Table of Contents

Key Takeaways:

-

Every USDT and USDC in circulation is supposed to be backed by an equal amount of U.S. dollars in cash and cash equivalents.

-

USDT and USDC are both widely adopted but differ in their utility. USDT is the most traded cryptocurrency with the highest 24-hour volume while USDC is thought to be a safer store of value as it is audited annually.

USDT and USDC are stablecoins backed by the U.S.dollar, and they are the two largest players in the space based on market capitalization. These stablecoins are less volatile than native cryptocurrencies as they are pegged to national currencies, and provide traders a store of value for their cryptocurrencies between trades.

What are Fiat-Backed Stablecoins?

The earliest stablecoins were backed by cash. How this works; fiat currencies are locked in an agreement and an equivalent is minted on smart contract blockchains. The minted stablecoins can be redeemed for real fiat. When redeemed, an equal amount is also burned through the traditional smart contract token burning process. The minting and burning processes are tightly controlled to ensure that the stablecoin doesn’t stray away from fiat pegging. This strategy has seen a great deal of success and has been adopted by many stablecoin projects, most notably by USDT and USDC.

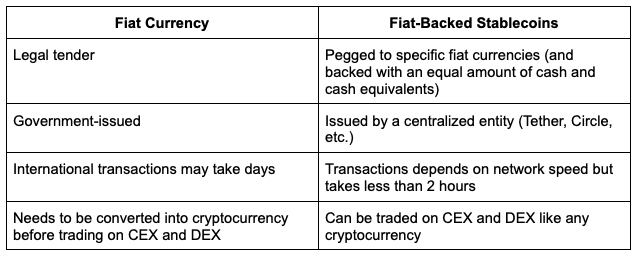

Fiat Vs. Stablecoins

Put simply, fiat-pegged stablecoins are tokenized versions of fiat currencies. However, this is a very diluted explanation. Stablecoins pegged to fiat maintain their value around that of the fiat, but unlike the fiat currencies, they open up opportunities for wider usage.

Fiat-pegged Stablecoins create a virtual copy of fiat currencies on a relatively better management technology – blockchain; without necessarily inflating the currencies. The virtual currency created on the blockchain allows permissionless and borderless usage of the currency.

Unlike the hard US dollar currency, stablecoins pegged to USD can be transferred to anyone around the world without going through rigorous steps to perform international transfers. They can be traded on centralized exchanges and DEXes like any other cryptocurrencies.

Just like Fiat-pegged stablecoins, other stablecoins give similar advantages to any other commodity they are pegged to. Fiat-pegged stablecoins are the most popular kind of stablecoins, but stablecoins pegged to other relatively stable commodities (including gold) also exist.

