What Are Crypto Lending Protocols (Decentralized Money Markets)?

Crypto lending platforms let users lend assets to earn interest or borrow assets by posting collateral. This article focuses on decentralized lending platforms where operations are automated via smart contracts.

Key Takeaways

-

Crypto lending platforms are decentralized money markets where users can earn interest by supplying assets to liquidity pools or borrow capital by providing collateral.

-

Operations are fully automated by smart contracts, which manage everything from loan origination and interest accrual to the liquidation of at-risk positions.

-

The lending sector dominates Decentralized Finance (DeFi), holding over 35% of the industry’s total value locked (TVL).

-

Leading protocols like Aave, Compound, and Morpho offer distinct features, but users must be aware of risks like liquidation and smart contract vulnerabilities.

What Are Crypto Lending Protocols and Why Are They Growing?

Crypto lending platforms function as non-custodial money markets that offer capital in the form of crypto assets. Unlike traditional financial institutions, these platforms are not controlled by a central administrator; instead, they leverage blockchain and smart contract technology to connect individual and institutional lenders directly with borrowers.

The mechanism is straightforward:

-

Lenders deposit their assets into shared liquidity pools, which allows them to generate passive income from the interest paid by borrowers.

-

Borrowers can then obtain on-demand loans from these pools after providing sufficient collateral, as determined by the protocol’s specific collateralization ratio.

This entire process is automated by smart contracts, which manage the custody of funds, the liquidation of at-risk loans, and the remittance of yield to lenders.

There are different types of lending in crypto:

-

Overcollateralized lending: This is the most common lending model; borrowers need to deposit collateral of a higher value than the amount borrowed, protecting lenders from defaults.

-

Undercollateralized lending: This model is often used by institutions, where loans are granted based on credit reputation or whitelisted access. Should the borrower default, the collateral will not be able to fully cover the principal.

-

Flash loans: Flash loans are undercollateralized loans that must be borrowed and repaid within a single transaction, meaning the entire process happens at once – if any step fails, the whole transaction is canceled.

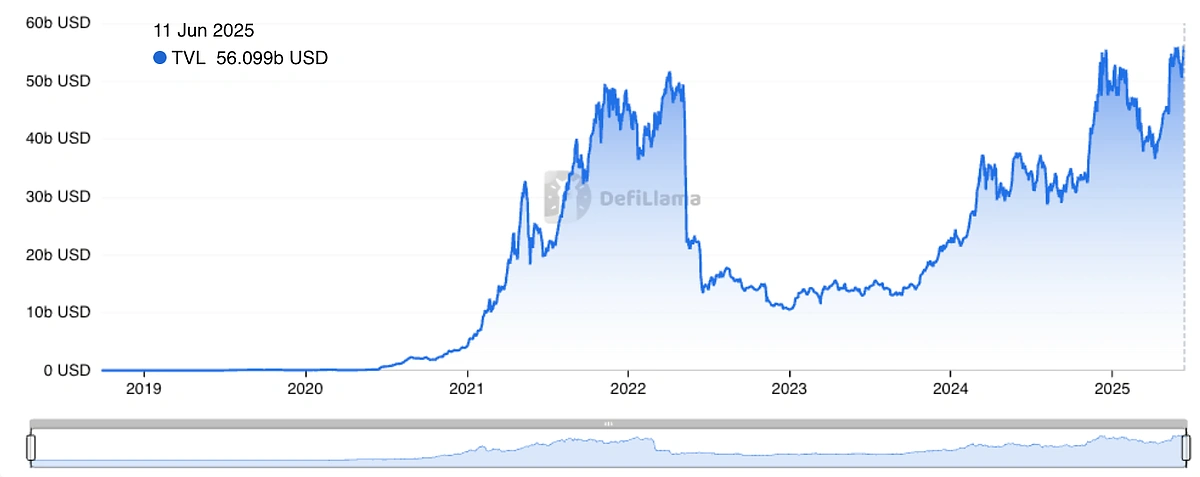

Over the years, these protocols have matured into efficient financial tools, driving significant growth in the DeFi sector. As a popular tool for both passive income and instant liquidity, the crypto lending category has become the largest in DeFi by Total Value Locked (TVL). The number of active protocols has grown to 526, with at least 170 of them holding a TVL of more than $1 million.

