Table of Contents

Key Takeaways:

-

Layer 1s are accountable for security, data availability and decentralization as Layer 2s handle transaction scaling.

-

Layer 2 crypto projects have been gaining traction and usage because of Ethereum’s high gas fees and slow processing speeds.

Layer 1 blockchains (L1) or first-generation blockchains, such as Bitcoin and Ethereum, have long experienced a blockchain trilemma – scalability, decentralization, and security. This compels them to sacrifice one of these features to function effectively. For example, Bitcoin and Ethereum trade scalability for security and decentralization. Though they store data in a secure and distributed ledger, these networks experience low transaction speeds as network users have been increasing steadily.

Bitcoin boasts a transaction per second (TPS) speed of approximately 7, while Ethereum has a TPS of around 15. These speeds are awfully slow compared to other settlement services such as Visa, which boasts a TPS of about 45,000. And this is where Layer 2 (L2) protocols come in.

This article will help you understand why developers built L2 protocols on top of L1 and the role and rise of L2 protocols. It also puts forward how L1 blockchains compare with L2 protocols. In addition, the article deeply delves into some examples of L2 chains and the top five L2 crypto coins by market cap.

What Does Layer 2 Mean in Crypto?

Layer 2s are a set of off-chain solutions (distinct chains) running on top of L1s to compact the bottlenecks of scaling and transaction costs. Let’s use the analogy of a restaurant kitchen to drive this point home:

When every order is made by one worker from the onset to offset before it’s verified and answered, the process becomes time-consuming and resource-intensive in the long run.

However, L2s are like preparation stations – there is a station for chopping food, cooking, taking orders, serving, and assembling and cleaning dishes. These stations help the management staff focus and perform every activity precisely. At the end of every order, an individual matches the assembled dishes to order and confirms them before serving the customer.

Payment companies like Visa leverage a similar method. Instead of discretely controlling thousands of daily micro-transactions from a vendor like Starbucks (which would fill up a few hours’ worth of work in seconds), Visa arranges them into groups settled by the banking system at periodic intervals. The banks then pile and sort transactions via internal equivalents of settlement layers. In that regard, Visa acts as an L2 protocol and the extensive network of banks and central banks that store transaction records and create the game’s rules as L1.

Essentially, L1s are accountable for security, data availability and decentralization as L2s handle transaction scaling.

The Importance of Layer 2 Protocols

Though Ethereum is known for its robust security and decentralization, the resultant market popularity over the years has hit the current capacity of 1.1 million daily transactions. Besides, since it can only handle about 15 TPS, periods of high network surges often result in data congestion. Consequently, this causes gas fees to increase, slowing the performance of dApps.

To solve these problems, L2 protocols out-spread Ethereum as a distinct chain above the L1 blockchain. They interconnect and unload the heavy burden of transactions from the Mainnet via smart contracts, which incorporate and benefit from Ethereum’s stable decentralized security mechanism.

