What Is Grayscale Bitcoin Trust (GBTC)?

Grayscale Bitcoin Trust (GBTC) is a Bitcoin Trust turned spot Bitcoin exchange-traded fund (ETF) that allows investors to have exposure to Bitcoin without directly owning it.

Key Takeaways

-

The Pioneer’s Paradox: Grayscale’s Bitcoin Trust (GBTC) pioneered institutional Bitcoin investing but became a victim of the competitive market its legal victory helped create.

-

From Trust to ETF: Launched as a trust in 2013, GBTC’s structure led to severe price dislocations from its underlying Bitcoin value. Its conversion to a spot ETF in January 2024 solved this issue through an arbitrage mechanism.

-

The Fee War: Once dominant, GBTC now faces fierce competition from lower-cost alternatives like BlackRock’s IBIT (0.25% fee) and Fidelity’s FBTC (0.25% fee), while charging a premium 1.5% annual fee.

-

Strategic Countermove: To combat outflows and address investor needs, Grayscale launched the Bitcoin Mini Trust (BTC) with a market-leading 0.15% fee, created from a portion of GBTC’s assets.

-

A Liquidity Leader: Despite higher costs, GBTC remains one of the largest and most liquid Bitcoin ETFs, making it a preferred vehicle for institutional traders who prioritize execution efficiency.

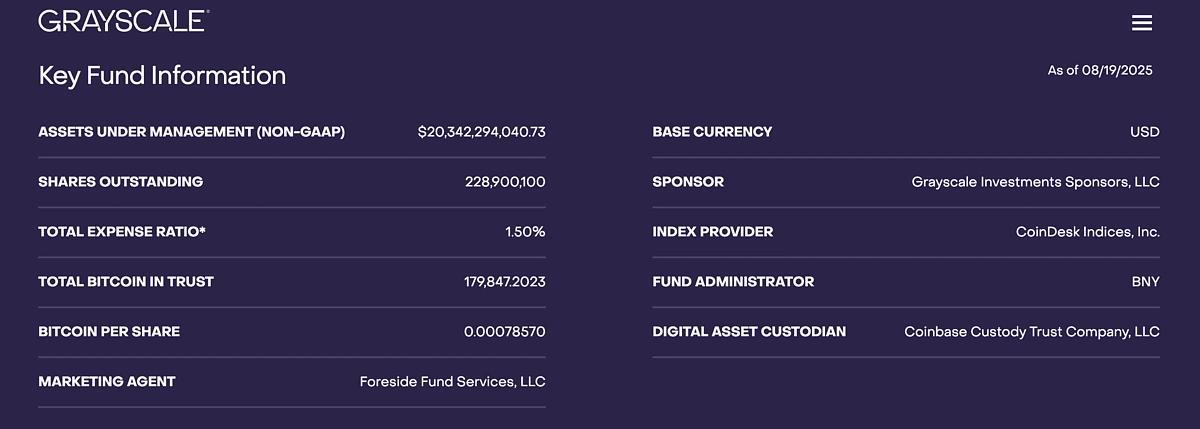

Once the dominant Bitcoin investment vehicle, GBTC now faces fierce competition from lower-cost alternatives like BlackRock’s IBIT (0.25% fees) and Fidelity’s FBTC (0.25% fees), while charging a premium 1.5% annual fee. Despite higher costs, GBTC remains the third-largest spot Bitcoin ETF with around $20.3 billion in assets, offering deep liquidity and a decade-long track record.

Introducing GBTC

GBTC (Grayscale Bitcoin Trust ETF) is a spot Bitcoin exchange-traded fund that holds actual BTC and allows investors to gain exposure to Bitcoin’s price movements through traditional brokerage accounts. Think of it like a stock that represents ownership in a large pool of Bitcoin—when BTC’s price goes up or down, GBTC’s share price follows.

Just as you might buy shares in a gold ETF instead of storing gold bars in your home safe, GBTC lets you invest in Bitcoin without dealing with crypto wallets, private keys, or cryptocurrency exchanges.