In June 2025, the TVL across all lending protocols reached a new high of over $56 billion, making up 35% of the total DeFi TVL according to DefiLlama data.

Risks When Using Crypto Lending Platforms

First, let’s start with the risks of crypto lending.

-

Liquidation Risk – For borrowers, if their collateral drops below the liquidation threshold, it will be liquidated and they have to pay a penalty.

-

Smart Contract Risk – If there are vulnerabilities in the smart contracts governing the protocol, these can be exploited.

-

Interest Rate Fluctuations – Yields are variable, and can change rapidly.

-

Oracle Risk – As lending platforms rely on oracles to import real-world pricing and user data to effect transactions, feed delays or poor data quality can affect loan health.

-

Regulatory Risk – Crypto lending is still in its early stages, and as regulations develop, these may affect DeFi platforms.

Choosing a Lending Protocol

When choosing a lending protocol, here’s a quick checklist of questions to consider:

-

What assets and chains are supported? The lending protocol you’ll choose likely depends on your preferred chain and assets.

-

Are the APYs sustainable, or temporarily boosted by incentives? If the APYs are too good to be true and significantly above market rates, you may want to look into them further to ensure they’re sustainable.

-

Is the protocol audited, and does it have a history of exploits? Knowing a protocol has been audited provides an extra layer of security and reassurance, as it indicates that any identified vulnerabilities are fixed.

-

What is the maximum LTV and liquidation threshold? A higher maximum LTV and liquidation threshold means you can borrow more crypto with your collateral.

Now, let’s look at the top lending protocols for 2025, listed in order of their TVL on DefiLlama. All information is based on data as of June 2025, and users are advised to check the latest rates on protocols as these will fluctuate based on market conditions.

Aave: Cornerstone of the DeFi Ecosystem

As one of the largest and oldest lending protocols, Aave has billions of dollars in weekly volume. It is available on Ethereum, Arbitrum, Optimism, and other networks. According to Aave, its main Ethereum market has a total market size of $35.2 billion, with $14.06 billion in active loans. Based on DefiLlama, it has a TVL of almost $43.8 billion.

-

Features: Aave supports a wide array of crypto assets and has pioneered the integration of Real-World Assets (RWA) through its Horizon initiative, which focuses on products like tokenized securities. It is governed by the Aave DAO, where AAVE token holders vote on key parameters.

-

Collateral and LTV: Aave is an overcollateralized protocol. Maximum LTV ratios vary by asset; for example, ETH has a higher maximum LTV, allowing users to borrow a larger percentage of its value compared to more volatile assets.

|

Maximum LTV (Loan-to-Value): This defines the highest percentage of a collateral asset’s value that can be borrowed. Liquidation Threshold: This is usually set higher than your collateral factor. If your LTV exceeds this threshold, your position becomes vulnerable to liquidation, and you may be charged additional penalities. |

-

Fees and Liquidation: The protocol earns revenue from a spread between the interest paid by borrowers and the yield earned by lenders. During liquidation, a penalty (or “bonus” for the liquidator) is applied to the seized collateral to incentivize the repayment of bad debt.

-

Security and Audits: The Aave protocol has undergone extensive security audits from firms like Oxorio and Certora and maintains an active bug bounty program.

-

Governance: The protocol is governed by its native token, AAVE.