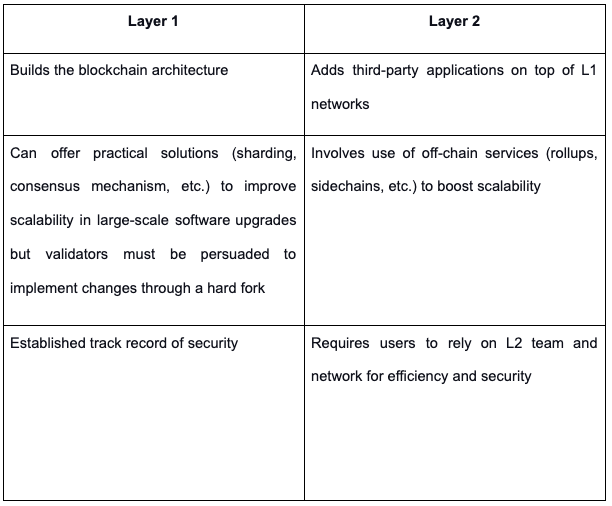

Layer 1 vs. Layer 2 in Crypto

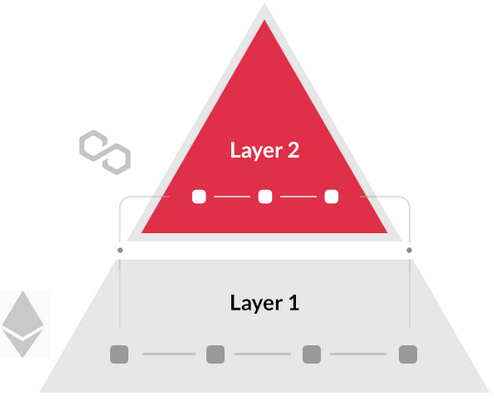

Layer 1 refers to the foundation level of a blockchain architecture – the primary structure of a blockchain. Examples of L1 chains include Bitcoin, Ethereum, and BNB Smart Chain. On the other hand, L2 are chains built on top of other networks. For example, Polygon (MATIC) is an L2 protocol built on the Ethereum blockchain, as seen in the diagram below.

Source: https://know.rendertoken.com/getting-started/using-layer-2-l2

The significant differences between L1 and L2 networks lies in their role and focus on the blockchain:

List of Layer 2 Chains

The application and use of blockchain technology are growing, and L2 protocols must rise to the occasion to improve on their L1 counterparts. Understanding the common L2 chains can provide more insights into how they can be a major milestone in blockchain evolution. HEre are some common L2 protocols:

Nested Blockchain

The design of a nested blockchain comprises a primary chain and some secondary chains. The design ensures that a network can seamlessly function jointly with other networks. The primary chain is accountable for assigning tasks, regulating the working parameters, and resolving disputes when necessary. The secondary chains execute transactions of the primary chain and send feedback and approvals to the main chain.

Sidechains

As the term implies, a sidechain is a side network linked to a primary blockchain through a two-way peg. You can think of it as a forest where the trees act as side chains, while the forest is the main chain. The main goal of sidechains is handling a high number of transactions. As such, they support the L1 blockchains by verifying transactions, freeing the main chain from the network congestion issue. However, you must trust the sidechains to operate appropriately as they can control assets on the main chain.

State Channels

State channels enable parties to interact directly on the blockchain by providing an option of executing transactions without considering the main chains. Moreover, validators can take less time verifying transactions, improving the processing speeds of L1 chains. State channels don’t rely on transaction validation on the L1 networks but instead use smart contracts to perform the same roles. When a transaction is finished successfully, the channels ensure secure storage on the main chain.

Rollups

Rollups are L2 chains that facilitate computations outside the main blockchain. The transfer of transaction details takes place after a certain interval, hence offering the necessary backup for maintaining records. Besides, rollups can manage transactions with minimal interference to the main chain. Therefore, they can ensure transactions are processed faster and at minimal costs. Optimistic and zero-knowledge are the common types of rollups.

Optimistic Rollups

These are L2 protocols intended to expand the throughput of L1s. They minimize computation on L1s by processing transactions off-chain, significantly improving processing speeds. Besides, they obtain their security from L1s by rolling transaction outcomes on-chain.

Zero Knowledge Rollups (ZK-Rollups)

ZK-rollups are similar to optimistic rollups in that they combine L2 transactions performed off-chain and publish them as a batch on L1s. But instead of assuming transactions are genuine until confirmed otherwise, ZK-rollups leverage validity proofs to rapidly verify whether transactions are authentic or not.

Top 5 Layer 2 Crypto Coins by Market Cap

L2 crypto projects have been gaining traction and usage because of Ethereum’s high gas fees and slow processing speeds. This section discusses the top five crypto coins by market cap:

