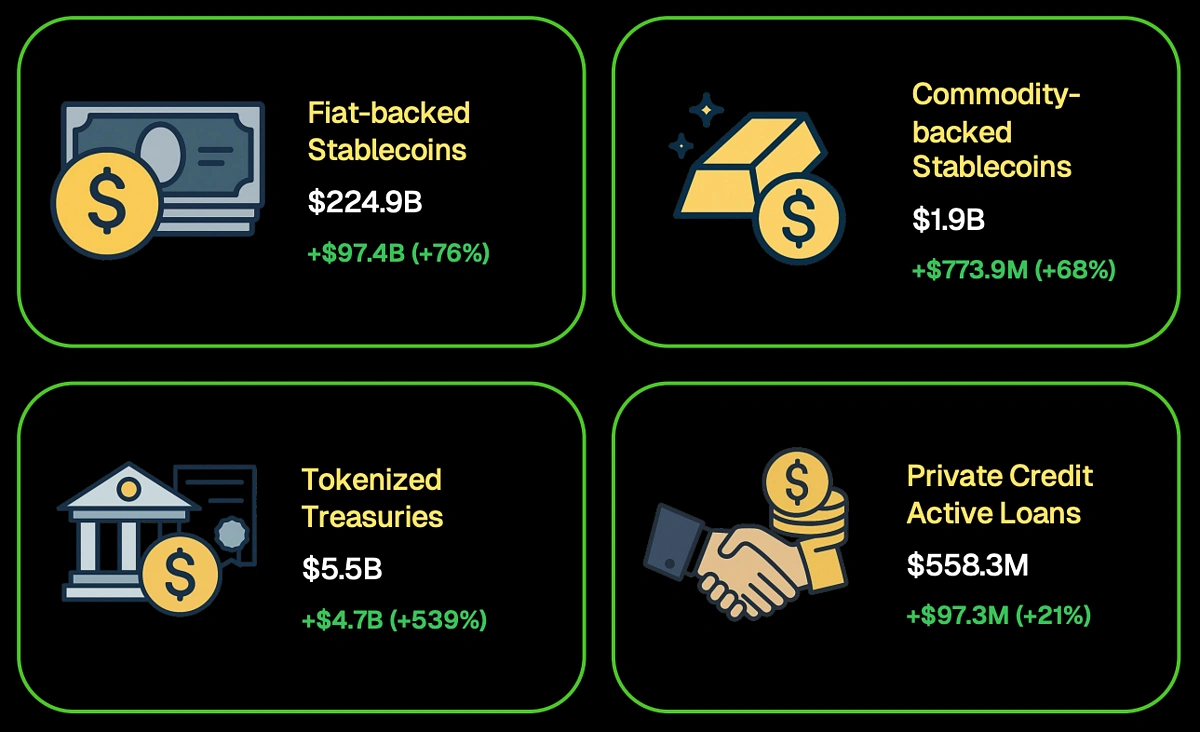

A Major, Growing Sector: Real World Assets (RWA) represent a crypto market of over $230 billion, having grown approximately 69% since 2024. The sector is dominated by fiat-backed stablecoins ($224.9 billion) and rapidly expanding tokenized treasuries ($5.6 billion).

-

Institutional Adoption is Here: Growth is being fueled by the entry of major financial institutions like BlackRock and clearer regulatory frameworks, such as Europe’s MiCA regulation and the proposed U.S. GENIUS Act.

-

Unlocking New Opportunities: Tokenization democratizes finance by offering investors access to new sources of yield from traditional assets, improving access to global investment opportunities, and enabling fractional ownership of high-value assets.

-

Significant Challenges Remain: Despite its potential, challenges facing the sector include regulatory requirements and reliance on centralized entities.

The RWA sector has evolved from a niche experiment into one of the most credible and capitalized sectors in crypto. Based on data from CoinGecko’s RWA 2025 Report, the size of the RWA market is over $230 billion.

All data points in this article are taken from CoinGecko’s RWA 2025 Report.

