Largest Gainers of First Half (H1) of 2025

The largest gainers of H1 2025 is led by Saros, a comprehensive DeFi suite with 1,379% growth, followed by Onyxcoin’s XCN with 551% growth and Zebec Network’s ZBCN (298%). RWA project Maple Finance’s SYRUP (288%) and memecoin TOSHI (5,132%) round up the top five. Other top gainers include Venom (255%), Euler (120%), WhiteBit Coin (90%), Hyperliquid’s HYPE (65%), and Monero (62%).

Key Takeaways

-

The crypto market navigated significant macroeconomic volatility in H1 2025, driven by the new US administration’s policies and US-China trade tensions.

-

Bitcoin reached a new all-time high above $112,000, fueled by sustained institutional inflows into spot Bitcoin ETFs and President Trump’s executive order around establishing a strategic Bitcoin reserve.

-

Dominant narratives of H1 2025 include Real World Assets (RWA), DeFi, and payments.

Overall Market Outlook

In the first half of 2025, we had the new crypto-friendly Trump administration in the United States providing regulatory tailwinds with the establishment of a US Strategic Bitcoin Reserve. However, this was offset by an escalating trade war between the U.S. and China, which eventually triggered a market-wide crash in April, as seen in the Bitcoin price chart below.

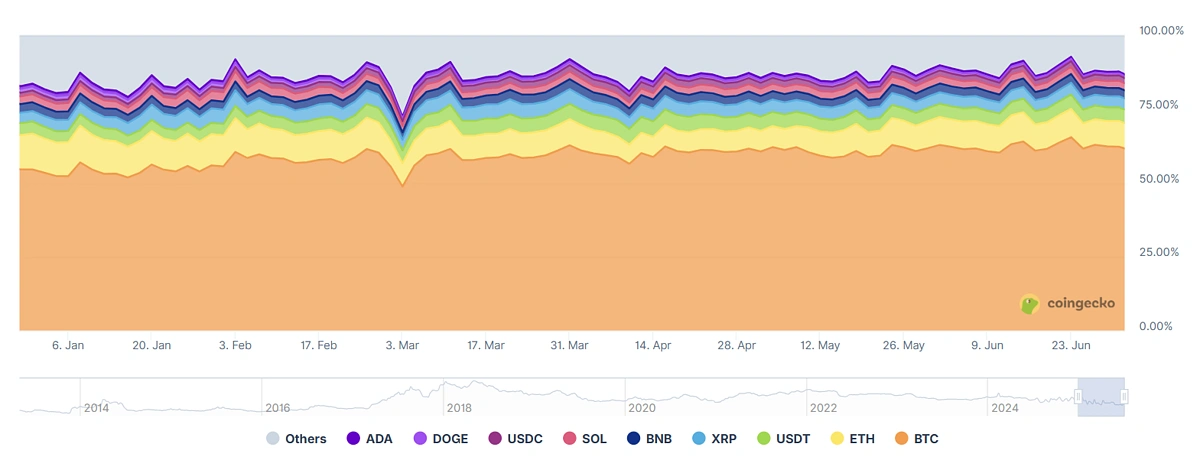

Nevertheless, institutional interest in digital assets grew during this time, ultimately pushing Bitcoin to a new high on May 22, 2025. Spot Bitcoin ETFs like IBIT reported significant inflows for most of the first half of 2025, indicating a growing interest in the asset from mainstream investors. Generally, Bitcoin outperformed the rest of the crypto market in H1, reclaiming 60% dominance for the first time since August 2024 in February 2025.

Here are some key narratives we saw in the first half of 2025:

-

Real World Assets (RWA): Tokenized private credit, as seen with Maple Finance, bridged the trillion dollar traditional finance market with the on-chain economy.

-

DeFi: High-performance decentralized perpetuals exchanges like Hyperliquid captured massive trading volume, and projects like Saros making advancements in the space with its Dynamic Liquidity Market Maker (DLMM).

-

Payments: Infrastructure providers like Zebec Network gained significant traction by bridging traditional and on-chain finance, offering compliant, real-world solutions for payroll and cross-border transactions.

This list covers the largest gainers among the top 300 cryptocurrencies on CoinGecko by market capitalization, and only takes into account cryptocurrencies launched before January 2025.

Saros (SAROS):1,379%

SAROS’s 1,379% price growth in the first half of 2025 is the best on record for crypto assets in the top 300 ranks. This is likely catalyzed by major product developments, such as the official launch of its DLMM. Upon the launch of its DLMM on June 3, the token’s price climbed to a new high one week later on June 10.

Saros is a comprehensive decentralized finance (DeFi) suite built on Solana by Coin98 Labs, with features including an AMM (Automated Market Maker) for spot trading, a decentralized perpetuals exchange offering up to 50x leverage, staking services, and a launchpad for new projects.

Saros’s key innovation is its Dynamic Liquidity Market Maker (DLMM) – an improvement of the standard AMM models that allows more flexible and efficient liquidity provision. This improves capital efficiency, reduces slippage, and simplifies the process of creating new markets for crypto assets on Solana. Saros has also adopted a dynamic fee structure, where the protocol adjusts fees based on market volatility, offering LPs higher rewards during periods of increased price fluctuation to offset potential impermanent loss.