Morpho: EVM Non-Custodial Lending Protocol

Morpho is a multichain EVM crypto lending protocol, offering borrowers zero fees while enabling lenders to passively earn yield from interest paid by borrowers through Morpho Vaults. According to Morpho, over $6.3 billion worth of crypto assets are deposited in the protocol (corresponding with DefiLlama’s reported TVL of $6.3 billion), with around $2.2 billion in active loans

-

Features: Morpho Vaults remove the complexity of managing positions across multiple lending markets, allowing users to deposit once and earn optimized yield.

-

Collateral and LTV: It supports over 70 assets, with some offering LTVs up to 86% before liquidation is triggered.

-

Fees and Liquidation: Morpho offers competitive borrowing rates and no processing fees. It aims to provide better rates for both lenders and borrowers compared to traditional pool-based models.

-

Security and Audits: Morpho has undergone over 25 audits from firms including OpenZeppelin, Spearbit, and Cantina.

-

Governance: The protocol is governed by its native token, MORPHO.

Spark: Empowering the USDS Ecosystem

Spark is part of the Sky Ecosystem (formerly Maker), and is currently available on Ethereum and Gnosis. According to Spark, its Ethereum market has a market size of $5 billion (with DefiLlama reporting similar TVL numbers) and over $1.6 billion in active loans.

-

Features: Its core products include Savings for users to earn on their stablecoin holdings, SparkLend for borrowing/lending and the Spark Liquidity Layer, which deploys liquidity across DeFi to generate yield.

-

Collateral and LTV: Supports ETH, WBTC, liquid-staked derivatives, and stablecoins like USDC and DAI. Liquidation thresholds vary by asset; ETH has a maximum LTV of 82%, while wstETH has a maximum LTV of 79%.

-

Fees and Liquidation: The platform offers transparent rates with no withdrawal fees, and the savings yield is financed from borrowing fees earned by the Sky protocol.

-

Security and Audits: SparkLend is based on the Aave codebase, which has been extensively audited. ChainSecurity completed the audits for the deployment of SparkLend and additional audits for additional code.

-

Governance: The protocol may be governed by the SPK token in the future.

