DeFi continues trudging along

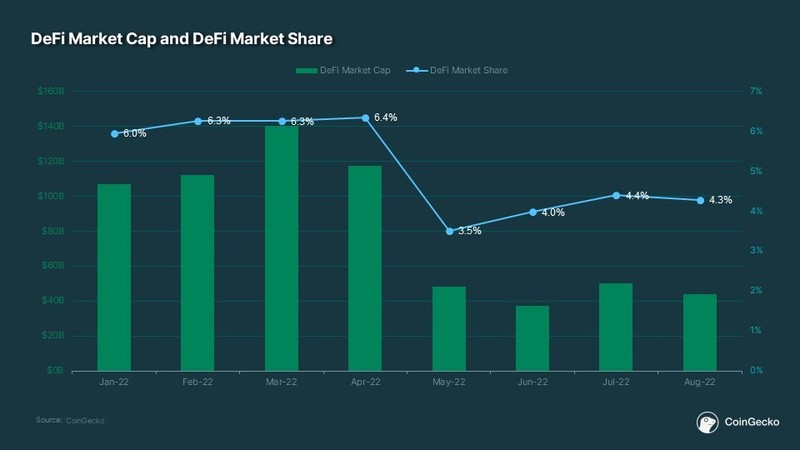

Bear markets are brutal and its impact on the Decentralized Finance (DeFi) sector is no exception. With the DeFi market cap once reaching as high as 7% ($160B) at the start of 2022, the black swan event in May has almost halved its total market share– it is now ranging between the 4 – 4.5% mark.

DeFi governance token appreciation based on speculation

Market caps do not reflect the utility rate of DeFi protocols, but rather its native tokens. A contributing factor in DeFi’s stagnation is the lack of development and discussion of value accrual effects for protocols’ governance tokens. While not all DeFi protocols have governance tokens, it is safe to assume that most do; though in most cases, there are no value accrual effects at all.

In other words, most of the token’s value or price appreciation comes from speculation, much like growth stocks who have yet to issue dividends.

Many investors throughout DeFi summer in 2020 have extrapolated value through governance tokens because it is the only form of monetary exposure one can have for a particular protocol. However, that level of risk and speculation involved becomes a lot more riskier against the onset of a global recession and hyper-inflationary economies.

What’s next for DeFi?

DeFi will likely maintain its market share, keeping within this range for the foreseeable future until more innovative token models are introduced. That said, it is worth noting that this rationale probably flies out the window in an exuberant bull market.

If you use these insights, we would appreciate a link back to this article on CoinGecko. A link credit allows us to keep supplying you with future data-led content that you may find useful.

Curious to find out more about our previous research studies? Check out this one we did on the Market Share of NFT Marketplaces.