What Is Keeta Network?

Keeta Network is an upcoming Layer 1 (L1) blockchain with the goal of bridging the gap between TradFi and DeFi, and has plans to launch their mainnet in the summer of 2025.

Key Takeaways

-

Keeta is designed with a focus to bridge the gap between traditional finance (Trad-Fi) and decentralized finance (DeFi).

-

Keeta is backed by former Google CEO Eric Schmidt, who is likely to have been instrumental in driving partnerships for the project.

-

Based on tests, Keeta boasts a high throughput of 10 million transactions per second (TPS) and 400 milliseconds transaction settlements.

Keeta’s Sudden Market Rise

Keeta came to market prominence after its governance token, KTA surged over 1000% in the month of May 2025, climbing to a market capitalization of over $500 million at the time of writing. Here is everything you need to know about what Keeta is and why it captured so much attention.

About Keeta Network

Keeta is a Delegated Proof of Stake (dPoS) blockchain that utilizes a Directed Acyclic Graph (DAG) data structure. DAGs are an innovation used by other high performance blockchains such as Sonic (formerly Fantom), Avalanche and Sui. DAGs improve parallel transaction processing speeds and overall blockchain performance, suggesting that Keeta will be able to keep up with other high performance blockchains.

Where Keeta differs from the other blockchains is their focus on being able to connect the world’s financial systems to the blockchain with features such as built-in KYC, digital identity, and on-chain FX. Notably, Keeta is able to leverage the vast corporate network of their major investor, former Google CEO Eric Schimdt, securing deals with other major financial infrastructure firms such as Solo, a firm also backed by Eric.

Keeta’s Token Generation Event (TGE)

Keeta quietly launched their token with the ticker KTA on the Ethereum Layer 2 Base in March 2025. Their token was launched without an airdrop with liquidity pools available on Base’s main decentralized exchange (DEX) Aerodrome. KTA maintained a modest market capitalization of under $10 million until its first breakout mid March.

KTA’s early price movement in March 2025.

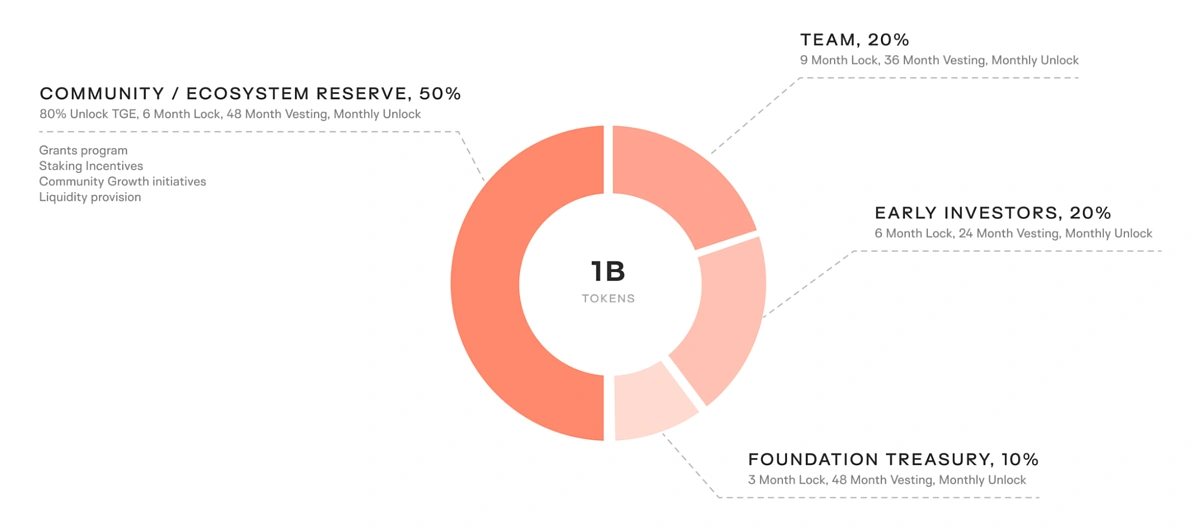

KTA Tokenomics

Source: https://docs.keeta.com/other-documentation/tokenomics

Summarized Tokenomics Information

-

Maximum token supply of 1 billion.

