Table of Contents

Key Takeaways:

-

Arbitrum is the leading Ethereum Layer 2 optimistic rollup scaling solution with a growing number of TVL, users, developers and dApps.

-

Arbitrum offers up to 65,000 transactions per second and transactions costing an average of $0.10 to $0.60, significantly faster and cheaper than Ethereum.

-

The speed and cheapness of Arbitrum is done by rolling up multiple transactions on Arbitrum onto a single transaction onto Ethereum.

-

It is not only cheap and fast, but it is also trustless and safe as it is economically secured by validators.

The Ethereum network resulted in the birth of many innovative technologies that attracted many users, however Ethereum was not scalable as the maximum supported transactions per second (TPS) is 25, which is very low compared to other networks.

Whenever there is a surge in activity, such as during 2021’s DeFi and NFT mania, the network will congest, increasing transaction fees to over $2,000 per transaction at times and taking as long as 30 minutes and more for transactions to go through. What’s worse is that the high fees are paid even if the transactions fail, causing a poor user experience for most users.

Ethereum was not meant for such activities and was turning many regular users away due to the high fees and slow transactions. An Ethereum scaling solution was required.

Arbitrum is one of the few scaling solutions that was created to help Ethereum to scale, but what is Arbitrum?

What is Arbitrum?

Arbitrum was developed by Offchain Labs and is a Layer 2 (L2) scaling solution that uses optimistic roll-up technology to offer high-speed transactions and lower fees for users.

It was created to help tackle the high transaction fees and slow transaction speed of the Ethereum network, offering a more scalable and cost-effective solution to DeFi users.

Even after Ethereum’s Merge upgrade in September 2022, speed and costs are still not comparable to transacting on Arbitrum, which has led to users and developers flocking over to this L2 ecosystem, and the total value locked (TVL) even reached a high of $3.2 billion in November 2021. The TVL currently sits at around $900 million as of this writing and is the highest TVL across all other Layer 2 ecosystems.

Arbitrum continues to be developed further, and there are actually two Arbitrum networks, One and Nova, which serve different purposes. For this article we’re focusing on Arbitrum One which is where most DeFi activities are occurring at the moment.

Source: DeFiLlama

How Does Arbitrum Work?

Arbitrum uses a roll up technology that enables smart contract transactions to be done on Arbitrum and rolled up into a message that will later be sent to Ethereum to be processed.

In simpler terms, it rolls up multiple smart contract transactions into one smart contract message and sends it to Ethereum for bulk processing, hence the name ‘roll up’.

This resulted in fees on Arbitrum being up to 50 times cheaper than the fees on Ethereum, and can process up to 65,000 TPS, a giant leap compared to Ethereum’s under 30 TPS, making Arbitrum attractive for users and developers alike.

With so much activity and money flowing in but exploits and hacks being a common thing in crypto, is it safe to use?

Arbitrum was not just designed with high speed and low costs in mind, it was also designed to be secure.

Firstly, Arbitrum is secured by the security of Ethereum as the transactions are directly written on Ethereum while the computation and storage of the smart contracts are done on Arbitrum. Validators would package all transactions into a roll-up block as a transaction onEthereum, also known as an assertion.

Secondly, Arbitrum uses a validator and slashing system. Validators need to stake Ether to be a validator. If a validator acts dishonestly, they may lose their staked funds, aka getting slashed.

Thirdly, when an Arbitrum assertion is posted onto Ethereum, there is a 7 days window for anyone to challenge this assertion, known as the challenge window. This gives anyone 7 days to challenge any suspicious assertions.

These are just a few of the many security mechanisms in place to keep the Arbitrum network safe.

How to Bridge Assets to Arbitrum

There are many ways to bridge assets to the Arbitrum network, let’s explore some of them.

How to use the Arbitrum Bridge

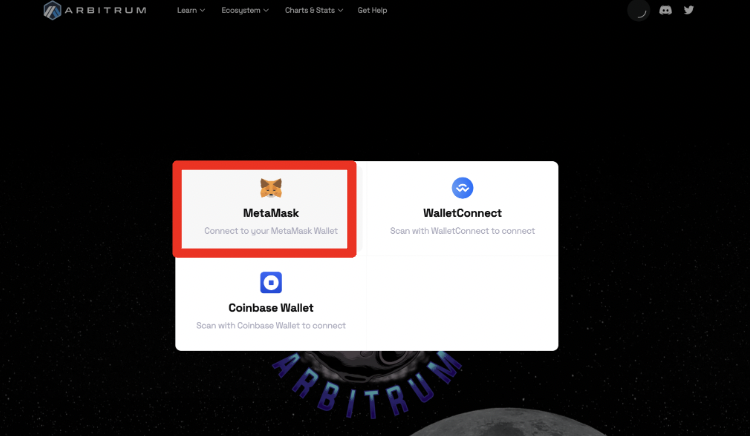

The official way is to use the Arbitrum Bridge, which requires a non-custodial crypto wallet such as Metamask.

