What Are Crypto Narratives?

Narratives in cryptocurrency refer to the trending ideas, stories, or beliefs that shape how people perceive and value cryptocurrencies. These narratives can influence investor sentiment, market trends, and the adoption of new technologies.

Key Takeaways

-

Narratives in cryptocurrency refer to the trending ideas, stories, or beliefs that shape how people perceive and value cryptocurrencies – they can influence investor sentiment, market trends, and the adoption of new technologies.

-

In 2025, we see an increase in interest from the mainstream, from asset tokenizations and ETF applications, to an inflow of capital into the crypto space via stablecoins.

-

Top narratives for 2025 are meme launchpads, Bitcoin staking, liquid staking and restaking, stablecoins, crypto ETFs, RWA and asset tokenization, along with DePIN.

-

Crypto narratives can also be misleading or even harmful based on false assumptions or hype. Therefore, it’s important to critically evaluate narratives and base your investment decisions on sound analysis and research.

This article was updated in July 2025 to reflect new and upcoming narratives by Vera Lim.

Market participants are always looking for trends to better understand what is taking place, why it’s taking place, and its potential impacts. Historically, they use the dynamics of market cycles to act more proactively in future market environments. From Elon Musk’s tweets moving the price of DOGE, to believing in the Bitcoin halving driving bull runs every four years, many investors use crypto narratives to predict price action.

For example, the narrative of cryptocurrencies as a store of value has attracted many investors who view cryptocurrencies as a hedge against economic uncertainty. Similarly, the narrative of blockchain as a disruptive technology has attracted many entrepreneurs and developers working to build new applications on the blockchain.

Why Are Crypto Narratives Important?

Crypto narratives emerge from a combination of factors, including the technological capabilities of crypto and the blockchain, social and economic events, and the beliefs and motivations of the individuals involved in the cryptocurrency industry. Mainstream media, social media, online forums, influencers, and market trends can fuel narratives. In 2025, we’ve seen narratives like memecoins and AI agents taking off, which make the crypto market accessible to anyone, as they don’t require any extensive knowledge of the crypto space to participate. We’ve also seen increased mainstream adoption through asset tokenization, ETF applications, and an inflow of capital through stablecoins.

Narratives are important because they play a significant role in shaping public perception and subsequently market movements. They provide a framework for people to understand the potential risks and rewards of different types of cryptocurrencies, and they can influence the trajectory of the entire cryptocurrency industry.

However, crypto narratives can also be misleading or harmful based on false assumptions or hype. As such, it’s important to critically evaluate narratives and base your investment decisions on sound analysis and research.

Now, there are multiple emerging trends and themes that are trying to define 2025. We’ll look at the top crypto narratives to watch in 2025 in this guide:

Meme Launchpads

In the past, creating a memecoin (or any other tokens) required an understanding of smart contracts, liquidity setups, and blockchain infrastructure. However, since the launch of Pump.fun, all of these complexities are now handled automatically on the backend. Users just need to choose their token name, image, and symbol, and their memecoin is ready for launch.

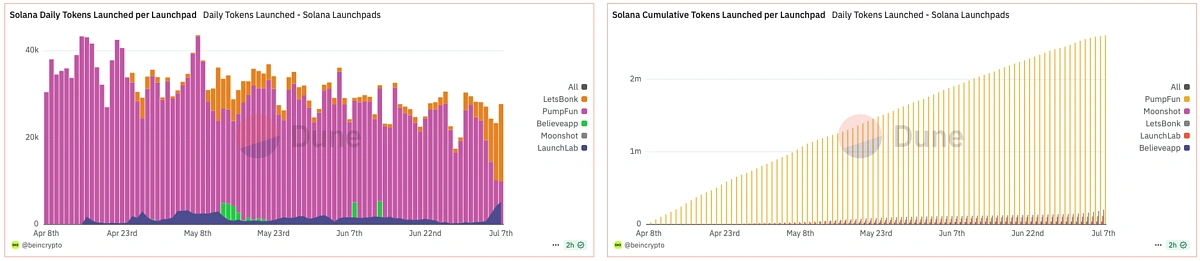

With the success of Pump.fun, many other launchpads dedicated to easy token launches have taken off. Most recently, we saw Bonk.fun, which overtook market leader Pump.fun and claimed over 55% of market share as seen in the above chart. This could in turn drive interest in BONK, as Bonk.fun’s fee structure involves 50% of fees going to buying and burning BONK, 8% to buying BONK for reserves, and the rest kept as revenue, potentially driving buy pressure for BONK.

Bitcoin Staking

Bitcoin staking involves BTC holders locking their Bitcoin in a self-custody vault to secure Proof-of-Stake chains. At time of writing, these protocols work by utilizing features of the Bitcoin network:

-

Timelocks: These make BTC unspendable until a specific time has passed, which allow users to lock their BTC for staking purposes without giving up control to a third party.

-

OP_RETURN: This allows data to be embedded in a Bitcoin transaction, which is used to record staking information like which chain is being secured.

