Table of Contents

Cardano vs. Ethereum. Which is superior? When it comes to tribalism, few names can conjure up the burning ire of maxis. In the red corner, we have Ethereum, the second-largest cryptocurrency by market cap. In the blue corner, we have Cardano, a slow yet formidable contender.

Even just last year, there was talk of Cardano as a promising “ETH Killer”, whatever that means. But since then, such talk has died down. So where is Cardano now? And how will it hold up against the Ethereum upgrades?

Let’s take a closer look, shall we?

Cardano vs. Ethereum: A breakdown

Below, we explore the commonalities as well as the differences between Ethereum and Cardano. So what do these two chains have in common? A lot more than you think. And it starts with their core philosophy.

Philosophy. When founder Vitalik Buterin initially conceived Ethereum, he envisioned it as a world computer, upon which decentralized applications (dApps) would operate.

Ethereum launched in 2015 with a similar philosophy to Facebook: “Move fast, break things.” In this sense, Ethereum launched as a minimum viable product, with expectations of future upgrades to come later.

Compare this to Cardano, which adopted a more cautious path. Cardano launched in 2017 with a peer-reviewed research-driven approach. It aimed to incorporate academic rigour and math with blockchain technology.

Cardano’s vision isn’t incidental either. Charles Hoskinson, the man behind Cardano, is a former Ethereum co-founder. In fact, many view Hoskinson as having gone on to find Cardano to overcome the many shortcomings of Ethereum. (We’ll discuss these shortcomings throughout the guide.)

Smart contracts. Ethereum is the first blockchain to launch smart contract functionality. Cardano has since implemented smart contracts, though.

What are smart contracts? Essentially, they are algorithms that self-execute once specific preset conditions are met. In other words, smart contracts allow us to conduct any type of transaction without having to rely on an intermediary or a central authority. (Watch this video to learn more about smart contracts.)

Development speed. Ethereum launched first, so it has a first-mover advantage. But then again, so did Blockbuster. Fun fact: Blockbuster actually had an offer on the table to buy out Netflix for a cool $50 million. We all know how that story ended.

© Rept0n1x | Wikimedia

© Rept0n1x | Wikimedia

But to take Ethereum for Blockbuster would be a huge mistake.

Still, Cardano doesn’t seem to be in any hurry. The chain is taking the tortoise and hare approach… and comfortably assuming the role of the tortoise. (Slow and steady wins the race, Hoskinson thinks.)

But I wouldn’t be too slow about it. Ethereum has been working on its series of Ethereum upgrades. The Merge, the most recent update, is on the horizon.

Speed of development aside, let’s take a look at what makes these two blockchains heavyweight contenders in the crypto space.

Consensus mechanism

© Miguel Á. Padriñán | Pexels

© Miguel Á. Padriñán | Pexels

A consensus mechanism is what enables blockchain technology to exist. Ethereum operates on the Proof-of-Work (PoW) consensus, the original mechanism inherited from Bitcoin.

Without getting too technical here, here’s what you should know. If a network is decentralized, it’s harder to take down because there is no single point of failure. Conversely, a centralized network is vulnerable to a single point of attack.

This organization of decentralized security works because all the participating nodes who are responsible for securing the network are…

1. Rewarded in freshly minted tokens for their participation

2. Heavily invested in the network, so taking it down is like taking a match to your own money.

The PoW mechanism achieves consensus by requiring nodes to invest in energy-intensive mining hardware. This hardware is used to run complex calculations to solve computational puzzles. In PoW, nodes are called miners. And once miners solve these puzzles, they mine (i.e., validate) the correct block to be added to the chain.

Ethereum may be the first chain with smart contracts. But Cardano launched with Proof-of-Stake (PoS) consensus, which Ethereum is only now aiming to achieve fully with the Merge. This energy-efficient consensus scheme doesn’t require nodes to invest in hardware. Instead, participants lock their investment into a smart contract on the blockchain network. The rationale is similar to PoW. (You wouldn’t attack the network on which you’ve staked your crypto assets, right?)