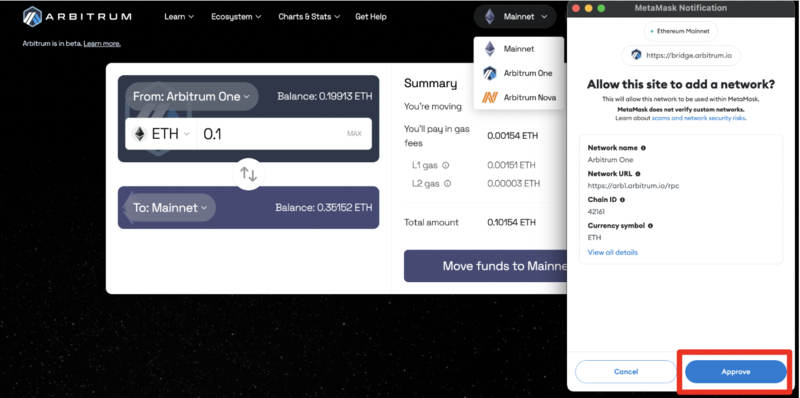

Once you’ve connected, you will be able to send ETH and other ERC20 tokens like USDC from Ethereum to Arbitrum One, double check that it is not Arbitrum Nova.

Select the ERC20 token and the amount that you wish to send, and click “Move funds to Arbitrum One” to begin the transfer. Metamask will pop up a transaction screen and once you’ve verified that the details are correct, you will click ‘Confirm’.

Do take note that there will be some gas fees ranging from $1-$5 that you will have to pay. Once the transaction is submitted, your tokens will arrive on Arbitrum in about 10 to 60 minutes depending on the network traffic.

Alternatively, if you do not have a crypto wallet, you can also send ETH and some ERC20 tokens like USDC from supported centralized exchanges, like Binance, directly to Arbitrum. Although if you are hunting for the Arbitrum airdrop which we will discuss later in this article, it is recommended to use the official Arbitrum bridge!

Connecting to Arbitrum

Once you’ve tokens on Arbitrum, you will need to connect your non-custodial wallet like Metamask to Arbitrum to interact with your tokens and other Arbitrum dApps.

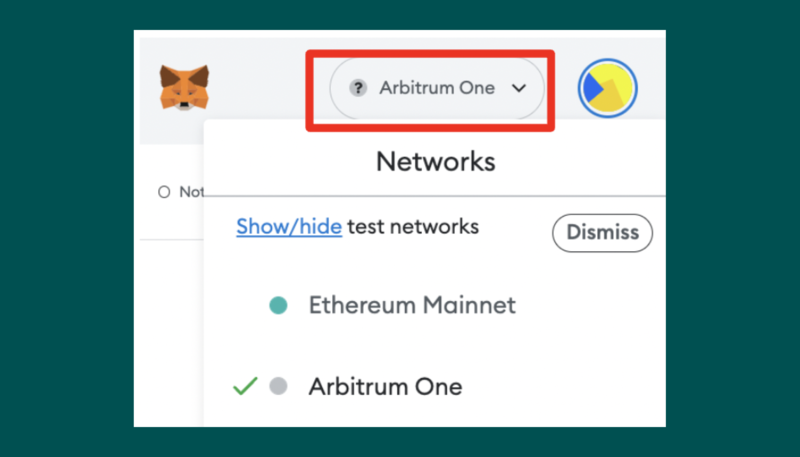

You can do this by clicking on the Ethereum Mainnet button to view a dropdown list of “Arbitrum One” and “Arbitrum Nova”. For this example, we will click on “Arbitrum One” and Metamask will pop up a message asking you to add the Arbitrum network. Once you approve, the Arbitrum network will be added to your Metamask and they will ask you to switch to Arbitrum as well.

