Table of Contents

Key Takeaways:

-

Aptos is developed by former Meta employees to solve the issues currently faced by decentralized systems.

-

It claims to offer a scalable system with a speed-oriented approach that handles transaction broadcasting, block data ordering and data storage in parallel to save time.

-

Aptos offers safer smart contracts using a detection system that screens for vulnerabilities and warns users of malicious and underwhelming smart contracts.

-

Prior to full launch, Aptos had already gained much traction and is backed by prominent VCs and it is expected to compete with existing blockchain networks.

Even before Aptos blockchain launched its mainnet on 17th October 2022, it was already a prominent figure in the crypto space. A strong social media presence resulting from widespread discussions about its mouth-watering promises about being “the safest, most scalable Layer 1 blockchain” saw its official Twitter handle rake in over 190,000 followers. Social media engagement peaked with millions of impressions from hundreds of social media posts about the potential “Solana Killer”.

Aptos blockchain’s launch wasn’t really spectacular; it faced issues like having a lower TPS than Bitcoin’s 7 instead of its promised 160,000, along with opaque tokenomics.

Aptos is broken.

Aptos launched today – October 17, 2022 at 14:22:40

However, Aptos is currently has a lower tps than Bitcoin and a majority of tokens are either staked or ready to be dumped on retail investors.

Curious? Thread Below

👇— Paradigm Engineer #420 (@ParadigmEng420) October 17, 2022

Despite this, top-tier centralized exchanges including Binance, OKX, Huobi and MEXC have pledged their support and shared plans to list its native coin (APT).

While Aptos works on fixing its launch issues, let’s look at what Aptos is, and why it’s a VC darling.

What is Aptos?

Aptos claims to offer “safe, scalable and upgradeable Web3 infrastructure.” It’s a contender in the race among Layer 1 blockchains to achieve the goal of a single ‘perfect’ blockchain.

The perfect blockchain is expected to maintain decentralization, deliver top-notch security, while offering scalability through stability, lightning-speed transactions and low fees. This is also known as the blockchain trilemma, and most blockchains only achieve any two of these and sacrifice the other. Existing blockchains are continously attempting to fix this, and Aptos is another attempt at a perfect blockchain.

Aptos is highly anticipated and the subject of many discussions not just because of the technology it promises to deliver, but also because of the team working on these solutions.

Who Founded Aptos

Aptos was founded by a team headed by former Meta (formerly Facebook) employees: Mo Shaikh as Aptos’ CEO, and Avery Ching as CTO. Before their project would burst into prominence, Shaikh and Ching had it in mind to deliver a blockchain that serves the crypto community (and the larger population) with a focus on the user experience.

To do this, Aptos will attempt to optimize existing solutions and also introduce revolutionary solutions. The desired end result is a scalable, decentralized, security-intensive, and super cheap blockchain network without downtime.

With developments commencing as early as 2018, Aptos’ team has spent over three years honing their codebase and building extra facilities to ensure not only a successful launch but a capable enterprise-level blockchain. The team has raised $350 million in funding from a series of investor campaigns led by Andreessen Horowitz and FTX Ventures.

The connection with Meta has gained so much attention for Aptos, but it isn’t the first cryptocurrency with a direct connection to the popular social media firm. Its predecessor – Facebook’s Diem also made many waves in this space and beyond. What is the relationship between these two?

Aptos: Diem’s Successor?

If things hadn’t hit the financial regulation rock for Mark Zuckerberg, he and his team would have gone very far with a project he hoped will “bank the unbanked”. Meta (then Facebook) introduced the Diem (formerly named “Libra”) as a decentralized payment system that connects the globe through a unified and “permissionless” financial infrastructure. Making up the team that pursued this were Aptos’ CTO, Avery Ching, and Mo Shaikh who was also involved in Facebook at the time.

Zuckerberg’s project gave in to strict financial rules despite the high-power partnerships with some of the biggest names in fintech. The crypto community had already been underwhelmed by Diem due to some shortcoming such as slow speed, centralization, and the fact that Diem was simply a stablecoin backed by fiat currencies and bonds.