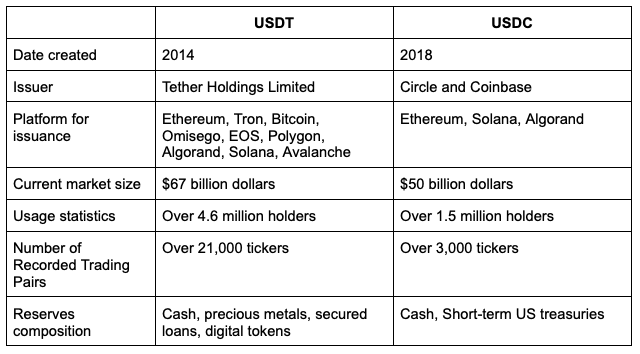

USDT Vs. USDC

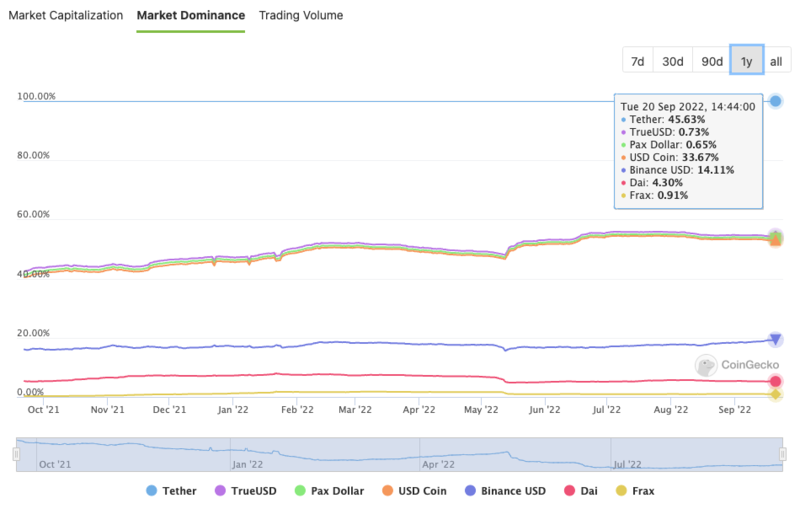

USDT and USDC at the time of this writing control a market capitalization of over $67 billion and $50 billion respectively, with a market share of 45.63% and 33.67%.

We’ve also put together a quick summary of how these coins compare against each other:

Tether USD (USDT)

The concept of fiat-backed stablecoins was introduced by Tether Holdings Limited with Tether USD (USDT) being the first known stablecoin pegged to the US dollar. USDT was introduced in 2014 to solve the raging liquidity and interconvertibility issue that plagued cryptocurrency’s development. Tether Holding was associated with the Bitfinex exchange, even though both companies have in the past issued statements contradicting this speculation.

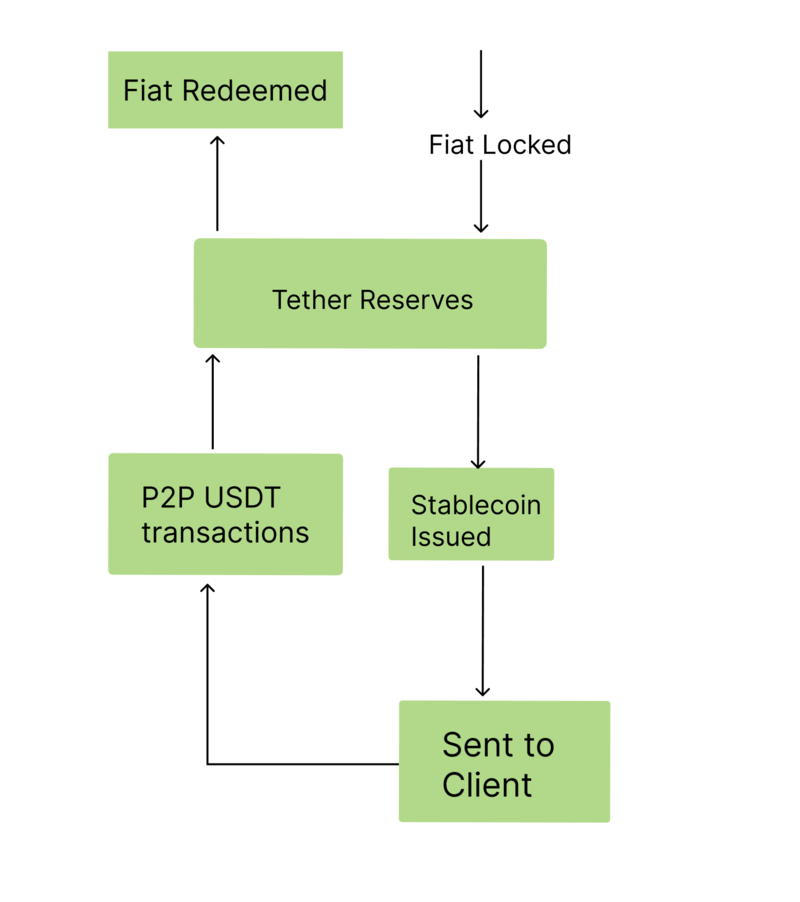

Tether runs USDT issuance services for institutions and individuals. To issue USDT, the client (which can be Tether itself as well) sends cash or cash equivalent of the USDT they wish to be issued to Tether’s reserves. USDT is then issued and sent to the client’s wallet. The issued USDT can be spent like any other cryptocurrency. They are pegged to the USD dollar and can be redeemed at will. Here’s a visual representation of the USDT cycle:

