What Are Tokenized Pokémon Cards?

Tokenized Pokémon cards are NFTs backed by physical Pokémon cards in secure vaults. Unlike conventional NFTs that only exist digitally, these are redeemable for the physical card.

Key Takeaways

-

Tokenized Pokémon cards are NFTs representing real Pokémon cards stored in secure vaults, enabling digital trading with physical redemption rights.

-

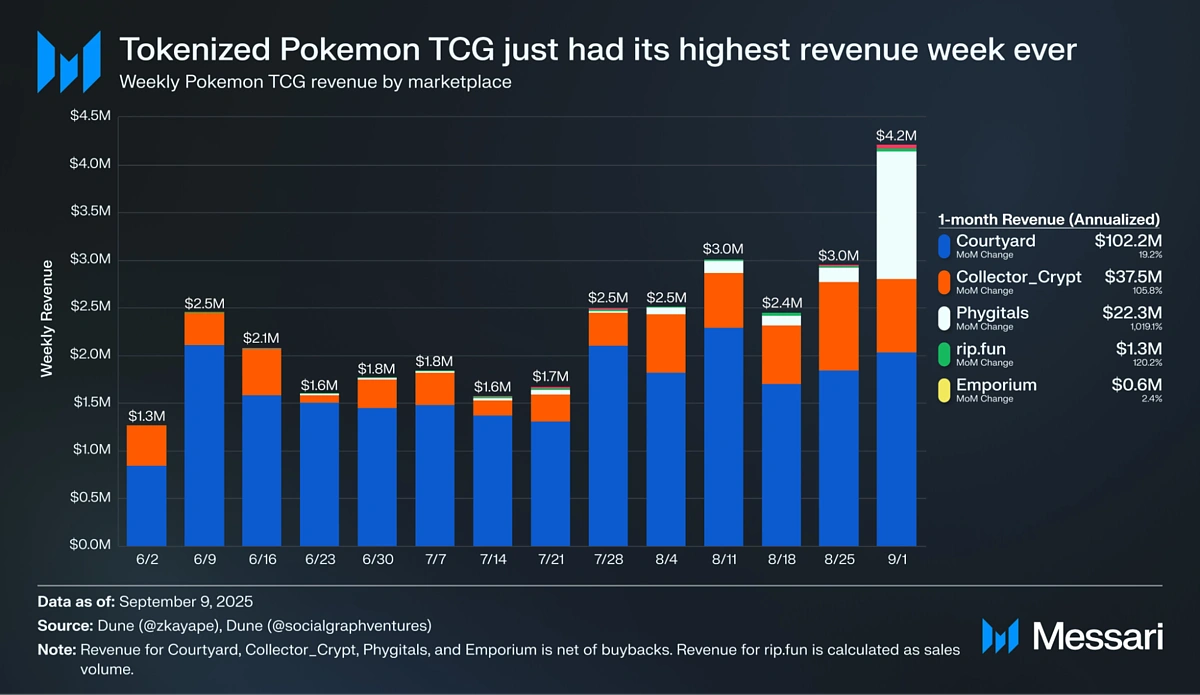

The sector processed $124.5 million in August 2025 trading volume, showing rapid 5.5x growth within the broader $21.4 billion trading cards market.

-

Cards undergo professional grading, secure vault storage, and NFT minting with 1:1 backing ratios maintained through smart contracts.

Tokenized Pokémon cards represent a significant development within the real world assets (RWA) sector, transforming how collectors interact with physical trading cards through blockchain technology. This emerging market processed over $124.5 million in trading volume during August 2025 alone, marking a 5.5-fold increase from early 2025, while addressing longstanding challenges in traditional collectibles trading.

The tokenization of Pokémon cards operates within the broader $21.4 billion trading cards market, offering solutions to issues including authentication challenges, shipping risks, geographical limitations, and liquidity constraints that have historically hindered the efficient trading of physical collectibles.

Understanding Tokenized Trading Cards

Tokenized Pokémon cards are blockchain-based digital representations of authenticated physical Pokémon trading cards stored in secure, third-party vaults. Unlike purely digital NFTs, these tokens maintain a verifiable 1:1 relationship with physical cards, enabling global trading without the risks associated with physical shipment while preserving the option for holders to redeem the actual cards.

The tokenization process transforms traditional card collecting into a hybrid model that combines digital efficiency with physical asset backing, where the corresponding NFT contains comprehensive metadata about the specific card.

Key Benefits of Tokenized Pokémon Cards

Tokenized Pokémon cards offer several advantages over traditional physical card trading by leveraging blockchain technology and secure custody solutions:

Instant Global Trading: Digital transactions complete within seconds, compared to traditional sales requiring days or weeks for physical delivery. There are no geographic barriers as collectors worldwide can participate without shipping restrictions or regional availability constraints.

Enhanced Security and Authentication: Professional grading services like PSA, BGS, and SGC establish condition and authenticity before tokenization, while blockchain verification and secure vault storage eliminate concerns about counterfeit cards that plague secondary markets.

Transparent Price Discovery: Real-time market data and complete transaction history provide clear pricing mechanisms that may be absent in fragmented physical markets. Users can access comprehensive metadata on the platform, including condition details, rarity information, and provenance records.

Improved Liquidity Options: Platforms offer instant buyback features (typically 85-90% of market value) providing immediate exit opportunities for cards attained through gacha/”pack opening.” High-value cards can be divided into fractional ownership shares, democratizing access to premium collectibles that might otherwise be unaffordable.

Lower Transaction Costs: On-chain marketplaces typically charge 2-4% (including redemption fees) compared to traditional trading card marketplaces such as eBay, which charges 13.25% of the total sale price (up to $7,500).

Interoperability: Standard NFT formats enable trading across multiple marketplaces and platforms, enhancing overall market liquidity and providing more trading venues for collectors.

Understanding the RWA Context and Market Dynamics

Tokenized Pokémon cards represent a specific application within the real world assets (RWA) space, where physical assets gain digital representations on blockchain networks.

The collectibles segment has emerged as a distinct RWA category, alongside more established areas like tokenized treasuries and stocks. In particular, Pokémon cards specifically benefit from certain characteristics that make them suitable for tokenization:

Established Valuation Systems: Professional grading services like PSA and BGS provide standardized condition assessment and pricing benchmarks, creating transparent value references that support digital trading. Users can enter the grading ID to check the card in the grading service’s database like https://www.psacard.com/cert, which also offers more details around the card, including an estimated market value.

High Transaction Friction: Traditional Pokémon card trading may involve challenges like shipping delays, authentication concerns, and geographic limitations, which blockchain solutions can address through instant settlement and verified provenance.

Nostalgic Demand: The millennial demographic driving crypto adoption also represents the primary market for Pokémon card collecting, creating natural user overlap between traditional collectors and blockchain-native traders.

Liquidity Constraints: Physical card markets may suffer from limited buyer pools and slow price discovery, particularly for more common cards. Meanwhile, tokenization of high-value items can unlock liquidity through fractional ownership,, inviting broader participation.

The Tokenization Process: From Physical to Digital

The transformation of physical Pokémon cards into tradeable digital assets generally follows a process designed to ensure security, authenticity, and regulatory compliance.

Authentication and Vaulting

A collector first sends their physical cards to a secure, third-party vaulting partner. Before submission, cards must have received professional grading from recognized authentication services, which establishes their condition and authenticity. Leading platforms partner with established security providers—Courtyard works with Brink’s security services while Collector Crypt utilizes PWCC vault facilities—ensuring institutional-grade custody standards.

Upon arrival at secure facilities, each card undergoes comprehensive documentation including high-resolution photography, detailed condition assessments, and assignment of unique identification numbers. These physical cards are then stored in climate-controlled environments with full insurance coverage, addressing traditional concerns about card preservation and security.

Digital Minting and Smart Contract Implementation

The digital representation emerges through smart contract deployment, typically utilizing ERC-721 NFT standards containing metadata linking to specific physical cards. This metadata includes grading information, serial numbers, storage locations, and complete provenance history. This NFT acts as a digital certificate of ownership, or a “digital IOU,” cryptographically tied to the specific physical card held in storage.

Platforms implement real-time verification systems to ensure 1:1 backing between tokens and physical assets. Critical ownership and transaction data remains on-chain for permanence, while supplementary information like detailed imagery may utilize IPFS decentralized storage for cost efficiency.

Redemption Mechanisms

The system’s value is anchored by the promise of redeemability, which is automated by smart contracts. The owner of the NFT can, at any time, choose to “burn” the token through the platform’s interface. This action permanently removes the NFT from circulation and signals the vault to prepare the physical card for shipment back to the owner.

The user typically pays a withdrawal fee plus shipping costs to complete the process. This physical-digital-physical loop ensures every token is backed by a tangible asset, though it introduces a critical risk: the entire system’s integrity rests on the trust placed in the centralized vaulting partner.

On-Chain Marketplaces: Recreating the Pack-Opening Experience

Once minted, these card-backed NFTs can be traded on specialized on-chain marketplaces that offer significant advantages over Web2 platforms like eBay, including lower fees, instant settlement, and interoperability with larger NFT ecosystems.

However, the most explosive growth has been driven by gamified features that replicate the thrill of opening a fresh pack of cards, as seen from the popularity of Courtyard, Collector Crypt, Phygitals, and RIP.FUN.

Collector Crypt’s Gacha Feature

A leading example on the Solana blockchain is Collector Crypt, whose most popular product is its “Gacha Machine”. This feature allows users to buy randomized NFT packs using crypto, digitally recreating the ritual of opening booster packs. A key innovation is an instant buyback feature, which gives users the option to immediately sell their revealed NFT back to the platform, providing instant liquidity. The platform’s ecosystem is powered by its native utility token, CARDS.

Courtyard.io’s Digital Packs

Operating on the Polygon network, Courtyard.io has seen tremendous success with a similar model centered on “digital pack” drops from its “Vending Machine”. The platform drives liquidity through these gamified pack-ripping experiences, which also include an instant buyback mechanic, typically offering 90% of the card’s fair market value.

Courtyard also focuses on security, partnering with global leader Brink’s for vaulting services, and differentiates itself with a zero-fee marketplace for vaulted items.

Phygitals: The Emerging Challenger

Also operating on Solana, Phygitals leans heavily into a “phygital” (physical + digital) hybrid model. Like the others, the platform’s core experience involves users opening digital packs to instantly reveal a real, physical Pokémon card. From there, collectors have the choice to hold the card digitally, trade it, redeem the physical version, or sell it back to the platform for 85% of its market value—a feature that provides immediate liquidity.

Phygitals also has a strong emphasis on gamification, offering interactive games like a “Claw Machine” and “Lucky Draw” for users to win cards.

RIP.FUN: Buy and Open New Packs

Unlike the above three platforms, which repackage opened cards, RIP.FUN lets users buy and open new packs and trade or sell the cards pulled. All transactions, pulls, and ownership details are recorded on Base.

When users open a pack on RIP.FUN, they are opening a real physical pack, and the cards pulled are exactly what came out of the pack, which they can keep digitally or redeem physically. The entire unboxing process of opening a new physical pack is stored on video, so users can watch footage of the pack being opened to confirm authenticity.

Currently, Rip.Fun is in closed beta. Opening packs, trading cards, and actively participating on the platform will earn users EXP points, which can be redeemed for in-platform rewards such as mystery packs, special collectibles, or additional cards.

Considerations and Risks Around Tokenized Pokémon Trading Cards

Tokenized Pokémon cards present unique risk-reward profiles.

Regulatory Environment

The regulatory landscape remains evolving, with the SEC maintaining that “tokenized securities are still securities” subject to federal oversight. Most tokenized collectible offerings likely qualify as securities under existing frameworks, requiring proper registration or applicable exemptions.

Intellectual property considerations add complexity, as The Pokémon Company maintains strict control over Pokémon trademarks and generally prohibits commercial use of their intellectual property without explicit licensing agreements.

Technology and Operational Risks

Platform concentration risk emerges from the centralized nature of physical custody, creating single points of failure where operational issues, security breaches, or regulatory actions could affect all tokenized assets.

Market Dynamics

Volatility: Token prices can experience significant fluctuations driven by speculation, limited liquidity, and broader crypto market sentiment rather than underlying collectible values.

Market Manipulation: Low liquidity in specialized segments creates susceptibility to coordinated manipulation, though traditional market benchmarks provide some price anchoring.

Platform Sustainability: The emerging nature of tokenized collectibles creates platform mortality risks, particularly during market downturns when user activity and revenue may decline substantially.

Conclusion

The tokenized Pokémon cards market represents an innovative application of blockchain technology to traditional collectibles, offering enhanced functionality while introducing new risk categories. As regulatory frameworks develop and technology matures, this sector may serve as a model for broader tokenization of physical assets across various categories.

The continued evolution of this market will depend on successful navigation of regulatory requirements, maintenance of robust security standards, and development of sustainable business models balancing innovation with participant protection.

This article is only for informational purposes and should not be taken as financial or investment advice. Always do your own research before investing or depositing any capital on any platform.