Diem made waves throughout 2019 to the first quarter of 2022, but Aptos blockchain had already gone into development before then. In contrast to Diem, Aptos was being developed to be a smart contract blockchain powered by a cryptocurrency (APT) that is subject to market forces.

The similarity in development teams is the only thing Diem and Aptos have in common. Shaikh, Ching, and any other ex-Meta employees joining the Aptos project will hope to use their experience to push the growth of a cheap and scalable platform that supports decentralized applications through smart contract technology.

How Does the Aptos Blockchain Work?

Aptos blockchain employs a flexible programming language (Move), modified data sharding technology, consensus mechanism, and state machine to achieve a scalable, fast and secure system.

The Move programming language was specially developed by the Diem team and used by Aptos developers for the Aptos blockchain. Move is an advanced programming language developed from Rust (programming language) with special abilities in protocol and algorithm development. Just like the Ethereum blockchain’s Solidity, the core of the Aptos blockchain was designed using Move-inspired protocols.

Aptos’s state machine is the Move Virtual Machine (MVM). The MVM is similar to Ethereum’s EVM (Ethereum Virtual Machine). MVM converts Move modules to bytecodes that can be understood by the Aptos blockchain. Move modules in this vein work just like Ethereum smart contracts. Move modules are code pieces that contain instructions for the Aptos blockchain. The modules turn the Aptos blockchain into an automated vending machine with their ability to sanction free-running transactions. This is only possible if the private key holder sanctions the permission request(s).

You can explore Aptos’ blockchain transactions and chain analytics with Aptoscan.

How Aptos Handles Block Data

In addition to Move’s inherent flexibility and protocols, Aptos handles block data with a speed-oriented approach that utilizes memory write sets as a cache for the next block to be executed. This is expected to birth an agile system. One way it does this is through its simultaneous and batched data processing mechanism. The Aptos blockchain handles transaction broadcasting, block data ordering, and data storage all at a time. These processes run parallel and save the system a great deal of time. The concurrent handling of parallel-running data makes Aptos blockchain at least 16 times faster than blockchains using similar tech.

In addition, transactions are processed in batches. To do this, the Aptos blockchain packages a series of transactions in stages and processes each of these stages at once. Transactions that fail to meet certain thresholds (like inadequate fees) are quickly removed from the execution queue to ensure that qualified transactions are executed faster.

Is Aptos PoW or PoS?

The Aptos blockchain runs the Proof-of-Stake (PoS) consensus algorithm. The PoS algorithm is generally preferred as a scalability-supportive consensus system. Like other PoS blockchains, validators on the Aptos network verify the integrity of data blocks added to the blockchain. Validators ensure that malicious data blocks are screened out of the chain to keep the network secure. Running a validator node on Aptos is basically the same process – stake at least a predetermined number of Aptos tokens.

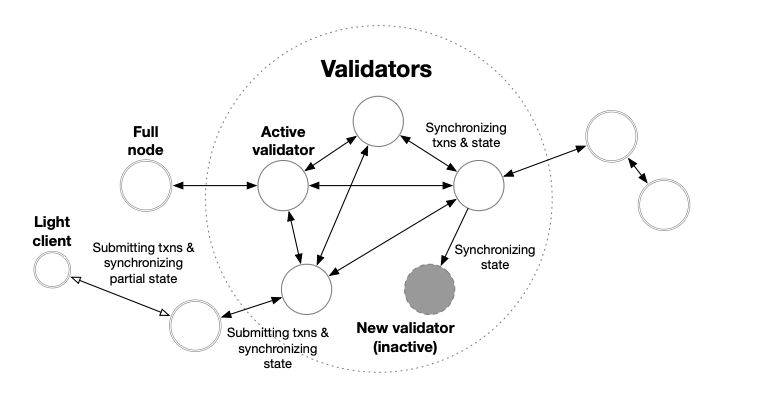

But Aptos shifts this paradigm in a special way. Aptos nodes are of two types; Full nodes and Light nodes. Both nodes participate in data block validation and contribute to keeping the chain stable, yet they play some different roles.

Source: Aptos White Paper

Full nodes are required to perform relatively more intensive computing tasks. Light nodes play maintenance roles, keep the system in check, and therefore perform lighter tasks.