USDT Volume and Market Capitalization

In its eight years of operation, USDT has seen exponential growth. This is thanks to the institutional adoption of cryptocurrencies and USDT being the stablecoin of choice for market makers and institutions looking to enter the crypto space. USDT’s market capitalization has risen to over $65 billion. It is the third biggest cryptocurrency, only behind Bitcoin and Ethereum.

An average of $45 billion worth of USDT is traded daily on centralized and decentralized exchanges. USDT is listed on almost every cryptocurrency exchange, and over 3000 USDT pairs are live on tracked exchanges, providing investors with an easy way to trade between USD and other cryptocurrencies.

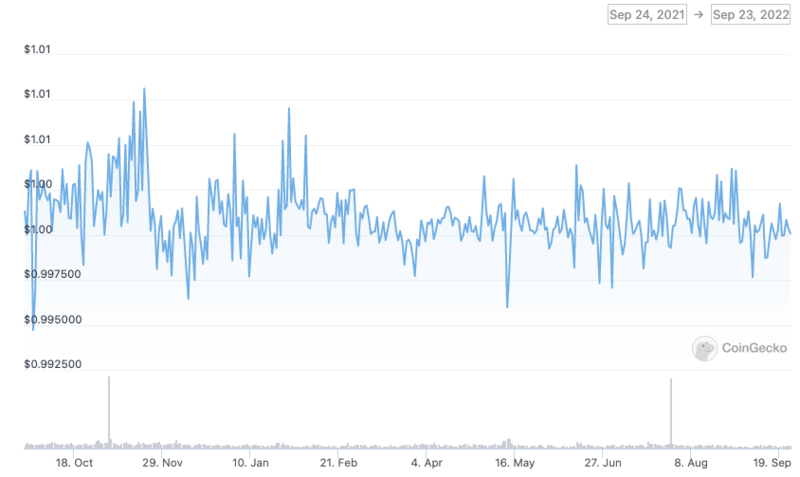

USDT Price Stability

USDT’s dollar peg is tightly maintained and hardly strays away from the $0.99-$1.01 range. However, following UST’s collapse, it slipped to as low as $0.95 on May 12, 2022, on some crypto exchanges.

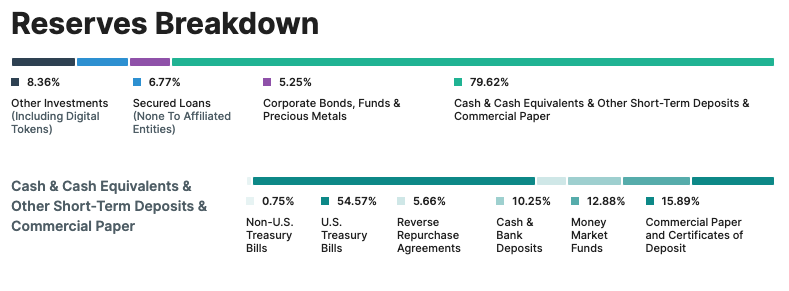

USDT Reserves

The reserve held by Tether is at the core of USDT’s functionality. It controls the stablecoin issuance process and is an index of USDT’s fiat backing. Cash or cash equivalents committed to USDT issuance are held in the Tether reserves and USDT redemptions are also paid out from these reserves.

Based on the latest reserves breakdown from Tether, just under 80% of its reserves is in cash, cash equivalents, and other short-term deposits and commercial papers, with over 99% of these having a duration of 0-90 days.

USD Coin (USDC)

USDC is issued and managed by Circle and U.S.-based cryptocurrency exchange Coinbase. Launched in 2018, USDC has since issued over $50 billion worth of U.S. dollar-pegged stablecoin. About half of this figure was issued between July 2021 and August 2022.