If done correctly, you will be able to see “Arbitrum One” when you click on the Networks button at the top of your Metamask.

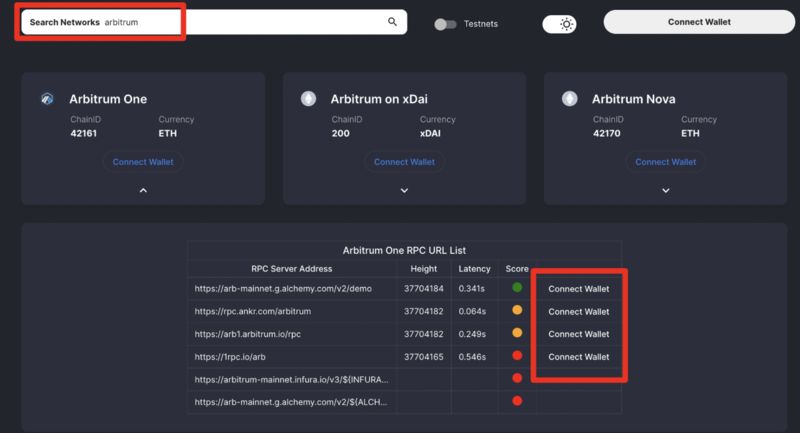

If that does not work, you can visit chainlist.org and search Arbitrum and try to connect to a few different RPC addresses until one of them works. It is possible for an RPC to freeze occasionally so you may be switching with multiple Arbitrum RPCs.

Image taken from Chainlist

Withdrawing tokens from Arbitrum to Ethereum

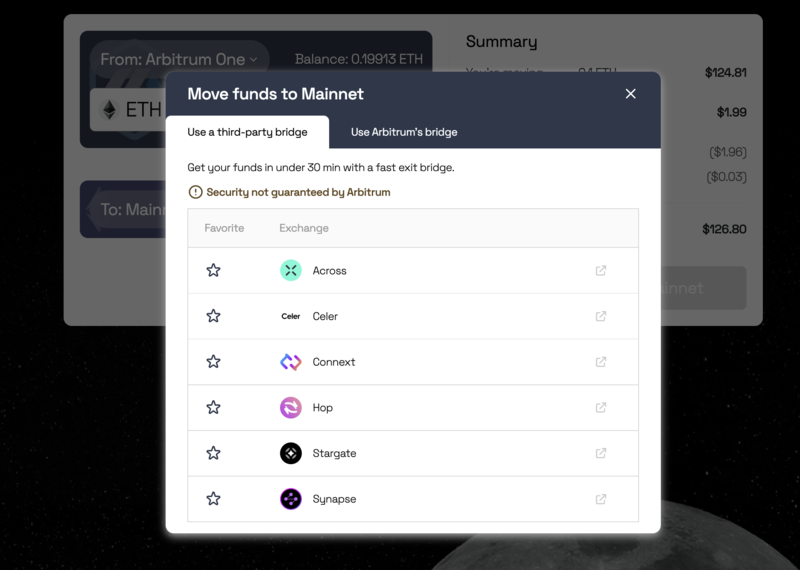

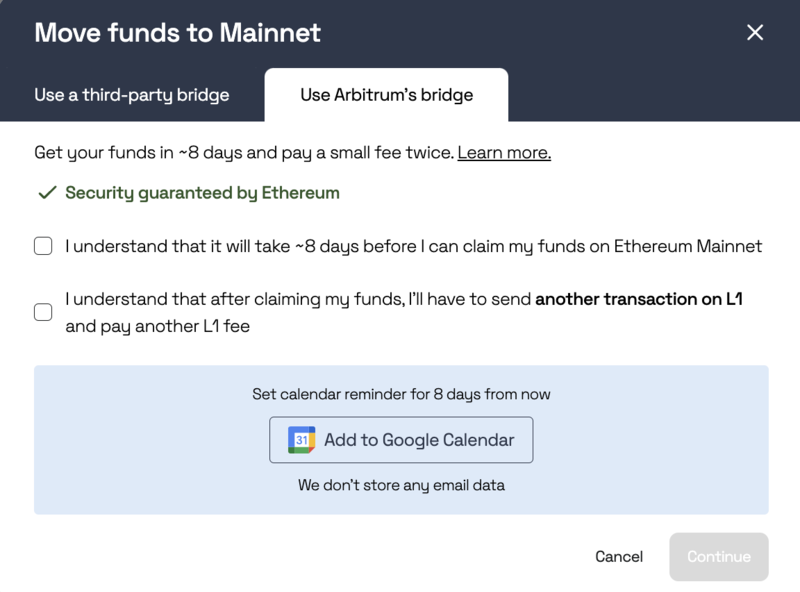

How about withdrawing funds back to Ethereum? There are two ways to withdraw ETH and ERC20 tokens from Arbitrum to Ethereum.