Full nodes validate the entire network transaction and also verify the network’s states.They have the ability to truncate the network’s history or data block, where they can remove a string or data from the memory of the chain. This keeps the block size within scalable limits. Blockchains getting ‘heavy’ as more blocks are added is a principal cause of poor scalability in many blockchains. Aptos solves this through this data sharding technology.

It is important to note that the truncated data aren’t lost and can be synchronized with the rest of the blockchain when needed. Users who wish for a faster and lighter chain can ignore the truncated memory and work with a lighter and scalable chain.

Batch transaction, parallel execution, an agile consensus mechanism, and validator sharding make up the core of Aptos blockchain’s functionality. But a handful of other unique features keep it further apart.

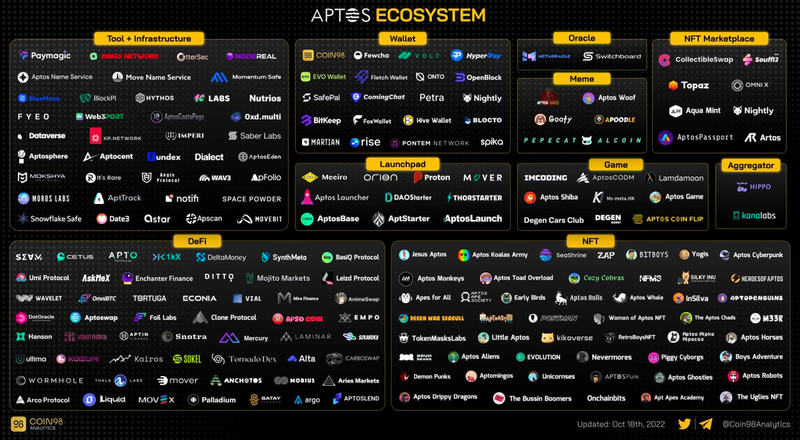

The Aptos Ecosystem

While the Aptos ecosystem is still in its early stages, it’s already attracted attention from numerous projects, setting the foundations for the future.

Source: Coin98

Unique Features of Aptos

Here are some of the incredible features of the Aptos blockchain. A number of these features work together with the core protocols while others are extra features on the blockchain that makes for better user experience and safety.

Move Multi-Account Privacy

Aptos can create and use multiple accounts that are controlled by a single account and are autonomous at the same time. The multiple wallets can’t be linked to the controller accounts and the owner can use the accounts without a trace of a single control point.

Move Prover

Smart contracts are high-level computing functions and are prone to exploitable vulnerabilities. In addition, they can easily dysfunction completely. The recent wave of smart contract exploitation in the crypto space is a proof of how important an efficient auditing system is.

Aptos blocks come with a special in-built auditing system. As the name suggests, the Move Prover runs a check on move modules deployed on the Aptos blockchain and verifies their authenticity, proving the security and feasibility of a module while confirming if these modules truly function as expected.

Private Key Delegation

If for any reason you ever wished to hand control of your wallet to a third-party, albeit temporarily, Aptos blockchain might just be an answer to your wishes. The private key delegation function allows wallet owners to delegate their wallets to an external party. The delegatee will have a good level of control over the wallet, although this control can be withdrawn by the wallet owner at will.

Aptos vs. Ethereum vs. Solana

Aptos joins a list of established Layer 1 blockchains, including Ethereum, the most established and most actively-developed blockchain, and Solana, touted to be one of the fastest blockchains in use. So how does Aptos stack up against these incumbents?