GBTC Quick Stats (August 2025)

|

Metric |

Details |

|

Ticker Symbol |

GBTC |

|

Custodian |

Coinbase Custody |

|

Exchange |

NYSE Arca |

|

Assets Under Management |

$20.3 billion |

|

Bitcoin Holdings |

179,847 BTC |

|

Annual Fee |

1.5% |

|

Bitcoin Per Share |

0.00078570 BTC |

|

Daily Volume |

~$100+ million |

|

Inception |

2013 (ETF conversion: Jan 2024) |

How Does GBTC Work?

Grayscale Trust issues ‘Baskets’ of shares (a block of 10,000 shares is a Basket) to Authorized Participants (APs) on an ongoing basis, also known as the Plan of Distribution. The price per Basket of shares is equal to the number of Bitcoins in a Basket of shares multiplied by the CoinDesk Index (XBX) Price, calculated at 4PM, New York time, on every business day.

-

Price Per Basket = Number of Bitcoins * Index Price

-

Price Per Share = Total Value of the Basket/ Number of Shares in the Basket

-

NAV* = Aggregate Value of Bitcoins Held – Expenses and Liabilities

-

NAV Per Share = NAV/ Number of Shares Outstanding

*NAV is not calculated in accordance with GAAP principles.

GBTC History: The Pioneer That Brought Bitcoin to Wall Street

Grayscale’s Grayscale Bitcoin Trust (GBTC) was among first Bitcoin investment vehicles that allowed accredited investors to passively invest in the digital asset, and the first vehicle that brought BTC to Wall Street.

Launched in September 2013, when Bitcoin was still considered experimental, GBTC provided institutional investors and traditional finance their first regulated pathway to Bitcoin exposure.

For the first time, investors who were excited about Bitcoin, but were wary of complexities of crypto exchanges and self-custody, could gain exposure simply by buying shares in their brokerage accounts. GBTC was incredibly successful, quickly becoming Grayscale’s flagship product and the primary vehicle for institutional capital flowing into Bitcoin.