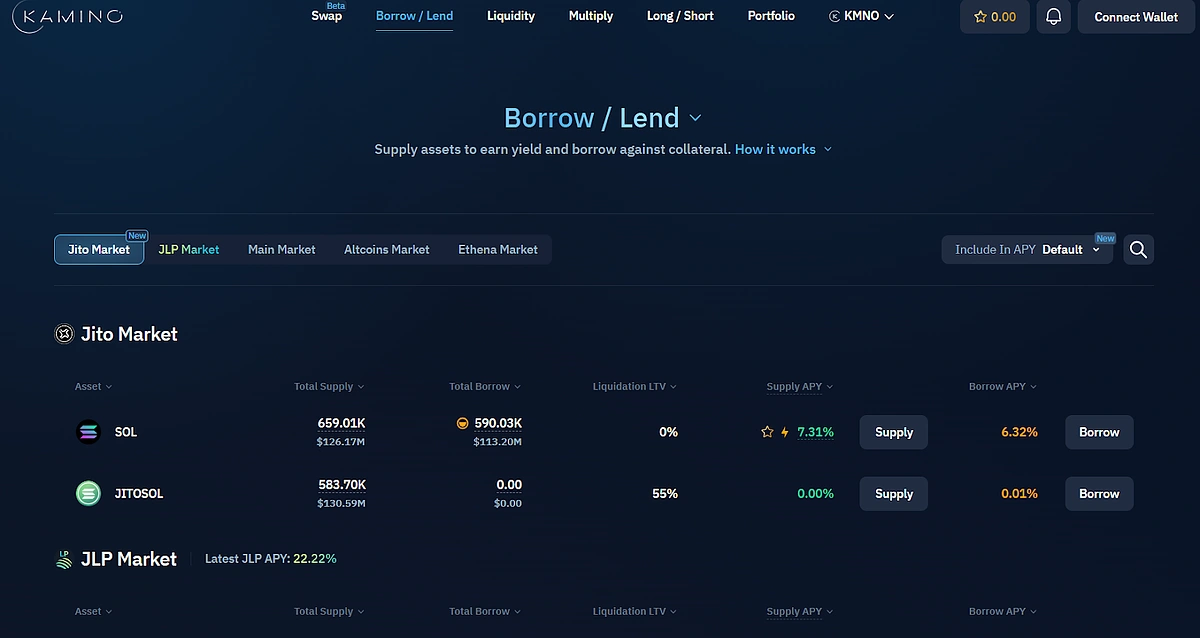

Kamino Finance: Largest DeFi Protocol on Solana

Kamino Finance is the dominant liquidity and lending hub on the Solana blockchain, offering a comprehensive suite of DeFi products including a DEX. Its lending arm has over $3.6 billion in TVL based on DefiLlama data.

-

Features: Offers concentrated liquidity vaults, leveraged lending (Multiply), and an integrated DEX. Lenders receive Ktokens as a representation of their deposit. Ktokens are yield-bearing tokens that can be used across Solana DeFi and as collateral on K-Lend.

-

Collateral and LTV: Known for offering high liquidation thresholds on Solana assets, with SOL reaching up to 75%, and stablecoins at 90%. It supports a wide range of assets native to the Solana ecosystem.

-

Fees and Liquidation: Interest rates and fees are determined by the utilization rate of each lending pool. On K-Lend, liquidation penalties start at 2% and are capped at 10%.

-

Security and Audits: As a leading protocol on Solana, Kamino undergoes regular security audits from firms like OtterSec and Certora.

-

Governance: Users can stake KMNO for voting power to participate in Kamino Governance.

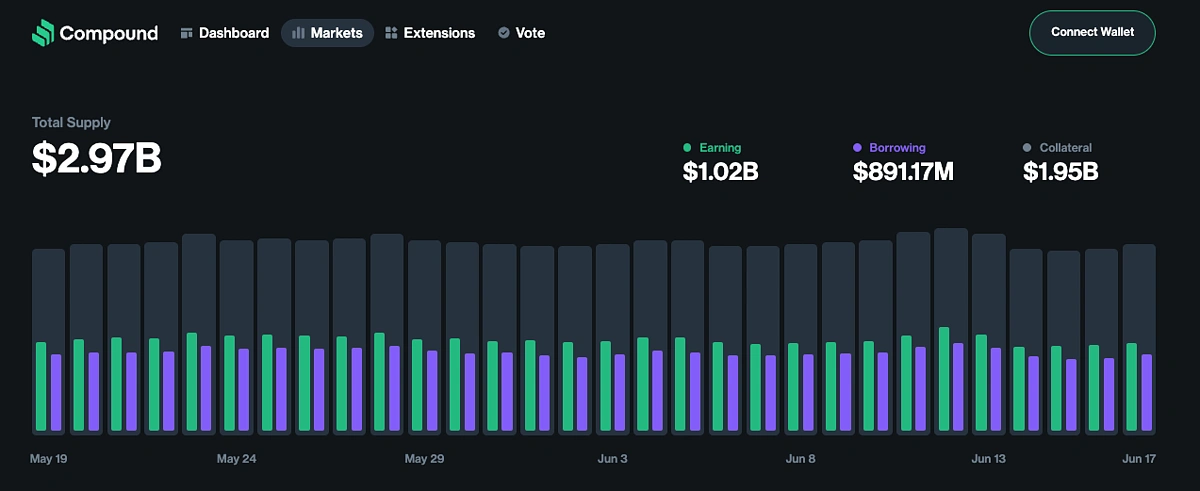

Compound: Veteran EVM-Compatible Lending Protocol

Compound is another veteran of the lending protocol space, launched in 2018. It supports a wide range of EVM networks including Ethereum, Polygon, Arbitrum, Base, and more. According to Compound, it has around $1.9 billion in collateral deposits, around $891 million in active loans, and an additional $1 billion in Earn deposits on Ethereum. Meanwhile DefiLlama reports a combined TVL of around $3.6 billion across all chains.