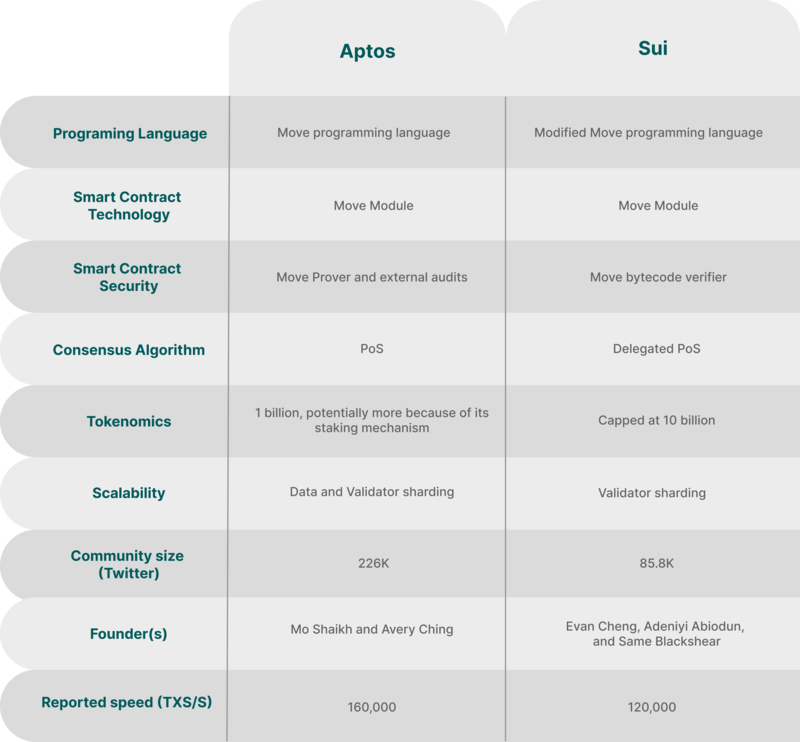

Aptos vs. Mysten Labs’ Sui

Aptos’ biggest competition is already existing blockchains, but an even closer contention is Mysten labs’ Sui blockchain. Just like Aptos, Sui is being developed by ex-Meta founders using the Move programming language, and is another high-profile Layer 1 blockchain project. Both projects have also raised an excess of $300 million each to pursue their goal of a scalable and secure low-fee blockchain.

Let’s see how these two projects compare against each other.

APT Tokenomics

The Aptos coin (APT) will embody the Aptos blockchain and its ecosystem. It functions as the utility and governance token.

As the utility token of the Aptos network, project building on the platform will be expected to integrate APT into their system and drive more utility. Aptos will also serve as the gas fee for the Aptos blockchain, where transaction fees will be charged in Aptos.

The Aptos coin will also be used to incentivize community contributions and security services of validators on the network. Existing holders who stake their assets as validators will be rewarded with APT for safeguarding the Aptos network.. The reward amount will be relative to the presiding APR and the number of tokens locked by the holders.

APT is also the governance token of the Aptos blockchain. Aptos holders can vote on improvement proposals and also submit their proposals for community deliberation. A decentralized government is expected to empower users of the Aptos blockchain, with APT at the helm of this goal.