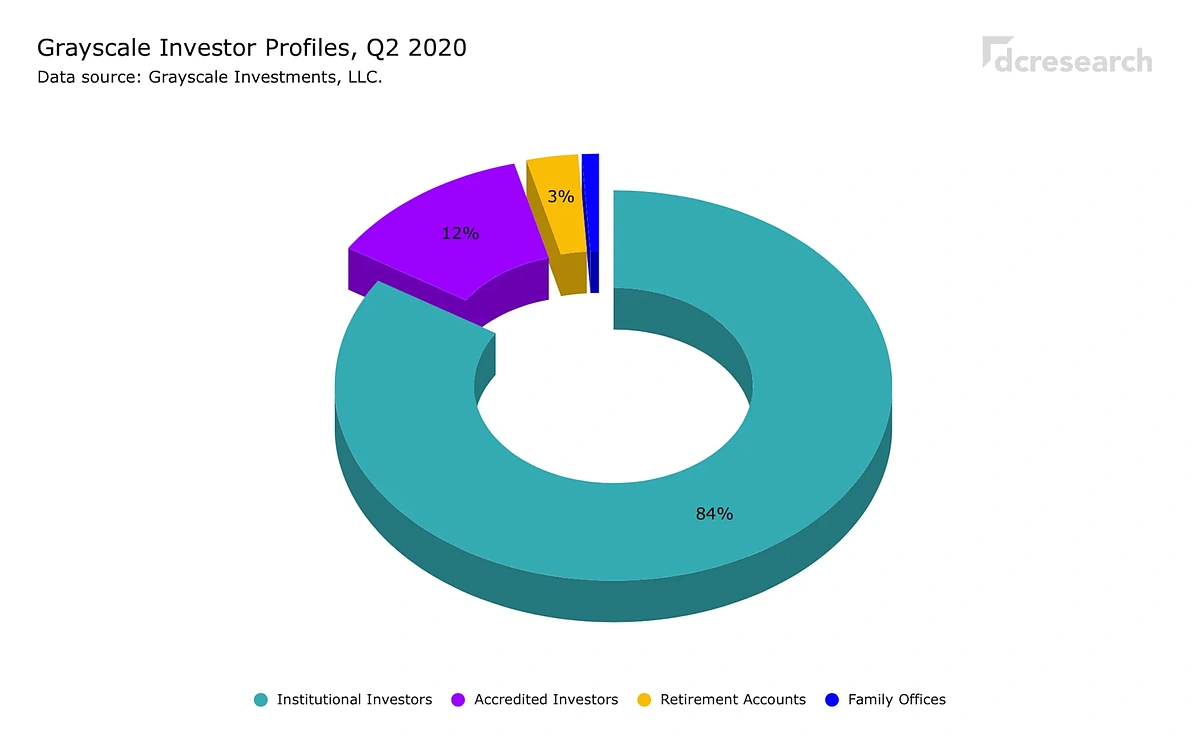

At one point in 2020, institutions held 85% of GBTC’s shares, proving that significant market demand existed and paving the way for the spot Bitcoin ETF boom that would follow.

However, GBTC’s monopoly ended in January 2024 when the SEC approved 11 spot Bitcoin ETFs, including BlackRock’s IBIT and Fidelity’s FBTC. This created intense competition and led to massive outflows from GBTC as investors sought lower-cost alternatives.

From Trust to ETF: The Evolution of Bitcoin Investment Vehicles

In the early days before Bitcoin ETFs, investment vehicles like GBTC operated as trusts rather than open-ended funds. Understanding this history is key to grasping GBTC’s significance.

Challenge with Early Bitcoin Funds: The Trust Model

Greyscale was quick to realize that Bitcoin is a heavily sought-after asset but many still vary of investing in it as it unlike any other TradFi financial product.

So, Grayscale ditched the mainstream route and created an alternative with a private trust in 2013 called the “Grayscale Bitcoin Trust.” It later became the first publicly traded (OTC markets) Bitcoin fund in the U.S. in 2015

As GBTC was traded in OTC markets, it worked as a closed-ended trust whose sole purpose was to hold Bitcoin on behalf of the investors. A closed-ended trust comes with restrictions and limitations. In the case of GBTC:

-

It offered a fixed number of shares

-

Shares could not be directly redeemed or sold in kind for Bitcoin

-

No redemption mechanisms led to trapped investor capital

-

Investors could not use arbitrage

-

There was a risk of the share price getting detached from Net Asset Value (NAV), resulting in volatile premiums and discounts.

Side note: NAV is calculated by dividing the total amount of Bitcoin held by the number of shares outstanding

This meant GBTC’s share price could diverge significantly from the actual Bitcoin per share value (its NAV, or net asset value).

The TL;DR is that there was no mechanism (say, arbitrage) to ensure GBTC share price is always tethered to the price of actual BTC. It was entirely based on “trust,” hence called the trust model.

The Problem of GBTC Discount

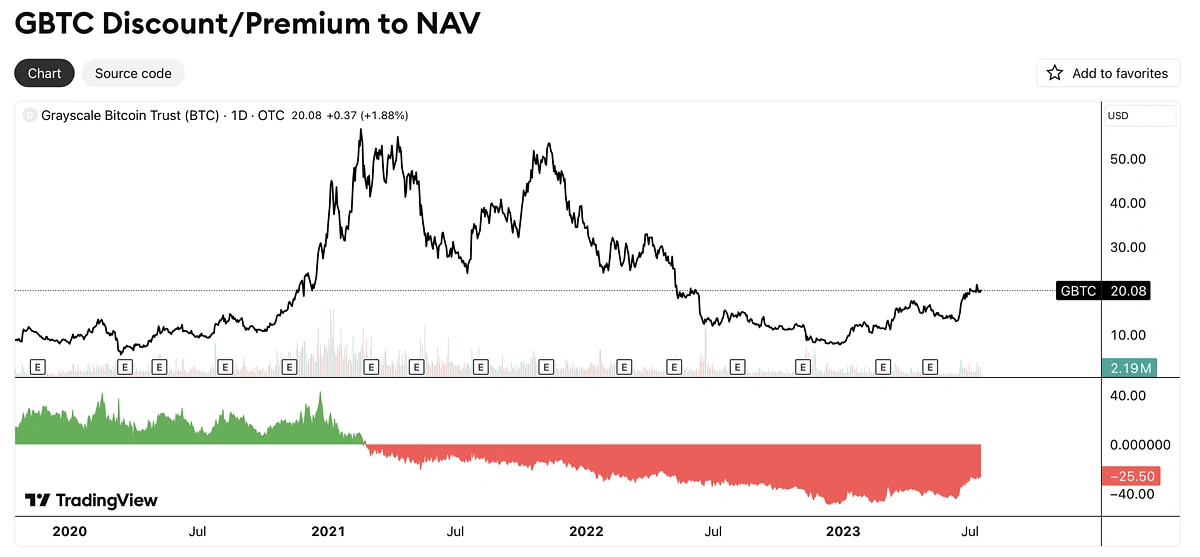

The trust model forced GBTC to trade above NAV (premium) when demand was high and below NAV (discount) when sentiment was negative.

-

When demand was high, investors piled in, driving the share price far above the NAV, creating a “premium.” In the 2021 bull market, this premium reached as high as 46%.

-

When sentiment was negative, investors rushed to sell, causing the share price to plummet below the NAV, creating a “discount.” At its worst in 2022, the discount widened to nearly 50%.

Although GBTC held the promised Bitcoin, shareholders could not extract it. They could only sell shares on the market, often at whatever price buyers were willing to pay. So, GBTC was a road for investors without an exit.

Post-ETF conversion, GBTC still trades at a discount. However, the rapid fluctuations have been replaced by minor movements on the charts, thanks to the newly instated ETF structure.

The Solution: How the Spot ETF Structure Works

The conversion of GBTC into an ETF in January 2024 effectively solved the discount/premium problem. Why? Because an ETF has an open-ended creation and redemption mechanism.

The new spot ETF structure allowed:

-

Daily in-kind redemption and creation of shares via Authorized Participants (APs)

-

Regulated offerings (Rule 19b-4)

-

Better share price alignment with the NAV

-

Stock exchange uplisting (NYSE Arca)

-

Reduction in fees from 2% to 1.5% (still higher than other ETFs)

-

Traders can employ arbitrage to secure profits.

Daily creation and redemption still doesn’t mean anyone can create shares by exchanging Bitcoin for shares. The setup works through APs, which are financial institutions in an agreement with Grayscale to hold exclusive rights for creating/redeeming ETF shares.

When GBTC trades at a premium:

-

Authorized Participants (APs) buy Bitcoin in the market

-

They deliver Bitcoin to Grayscale in exchange for new GBTC shares

-

APs sell these shares on the market, increasing supply and lowering the premium.

When GBTC trades at a discount:

-

APs buy discounted GBTC shares from the market

-

They redeem shares with Grayscale for actual Bitcoin

-

APs sell Bitcoin in the market, reducing GBTC supply and narrowing the discount.

This creates a self-balancing system that keeps GBTC’s price closely aligned with Bitcoin’s value.

|

|

Spot BTC ETF |

BTC Trust |

|

Type of Fund |

Open-ended fund |

Closed-ended fund |

|

Number of shares |

Daily creation and redemption |

Fixed Supply |

|

Listing |

NYSE Arca |

OTCQX Market |

|

In-kind Redemption |

In-kind redemption via APs |

No redemptions possible |

|

NAV alignment |

Very Tight |

Wide deviations |

|

Bid-Ask Spreads |

Wide |

Narrow |

|

Regulations |

Regulated by the SEC, the Exchange Act, and ETF-level compliance rules |

Unregulated |

|

Annual Maintenance Fees |

1.5% |

2% |

|

NAV Discount Risk |

Least |

High |

|

Liquidity |

High |

Low |

|

Arbitrage |

Possible |

Not possible |

GBTC Performance

As of mid-2025, GBTC manages over $20 billion in assets (i.e. the value of its Bitcoin holdings), making it one of the largest institutional Bitcoin holders globally.