USDC’s mode of operation is very similar to USDT. The biggest difference lies in their reserve’s compositions. Circle pay and Coinbase accept only cash and short-term U.S. treasuries for USDC issuance. USDC stablecoin’s cycle is similar to that described earlier for USDT.

USDC Volume and Market Capitalization

USDC control a market capitalization of over $51 billion at the time of this writing. It is the second largest stablecoin and the fourth largest cryptocurrency, only behind USDT in both instances. Over $4 billion worth of USDC is traded on cryptocurrency exchanges daily.

USDC Price Stability

USDC’s dollar pegging has been incredibly tight. Tangible slips haven’t been recorded in the past year, even in the face of the UST collapse.

USDC Reserves

USDC’s reserves control the issuance and redemption of USDC stablecoin. Circle’s July audit report conducted by Grant Thornton reports that USDC’s stablecoin is backed by over $54.6 billion, an excess of about $100 million, relative to circulating USDC. USDC reserves hold cash and short-term U.S. government treasury bills only.

Popular Arguments Against USDT and USDC

Stablecoins are touted as “cryptocurrency’s doomsday”. Critics speculate a dramatic event should any of the big stablecoin projects crumble. A similar scenario to that seen during the LUNA (now LUNA classic) and UST (now USTC) collapse. USDT and USDC are the main recipients of the ‘doomsday’ speculations. Here are the most popular arguments against the two biggest stablecoins;

Fraudulent Information on Banking and Reserves

The trust level for USDT and USDC is somewhere below the level of trust for native cryptocurrencies. The constant minting of billions of dollar-pegged cryptocurrencies with vague explanations has eroded the trust between the USDT team, the USDC team, and the rest of the crypto space, where “Tether printer go brrr” is a popular phrase that embodies the frequent printing of stablecoins by the stablecoin giant.

USDC and USDT are both subjects of continuous controversy. These controversies have persisted throughout the course of their existence. Questions arise regarding the legitimacy of their minting process and if these minted coins are fully backed as stated, especially in the case of Tether, which has yet to deliver on its promised audit since 2017.

USDC reserves are considered to be more transparent than Tether’s. The monthly audit reports and the reserve compositions make it easier to track the collateralization of the USDCs minted by the institutions, while the basket of commodities in Tether’s reserves makes its audit report even more complicated.

Market Manipulation

A couple of investigative journalism reports on USDT have shone the light on how printed USDT is utilized by exchanges. These reports are unverified but provide a base for the allegations that printed USDTs are used to artificially influence the price of cryptocurrencies. USDT, USDC, and other stablecoins are known to be used by market makers and that probably explains why a good percentage of printed stablecoins go straight to exchanges. Notwithstanding, this process hasn’t been properly addressed by both issuers or the implicated exchanges, although Tether has been ordered by a U.S.judge to produce financial records related to the backing of USDT as part of a lawsuit that alleges Tether has used unbacked USDT to inflate the price of bitcoin.

Centralization

In the wake of the ban on Tornado cash – a cryptocurrency mixer – USDC issuer, Circle Pay reportedly froze over $750,000 worth of assets belonging to cryptocurrency wallets related to the project. Both projects have exhibited ‘undue’ use of their powers according to many cryptocurrency enthusiasts. USDT and USDC are issued and managed by designated central bodies, unlike decentralized stablecoins.

While a completely centralized project is at odds with cryptocurrency’s promise of decentralization, decentralized stablecoins are seen as comparably high-risk due to their lack of fiat backing.

Stablecoin Regulations

Over the past few years, stablecoins have been in the news for controversial reasons, some of which we have discussed above. Internal financial regulatory bodies face an uphill task in ensuring that stablecoins comply with regulations like other forms of payment. To achieve this, custodial financial institutions are delineating rules which stablecoin projects must follow to ensure proper accounting and liquidity for every minted stablecoin.