-

Features: When users supply an asset, they receive a corresponding cToken (e.g., cUSDC), which represents their share in the pool and accrues interest. Its Comptroller contract acts as the primary risk management layer.

-

Collateral and LTV: LTVs are asset-dependent and determined by the COMP governance community, and can reach 90%.

-

Fees and Liquidation: Compound’s revenue comes from reserves accumulated from the interest paid by borrowers. The liquidation penalty varies by asset.

-

Security and Audits: Compound has been audited by firms like OpenZeppelin and maintains an active bug bounty program on Immunefi to encourage responsible disclosure of vulnerabilities.

-

Governance: The protocol is governed by its native token, COMP.

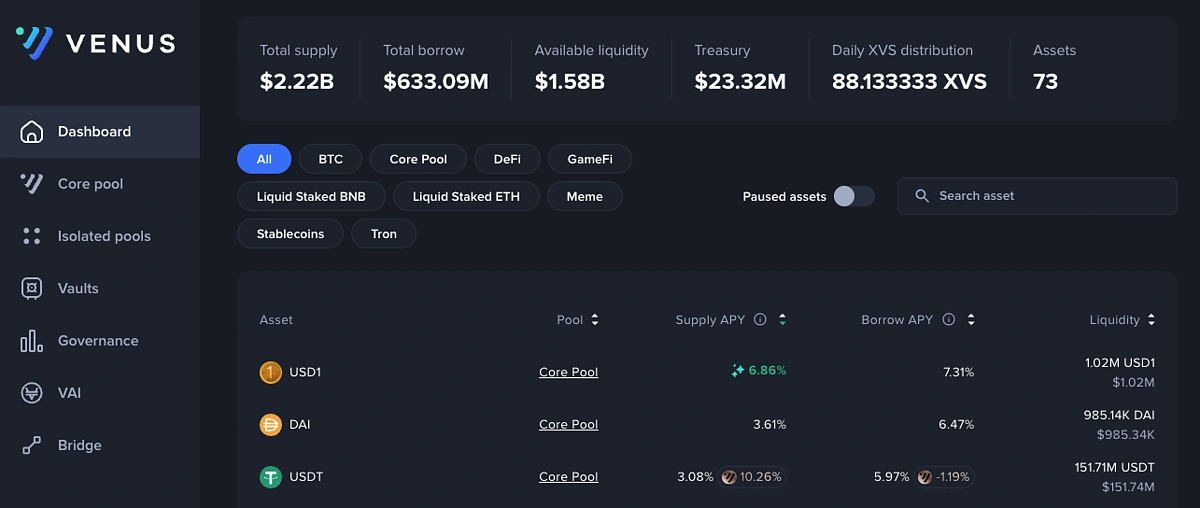

Venus: Combining Stablecoin Minting and Algorithmic Money Markets

Venus is a decentralized money market on BNB Chain (BSC) and other networks that combines lending with the ability to mint a native stablecoin, VAI. According to DefiLlama data, it has around $2.3 billion in TVL, and is the largest protocol on BSC.

-

Features: It functions as a fork of Compound and MakerDAO, allowing users to borrow, lend, and mint stablecoins all within one ecosystem.

-

Collateral and LTV: Supports 73 assets, where each asset has a “Collateral Factor” that determines its borrowing power. This maximum LTV can range between 50% to 82.5%.

-

Fees and Liquidation: When a borrow limit reaches the liquidation threshold, a position can be liquidated. Liquidators repay up to 50% of the debt and receive a portion of the user’s collateral with a 10% bonus as their reward, making it a costly event for the borrower.

-

Security and Audits: Venus has undergone smart contract audits by CertiK to ensure security for their users.

-

Governance: Holders of XVS tokens can lock their tokens in a vault to acquire voting power for Venus Improvement Proposals.