Onyxcoin (XCN): 551%

Onyxcoin’s XCN saw a price surge at the start of the year, likely due to the release of a new whitepaper in February, which created a new Layer 3 narrative for the project. However, in spite of the mainnet launch in March, the token did not see another surge until April when XCN was listed on Binance futures leading to increased trading activity, resulting in a 550% price growth by the end of H1 from its opening price in January.

Onyx pivoted to becoming a Layer 3, aligning it with the next level of blockchain scalability and specialization. This technical repositioning, deployed using Arbitrum Orbit’s rollup technology and Coinbase’s Base Layer 2 for settlement. The native XCN token is used for paying transaction fees, network security via staking, and governance of the Onyx DAO. Its governance model was also radically democratized, transforming it into a highly accessible, community-driven protocol.

Zebec Network (ZBCN): 298%

Zebec Network’s ZBCN price doubled in the first two months of H1 following initiatives and development around the launch of its RWA payment network. ZBCN grew by over 400% in May, reaching a new all-time high of $0.007 per token on May 30, 2025 with the announcement of a landmark partnership with Circle, issuer of the USDC stablecoin, integrating USDC as the default stablecoin across its product suite.

Zebec Network is a decentralized financial infrastructure platform focused on bridging real-world payments with the on-chain economy. Its product suite includes real-time payroll streaming, crypto-enabled Mastercard payment cards, treasury management solutions for businesses, and Zebec-powered point of sale systems that allow businesses to accept crypto. The ZBCN token is the native asset of the ecosystem, with its value supported by a buyback program funded by real-world revenue.

Rather than building from scratch, Zebec acquires Web2 fintech companies, such as WageLink, a payroll app,and the compliance platform Gatenox, to rapidly gain users and technology. It then enhances these acquired companies with Web3 capabilities like low-cost cross-border payments using USDC.

Maple Finance (SYRUP): 288%

Enterprise-focused real world asset (RWA) protocol, Maple, was the fourth best performer in H1 among top 300 ranked assets. SYRUP, the native token of the project, grew by 288% between January and June 2025. Beginning with a strategic pivot to over-collateralized lending after the FTX crisis, which rebuilt market trust, Maple also launched the Syrup protocol and the new SYRUP token, which unlocked institutional yield for the DeFi masses. In 2025, Maple’s TVL grew from around $510 million to $3 billion at time of writing.

From an opening price of $0.156 per token on January 1, SYRUP rose to a record high of $0.65 per token and closed for trading on June 30 at ~$0.61 per token. SYRUP’s yield-bearing stablecoin, SyrupUSDC, also grew to a market cap of over $900 million in H1. It is now the third-largest yield-bearing stablecoin.

In H1, Maple refined its financial products, scored several partnerships, and expanded its products to other networks. On June 5, it announced the expansion of the SyrupUSDC to the Solana network. Prior to expanding SyrupUSDC to Solana, Maple boosted the adoption of its yield-bearing stable by integrating it into several other DeFi platforms, including Ether.fi, Pendle, and Morpho. Maple also partnered with CoreDAO to launch Bitcoin Yield, a Bitcoin-backed product that offers a 5.1% yield on Bitcoin. It also launched Lend & Long, an institution-targeted product offering up to 30% APY on Bitcoin.

In addition to new partnerships, other events like the integration with Lido and the support for Marinade staked SOL (mSOL) as a collateral asset for crypto lending also contributed to SYRUP’s growth in H1. $50 billion asset manager, GrayScale, also featured SYRUP in its top index for Q2 2025, highlighting mainstream interest in the asset.

Toshi (TOSHI): 284%

TOSHI is a memecoin on the Base Layer 2 network inspired by CEO Brian Armstrong’s cat. As with other meme tokens, TOSHI’s price development is driven by community activity. In January, Coinbase announced that it would be listing TOSHI on its exchange. TOSHI jumped 70% on the news and grew to a record high of $0.0022 on January 26, 2025.

TOSHI spent the majority of H1 in consolidation. On June 30, it closed for trading at $0.0048 per token, netting a 284% growth from levels recorded on January 1. It is the fifth-best-performing asset in H1 among the top 300 ranked assets.

Prior to the Coinbase listing, other exchanges like Bybit added trading support for Toshi. Kraken also listed the asset on February 21, adding to the list of trading platforms that support the asset. Beyond listings, Toshi also evolved toward platform utility with the launch of Toshi Mart, a memecoin launchpad on Base.

Venom (VENOM): 255%

Venom is the sixth highest gainer in H1 among the top 300 ranked crypto assets. VENOM trading opened at $0.05 per token on January 1 and closed at over $0.184 on June 30, netting a 255% growth in value in the first half of the year.

Venom is a Layer 0 and Layer 1 blockchain designed for extreme scalability through the use of a mesh network and dynamic sharding. It is designed to serve as a foundational infrastructure layer for large-scale, high-performance applications, including national payment systems and Central Bank Digital Currencies (CBDCs). The project is built on a Threaded Virtual Machine (TVM) and uses a developer-friendly language called T-Sol.