-

50% for Community.

-

40% for the team and investors.

-

10% as foundation treasury.

-

Linear vesting periods of 24 to 48 months, the first unlock of insiders excluding foundation tokens is in September 2025.

Airdrop Potential

While the team has not conducted an airdrop, 20% of the community portion of the token supply (or 10% of the total token supply) is earmarked for future community events which could happen via an airdrop in the future.

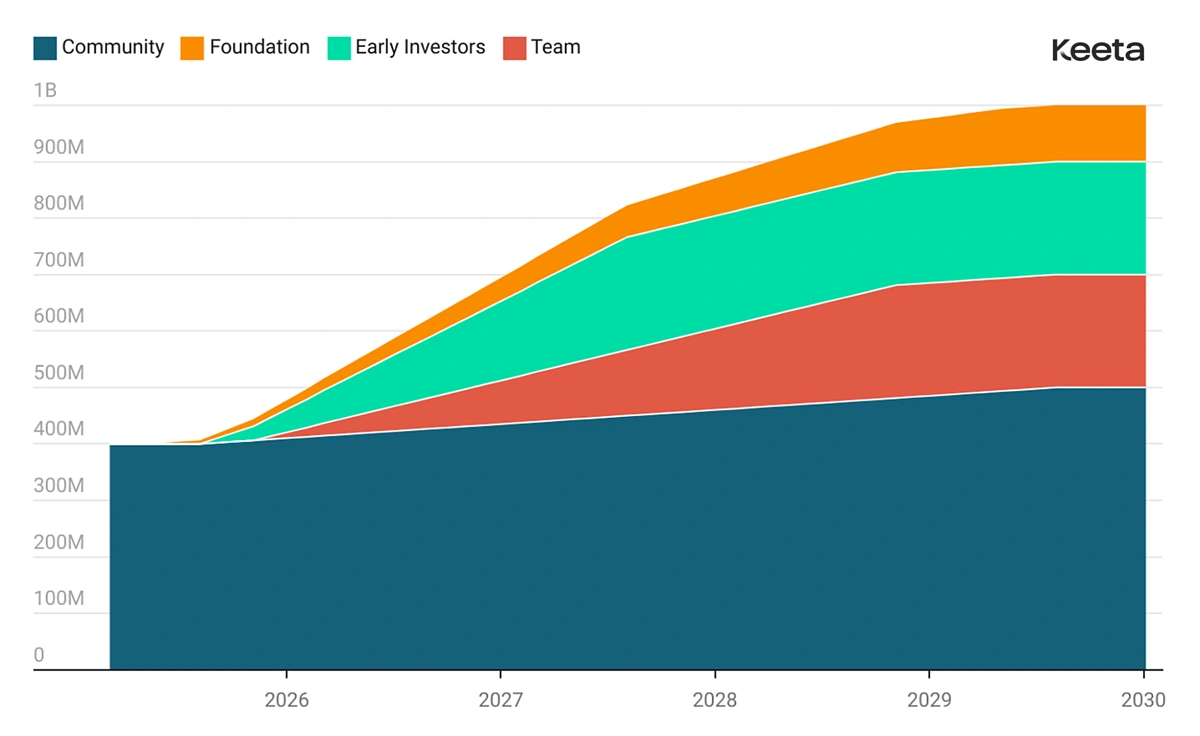

Token Emission Schedule

A graphical representation of the above is as follows, with the supply fully unlocked by 2030.

Keeta Network’s Launch Timeline

We’re just getting started.

Learn more on https://t.co/MmZwhqaPPK.$KTA pic.twitter.com/yZZz59qlyN

— Keeta (@KeetaNetwork) May 14, 2025

-

Development began after a successful fund raise in 2023

-

KTA TGE in March 2025

-

Testnet begins in April 2025

-

Secured partnership with KYC firm Footprint

-

Successful public stress test of 10 million transactions per second (TPS) in June 2025

-

Planned mainnet launch at an unspecified time in the summer of 2025.

Keeta Network’s Official Partnerships

While Keeta Network is still in the early stages, it has already secured some official partnerships to bridge TradFi and DeFi.