Euler: Modular Lending Platform on EVM Networks

Euler offers a flexible, efficient and user-friendly experience, solving common issues like limited asset choices, fragmented liquidity, and high liquidation penalties, promising users better yield opportunities and powerful trading capabilities through EulerSwap. According to the project, it has a total supply of over $2 billion, and total borrow of around $987 million.

-

Features: Euler provides access to specialized lending markets (vaults), each with tailored assets and risk levels. Users can also earn rewards on their supplied assets without having to stake them, allowing them to collect rewards and borrow against their collateral simultaneously.

-

Collateral and LTV: Users can choose between depositing into a governed vault, where an active manager sets risk parameters like LTV, or an ungoverned vault that has fixed parameters.

-

Fees and Liquidation: Fees on Euler are set by the creators of each vault, providing flexible structure across different markets. When a borrower’s position becomes undercollateralized, liquidators can step in to repay the debt and receive the borrower’s collateral at a discount. The discount is proportional to how undercollateralized the position is, avoiding excessive penalties for borrowers.

-

Security and Audits: Euler has received over 40 security reviews by auditors including Certora, OpenZeppelin, and Cantina. The vault-based architecture also enhances security by isolating risk within each individual market.

-

Governance: The protocol is managed by the Euler DAO, where holders of the EUL token can vote on key decisions.

Fluid: Improving Capital Efficiency Through Its Liquidity Layer

Fluid is a newer protocol on Ethereum, Base, and Arbitrum that aims to increase capital efficiency by tackling liquidity fragmentation. When users transition from one protocol built on the Liquidity Layer to a new version, they will not need to move their funds and can instantly start utilizing new features. According to DefiLlama, it has over $2 billion in TVL.

-

Features: It uses a dual-interface for lending and borrowing and a “Smart Collateral” system that allows assets to earn trading fees on an integrated DEX while also serving as collateral.

-

Collateral and LTV: Supports stablecoins and liquid-staked assets, with some vaults offering very high maximum LTVs (e.g., 95% on wstETH/ETH).

-

Fees and Liquidation: Fluid boasts extremely low liquidation penalties – as low as 0.1% – thanks to its efficient architecture. It does not charge origination or protocol fees on loans.

-

Security and Audits: Fluid has been audited by State Mind and Cantina researchers.

-

Governance: The protocol is governed by its native token, FLUID.