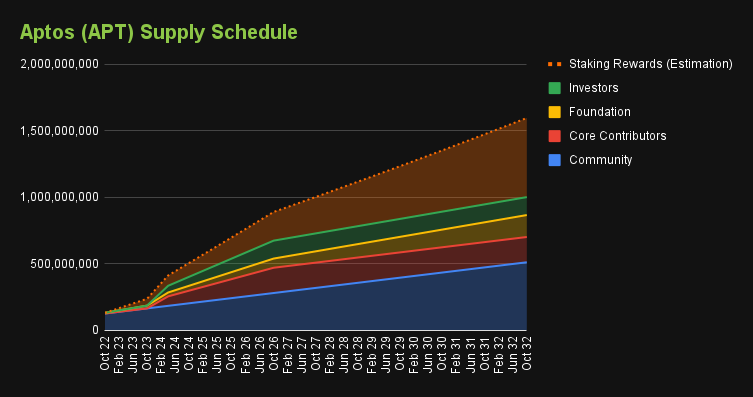

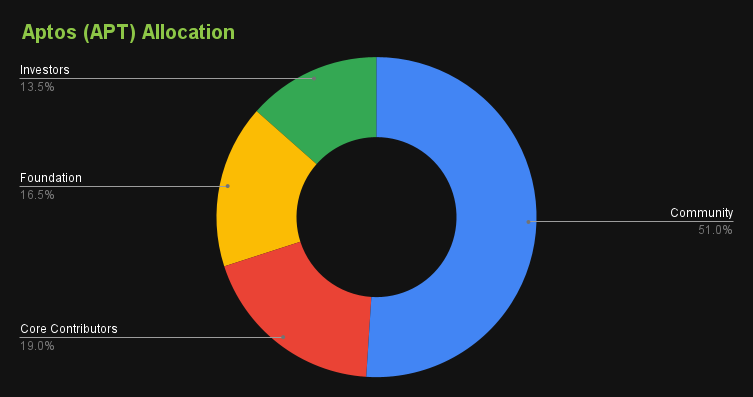

Published tokenomics data for APT reports that one billion (1,000,000,000) Aptos coins were minted at launch. This supply will be distributed to investors, community members, and the project team. The total supply is expected to grow to over 1.5 billion tokens in the next ten years.

Source: CoinGecko Aptos (APT) Tokenomics

13% of the initially minted tokens will be distributed to seed and funding round investors while 51% of the 1 billion tokens will be reserved for the Aptos community. These tokens will be held by the Aptos foundation (which has received 16% of the supply as well) and will be used for grants and community incentives and also used to fund growth initiatives.

The core team will receive 19% of this supply. This will be vested for a year and will be gradually released over time.

Source: CoinGecko Aptos (APT) Tokenomics

APT Tokenomics Controversy

Before launch, there was no news of the tokenomics for APT. This lack of visibility led to concerns in the community, which the team sought to quiet by revealing their tokenomics. Unfortunately, crypto twitter didn’t take kindly to 49% of the token supply being allocated to the investors, core contributors and foundation.

Where to Buy Aptos

Hot on the heels of the mainnet launch, top-tier exchanges and many more have listed APT for trading, including Binance, Huobi Global, MEXC, OKX and FTX which listed APT at the same time on 19th October 2022.

While APT’s had a rocky start, dropping over 45% from its peak of $13.73 at time of writing, it currently ranks 56 on CoinGecko by market cap.

Aptos Supported Wallets

Thinking about where to keep your APT coin? A handful of wallets already exist for Aptos investors. Here are some wallet options for safekeeping your APT.

Pontem Wallet

Pontem network is building the first decentralized exchange on Aptos blockchain and wallet for asset safekeeping of assets. Pontem network’s liquid swap will also be integrated into the wallet application

Petra App

Petra is developing a wallet for Aptos coin. Petra wallet is still in development and core functionalities are yet to be verified. However, the demo mode is available for early testers. Check out the Petra Aptos wallet.

Martian Wallet

Martian wallet has already registered over 250,000 downloads on its chrome extension wallet for Aptos coins. It claims to be the gateway to the Aptos. Martian can be downloaded on used on desktop wallets for Web3 interactions on the Aptos network

Fewcha Wallet

Fewcha wallet is developed by Apps Cyclone. It is available for iOS users and also as a chrome extension.

Can I Add Aptos to My MetaMask Wallet?

You won’t be able to add Aptos to your MetaMask wallet as the Aptos blockchain is not compatible with the Ethereum Virtual Machine (EVM).

Final Thoughts

If we’re to have a single blockchain that serves as the “go-to” platform for building and using decentralized applications, then that blockchain must solve the most important issues faced by the common user. Current blockchains are brilliant, yet they are far from perfect. Even in the face of incessant challenges, developers of these blockchains aren’t relenting on fixing their systems, while facing up and coming competitors like Aptos.

Aptos is attempting to develop a new system that solves all these problems at one go. While that is a herculean task, their technology is promising. Unlike some other smart contract blockchains, Aptos isn’t reinventing the wheel. They are developing highly modified versions of existing technologies and introducing completely new ways to pursue security, decentralization, and scalability.

These technologies packaged in one system might be the answer or a good step towards it. Whichever one it becomes; it is a step in the right direction for the whole space. Aptos has garnered a lot of attention even before its launch, and the resultant influx of users at launch is a good test for the scalability it promises and its whole infrastructure.

Thanks to a relatively unimpressive launch, its capabilities are already questionable, but given time, we could still see it grow into an enviable technology and ecosystem. That being said, do keep in mind that Aptos’ systems are still under heavy development and prone to dysfunctions and vulnerabilities. As a general rule, apply caution while interacting with complicated computing protocols and do your personal research before investing in any cryptocurrency.