Assets Under Management (AUM)

The post-ETF conversion period saw Grayscale bleeding heavily as multiple competitors with substantially lower fees entered the market. Before it became an ETF, Grayscale had an AUM of $28.5 billion and held approximately 619,220 BTC, which was significantly higher than the initial holdings of other ETFs.

After January 2024, Grayscale lost over $10 billion worth of Bitcoin to recurrent outflows. BlackRock’s IBIT took over GBTC in just 96 trading days. Now (at the time of writing), GBTC has an AUM of ~$20.3 billion and is the third-largest Bitcoin spot ETF by AUM, after BlackRock’s IBIT and Fidelity’s FBTC.

Liquidity

Liquidity is GBTC’s strongest competitive advantage. The fund has a long trading history and a deep investor following, translating into substantial daily trading volume. Typically, over 1.1 million GBTC shares trade daily, which at current prices is well over $100 million in turnover per day.

This superior liquidity makes GBTC particularly attractive to institutional investors and large traders who need to execute significant positions without causing adverse market impact. The fund’s established market-making relationships and extensive distribution network contribute to this liquidity advantage.

Bid-Ask Spread

GBTC’s bid-ask spreads (the difference between buy and sell quotes) are extremely tight for a crypto-linked product.

Recent analysis shows bid-ask spreads averaging around 0.01% over a 30-day period. A 0.01% spread is practically negligible, indicating that large orders can be executed very efficiently without moving the price.

For investors, deep liquidity and tiny spreads reduce the cost of trading and ensure that the market price reflects fair value.

Who Is Grayscale?

Grayscale Investments serves as the asset management firm behind GBTC and represents one of the pioneering companies in institutional cryptocurrency investing. Founded in the same year as the Bitcoin Trust launch, Grayscale was later acquired by Digital Currency Group, a prominent cryptocurrency conglomerate led by Barry Silbert.

The firm operates from its headquarters in Stamford, Connecticut, and has established itself as the largest digital asset-focused investment platform in the United States. Grayscale’s significance extends beyond GBTC, as the company has built a comprehensive suite of cryptocurrency investment products over the past decade.

Regulatory Battles and Legal Victories

Grayscale’s journey to ETF approval involved significant regulatory challenges and legal battles with the SEC. The firm submitted multiple Bitcoin ETF applications over several years, facing repeated rejections from regulators who cited concerns about market manipulation and investor protection.

Rather than concede, Grayscale took the extraordinary step of suing the SEC. In a pivotal court filing, Grayscale argued that the SEC was applying a “special harshness” to spot Bitcoin products while having already approved Bitcoin futures-based ETFs. The firm contended that since both products derive their value from the price of Bitcoin, they should be treated equally.

This legal strategy proved successful when, in August 2023, a federal appeals court ruled in Grayscale’s favor, effectively forcing the SEC to reconsider its position on Bitcoin ETF approvals. This legal victory was instrumental in the eventual approval of spot Bitcoin ETFs in January 2024.

Product Portfolio Beyond GBTC

While GBTC represents Grayscale’s flagship product, the firm offers an extensive range of cryptocurrency investment vehicles. The company manages several other prominent funds, including the Grayscale Digital Large Cap Fund (GDLC), which provides diversified exposure across major cryptocurrencies including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

Grayscale has continued expanding its product offerings, recently adding specialized trusts for emerging cryptocurrencies like Solana (SOL).

Custody and Operations

An important distinction in Grayscale’s operations is that the firm doesn’t directly custody the cryptocurrencies underlying its investment products. Instead, Grayscale maintains a custodial agreement with Coinbase Custody Trust Company, which serves as the qualified custodian for GBTC’s Bitcoin holdings.