The bulk of this value comes from fiat-backed stablecoins ($224.9 billion), with other key categories including tokenized treasuries ($5.5 billion), commodity-backed tokens ($1.9 billion), and private credit ($558.3 million).

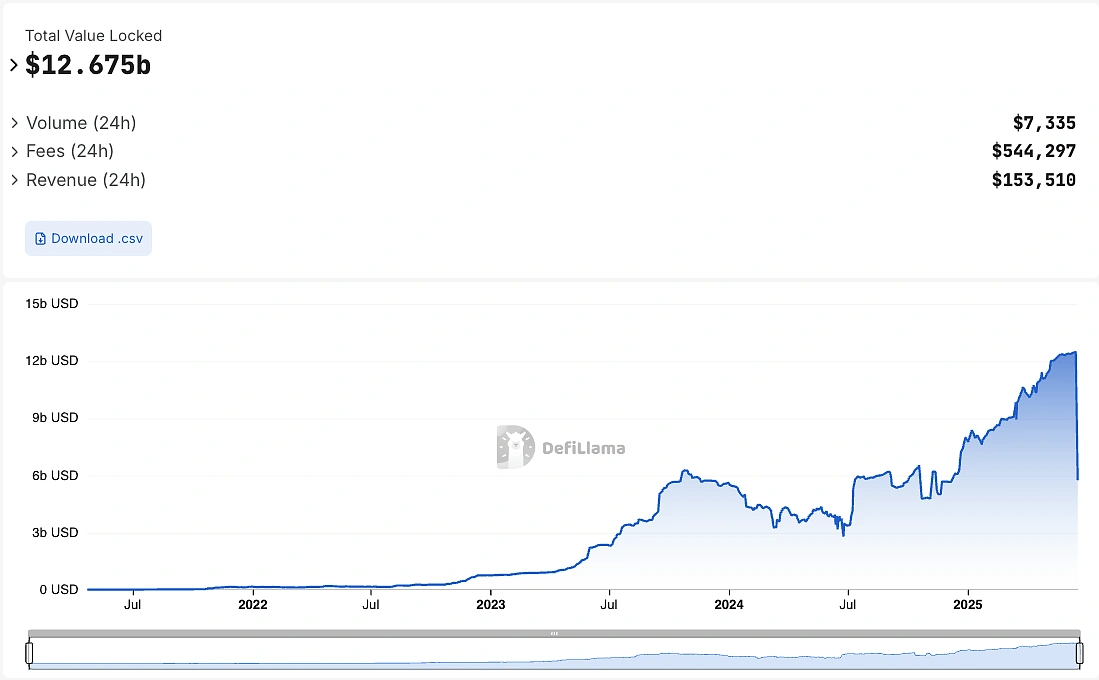

Data from DefiLlama tracking the RWA sector’s total value locked (TVL) – which represents the total value of assets deposited in RWA protocols – shows the sector on a significant upward trend, reaching a new high of almost $12.7 billion as of June 2025.

How Does Tokenization Work?

Tokenization is the process of converting ownership rights of a real-world asset into a digital token on a blockchain. While technical details vary, the process generally involves three key stages:

-

Off-Chain Structuring: To legally prepare an asset, it is first isolated within a protective legal wrapper, like a Special Purpose Vehicle (SPV). It is then overseen by a Regulated Asset Manager for compliant management and a Licensed Custodian who securely safeguards the off-chain collateral.

-

Data and Valuation: Information about the asset, including its value and legal title, is verified. This data is crucial for establishing the digital token’s value and legitimacy.

-

On-Chain Token Issuance: A smart contract is used to “mint” (create) digital tokens on a blockchain, with each token representing a share or a direct claim on the underlying asset.

Tokenizing a U.S. Treasury Bond

The market for tokenized treasuries has seen explosive growth, surging by 539% from January 2024 to April 2025, largely driven by financial institutions like BlackRock with its BUIDL fund. Here is how the process works:

-

Structuring: BlackRock, as the Regulated Asset Manager, purchases U.S. Treasury securities and places them into a dedicated fund (the legal wrapper). A custodian like BNY Mellon physically safeguards these bonds.