In PoS, nodes are known as validators. Not everyone can become a validator node, though. Smaller holders of ADA, the native token of Cardano, can join validator pools. Validator pools are run by a validator, who is responsible for maintaining the pool, including the total amount staked.

Validators must ensure that their pool doesn’t get too saturated, or they risk getting the pool rewards slashed. This design is baked in to encourage as much decentralization as possible.

Unlike with PoW algorithms, in PoS algorithms randomization plays a major role. Once ADA is locked up in a smart contract, validators are selected at random to add new blocks.

© TechCrunch | Flickr

© TechCrunch | Flickr

Programming Languages

All blockchains that are Ethereum virtual machine-compatible speak Solidity. This makes up a huge chunk of the blockchain space.

Contrast this with Cardano, which uses Haskell, arguably for its security and speed. However, Haskell is much more difficult to learn, making it unpopular among many developers.

Blockchain Architecture

Ethereum is a Layer 1 technology. Yes, even with the Beacon Chain, the Merge, and everything else planned, these are all just parts of the series of network upgrades that will strengthen the Ethereum network and prepare its architecture for rollups on Layer 2.

Why does Ethereum need an upgrade at all? Well, the chain was originally designed with an auction-based model. So, when people want their transactions added to the chain, they bid on that space. That’s why, whenever the network gets congested, Ethereum fuels bidding wars, triggering price spikes and slower speeds.

Believe it or not, Cardano also operates on two layers. The Cardano Settlement Layer is transactional. The Cardano Computation Layer on top of it uses smart contracts so that dApps can run on Cardano.

Governance Structure

Cardano has three independent organizations under its umbrella:

- IOHK, the organization that coded Cardano and is responsible for the PoS algorithm it uses

- The Cardano Foundation, in charge of blockchain development

- Emurgo, an external facing organization whose mission is to onboard large-scale businesses to join Cardano

Cardano also has a treasury, which runs as a separate entity from these organizations. Whenever a block is added to the chain, a portion of the ADA rewards are rerouted to a separate treasury wallet. And whenever a change is proposed to the network, ADA holders vote on the proposal. Should the proposed changes pass, a grant is approved and released by the treasury. Pretty cool, huh?

When it comes to organizational structure, Ethereum is overseen by a single organization, the Ethereum Foundation. The foundation claims not to run Ethereum, and this is certainly more true today than it was in the past, since decision-making on the chain has become more decentralized over time. However, we shouldn’t forget what happened with the DAO fork of 2016.

Time for a very short story: In 2016, a protocol called The DAO got hacked for 3.6 million ETH. The Ethereum Foundation decided the following. Anyone who held ETH was allowed to vote on whether Ethereum should fork.

So what happened?

The vote passed with 85% voting for the fork, and thus it was done. A few miners did not recognize the vote because the fork proposal wasn’t due to any defect in Ethereum itself. So, they rejected the fork and went on to create Ethereum Classic (ETC).

Transaction Speed

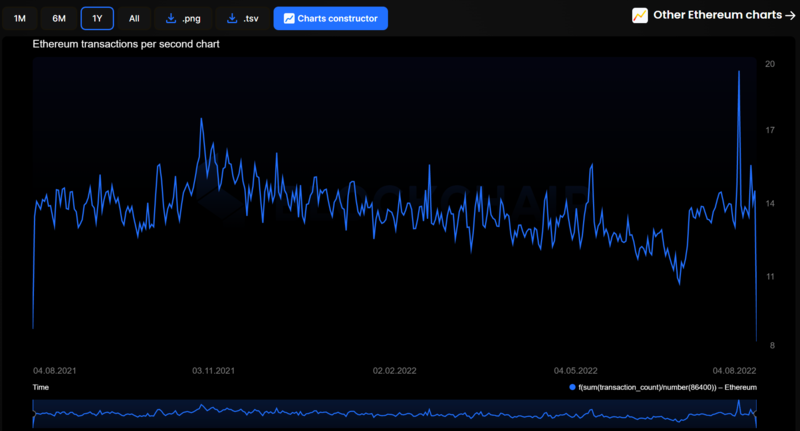

© Blockchair

© Blockchair

On Layer 1, Ethereum can process up to 30 transactions per second (TPS). Despite criticisms about Cardano’s developmental speed, the chain can process roughly 250 TPS. But then again, we’re talking about the present state. When we consider future upgrades, both Cardano and Ethereum have the potential to change the stakes. (Pun intended.)