This arrangement with Coinbase Custody provides institutional-grade security including offline cold storage, multi-signature controls, and comprehensive insurance coverage. The custodial relationship represents a critical component of GBTC’s operational infrastructure and regulatory compliance framework.

GBTC vs The Competition: Fighting for Survival

The Bitcoin ETF landscape transformed overnight when the SEC approved multiple competing products in January 2024.

Grayscale’s victory was a monumental step forward for the crypto industry, but it created the “Pioneer’s Paradox.” By winning its lawsuit, Grayscale unleashed a wave of competition from financial giants like BlackRock and Fidelity, who entered the market with fresh marketing budgets and, most importantly, dramatically lower fees.

The result was immediate and severe. Investors, no longer trapped by the trust structure, began pulling billions of dollars out of GBTC in search of cheaper alternatives. BlackRock’s IBIT, with a fee of just 0.25%, quickly surpassed GBTC in assets under management, a title Grayscale had held for over a decade. GBTC, the pioneer, had become a victim of the very market it fought to create.

The New Landscape

The current Bitcoin ETF rankings tell the story of GBTC’s competitive challenges:

|

Rank |

ETF |

Assets |

Annual Fee |

Key Advantage |

|

1 |

BlackRock IBIT |

$85.1B |

0.25% |

Largest asset manager backing |

|

2 |

Fidelity FBTC |

$23.5B |

0.25% |

In-house Bitcoin custody |

|

3 |

GBTC |

$20.3B |

1.5% |

Longest track record |

|

4 |

ARK ARKB |

$5.8B |

0.21% |

Innovation focus |

Why Investors Still Choose GBTC Despite Higher Fees

Despite charging six times more than its primary competitors, GBTC maintains substantial investor loyalty for several compelling reasons. The fund offers the deepest liquidity in the Bitcoin ETF space, with over $100 million in daily trading volume, making it ideal for institutional investors who need to execute large trades without moving the market.

GBTC’s decade-long operational history provides comfort to risk-averse institutional investors who value proven track records over cost savings. The fund has successfully navigated multiple Bitcoin bear markets, regulatory uncertainties, and operational challenges that newer ETFs haven’t faced.

For existing GBTC shareholders, tax considerations often outweigh fee concerns. Investors who bought GBTC shares before the ETF conversion can avoid triggering capital gains taxes by maintaining their positions, even if switching to a lower-cost alternative would save money in the long term.

Investment Scenarios: Fee Impact Over Time

Understanding GBTC’s fee impact requires looking at long-term scenarios. While the 1.5% annual fee might seem modest, it compounds over time and can significantly reduce your investment returns compared to lower-cost alternatives.

Consider a $10,000 investment held for five years. GBTC would charge approximately $750 in fees annually, totaling $3,750 over the period (assuming no Bitcoin price appreciation). In contrast, BlackRock’s IBIT would charge only $125 annually, or $625 total—a difference of over $3,000.

Example fee comparison over 5 years:

|

ETF |

Annual Fee |

Total Fees Paid |

Savings vs GBTC |

|

GBTC |

1.5% |

$3,750 |

– |

|

IBIT/FBTC |

0.25% |

$625 |

$3,125 |

|

Mini Trust (BTC) |

0.15% |

$375 |

$3,375 |

These fee differences become more dramatic over longer holding periods. Over 20 years, GBTC’s higher fees could cost an additional $25,000 or more compared to low-fee alternatives, assuming a consistent investment balance.

Grayscale’s Strategic Response: The Mini Trust

Recognizing the existential threat posed by low-cost competitors, Grayscale executed a strategic counterattack by launching the Grayscale Bitcoin Mini Trust in July 2024. This new product directly targets fee-sensitive investors while allowing Grayscale to maintain GBTC’s premium positioning.

The Mini Trust was born from 10% of GBTC’s Bitcoin holdings, representing approximately $1.7 billion in assets at launch. More importantly, it carries an annual fee of just 0.15%—making it the lowest-cost Bitcoin ETF globally and undercutting even BlackRock and Fidelity by a significant margin.