-

Issuance: BlackRock issues the BUIDL digital token, which represents a share in the fund and is backed by the real-world treasury bonds.

-

Yield Distribution: As the underlying bonds generate yield, that value is passed on to BUIDL token holders.

This process transforms a traditional financial instrument into a programmable and globally accessible digital asset. The success of BUIDL, which quickly captured a 45% market share, demonstrates the powerful appeal of bringing real world assets on-chain.

Types of Real World Assets

The RWA ecosystem is diverse, but most of the value is concentrated in a few key categories.

Fiat-Backed Stablecoins

Fiat-backed stablecoins are digital tokens pegged 1:1 to a real-world fiat currency, like the U.S. Dollar. They are a fundamental type of RWA because each on-chain token is directly backed by reserves held off-chain. To maintain this peg, issuers hold reserves of equal or greater value. The composition of these reserves varies; Circle (USDC) primarily uses cash and U.S. treasury bills, while Tether (USDT) also includes corporate bonds and even Bitcoin.

This is the most dominant RWA sector, with a market capitalization of $224.9 billion as of April 2025, a 76% increase since January 2024. The market is heavily concentrated on two players, with Tether’s USDT and Circle’s USDC collectively accounting for 93.5% of all issuance.

Tokenized Treasuries

Tokenized treasuries are tokens that let holders earn yield from government bonds on the blockchain. This sector’s market cap climbed by an impressive 539% since early 2024, reaching a new all-time high of $5.6 billion by April 2025. BlackRock’s BUIDL fund is the dominant force, capturing a 44% market share. Despite this growth, the number of on-chain holders remains small at around 11,000 addresses, suggesting growth is fueled by institutions and stablecoin issuers, though their appetite for such assets onchain continues to grow.

Commodity-Backed Tokens

Commodity-backed tokens are tokens backed by a physical commodity, most commonly gold. Tether Gold (XAUT) and PAX Gold (PAXG) make up 84% of this market.The market cap for these tokens grew by 67.8% since 2024 to $1.9 billion, a rise almost entirely attributed to the run-up in gold prices, as the actual supply of tokenized gold did not increase, suggesting on-chain demand has not risen.

Private Credit

Private credit protocols provide loans to real-world businesses using crypto capital, with demand largely concentrated in emerging markets. After a decline in 2022, this sector is growing again, with active loans reaching $558.3 million as of April 2025. Maple Finance has emerged as the clear market leader in 2025, holding 67% of the total active loan share among top protocols.

Tokenized Stocks and Real Estate

This category represents emerging RWA sectors with significant potential.

-

Tokenized Stocks: This sector is small, with a market cap of just $11.4 million, though it has grown nearly 300% since the start of 2024. Major exchanges have expressed interest in offering tokenized US-listed stocks, which could spur future growth.

-

Tokenized Real Estate: While large partnership deals have been announced, the data remains opaque, and there has been a lack of significant on-chain traction for these projects so far.

Benefits of Tokenizing Real World Assets

-

They Unlock New Sources of Yield: As traditional DeFi yields tend to fluctuate with crypto market cycles, RWAs like tokenized treasuries and private credit may offer new, more stable returns that are often less correlated with crypto market volatility.

-

They Increase Access for Global Investors: Tokenization democratizes access to investments like U.S. government bonds or public stocks, especially for individuals in underserved markets, by significantly lowering entry barriers.

-

They Enable Fractional Ownership: High-value assets like gold, real estate, or art can be digitally divided into affordable fractions, allowing multiple investors to hold partial ownership in an asset that was previously inaccessible.

-

They Improve Capital Access for Businesses: On-chain credit protocols create a new financing avenue for real-world businesses, particularly in emerging markets where obtaining traditional undercollateralized loans is difficult.