The fast way is to use a third-party bridge which can be done in under 30 minutes. As there are many options, a bridge aggregator such as Rango is a convenient way to get the best prices as it finds the best prices and fees between many bridges.

The official and safer way is to use the same Arbitrum bridge, however, this method is slower and funds will take about 7-8 days to be received. There will be a countdown stating that your deposit will be received in 7-8 days and you can check the status of your withdrawal and claim when it’s ready by clicking on your profile on the top right.

The Arbitrum Ecosystem

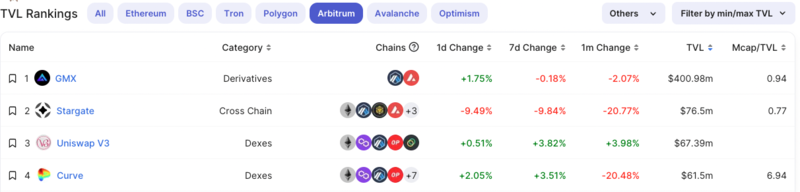

Since Arbitrum started, there has been a growing number of dApps on Arbitrum, and it is now a vibrant and thriving ecosystem as the leading L2 ecosystem with over 100 protocols.

Let’s go through some of these interesting protocols such as Uniswap, GMX, Dopex, Vesta Finance, and Treasure DAO.

Uniswap

Uniswap is a decentralized exchange (DEX) protocol where users can swap assets and provide liquidity permissionlessly.

UniswapV3 introduced concentrated liquidity, where a user can concentrate all their liquidity into their specified price range instead of from 0 to infinity. This allows for greater liquidity while the token price is trading within the price range.

Greater liquidity creates lower slippage for traders, attracting greater trade volume, which is why Uniswap is one of the most widely traded DEX in DeFi, including on Arbitrum which ranks top 8 in volume traded on CoinGecko.

More trade volume means more fees are generated for liquidity providers as well, attracting more liquidity providers to provide liquidity and earn trading fees, allowing Uniswap to be the 4th largest protocol by TVL on Arbitrum. It currently has a market cap of $4.45 billion, ranking top 18 in market cap.

Image taken from DeFiLlama

To find out more information about Uniswap, you can visit their docs here.

GMX

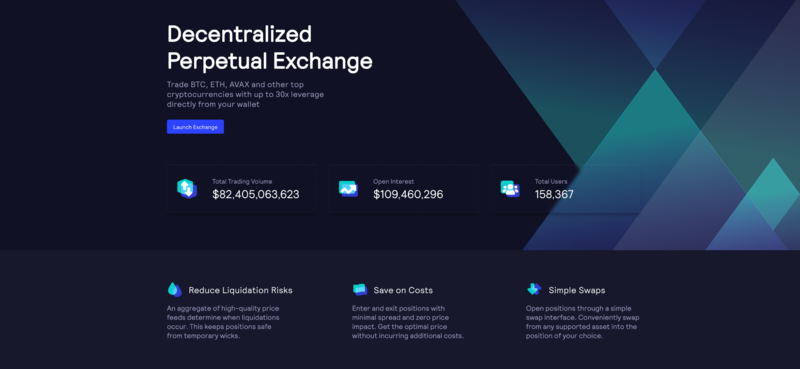

GMX is a decentralized spot and perpetual exchange with low swap fees and zero slippage where users can place market, limit, or trigger orders with up to 30x leverage. As GMX is one of the most popular protocols in the Arbitrum ecosystem, we will expand a little more on them.

What makes GMX unique compared to other perpetual exchanges is its zero-slippage swaps and this is thanks to using oracle price feeds and their index token, GLP, which is the liquidity provider token of GMX that traders would trade against, and it also accrues 70% of all generated fees on the platform.

On Arbitrum, the GLP basket includes assets like ETH, BTC, LINK, UNI, USDC, USDT and DAI with different weightings, equally balanced between volatile assets and stablecoins. This 50-50 basket has proven attractive to users, especially in a bearish or volatile market where they seek a more defensive portfolio.