Beyond being a “budget-friendly option,” the Mini Trust offered a solution for long-term investors who might be tempted to switch to a cheaper ETF like IBIT. However, switching to a cheaper ETF would trigger a significant tax event, potentially wiping out any future savings from the lower fee.

The Mini Trust was designed to solve this exact problem. Grayscale structured the launch as a tax-free spin-off, distributing shares of the new, low-fee fund to existing GBTC shareholders. This allowed legacy investors to gain exposure to the new fund — with its market-leading 0.15% fee — without having to sell their original GBTC position and trigger a taxable event. It was a sophisticated maneuver designed to retain Grayscale’s most valuable, long-term assets by addressing their specific tax pain point.

GBTC vs Mini Trust: Tale of Two Strategies

This dual-product strategy allows Grayscale to compete across the Bitcoin ETF market:

|

|

GBTC |

Mini Trust (BTC) |

|

Annual Fee |

1.5% |

0.15% (lowest globally) |

|

Assets |

$20.3 B |

$5.5B |

|

Strategy |

Premium product |

Budget-friendly option |

|

Target Investor |

Institutions, existing holders |

Fee-sensitive investors |

|

Bitcoin Holdings |

179,847 BTC |

44,471 BTC |

The Mini Trust has attracted approximately $5 billion in assets and proven that Grayscale can compete effectively on fees when necessary. However, the product’s smaller size means lower liquidity compared to GBTC, making it less suitable for very large institutional trades.

Which Should You Choose?

The choice between GBTC and the Mini Trust depends primarily on your investment size and priorities. GBTC remains superior for investors who need maximum liquidity, such as institutional investors making large trades or frequent traders who require tight bid-ask spreads, or for pre-invested investors who wish to avoid triggering capital gains taxes by selling.

The Mini Trust makes more sense for buy-and-hold investors focused on long-term Bitcoin exposure. The fee difference compounds significantly over time—a $100,000 investment pays $1,500 annually in GBTC fees versus just $150 in Mini Trust fees. Over a decade, this difference amounts to $13,500 in additional costs for choosing GBTC.

Potential Benefits of Investing in GBTC

GBTC is the third largest spot Bitcoin ETF is the U.S. and comes with many advantages for investors. Here are six of them:

-

Easy Access: GBTC can be traded through traditional brokerage accounts (no crypto wallets required).

-

Deep Liquidity: GBTC shares can be traded during market hours just like any stock or ETF.

-

Fully Regulated: GBTC is a regulated investment vehicle much like gold ETFs.

-

Tax-Advantaged Accounts: Unlike Bitcoin itself, GBTC can be held in tax-advantaged retirement accounts like IRAs and 401(k)s.

-

Low Bid-Ask Spread: GBTC has a low spread of just 0.01%, which allows for large trading volumes without significant price swings.

Risks of Investing in GBTC

While GBTC has its benefits, it has notable risks that investors must be aware of. Here are four of them:

-

High Management Fees: GBTC charges an annual fee of 1.5%, which is higher than most spot Bitcoin ETFs (typically 0.2%–0.5%).

-

High Volatility: Albeit not directly stemming from GBTC, its price is closely correlated to BTC and is hence volatile.

-

No BTC Ownership: GBTC investors own shares of a trust, not actual Bitcoin, and so cannot participate in web3.

-

Not a 1940 Act Fund: It is not subject to the same regulations and investor protections as traditional ETFs under the Investment Company Act of 1940.

How to Invest in GBTC

People interested in buying Bitcoin but want to avoid unregulated exchanges or wallet management can buy GBTC or Mini Trust ETFs from any of the brokerage accounts mentioned below:

-

Charles Schwab

-

Extrade (from Morgan Stanley)

-

Interactive Brokers

-

Robinhood

-

Fidelity

-

Ameritrade

Note that the aforementioned list is non-exhaustive and for educational purposes. CoinGecko does not solicit or endorse any particular brokerage.

GBTC shares can be traded during normal trading hours, between 9:30AM and 4:00PM EST. The daily share volume (from the previous day) can be updated between 1:00AM. and 5:00AM.