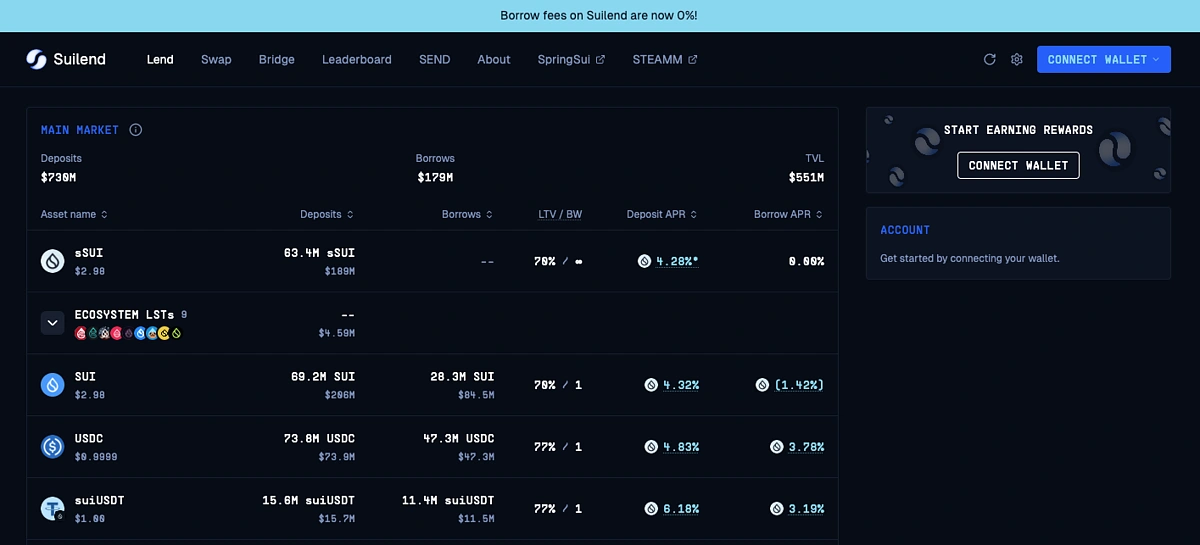

Suilend: Largest Protocol on the Sui Blockchain

Built by the experienced team from Solend (now Save), Suilend is the leading lending protocol native to the Sui blockchain based on DefiLlama data, with around $741 million in TVL.

-

Features: Suilend is a multi-purpose platform offering lending, a DEX, and a cross-chain bridge. Lenders can earn up to 8.9% APR.

-

Collateral and LTV: Supports over 17 Sui-native assets, with LTVs reaching up to 77% for stablecoins.

-

Fees and Liquidation: Borrow fees on Suilend are 0% at time of writing. In the event of a liquidation, third party liquidators will repay 20% of the loan by selling the equivalent in collateral, and collect an additional 5% on the liquidated amount.

-

Security and Audits: Suilend has undergone audits by top firms like Zellic and Ottersec, and maintains a $1 million bug bounty program to ensure protocol integrity.

-

Governance: The SEND token grants its holders the ability to participate in governance decisions in the upcoming SEND DAO.

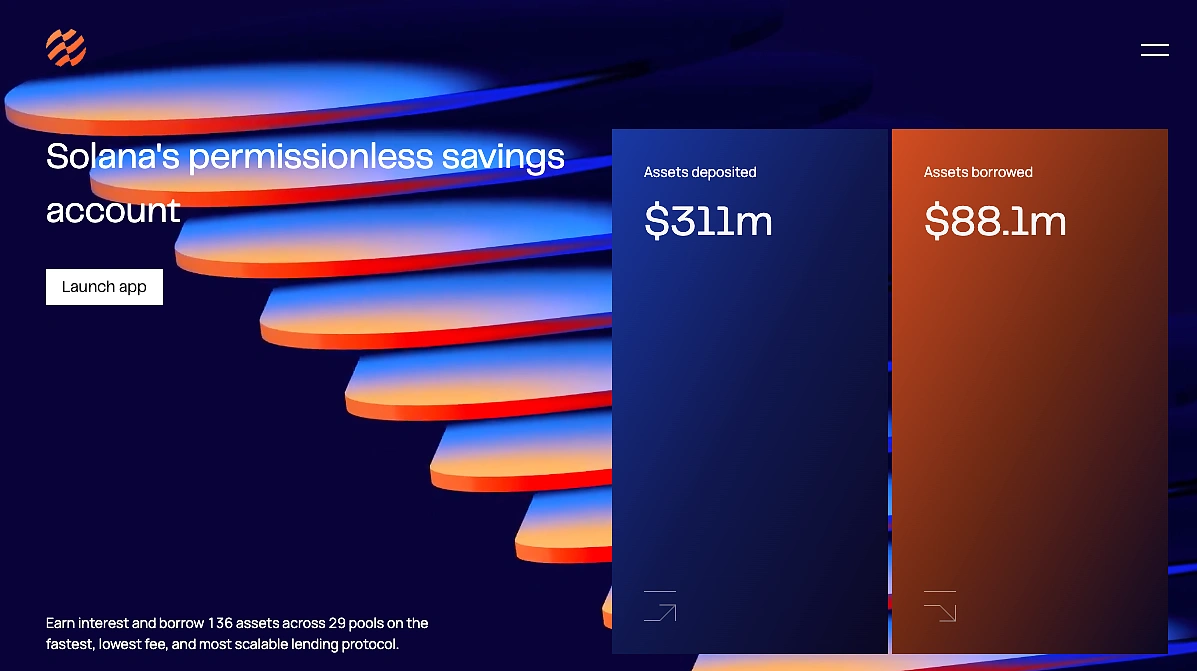

Save Finance: Loans Without a Repayment Deadline on Solana

Formerly known as Solend, Save Finance is a major lending protocol on Solana with around $284 million in assets deposited, according to the project.