Users can obtain this index token by minting with any underlying index asset, providing liquidity for traders to trade against. On top of that, GLP holders also earn a profit when traders lose money, but lose money when traders earn a profit, as GLP holders provide liquidity and are essentially acting as ‘the house’ in a casino.

Fortunately, the net PnL of traders overtime is trending downwards, meaning GLP holders are actually earning from traders who are net losing money, making GLP an even more attractive token for users to mint and hold. This increases the liquidity of GLP, attracting even more traders and creating a positive flywheel effect.

Image taken from GMX

The protocol balances the weightage of an asset through GLP minting fees. It does not auto rebalance which means that there is no standard impermanent loss.

If an asset is above its targeted weight, the cost to mint GLP with that asset would be higher. Likewise, if an asset is below its targeted weight, the cost to mint GLP would be lower or even free.

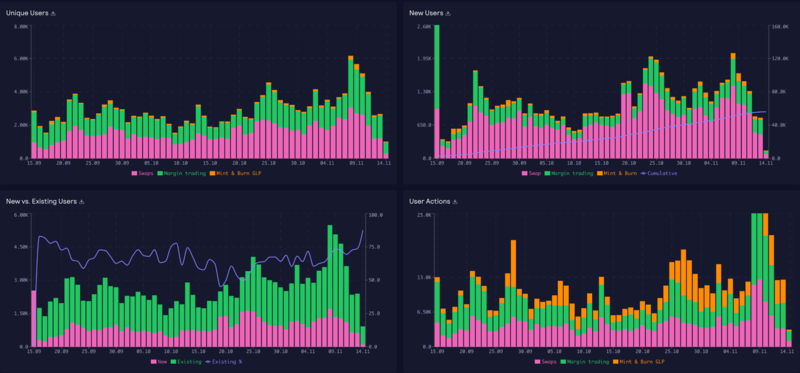

These features have made it one of the most popular protocols on Arbitrum, with over 140,000 users, and it has seen an increase in users during the fallout of FTX as some traders flock to GMX as an alternative to centralized derivative exchanges.

With a current market cap of $327 million, GMX ranks 1st on Arbitrum in TVL with a total of $370 million and over $65.3 billion of trading volume starting from 1st Sep 2021.

This information can be seen on their stats page.

GMX is the utility and governance token that also accrues 30% of fees generated from swaps and leveraged trades. For more information about GMX, GMX token and how the platform works, you can visit their docs here.

Dopex

Dopex is an options protocol that aims to provide maximum liquidity and minimal exposure for options traders.

With a current market cap of $36.6 million, Dopex ranks 11 on Arbitrum with a TVL of $17 million.