Footprint

We are excited to officially welcome Footprint as the first KYC provider on Keeta Network!

Footprint will issue KYC certificates to users globally, enabling regulatory-compliant transfers and seamless onboarding.

This marks a major step toward bringing financial institutions to… pic.twitter.com/EW5iBp6N7S

— Keeta (@KeetaNetwork) April 22, 2025

Footprint is a Know Your Customer (KYC) and identification company founded in 2022 in New York City. Footprint helps other organizations onboard users into their platform by simplifying KYC processes into “one-click”. Footprint is a small organization targeted at startups and small businesses and has successfully raised $13 million from QED Investors. Interestingly, Keeta Network is their first high profile client. This partnership will onboard the future on-chain users of Keeta Network with KYC certificates endorsed and issued by Footprint.

SOLO

Keeta and SOLO have partnered to launch the first blockchain-native credit bureau.

Built on Keeta’s high-performance blockchain, the system enables verified financial identities through SOLO’s PASS — an on-chain profile that consolidates KYC, KYB, income, crypto assets, and… pic.twitter.com/yMWvh1FKRN

— Keeta (@KeetaNetwork) June 5, 2025

SOLO is the second financial infrastructure firm to partner with Keeta Network and is the more notable announcement of the two. The partnership aims to launch the world’s first on-chain credit bureau. To do this, SOLO will be building PASS – a banking-grade financial identity layer, allowing sensitive information such as KYC information, income, crypto assets and business credentials to be safely stored on-chain. Built on the Keeta L1, PASS will now allow such information to now be stored on-chain, and be easily integrated and shared with both Web2 and Web3 applications. SOLO is notably another firm that is also backed by Eric Schmidt, suggesting that this partnership was in part enabled by his connections.

Keeta Network’s Public Stress Test

Keeta Network stress tested their test net publicly on June 13 2025 and has successfully achieved the following performance results:

-

11.2 million transactions per second (TPS)

-

26.5 billion transactions signed

-

Over 30 million accounts used

-

Over 2.2 TB of block data added to the ledger

While test net performance is not a guarantee of actual network performance when their mainnet eventually launches, the above results have gone above their stated claims of 10 million TPS (higher is better). This suggests that the team is currently on track to deliver their product as promised.

The Payment Finance (PayFi) Narrative

PayFi is the concept whereby real world finance payments are brought to the blockchain to leverage the technological strengths of DeFi and Web3 for greater gains in efficiency and potentially lower transaction costs.

It is a narrative that has gained significant traction and capital investment as evident from the record growth in stablecoin adoption in recent times. While blockchain solutions offer gains in efficiency and costs, there is the main hurdle which is network performance. Blockchain solutions are often compared to TradFi giants such as Visa and Mastercard, which are capable of 65,000 TPS, a benchmark which is hard to hit for many blockchain solutions.

With the successful stress test completed, Keeta Network positions itself as a blockchain solution that not only has the benefits of DeFi, but also the performance strengths comparable, potentially even surpassing that of TradFi giants such as Visa and Mastercard.

Conclusion

In a world where crypto is increasingly accepted and adopted by many financial institutions, innovations such as Keeta Network, is a welcome addition as it has the potential to leverage on the current rise of stablecoins and real world assets (RWA) and perhaps become a mainstay as the bridge between TradFi and DeFi. Keeta’s products and offerings bear resemblance to another TradFi focused L1, Mantra Chain who also seeks to bring KYC and RWAs on-chain. The striking difference so far seems to be their approach to launching products with Mantra having a significantly larger market presence by way of multiple airdrop campaigns as compared to Keeta who quietly launched their token and products.

Another significant difference is the backing and name of Eric Schmidt, the former Google CEO, Eric’s connections will likely lead to many more partnerships for Keeta. Keeta’s future remains exciting but given that their mainnet has yet to launch, users should exercise caution especially if they are interacting with the KTA token, which has a somewhat high insider allocation of over 50%.

Users are reminded that this article is purely for educational purposes and is not financial advice or endorsement for users to invest in this project. Always do your own research before connecting your wallet to any protocol.

Source:

Source: