What Is Bitcoin Halving?

Bitcoin halving is a built-in feature that cuts mining rewards in half approximately every four years. This controls the rate at which new bitcoins enter into circulation and plays a key role in ensuring Bitcoin’s scarcity, managing inflation, and shaping long-term market expectations.

Key Takeaways

-

Bitcoin halving cuts mining rewards in half every ~4 years (most recent: April 2024)

-

The next halving is expected in April 2028—rewards will drop to 1.5625 BTC per block

-

Historically, past halvings often preceded significant price increases

-

The final halving is estimated to take place around 2140 when all 21 million Bitcoin will be mined

-

Halvings are essential to Bitcoin’s deflationary model and are designed to enforce scarcity, a key driver of its long-term value proposition.

Understanding Bitcoin Halving

Bitcoin operates on a Proof-of-Work (PoW) consensus mechanism where miners compete to solve complex cryptographic puzzles. The first miner to solve the puzzle validates the block and earns a reward in the form of newly minted bitcoin (BTC). This process not only confirms transactions but also introduces new BTC into circulation.

However, the number of new bitcoins introduced into the system is not constant. Approximately every four years—or every 210,000 blocks—the protocol halves the miner reward. This event is known as the Bitcoin halving.

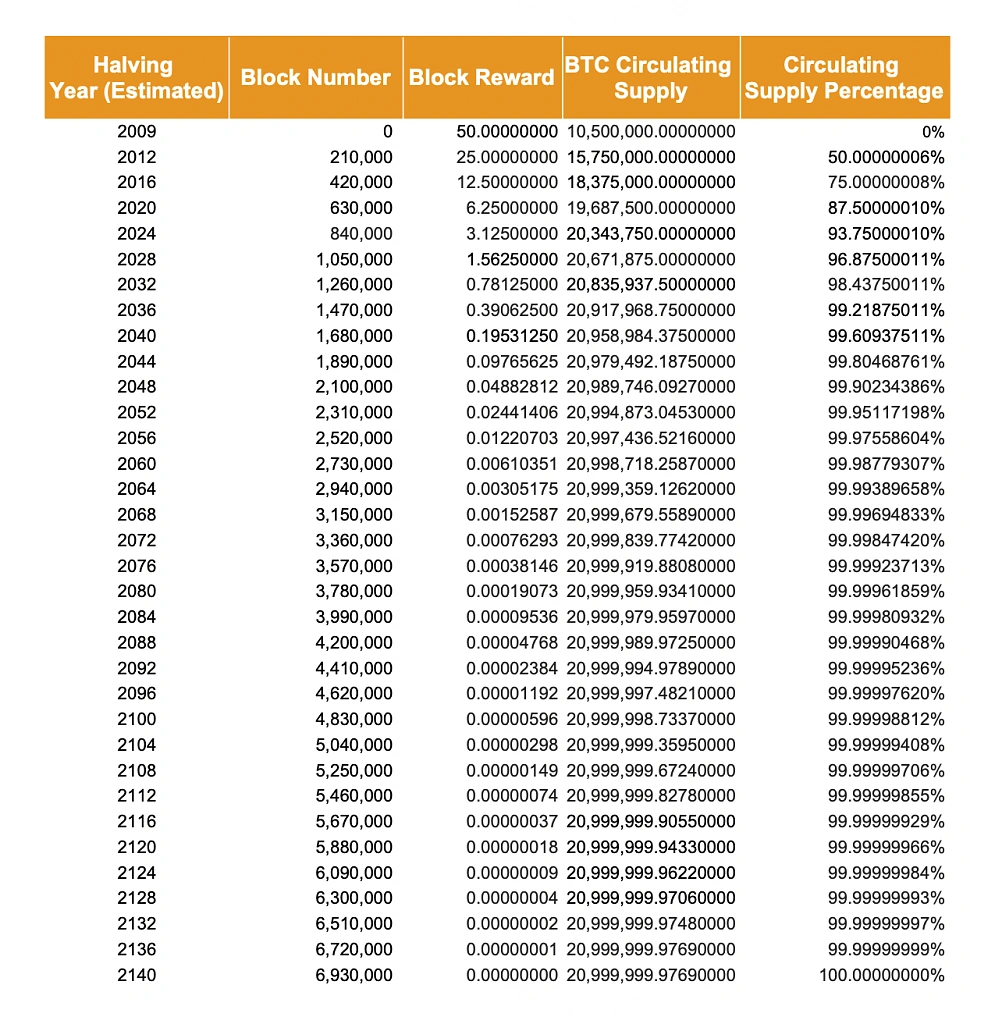

For instance, when Bitcoin launched in 2009, miners earned 50 BTC per block. After the first halving in 2012, the reward dropped to 25 BTC, then to 12.5 BTC in 2016, 6.25 BTC in 2020, and most recently to 3.125 BTC in April 2024. This gradual reduction ensures that the supply curve follows a predictable decline until the maximum supply of 21 million BTC is reached.

The halving mechanism is central to Bitcoin’s identity as “digital gold.” Just like mining gold becomes more difficult and expensive over time, mining bitcoin becomes less rewarding, increasing scarcity and preserving value.

When Is the Next Bitcoin Halving?

Bitcoin blocks are added approximately every 10 minutes. Since a halving occurs every 210,000 blocks, this translates to one event roughly every four years. The most recent halving occurred in April 2024, reducing the block reward from 6.25 to 3.125 BTC. Based on current block generation rates, the next halving is projected to occur sometime in April 2028.

Although the exact date can vary due to fluctuations in mining activity and network difficulty, the protocol’s precision ensures that halvings remain consistent over the long run.

How Does Bitcoin Halving Work?

Bitcoin halving is not manually controlled or subject to human intervention. It is programmed directly into Bitcoin’s code by its creator, Satoshi Nakamoto.

The software monitors the blockchain and triggers a halving every time the block height increases by 210,000. When this condition is met, the reward that miners receive for adding a new block is cut in half.

This system is not based on a calendar or external timer. Rather, it is directly linked to Bitcoin’s internal block production. This ensures a predictable and transparent schedule, regardless of external market dynamics.

Who Controls the Halving?

It is an automated and deterministic event coded into the Bitcoin Core protocol. Any changes to this rule would require overwhelming consensus from miners, developers, node operators, and other ecosystem participants.

The automatic nature of halvings is one of the key reasons why Bitcoin is seen as trustworthy. It eliminates discretionary control and ensures monetary policy cannot be altered arbitrarily.

Bitcoin Halving History & Dates

|

Halving |

Date |

Block Reward |

Price Impact (1 Year Later) |

|

Genesis |

Jan 2009 |

50 BTC |

– |

|

1st |

Nov 28, 2012 |

25 BTC |

+8,232.88% |

|

2nd |

Jul 9, 2016 |

12.5 BTC |

+263.4% |

|

3rd |

May 11, 2020 |

6.25 BTC |

+561.6% |

|

4th |

Apr 19, 2024 |

3.125 BTC |

+33.04% |

|

5th |

~Apr 2028 |

1.5625 BTC |

? |

-

First Halving (2012): The first halving was on November 28, 2012, and it reduced the mining reward from 50 BTCs per block to 25 BTCs. It was also the first major test of Nakamoto’s design on supply reduction to Bitcoin’s value. The price of Bitcoin rose over 8,000% over the next 365 days.

-

Second Halving (2016): This event took place on July 9, 2016, and further reduced the mining reward to 12.5 BTCs per block. At this time, Bitcoin was starting to build traction outside of the blockchain and cryptocurrency space. This halving helped to spur some of the discussions on Bitcoin’s future potential as a store of value. Over the following year , Bitcoin’s price rose by 263%.

-

Third Halving (2020): The third halving took place on May 11, 2020, and decreased the mining reward to 6.25 BTCs per block. It was also a year that marked a growing interest from retail investors and users in cryptocurrencies as a whole. This Bitcoin halving pulled in some media and investor attention on how Bitcoin could play a bigger role as a financial asset. The following year saw Bitcoin’s price rise 561%.

The 2024 Difference

Fourth Halving (2024): Bitcoin’s fourth halving event occurred on April 19, 2024, and saw the mining reward reduced to 3.125 BTCs per block. The backdrop for this halving featured a lot of market activity due to some significant events.

Spot Bitcoin ETFs including IBIT and FBTC also began trading at the start of year, opening the gates for a wider range of investors, recording $4.6 billion in first-day trading volume. Institutional corporations have also been stocking up their BTC treasuries in a move that showcases conviction for the token’s future value.

Donald Trump was re-elected and has made it clear that his administration will support cryptocurrencies through various programs, with pro-crypto legislations in 2025 like the GENIUS Act and the Executive Order for a Bitcoin Strategic Reserve have also helped to push BTC to new all-time highs.

However, do note that past performance is not and should not be taken as a guarantee for future results.

Why Bitcoin Halving Happens

The halving serves the specific purpose of controlling inflation by regulating the issuance of new bitcoins. Traditional fiat currencies have no fixed supply limit, which can lead to inflation when too much money is introduced into the economy without a corresponding rise in demand. Bitcoin’s supply, on the other hand, is fixed and follows a diminishing issuance curve.

Each halving reduces the amount of new BTC entering circulation, making it more scarce over time. This deliberate scarcity is one of the reasons Bitcoin is often compared to precious metals like gold. Just as the difficulty of extracting gold increases over time while supply remains finite, Bitcoin becomes increasingly difficult to “mine” profitably as rewards diminish.

Halving events also attract public and media interest which can boost Bitcoin’s visibility and potentially attract new users and investors.

1. Controlling Inflation

In contrast to fiat currencies where central banks can adjust monetary policy based on economic conditions, Bitcoin’s monetary policy is entirely algorithmic. There will never be more than 21 million bitcoins, and the rate at which they are issued is halved roughly every four years, ensuring the supply is released gradually and predictably.

2. Ensuring Scarcity

Bitcoin might be digital but it was not programmed to endlessly create new tokens. In fact, the protocol dictates that the maximum total number of bitcoins that can exist is capped at 21 million. This limit is enforced by code and cannot be changed without a majority consensus among network participants which is a highly unlikely event. Each halving also makes bitcoin more scarce, as it becomes harder to mine.

3. Economic Incentives

This predictable deflationary schedule and reduction in supply enhances Bitcoin’s appeal as a long-term store of value. Knowing that supply is verifiably limited gives holders confidence that their asset cannot be devalued by overproduction. When coupled with steady or growing demand, this further creates economic pressure that has historically driven price appreciation.

Impact of Bitcoin Halving

Now, let’s look at the impact of Bitcoin halving.

Effect on Bitcoin’s Supply

Of course the main impact of the Bitcoin halving is on the supply of new bitcoins that enter the market. Since more than 93% of Bitcoin’s supply has already entered the market, the number of new bitcoins to mine is already quite low.

Each halving reduces the supply of new bitcoins entering the market by 50%, impacting the overall rate of inflation. This method of controlling the supply is similar to the extraction process of precious metals.

Historically, a slowing supply of new bitcoin has often been followed by long-term price growth, though this doesn’t confirm a direct cause-and-effect relationship. Regardless of price movement, the idea of scarcity significantly influences investor behavior. Many believe that a fixed supply combined with consistent or increasing demand may contribute to upward price pressure.

Effect on Bitcoin Miners

Miners are most directly affected by halvings, as their revenue is cut in half instantly. The mining network competes to add new blocks to the chain but only one miner can win each round and receive the block reward of newly minted BTC.

However, as the cryptographic puzzles get increasingly difficult, miners need to invest in better technology and setups to have enough computer power, causing them to face higher operational costs for lower rewards. This in turn might cause smaller miners to become unprofitable, potentially impacting Bitcoin’s decentralization.

Effect on Investors

Halvings tend to generate speculation among investors who might see it as an opportunity for value increase. The combination of reduced supply and increased demand can influence investor expectations. Historical patterns also see generally positive price impact over the 12-18 months post-halving.

Long-term holders view the halving as a strengthening of Bitcoin’s value proposition while traders might view it as a catalyst for volatility. It could become either an opportunity or risk for them.

Potential Risks From Bitcoin Halving

Bitcoin halving can impact the market, as well as the Bitcoin ecosystem in the following ways:

Short-Term Price Volatility (Sell the News)

Although halvings are predictable, markets don’t behave the same way. Sometimes, the event may already be priced in, leading to a phenomenon known as “sell the news.” Traders who buy ahead of the halving in anticipation of a rally may begin to take profits immediately after the event, causing sharp price corrections.

Mining Centralization Risks

As mining rewards grow smaller, some miners might not be able to sustain their setup or keep the process profitable. Large-scale mining facilities will likely have the resources to acquire cheaper and more efficient gear while smaller miners might be forced to drop out.

This raises concerns about centralization of mining power if a handful of firms were to control the majority of hash power. It could undermine Bitcoin’s decentralized ethos and expose the network to risks usually associated with centralization. This would result in the bigger firms taking over most, if not all, of the mining opportunities.

Effects of Halving Are “Priced-In”

As the market matures, many argue that halving events no longer have the explosive impact they once did. The efficient market hypothesis (EMH) suggests that since the halving schedule is public and predictable, its impact is already priced-in to Bitcoin’s price well before the event.

Yet, history has shown that unforeseen variables such as regulatory changes or institutional flows can still drive post-halving price movement. So while the halving itself is known, the market response remains uncertain.

What Happens After the Last Halving?

The final bitcoin is expected to be mined around the year 2140. At that point, all 21 million coins will be in circulation, and no new bitcoin will be minted. This doesn’t mean the network will stop functioning. Instead, miners will rely solely on transaction fees as their incentive to continue validating and securing the network.

This shift could potentially change the mining economics. If Bitcoin continues to be widely used and transaction volume keeps increasing, fees could be enough to sustain a decentralized network of miners. However, this depends on whether Bitcoin’s utility, security, and network activity remain high.

The Future of Bitcoin

It is impossible for anyone to definitely know the future of Bitcoin after the final halving in 2140.

Miners will no longer receive block subsidies and will rely solely on transaction fees. Whether this will be enough to maintain network security depends on user demand, transaction volume, and fee structures.

The landscape could look vastly different from what we have today as innovations like Bitcoin sidechains, Bitcoin Layer 2s, and DeFi on Bitcoin continue to expand its utility. These advancements could play a role in supporting a robust ecosystem.

Ultimately, Bitcoin’s long-term value post-halving will depend on continued adoption, network resilience, and its potential as a store of value.

Frequently Asked Questions

Does halving affect my existing Bitcoin?

No, halving only affects new Bitcoin being created. Your existing Bitcoin remains unchanged.

Why every 210,000 blocks instead of a set time?

This ensures predictable issuance regardless of how fast or slow blocks are mined.

Can the halving schedule be changed?

Technically possible but would require overwhelming network consensus, which is extremely unlikely.

What if miners stop mining after halving?

Bitcoin’s difficulty adjusts automatically to maintain ~10-minute block times regardless of miner participation.

Is Bitcoin halving similar to stock splits?

No, stock splits increase shares while halving decreases new Bitcoin creation.