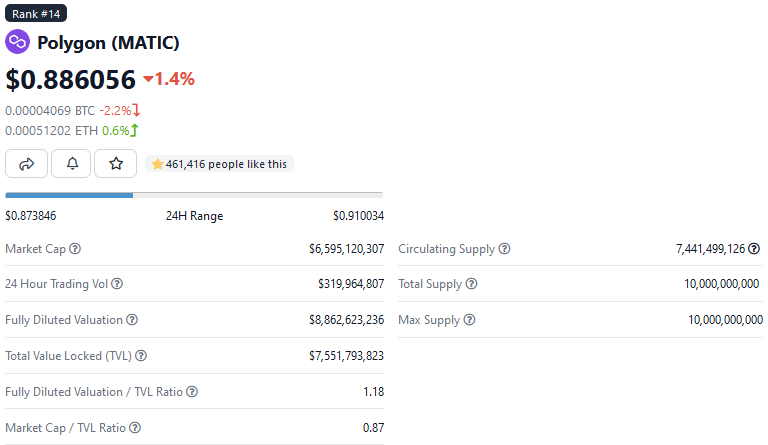

Polygon (MATIC) – $6.5B Market Cap

Polygon, formerly Matic, is an L2 scaling solution that allows developers to create scalable and user-friendly dApps with minimal transaction costs and without sacrificing security. It boasts a TPS of up to 7,000 compared to Ethereum’s 15 TPS. Besides, Polygon is already used by major crypto brands like Sushiswap, Chain Games, and Quickswap, and non-crypto brands like Instagram, Stripe, Adidas Originals, and Prada. Currently, MATIC has a market cap of around $6.5 billion and a maximum supply of 10 billion. You can trade MATIC on various exchanges, including Binance, Coinbase, Digifinex, and FTX.US.

Loopring (LRC) – $454M Market Cap

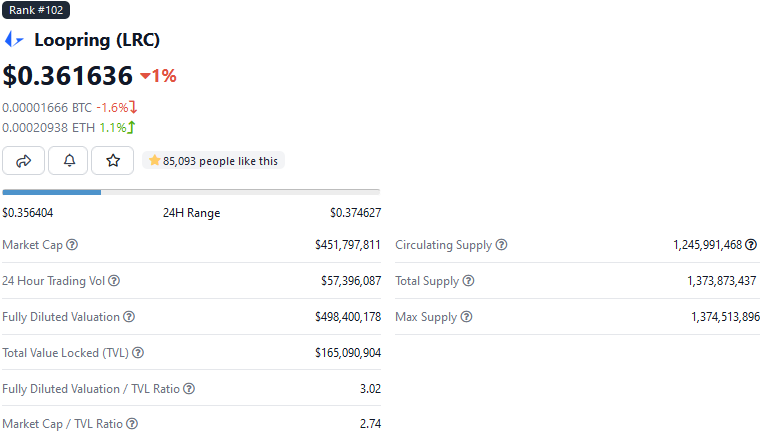

LRC is an ERC-20 token that describes itself as “an open-sourced, audited, and non-custodial exchange protocol.” Its mission is to enable developers to create non-custodial, order book-based marketplaces on Ethereum using zero-knowledge rollups. Loopring offers a TPS of up to 3,000 and imposes a transaction fee of 0.25% for each swap. Instead of processing transactions on Ethereum directly, Loopring leverages zero-knowledge rollups to allow exchanges to build on top of it to avoid the slow transaction speeds and high costs associated with Ethereum exchanges. LRC has a market cap of $450 million and a maximum supply of 1.3 billion. You can trade LRC on Coinbase Exchange, Bitget, Binance, XT.COM, and Dcoin.

OMG Network (OMG) – $267M Market Cap

OMG Network, formerly OmiseGO, is a value transfer platform for Ethereum and an ERC20 token. It labels itself as the first production-grade L2 scaling project that aims to allow crypto users to transfer digital assets faster, cost-effectively, and securely. It achieves this by moving the process of verifying transactions outside the Ethereum network, except during the final settlement. Additionally, it batches transactions to make the process frictionless and less resource-intensive. The OMG Network handles thousands of TPS and minimizes the cost of using Ethereum by one-third. You can trade OMG tokens on exchanges like BitFinex, Binance, and Coinbase.

