Table of Contents

The Ethereum Merge generated a lot of interest in Ethereum Classic. The Merge is the event Ethereum has been building up to ever since its launch in 2015. It will transition Ethereum from a Proof of Work (PoW) consensus mechanism to Proof of Stake (PoS).

It will lower Ethereum’s energy footprint as well as decrease the costs of running a node. As a result, Ethereum will become more energy efficient and more decentralized.

Conversely, Ethereum Classic would remain the same – using PoW consensus. It has stayed under the radar for a while, whereas Ethereum has been the talk of the town. But as we get closer to the Merge, more miners are considering Ethereum Classic as an alternative.

So in this piece, we will put Ethereum and Ethereum Classic together to see how they compare against each other.

Let’s dive in.

Difference Between Ethereum and Ethereum Classic

From the outside, Ethereum (ETH) and Ethereum Classic (ETC) look similar. After all, they both carry a similar name and use the same consensus mechanism (at least for now.) They share the same blockchain technology.

But a closer look will show you how different they are.

ETH has no fixed supply, but there’s a cap on how much ETH could be issued in a year (18 million tokens.) ETC has a fixed supply of 210.7 million tokens. This, at least in theory, makes ETC more deflationary compared to ETC because the block rewards for ETC miners decrease over time. There’s a 20% reduction in the block rewards, every 5 million blocks.

Ethereum has a much wider institutional adoption. For instance, the Grayscale Ethereum Trust offers institutional investors ETH exposure. The top holders of that trust are Rotchschuld Investment Corp, Rye Rook Capital LLC, and Weatherbie Capital LLC.

So what led to the creation of ETC?

It’s storytime.

How Did Ethereum Classic Come About?

Back in 2015, Vitalik Buterin created Ethereum. It was the first blockchain that supported smart contracts and became popular around the “ICO craze.” An ICO – an initial coin offering – is a way of raising capital for early-stage crypto projects.

Various projects launched their tokens on Ethereum. One of the most successful ICOs was The DAO, raising over $150 million worth of ETH. Its success was short-lived. Hackers found and exploited a smart contract bug. They withdrew a third of The DAO’s ETH (around $60 million worth of tokens.)

As you can imagine, a lot of investors felt cheated and even wanted Ethereum to fork. A fork is a change in the protocol. And in this case, the community wanted Ethereum to fork, so it could reverse the DAO’s transactions. That way the investors would become whole.

The situation created a huge debate within the Ethereum community. Some people felt that a fork goes against Ethereum’s ethos of immutability and decentralization. How could you trust Ethereum’s transactions when they could be reversed? That was the big question.

But the majority of the community agreed to restore the funds, forking the chain. As a result, the Ethereum blockchain split into two separate blockchains. The new blockchain network became Ethereum, using ETH as its cryptocurrency.

The older one, which has the original blockchain technology is Ethereum Classic. Its native token is ETC. And that’s how it came about.

But what about their consensus mechanisms?

Consensus Mechanism

As of now, both chains use the PoW consensus mechanism but Ethereum is transitioning to PoS. A consensus mechanism validates the transactions, keeping the network secure.

If everything goes according to plan, Ethereum would become a PoS chain by the end of 2022. Ethereum Classic won’t be affected by that change. It will keep using PoW and won’t get any updates from the Merge.

This means both chains are equally secure, right?

Not really.

Ethereum Classic has been a victim of a 51% attack a few times. This attack happens when bad actors take control of more than half of the network.

In 2019, Ethereum Classic was hit for the first time with a 51% attack. The bad actors stole almost $500 000 worth of ETC at the time. And in 2020, the same attack happened three times in a row.

As a result, Ethereum Classic implemented a security change called Mess Network Security Solution. It made a 51% attack 31 times more expensive. Since then, Ethereum Classic hasn’t suffered any attacks. But many investors have lost trust in its security.

So far, Ethereum hasn’t had the same problem. It has never suffered from a 51% attack.

While their security might differ, both chains handle the same amount of transactions per second (TPS), which is around 30. If you compare their capacity to established players in the financial servicing world like Visa (1700 TPS) and Mastercard (5000 TPS), you’ll realize they still have a lot of catching up to do.

If the Merge is successful, Ethereum would be in a pole position to increase its scalability via layer 2 solutions. Layer 2s are blockchains built on top of existing layer ones like Ethereum. They provide users with better scalability while taking advantage of layer 1’s security.

Now, let’s take a look at both ecosystems.