There is also a slashing mechanism included in Bitcoin staking platforms to penalize dishonest behavior.

Examples of Bitcoin staking protocols include Babylon, which pays yield in its native token, BABY, and Core, where users can stake both Bitcoin and CORE for higher BTC staking rates.

Liquid Staking

Liquid staking tokens (LSTs) are cryptocurrencies issued by liquid staking platforms, allowing stakers a means to unlock their illiquid-staked assets and generate more yield. Instead of staking with a Proof of Stake blockchain directly, users can stake their tokens with a liquid staking provider, receiving a derivative token that can be used to engage in other DeFi activities like lending and providing liquidity.

The cumulative market cap of liquid staking tokens and governance tokens of liquid staking protocols is over $48 billion at the time of writing, according to data from CoinGecko. This sector is mainly dominated by liquid staked ETH and liquid staked SOL.

Restaking

Taking LSTs to the next level is restaking – a growing narrative that focuses on capital efficiency, allowing users to stake the same token to secure multiple networks simultaneously. EigenLayer is the pioneer in the restaking space, with over 3.5 million ETH in TVL at time of writing. Users can restake their liquid staking tokens (along with other supported tokens) to secure Actively Validated Services (AVSs) on EigenLayer.

According to data from CoinGecko, the market cap of restaking projects is almost $14.7 billion at the time of writing.

Bitcoin Restaking

Restaking on Bitcoin is also an area of growing interest and one of the potential top narratives of 2025. When restaking Bitcoin, users can leverage their staked Bitcoin to earn additional yield from protocols beyond the original staking network. Liquid Staking Tokens (LSTs) or Liquid Restaking Tokens (LRTs) represent a claim on the staked BTC, and can be traded or used in other DeFi applications, maximizing capital efficiency by letting users earn multiple rewards from the same Bitcoin holdings.

Lombard is one such project, with its product, LBTC, which represents BTC that is already staked on Babylon. LBTC can then be deposited into yield-generating vaults across multiple blockchains and DeFi applications. According to Lombard, they have over 15.1K LBTC minted and over 269K LBTC users.

Stablecoins

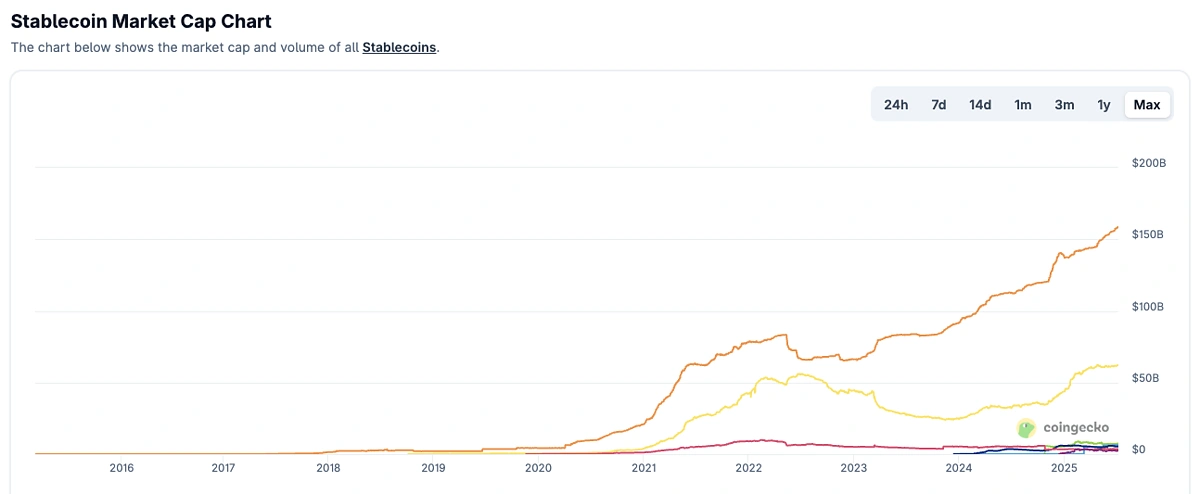

While stablecoins are not a new innovation in the crypto space, they play a key role in contributing to general liquidity of the crypto market while allowing users to preserve value in the crypto market. In 2025, we are seeing the market cap of stablecoins rise to over $264 billion, suggesting an inflow of capital into the crypto space.

Stablecoin projects like USDe by Ethena and USDS by Sky Finance (previously Maker) are also exploring improved yield opportunities for stablecoins.

Ethena’s USDe is a synthetic dollar backed by crypto assets and doesn’t rely on traditional financial infrastructure, nor does it require overcollateralization (which is often the case for crypto-backed stablecoins). Users can accrue protocol yield by staking their USDe and receiving sUSDe in return, with no further action required. According to Sky, USDS is an improved version of DAI, where users can accumulate additional USDS when they supply USDS to the Sky Savings Rate.

ETFs

An Exchange Traded Fund (ETF) is an investment fund designed to track the performance of underlying assets such as stocks, bonds, currencies, commodities, and future contracts. Likewise, a crypto ETF is an investment fund that tracks the performance of one or more cryptocurrencies, or even other crypto-related assets.