For instance, Cardano’s Layer 2 Hydra upgrade could raise Cardano’s TPS to a potential 2.5 million. Ethereum’s upgrades, which we’ll cover in a later section, are looking at a TPS increase of up to 100,000 (!).

DeFi Ecosystem

© Uniswap

© Uniswap

Let’s compare the decentralized finance (DeFi) ecosystems of Ethereum and Cardano. To date, Ethereum has 3,000+ decentralized applications (dApps) running on it, whereas Cardano has a little over 1,000. (Still impressive, btw.)

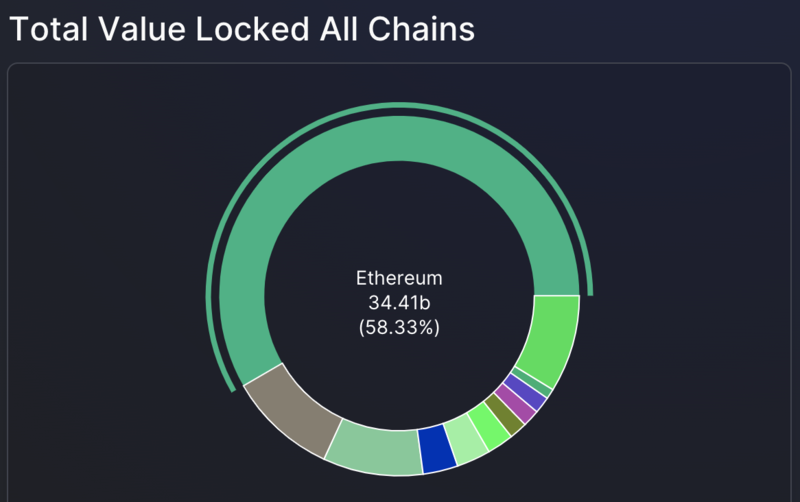

Since Ethereum is the first chain with smart contracts, it only makes sense that it has the first DeFi dApps. To name a few, these DeFi apps include Uniswap, the first decentralized exchange to rely on an automated market maker model, as well as DeFi giants like Aave and Curve. When looking at total value locked (TVL), Ethereum’s DeFi ecosystem dwarfs all the other chains.

© DefiLlama

© DefiLlama

But what about Cardano? Believe it or not, Cardano’s DeFi ecosystem has its users, despite TVL being less than $100 million at the moment. And even though it comprises only a tiny fraction of Ethereum based on TVL, Cardano DeFi holds its own, featuring prominent projects such as Minswap, WingRiders, and Sundaeswap.

NFT Ecosystem

© BAYC

© BAYC

Ethereum is the first blockchain to feature non-fungible tokens (NFTs). Some of the most popular—and lucrative—NFT projects have come from Ethereum. They include the iconic CryptoPunks and Bored Ape Yacht Club (BAYC). However, due to Ethereum’s scalability issues, at present, users can’t do much with their prized digital assets.

But the blame doesn’t rest entirely on Ethereum’s shoulders. To be fair, these limitations also depend heavily on the individual NFT project itself, and whether the team wishes to incorporate additional utility into their NFT collection (e.g., buying a plot of land in the Metaverse or granting access passes to IRL events).

Despite what people say about Cardano being a “ghost chain”, it does have a somewhat vibrant and active NFT community. A couple of popular projects on Cardano include SpaceBudz and the gorgeously crafted Clay Nation by Clay Mates. Cardano also boasts 15 secondary marketplaces, one of them being jpg.store.

Criticisms on ADA

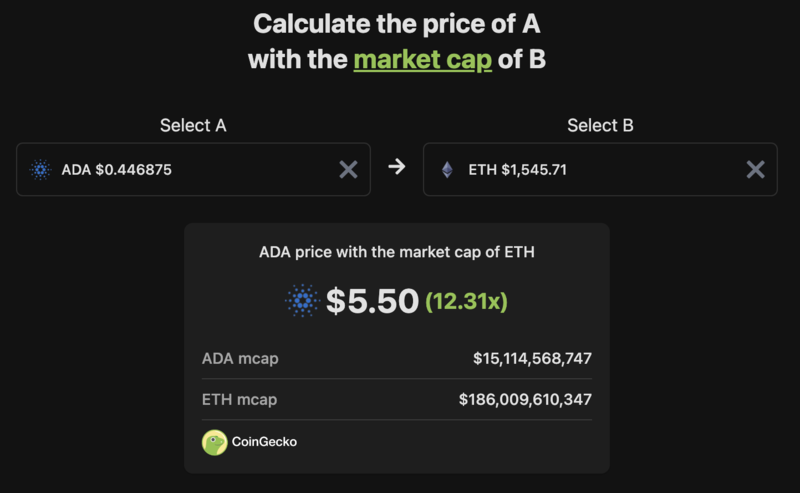

© CoinGecko

© CoinGecko

During the last bull run, there was a lot of talk about whether Cardano would actually reach $5, or even $10. But CoinGecko’s coin comparison tool comparing ADA to ETH token quickly shows otherwise.

For ADA to breach the $5 mark, at its current price, Cardano would have to reach (close to) Ethereum’s market cap! Sure, it’s not impossible. In a new market with extremely high volatility, anything’s possible.

Sure, Ethereum can get slow and stupidly expensive. But Cardano hasn’t fully launched yet. And will devs actually hop over?

Still, discussing all this without looking at the finished product is a bit premature. So let’s try to imagine these chains from a post-upgrade perspective. In the next section, we look at what Cardano and Ethereum are aiming to bring their users in the future.

Cardano Hydra vs Ethereum 2.0

© cottonbro | Pexels

© cottonbro | Pexels

Why upgrade Ethereum in the first place? Ethereum rushed to market and prioritized security and decentralization. Scalability would come later. Much later. And today, scalability is the challenge.

This is where the real differences will show. But even once the Ethereum upgrades are complete (not called Ethereum 2.0 anymore, btw), even with a seamless launch, there probably won’t be a clear winner because the future will probably be multichain.

These Ethereum upgrades aren’t going to be completed anytime soon. Sharding is planned for 2023, and that too will undergo several iterations. And even then, Ethereum’s Layer 1 will still be just as expensive and slow.

What will change is the fact that Ethereum’s Layer 1 architecture will have been optimized and prepared for Layer 2 rollups. With the successful implementation of rollups, we should see Ethereum handle roughly 100,000 TPS.

Read more: Ethereum Upgrades: Understanding The Merge And Ethereum 2.0

Showdown Results

© Louis Hansel | Unsplash

© Louis Hansel | Unsplash

This guide looked closely at the similarities and differences between Cardano and Ethereum. In the end, the major differences emerge not only from the technological features, but those that speak to their philosophy, infrastructure, governance structure, and more.

So who has the better design and philosophy? Cardano or Ethereum?

Ultimately, it might not even matter which one is “better”. What’s most important may quite possibly be whether a specific use case for each will exist. And I believe it will. Cardano is capitalizing on things Ethereum is not, and vice versa. Look no further than the Africa initiatives for Cardano, and DeFi for Ethereum.

Ethereum can help retail investors access financial instruments that were unavailable to us in the past. Cardano can bring financial services to millions of unbanked in parts of Africa and Asia. With this greater sense of mission, isn’t tribalism just a distraction from the bigger scheme of things?

There’s a chance that in the future, Ethereum and Cardano will both be winners. And in such a future, where users don’t have to choose between one or the other option, the users are the real winners.

To learn more, check out how Solana and Ethereum battles against each other!