Skale (SKL) – $190M Market Cap

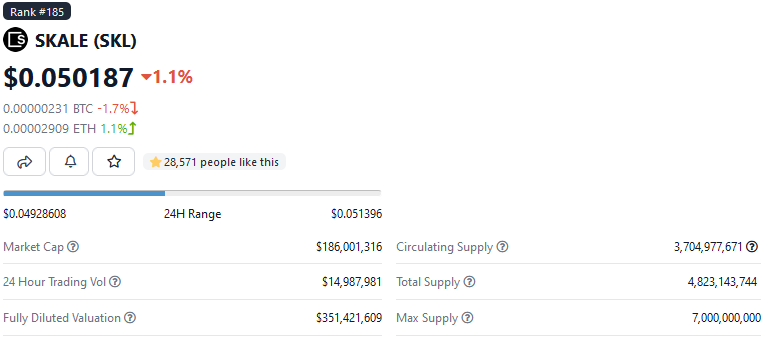

Skale network is an L2 scaling solution for the Ethereum blockchain that allows developers to sidestep Ethereum congestion by transferring the development of dApps into sidechains. As such, it facilitates dApp running in a reliable, high-throughput, and resource-intensive environment via self-governing, dApp-specific Skale chains. 500 Skale chains can process up to 1 million TPS and zero end user gas fees. SKL is the native token for Skale and is used to pay for network services, staking, and governance. It has a market cap of $186 million and a maximum supply of 7 billion. You can trade SKL on Gemini, KuCoin, FTX, Coinbase, Binance, etc.

ZKSpace (ZKS) – $13M Market Cap

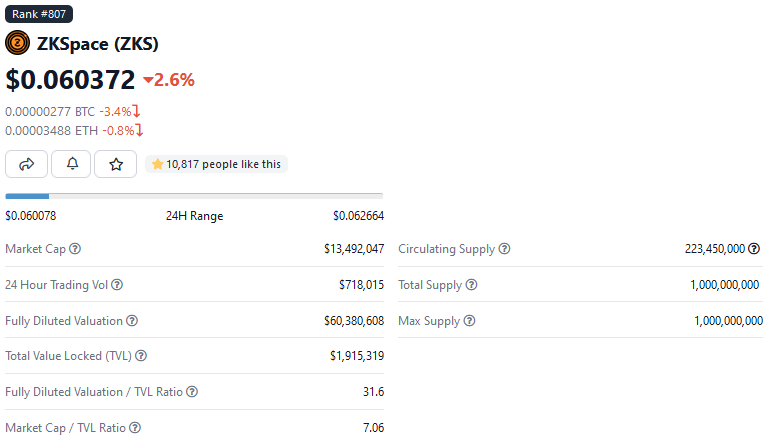

ZKSpace, formerly ZKSwap, is an all-inclusive L2 platform featuring an Automated Market Maker (AMM) decentralized exchange (DEX) using ZK-rollups. In addition, it has a payment service ZKSquare and a Non-Fungible Token (NFT) issuance and trading center known as ZKSea. With an improved user interface, NFT support, unlimited asset listing, seamless deposits and withdraws, high efficiency, and multi-chain support, ZKSpace aims to execute Ethereum Virtual Machine (EVM) compatible ZK-rollups and offer users more L2 products in the future.

ZKSpace imposes transaction fees of 0.3% on every swap and handles thousands of TPS. ZKS has a market cap of $13 million and a maximum supply of 1 billion. You can trade ZKS on exchanges, such as Gate.io, OKX, LBank, Huobi Global, Uniswap, and ProBit Global.

What are Layer 3 Protocols?

Layer 3 (L3) protocols refer to blockchain-based applications, like dApps and distributed storage, which present cross-chain functionalities. These protocols strive to attain blockchain interoperability without relying on custodians or third parties, while maintaining the simplicity of processes in the underlying layers.

Conclusion

Scalability is the stumbling block of L1 blockchains, limiting them from exploring their full potential. And this is where L2 protocols come in. They have evolved to combat this issue head-on and ensure the future of blockchain technology is scalable. In the future, L3 interoperability projects are expected to connect different blockchains and L2 services, removing the fragmentation issue faced by the cryptocurrency industry today.