Crypto ETFs are regarded as an indication of adoption of cryptocurrencies by mainstream investment firms, as they provide mainstream investors a way to invest in cryptocurrencies. In 2024, we saw the first approval of a Bitcoin ETF, followed by the approval of the first Ethereum ETF in the second quarter of the year.

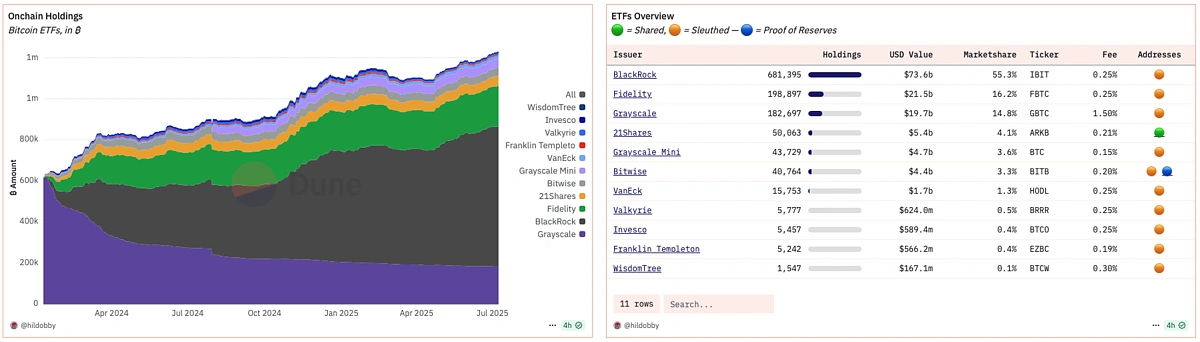

Notable mainstream financial institutions with an active crypto ETF include Blackrock, Gray Scale, and Fidelity Investments.

Blackrock’s IBIT reportedly controls about 55% of the Bitcoin ETF market share. The investment firm has acquired over $73.6 billion worth of BTC between the end of 2023 and 2025. Following this are Fidelity (16.2%) and Grayscale (14.8%) with about 31% market share and $41.2 billion worth of Bitcoin. 21 Shares and Bitwise control about 7% of the Bitcoin ETF market share between them.

As financial regulatory agencies clarify their positions on cryptocurrencies, the structure of mainstream applications for crypto assets is expected to improve. Trump’s presidency also heralds a more crypto-friendly SEC, with ongoing ETF applications for cryptocurrencies including SOL, XRP, and even DOGE.

Asset Tokenization and Real-World Assets

As the name suggests, real-world assets (RWA) are assets from the physical world, including financial instruments including fiat currencies, shares, and bonds, along with other asset categories such as real estate, machinery, art, and more. At time of writing, the total market cap of the RWA sector sits at $37.8 billion.

RWA tokenization is a way to render these assets accessible to a broader range of investors through fractional ownership, democratizing access to high-value assets.

For example, in the case of tokenized gold, investors can buy tiny fractions of a token based on their investment capability (as low as ~$0.01), without having to worry about the hassle of storage while accessing greater liquidity and faster settlement times by being able to trade on crypto markets 24/7.

Fiat-backed stablecoins are still the largest vertical in RWA, where a representation of the asset is minted on the blockchain, which can then be used to engage in DeFi activities as an alternative to traditional finance, or even as a way to retain value for regions suffering from hyperinflation.

Tokenized U.S. treasuries featuring projects like Ondo Finance and BlackRock’s BUIDL are also on the rise, reaching an all-time high of $5.6 billion in April 2025. However, with a small number of on-chain holders, this growth is likely fueled by institutions and stablecoin issuers, although their appetite for such assets onchain is growing.

Decentralized Physical Infrastructure Networks (DePIN)

DePIN refers to decentralized physical infrastructure networks, which use blockchains and token rewards to develop infrastructure in the physical world across different fields, such as wireless connectivity, geospatial mapping, mobility, health, energy, and more. At time of writing, the total market cap of projects in the DePIN space is $16.1 billion.

The goal of DePIN is to create resource-efficient physical infrastructure through incentivizing providers to commit their physical resources to a decentralized network. The DePIN project then makes these resources available to users who are looking for cheaper service charges (relative to centralized facilities), and the network generates revenue through fees paid by the users.

Conclusion

In 2024, we saw narratives like prediction markets, blockchain modularity, and an increase in interest around Bitcoin, with the launch of Layer 2s and new token options, such as Ordinals, BRC-20 tokens, and Runes. The interest in Bitcoin is continuing into 2025, with protocols offering liquid staking and restaking for BTC. Other new and emerging narratives to watch in 2025 include memecoin launchpads, along with mainstream interest as seen in stablecoins, ETFs, and asset tokenization.

Remember, this article is only for educational purposes and should not be taken as financial advice. Please do your own research (DYOR) before investing in any asset.