DeFi Ecosystem

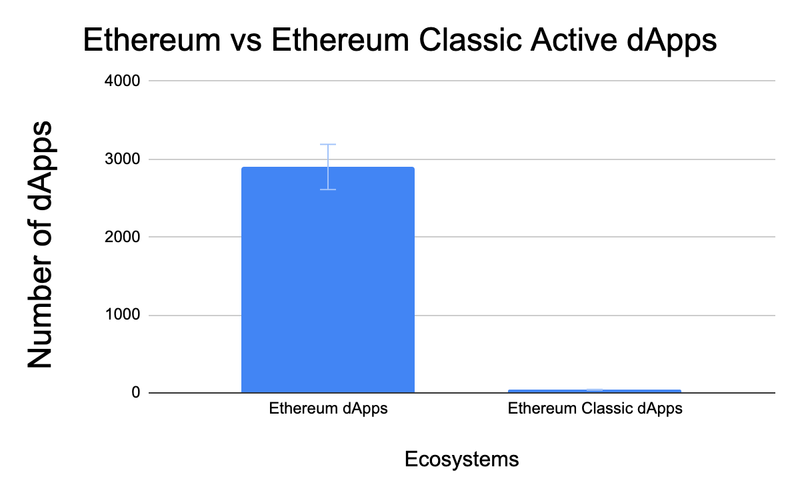

Ethereum and Ethereum Classic both want to be the go-to platform for decentralized applications (dApps.) Despite these intentions, Ethereum is outperforming Ethereum Classic by a wide margin. There are more than 2900 dApps running on Ethereum while Ethereum Classic has less than 40.

Below is a chart for illustration:

Source: Tanyo Gochev

Source: Tanyo Gochev

That’s because Ethereum has a much stronger ecosystem pull. It has more tools and better infrastructure that allow developers to create dApps. Wallets like MetaMask make it easy for regular people to transact on the network. And the world of decentralized finance (DeFi) also favors Ethereum. Popular DeFi apps like Aave and Compound use Ethereum as their blockchain platform.

As the primitive version of Ethereum, Ethereum Classic doesn’t have these things going for them. Although most tools available for Ethereum could also be used for Ethereum Classic, there’s a lack of native developer tools, making it harder to create and maintain dApps on its network.

Ethereum Classic has existed as long as Ethereum, but it doesn’t generate the same interest. That might be because Ethereum is seen as the more legitimate chain at that time.

So what does the future hold for these chains?

What’s the Future of Ethereum Classic?

Ethereum has its future in its own hands, especially if the Merge is successful. But Ethereum Classic’s future depends on how the Merge goes. It could create an opening for Ethereum Classic to take some miners and developers away from Ethereum. That’s because post-Merge, it won’t be possible to mine ETH. But it would still be possible to mine ETC.

And switching between those would be easy. Since the miners won’t need to buy extra equipment, mining ETC is convenient.

Ethereum Classic’s hope is that the new wave of miners would drive more interest toward its ecosystem. And if there are some unforeseen technical problems around the Merge, Ethereum Classic could take advantage of those. Could it become the fallback chain for Ethereum developers and miners?

Only time will tell how it plays out.

There’s only one problem with this thesis though – there’s already talk of a new Ethereum fork. It has its own token (ETHW). This potential new fork might create a new competitor to ETC given that its biggest supporters are the miners.

But it remains to be seen if they go ahead with the ETHW fork or choose to mine an already established coin like ETC.

In addition, Ethereum Classic has its own plans. It will launch versioning of deployed contracts. This update will guarantee that the code will run on a compatible version of the Ethereum virtual machine (EVM.)

It’s hard to say what the future holds for Ethereum Classic, but as of now, the project doesn’t drive the same interest as Ethereum.

Ethereum Classic vs Ethereum: Showdown Results

In the battle between Ethereum Classic vs Ethereum, Ethereum is dominating. Ethereum has more working dApps, developers, retail, and institutional money behind it compared to Ethereum Classic. It has also never suffered from a 51% attack, so in theory, it has better security than the original version.

And with the Merge around the corner, the narrative favors Ethereum. But let’s not count out Ethereum Classic yet. If the Merge fails or faces some technical problems, Ethereum Classic could take advantage of those.

Regardless of what happens, it’s clear that ETH miners would need to find a new coin to mine. And ETC seems like a viable alternative.

Interested in more battles? Check out how Ethereum compares to Solana!