Challenges in Tokenizing Real World Assets

-

Regulatory Requirements Create Hurdles: As real world assets are tied to specific jurisdictions, they can come with regulatory hurdles on who can purchase / hold / redeem such tokens. For example, a protocol may require users to undergo KYC / AML checks before being allowed to redeem tokens.

-

Reliance on Centralized Parties: RWA tokens involve trusting a centralized party to properly manage the off-chain asset. For an on-chain token to be lefitimate, users must trust that the issuer is backing it up as claimed. For example, stablecoin issuers regularly issue attestations from 3rd-party auditors that verify their reserves. In the case of private credit, holders may need to rely on lawyers to conduct default proceedings if a loan goes bad.

-

Lack of Legal Precedents: The legal contracts used to assign asset rights to token holders are novel and largely untested in court. This lack of case law precedent creates uncertainty about the enforceability of these digital ownership rights, and the available course of remedial action if something goes wrong.

-

Protocol Tokens Can Be Risky Investments: Investing in the governance tokens of RWA protocols has proven risky. Despite growth in the underlying assets, the majority of RWA governance tokens delivered negative returns between January 2024 and April 2025, with most falling between -26% and -79%.

-

Demand for Other Forms of RWA Outside of Stablecoins and Treasuries Still Need to be Established: Beyond stablecoins and tokenized treasuries, it is unclear if there is strong market demand for other forms of RWAs. The average crypto trader is more familiar with assets like utility tokens, governance tokens, or even memecoins. For the RWA sector to flourish, these newer asset types must either win over existing crypto users or succeed in bringing a new base of investors on-chain.

Key RWA Trends to Watch in 2025

-

Surge in Institutional Adoption: Major TradFi institutions are entering the RWA space. BlackRock launched its BUIDL fund in March 2024, a consortium including Goldman Sachs and BNP Paribas began a pilot on the Canton Network in July 2024, and in 2025, Fidelity and VanEck shared plans to launch tokenized funds.

-

Impact of Regulatory Clarity: New regulations are providing clearer rules for the industry. Europe’s Markets in Crypto-Assets (MiCA) regulation is now in effect, and in the U.S., the GENIUS Act stablecoin bill has passed through the Senate banking committee with bipartisan support.

-

Emergence of RWA-Focused Chains: A slew of new blockchains dedicated to RWAs have been announced. These platforms, like Plume, Converge, and Plasma, aim to provide better performance and specialized features for tokenized assets.

Conclusion

Real-world assets are effectively bridging the gap between traditional finance and the on-chain world. With a market size exceeding $230 billion, led by the growth of stablecoins and tokenized treasuries, the RWA sector is emerging as a major force in crypto. The entry of institutional giants like BlackRock, coupled with clearer regulatory frameworks like MiCA and the GENIUS Act, is setting the stage for broader adoption. However, challenges remain, such as regulatory requirements and a reliance on centralized entities, along with the volatility of protocol tokens.

Ultimately, the tokenization of real-world assets holds the potential to unlock liquidity, democratize access to investments, and create a more efficient global financial system.

Frequently Asked Questions (FAQ)

-

What is the difference between an RWA and an NFT? While both exist on the blockchain, RWAs are specifically backed by an off-chain asset with verifiable value (like a bond or a building). Many NFTs, particularly in art and collectibles, have subjective value that is not tied to an off-chain asset. However, an NFT can be used as the technical “wrapper” for an RWA.

-

Is Bitcoin an RWA? No. Bitcoin is considered a native crypto asset. Its value is derived entirely from its own blockchain network, supply and demand dynamics, not from an underlying off-chain asset.

-

Are RWAs a safe investment? RWAs are generally considered to be lower risk than traditional cryptocurrencies because their value is tied to stable, off-chain assets. However, they still carry risks, including smart contract vulnerabilities, regulatory changes, and the volatility of protocol-specific governance tokens.

Disclaimer: Projects mentioned in this article are for illustrative purposes only. Always do your own research before investing in any protocol.

A previous version of this article was written by CJ.