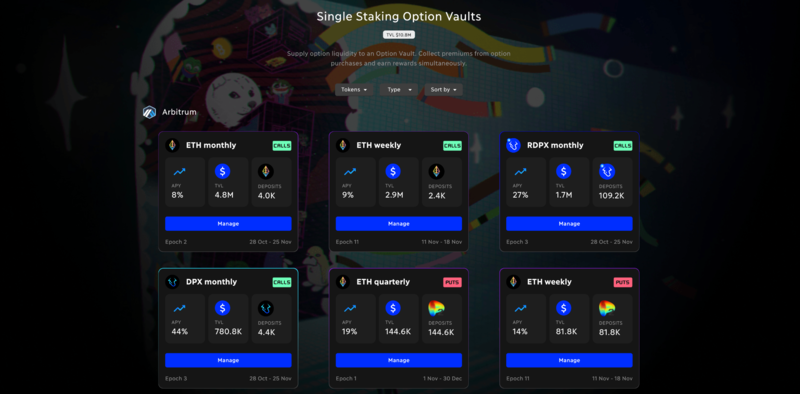

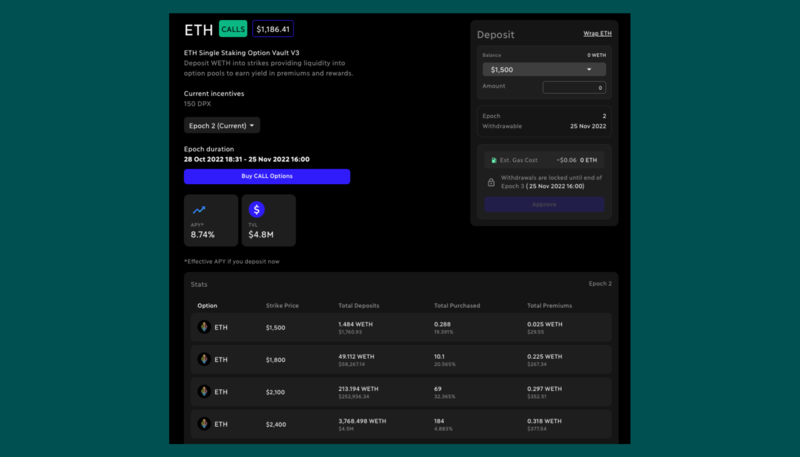

Similar to most option platforms, Dopex offers call and put options at strikes ranging from near to far out of the money with weekly, monthly, and quarterly expiry for ETH options. It also offers some exotics options such as GMX, GOHM, CRV, and even for its own tokens, DPX and rDPX.

What makes Dopex interesting is their Single Staking Option Vaults (SSoV) which allow users to earn a non-risk-free passive yield by depositing accepted assets as liquidity for users who wish to buy call and put options on these assets. This is essentially writing calls and puts which can result in losses if the market is volatile.

Image taken from Dopex

These structured option vaults can be a popular way to earn passive yield with different strategies that perform better depending on the market movement, whether it is trending or sideways, but generally do not do well during overly volatile periods.

Dopex uses a dual-token model. DPX is the governance token with value accrual. rDPX is distributed as rebate tokens to the option pool participants in case losses are incurred by the pool. veDPX is locked and staked DPX which gives users value accrual through allocations of protocol fees, staking rewards, etc.

For more information about Dopex, its token model, and how the platform works, you can visit their docs here.

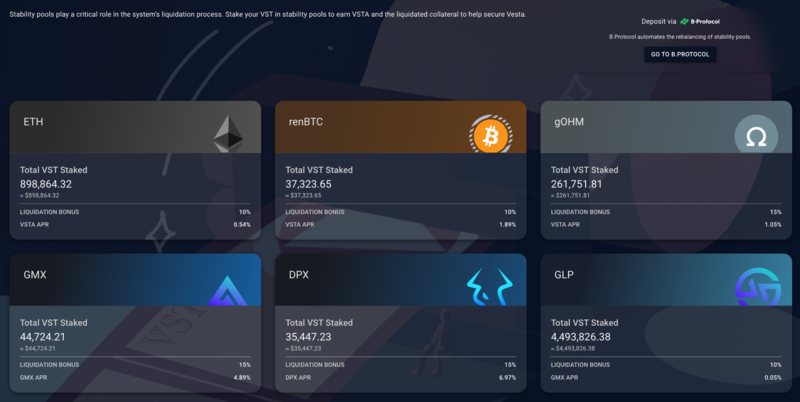

Vesta Finance

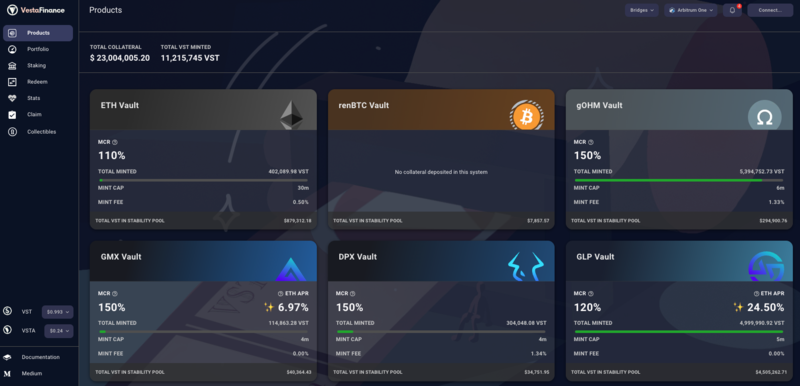

Vesta Finance is a lending protocol on Arbitrum that allows users to borrow a collateralized stablecoin, VST, against a variety of collateral with a minting fee but no interest fee, in order to obtain higher capital efficiency.

With a current market cap of $6.48 million, Vesta ranks 13th on Arbitrum with a TVL of $57.55 million.

Using ETH as an example, users will be able to borrow against ETH on Vesta Finance at 110% minimum collateralization ratio at zero interest. This means you will be able to mint up to $90.9 worth of VST with every $100 worth of collateral.