The minimum investment is typically one share, which costs approximately $89 as of August 2025. However, some brokers offer fractional share investing, allowing you to invest any dollar amount.

Here are the basic steps to investing in GBTC:

-

Get a Brokerage Account: Register on a brokerage account that allows U.S.-listed securities trading. GBTC is listed on NYSE Arca under the ticker symbol GBTC.

-

Place an Order: During normal market hours, you can place an order to buy GBTC. Simply search for the ticker “GBTC” in your brokerage’s trading platform. Decide how many shares you want to purchase.

-

Settlement and Holding: Once your order executes, you’ll see GBTC shares in your account, just like any stock holding.

Conclusion

GBTC has been a landmark vehicle in bringing Bitcoin to mainstream investors. It’s a convenient option for adding Bitcoin exposure to an investment portfolio without needing to manage any digital wallets or worry about self-custody best practices.

However, today’s competitive reality presents GBTC with significant challenges. While the fund maintains substantial advantages including deep liquidity, proven operational history, and established institutional relationships, its 1.5% fee premium becomes increasingly difficult to justify when competitors offer identical Bitcoin exposure for 0.25%.

The introduction of Grayscale’s Mini Trust at 0.15% fees shows the company can compete effectively on cost when necessary. This dual-product strategy allows Grayscale to serve both premium and budget-conscious investors while maintaining flexibility in a rapidly evolving market.

Investors should note that GBTC does not pay any dividends or interest (Bitcoin itself doesn’t yield anything), so the only return (profit or loss) comes from price action of Bitcoin.

In addition to GBTC’s 1.5% annual management fee, investors should also consider their broker’s trading commissions.

Frequently Asked Questions

What does GBTC stand for and how does it work?

GBTC stands for Grayscale Bitcoin Trust ETF. It operates by holding actual Bitcoin in institutional custody and issuing shares that represent fractional ownership of the fund’s Bitcoin holdings. When you buy GBTC shares, you’re buying indirect exposure to Bitcoin’s price movements without owning Bitcoin directly.

Does GBTC pay dividends?

No, GBTC does not pay dividends. Bitcoin itself doesn’t generate income or yield, so the fund has no income to distribute. All returns come from Bitcoin price appreciation, which is reflected in GBTC’s share price.

How much Bitcoin does GBTC currently hold?

As of August 2025, GBTC holds approximately 179,847 Bitcoin worth about $20.3 billion. This represents roughly 0.87% of Bitcoin’s total supply and makes GBTC one of the largest institutional Bitcoin holders globally.

What’s the minimum investment for GBTC?

The minimum investment is one share, which costs approximately $89 as of August 2025. Some brokers offer fractional share investing, allowing investments of any dollar amount. Most major brokers also offer commission-free ETF trades, so there are no additional trading costs beyond GBTC’s annual management fee.

Can I hold GBTC in my retirement account?

Yes, GBTC is available in most IRA and 401(k) accounts, providing tax-advantaged Bitcoin exposure. However, availability in employer-sponsored retirement plans varies by provider, so check with your plan administrator about Bitcoin ETF options.

Is GBTC the same as owning Bitcoin?

No, owning GBTC shares is different from directly owning Bitcoin. GBTC provides indirect exposure to Bitcoin’s price movements, but you cannot withdraw actual Bitcoin, use it for transactions, or participate in Bitcoin forks or airdrops. You own shares of a fund that holds Bitcoin on your behalf.

Why is GBTC more expensive than other Bitcoin ETFs?

GBTC charges 1.5% annually compared to 0.25% for most competitors. Grayscale justifies this premium through superior liquidity, longest track record, and established institutional relationships. However, many investors have migrated to lower-cost alternatives since they became available in 2024.

Should I sell GBTC to buy a cheaper ETF like IBIT?

This depends heavily on your tax situation. If you have held GBTC for a long time, selling could trigger significant capital gains taxes that may outweigh the long-term fee savings. For new investments, lower-cost alternatives generally make more financial sense.