Janet Yellen as quoted on a US PWG (President’s Working Group) report released on 1st November 2021 said;

“Stablecoins that are well-designed and subject to appropriate oversight have the potential to support beneficial payment options. But the absence of appropriate oversight presents risks to users and the broader system. Current oversight is inconsistent and fragmented, with some stablecoins effectively falling outside the regulatory perimeter.”

To address the risks associated with stablecoins, the U.S. Congress will proceed to enact legislation that brings stablecoins to a check and ensures compliance. These legislations would complement existing regulatory attempts on stablecoins as related to market integrity, investor protection, and illicit finance, and also address key concerns about stablecoins.

The U.K., Australia, Singapore, and many other nations have also proposed a new set of rules for stablecoins. Regulatory attempts on stablecoins have intensified since the tragic collapse of Terra foundation’s UST stablecoin.

Investing in USDT and USDC

Unlike other cryptocurrencies, USDT and USDC prices are very stable with only slight variations in value. The traditional ‘investing’ doesn’t really work with stablecoins. However, there are several earning opportunities for USDT and USDC holders. Centralized exchanges and DeFi platforms offer passive and active earning opportunities for USDT and USDC which include:

Liquidity Mining on Decentralized Exchanges

Automated Market Makers (AMM) are powered by liquidity pools. The liquidity pool is a collection of tokens locked up by the liquidity providers, this pool is available for traders who wish to exchange any of these assets. To provide liquidity, a liquidity provider locks up equal values of the two tokens in the pool. Liquidity providers receive liquidity pool tokens (LP tokens). LP tokens are a cryptographic representation of the percentage of the total liquidity pool owned by the individual liquidity provider.

Providing liquidity comes with its own disadvantage, this is commonly known as impermanent loss. Impermanent loss is a ‘temporal’ and ‘illusional’ loss incurred by liquidity providers due to variations in demand and values of the tokens they supplied to the liquidity pools.

To encourage investors to provide liquidity amidst this risk, many DeFi projects offer liquidity mining opportunities. To earn tokens in a liquidity farming program, liquidity providers stake their Liquidity pool tokens on the platform and earn according to the APR and amount of LP tokens they stake. Most of these programs offer rewards for USDT/USDC liquidity pairs and other crypto assets paired with USDT or USDC.

Lending on Centralized and Decentralized Exchanges

Lending out dormant USDT or USDC on centralized and decentralized exchanges is a good way to earn passive rewards on stablecoin holdings. Lending programs let you loan out your assets and the borrower pays interest on the borrowed asset. Lending platforms like Nexo can offer interest rates of up to 12% on stablecoins.

Single-Side Staking

Single-side staking programs are comparably low-risk opportunities for cryptocurrency investors. DeFi projects are adopting stablecoin single-side staking as a strategy to improve the Total Value Locked (TVL). USDT and USDC holders can stake their assets on platforms offering stablecoin staking programs to earn rewards as specified.

Savings Programs on Centralized Exchanges

Many cryptocurrency exchanges offer interest on USDT and USDC deposits. These savings programs, where available, grant interest to depositors of accepted cryptocurrencies at predetermined rates for depositing their assets on the exchange. USDT holders who participate in the Binance flexible savings program can earn up to 2% of their deposit. Huobi also offers up to 4% interest on USDT in their savings program.

As always, remember to do your own research before investing.

Final Thoughts

Together with other stablecoin projects, USDT and USDC have enriched the crypto space with a sufficient store of fiat-standard currencies. More important is their efforts to maintain these coins’ value. Compared to stablecoins backed by algorithms, they have shown plausible stability and seen an incredible adoption rate.

With over $100 billion worth of stablecoins issued, USDT and USDC are both waxing strong amidst incessant backlashes. Both projects are still seen through opaque glasses, constantly fending off concerns raised by independent audits and investigations. While USDT and USDC have both managed to pull through, there’s still a need for increased transparency, and this is a concern for every other centralized fiat-backed stablecoins.