Vesta also allows users to earn VSTA for providing VST liquidity on their platform which is used to instantly liquidate any vaults that are under the minimum collateralization ratio. This liquidation process can be initiated by anyone and provides a return for people who deposit into the stability pools.

For more details about the protocol features and tokenomics, you can visit their docs here.

Treasure DAO

Treasure is a decentralized NFT ecosystem on the Arbitrum ecosystem that is built specifically for metaverse projects.

Treasure has a current market cap of $56 million, ranking 9th on Arbitrum with a TVL of $25.7 million.

One of these projects is Bridgeworld, a P2E game built within the Treasure ecosystem. The game works around strategic trade and land control by farming key resources. It also allows the formation of guilds and DAOs, enabling strategies around farming optimization.

Trove is the main NFT marketplace in the Treasure ecosystem. Trove allows transactions in both ETH and MAGIC for ease of convenience. It will implement user levels and achievement systems to provide a gamified NFT collectors’ experience.

MAGIC is the sole currency around the Treasure ecosystem and can be staked to earn rewards and used to purchase NFTs on Trove. Besides marketplace transactions, it also acts as the reserve currency for metaverses under the Treasure umbrella.

For more details on TreasureDAO, Bridgeworld, Trove, and MAGIC, you can read them on their docs here.

Arbitrum vs. Optimism

Arbitrum and Optimism are both optimistic roll-ups and appear similar on the surface, however, they have a different dispute resolution frameworks when it comes to validating transactions onto Ethereum.

Optimism utilizes single-round fraud proofs that are executed on Ethereum, whereas Arbitrum utilizes a more sophisticated technique known as multi-round fraud proofs that are executed off-chain which is more efficient and cost-effective than Optimism’s single-round proofing.

Compared to Optimism which has under 100 protocols, Arbitrum has well over 130 protocols, and the total TVL of Arbitrum is about 60% more than Optimism.

Additionally, as if Arbitrum wasn’t fast and cheap enough, there is another separate network known as Arbitrum Nova which is even faster and cheaper and is meant for social and gaming transactions.

There have been significant rumors surrounding an airdrop of Arbitrum tokens, particularly following the Optimism airdrop. Let’s talk about how you can potentially get it as a free airdrop!

The Arbitrum Airdrop

Airdrops are a way to encourage users to interact with the protocol by rewarding users who have fulfilled certain requirements with a token that is dropped directly into their wallets.

Arbitrum is the most hyped protocol right now for airdrop hunters as they have repeatedly hinted about their airdrops. Here are some ways you can get yourself eligible. Although there’s no guarantee as the requirements are not known, it is certainly worth trying as these airdrops can sometimes be worth a lot, up to even $50k!

Here are some potential eligibility criteria:

-

Interact with Arbitrum dApps

-

Obtain Guild roles on Discord

The first step is to interact with Arbitrum dApps, and that should start with none other than the Arbitrum bridge. If you haven’t already bridged assets over, the possibility of a lucrative airdrop should be enough of an incentive for you!

After you’ve bridged funds over, interact with the various dApps we talked about, from GMX to Dopex! Arbitrum even created a guild page where you can collect discord roles by accomplishing certain tasks, so make sure you check that out! Most of these tokens can be purchased by going to 1inch and will need about $10 to finish these steps (including gas fees).

Lastly, Arbitrum Odyssey lasted briefly as gas fees skyrocketed above ETH’s fees, and users that interacted with it got an Arbitrum Odyssey NFT, if you missed out on this, you can purchase the NFT here, which will also help you get one of the roles on Discord!

Additionally, it also helps if you have participated in ETH and other L2 networks like donating to Gitcoin Grants on L1, being a DAO voter, being a Multi-sig signer, which can be done on Gnosis Safe, as well as being a repeated Optimism network user!

Optimism doubled their TVL after their airdrop, increasing their rank from 5th to 2nd place, and rewarded users with over $10k in value, so the Arbitrum token may not be easy to get, but it is likely going to be worth it!

Conclusion

Ethereum is facing scalability challenges, and Layer 2 solutions like Arbitrum are a great way to scale the Ethereum ecosystem, allowing the average user to have a much better user experience, while still maintaining security and self-custody over the user’s own funds.

With the high transaction speed and low fees, it is possible that one day, mass adoption for DeFi comes through massive growth in a Layer 2 network like Arbitrum rather than Ethereum directly.