-

Features: The protocol allows users to earn passive income, with deposit APRs for reaching up to 7.06%. Loans have no repayment deadline, although interest will continue to accumulate until the loan is repaid.

-

Collateral and LTV: Save Finance supports over 129 assets, including SOL, wrapped tokens, stablecoins, and memecoins.

-

Fees and Liquidation: There is a 0.1% borrow fee. In the event of a liquidation, third party liquidators will repay 20% of the loan by selling the equivalent in collateral, and collect an additional 5% on the liquidated amount.

-

Security and Audits: Solend has been audited by Kudelski, with the Solend smart contracts being fully open source.

-

Governance: The protocol is governed by its native token SAVE, which was rebranded from the previous SLND token.

Comparison of Top Lending Protocols

Here’s a summary table for the top lending protocols.

|

Protocol |

Primary Network(s) |

Native Token |

Max APY/APR for Deposits (Approx.) |

Max APY/APR for Borrows (Approx.) |

Security Audits |

Unique Feature |

|

Aave |

Ethereum, L2s |

AAVE |

Up to 5.32% APY |

Up to 7.35% APY |

Yes |

RWA & GHO Stablecoin |

|

Morpho |

Ethereum, Base |

MORPHO |

Up to 33.92% APY |

Variable |

Yes (25+) |

Optimized Peer-to-Peer Rates |

|

Spark |

Ethereum, Gnosis |

SPK (Future) |

Up to 3.41% APY |

Up to 5.02% APY |

Yes (via Aave) |

Sky Ecosystem Integration |

|

Kamino |

Solana |

KMNO |

Up to 8.22% APY |

Up to 11.85% APY |

Yes |

All-in-one Liquidity Hub |

|

Compound |

Multi-Chain EVM |

COMP |

Up to 5.33% APR |

Up to 5.51% APR |

Yes |

cToken Model |

|

Venus |

BNB Chain, Ethereum, L2s |

XVS |

Up to 7.82% APY |

Up to 9.53% APY |

Yes |

Native Stablecoin (VAI) |

|

Euler |

EVM Networks |

EUL |

Up to 33.37% |

Up to 11.78% |

Yes (40+ reviews) |

Specialized Lending Vaults |

|

Fluid |

Ethereum, L2s |

FLUID |

Variable |

Variable |

Yes |

Zero-fee lending & Smart Collateral |

|

Suilend |

Sui |

SEND |

Up to 7.65% APR |

Up to 4.04% APR |

Yes (Zellic, Ottersec) |

Leading protocol on Sui |

|

Save Finance |

Solana |

SAVE (formerly SLND) |

Up to 4.99% APR |

Up to 9.40% APR |

Yes (open-source) |

No loan repayment deadlines |

Final Thoughts

Crypto lending protocols drive the crypto market by incentivizing holders to contribute liquidity to the space in exchange for interest. For users, they offer a powerful way to put idle assets to work, or to unlock liquidity without selling by borrowing. From established players like Aave and Compound, to newer protocols like Euler and Morpho, there is a wide range of lending protocols to choose from.

The choice of protocol ultimately depends on an individual’s goals, risk tolerance, and preferred blockchain ecosystem. However, users should always prioritize lending protocols with a strong security track record, understand the conditions of their loan, and never supply more capital than they are willing to lose.

This article is for educational purposes only and should not be considered financial advice. Users should always conduct their own research and apply appropriate risk management precautions when using DeFi platforms.