In May, a successful closed-network stress test that demonstrated an impressive 150,000 transactions per second (TPS) provided tangible proof of its enterprise-grade capabilities. Venom also issued a public invitation to multiple Southeast Asian central banks and regulators to co-develop financial systems.

Euler (EUL): 120%

Euler is a decentralized money market, allowing individuals to create and customize their own permissionless lending and borrowing markets for any crypto asset. According to data from Defillama, TVL on the platform grew by over 900% in H1, and this is mirrored in EUL growth. From just over $110 million in January, over $1.1 billion worth of crypto assets are now locked across lending pools on the protocol and the EulerSwap.

Euler V2 represents a paradigm shift in DeFi lending through its highly modular architecture. This consists of two core components: the Euler Vault Kit (EVK), a toolkit for creating isolated lending vaults, and the Ethereum Vault Connector (EVC), an immutable layer that allows collateral in one vault to be used for borrowing across the entire ecosystem.

WhiteBIT Coin (WBT): 90%

Between January 1 and June 30, WhiteBIT Coin’s value grew by 90% and reached a new all-time high of $52.27 on June 16. WBT is the eighth highest gainer among the top 300 ranked crypto assets. WBT price growth during this time was driven by marketing activities aimed at achieving mass brand recognition. The main draw was the announcement of a multi-year deal to become the official sleeve sponsor for Italian football giant Juventus. This sparked a surge in the WBT price in mid June.

WhiteBit serves over 5 million cryptocurrency investors across Europe and other continents worldwide. It is a custodial cryptocurrency exchange with support for over 300 crypto assets. Users can trade supported assets on the spot and derivatives trading platforms. In addition to crypto trading services, WhiteBit Exchange also offers secondary financial services, including passive income through crypto lending.

WhiteBit also operates WhiteChain, an EVM-compatible Layer 1 network powered by the WhiteBit coin. According to WhiteBit, the network offers cheap transaction fees, fast transaction execution, and significant advantages to the WhiteBit ecosystem. The Whitebit Coin powers its ecosystem, providing financial support and opportunities for the platform users and holders.

Hyperliquid (HYPE): 65%

Hyperliquid’s HYPE is the ninth-highest gainer among tokens ranked in the top 300 positions in the first half of 2025. As of January 1, HYPE was trading at just over $24 per token. Following an eventful half, the token grew to an all-time high of $45.57 per token on June 16. HYPE closed for trading on June 30 at over $39.7 per token, netting a 65% overall growth in H1 2025.

Hyperliquid is a decentralized perpetuals exchange (perp DEX) built on its own custom-designed Layer 1 blockchain to serve the specific needs of an on-chain order book. The entire system is vertically integrated and optimized for a single purpose: to provide a fully on-chain, high-performance derivatives trading experience that rivals the speed of centralized exchanges. The HYPE token is used for platform governance and to promote adoption through staking rewards.

HYPE’s 65% gain was a direct reflection of the platform’s growth. The primary driver was the massive surge in activities on Hyperliquid which began around mid-April, growing from $400 million TVL to almost $2.2 billion by June 30. The launch of the HyperEVM further boosted the ecosystem by adding a general-purpose smart contract layer, enabling developers to build EVM-based dApps on the Hyperliquid blockchain.

Monero (XMR): 62%

Monero’s XMR rounds up the top 10 best-performing assets among the top 300 crypto assets in H1 2025. It delivered a net price 62% growth between January and June 2025. Events around the ongoing Tornado Cash case, such as the Ethereum Foundation supporting Tornado Cash developers could also have contributed to a growing privacy coin narrative.

Monero is the market’s foremost privacy-preserving cryptocurrency, built on its own Proof-of-Work blockchain. It is designed to be a private, censorship-resistant, and fungible form of digital cash. Monero achieves privacy by default for all users by obscuring the sender, receiver, and amount of every transaction using core technologies like ring signatures, stealth addresses, and RingCT (Ring Confidential Transactions).

Monero’s development is driven by a decentralized community focused on fundamental cryptographic research and resilient engineering rather than marketing hype, as seen from quiet but significant protocol upgrades in H1, like the ‘Fluorine Fermi’ software releases that enhanced network security.

Final Thoughts

The first half of 2025 was defined by a market environment where institutional inflows propelled Bitcoin to new heights. Beyond Bitcoin, we saw interest in narratives like RWA, DeFi, and payments, with many of the protocols who made this list showcasing technological innovation and ecosystem expansion.

Having said this, note that this review only covers projects ranked in the top 300 by market cap on CoinGecko that were launched before January 1 2025. That said, there were other interesting tokens that saw significant growth in the first half of the year that were omitted from this list, such as LAUNCHCOIN, the flagship token of X memecoin launchpad Believe. Click here to check out other top gainers and losers on CoinGecko.

Disclaimer: This article reviews the top-performing assets in H1 for informational purposes only, and should not be taken as endorsement or investment advice around any of the featured projects. Always do your own research before investing in any crypto asset. Some tokens may have been excluded from this list due to there being no clear developments that prompted price growth.

Related: