*This picture is for image illustration purposes and should not be taken as financial or investment advice

Table of Contents

Key Takeaways:

-

Solana has its list of blue-chip NFT projects, including DeGods, Taiyo Robotics, Blocksmith Labs (BSL), and Famous Fox Federation.

-

If you don’t mint your own NFTs, there are secondary marketplaces to purchase Solana NFTs, such as Magic Eden that accounts for around 90% of trading volume.

-

DYOR with charting tools, unlock liquidity with NFT lending protocols, and snipe coveted NFTs using sniper bots.

Solana NFTs have been making a lot of noise lately. But most, if not all the necessary info on Solana NFTs is gated to Crypto Twitter or Discord. That’s why this guide isn’t going to be like any other Solana NFT guide you’ve ever read. That’s my promise to you right now. There’s no mention of Okay Bears, no Cets on Creck, nada. (I see these more as brand plays, and on Solana, we like to invest in builders.)

Builders are the meta in the Solana NFT space. That’s why all the projects mentioned in this piece have a strong team of builders behind them. Now let’s take a look at how you can go from zero to NFT degen mastery by the end of this guide.

First, we’ll cover a list of blue-chip projects. Afterward, we’ll discuss how and where you can buy these Solana NFTs. Then we’ll go over a few Solana-specific NFT tools to give you a massive—and I mean, massive—advantage when it comes to collecting NFTs.

After that, we’ll go over how to mint NFTs for new projects real quick. Then we’ll close with some thoughts on where Solana NFTs are going from here, okay? Okay.

Let’s get to it then!

A List of Blue-Chip Solana NFT Projects

Below, we present a list of blue-chip NFT projects. By “blue chip”, we’re referring to OG projects that have cemented their presence in the NFT space. And more often than not, they’ve also helped lift up the Solana ecosystem as a whole.

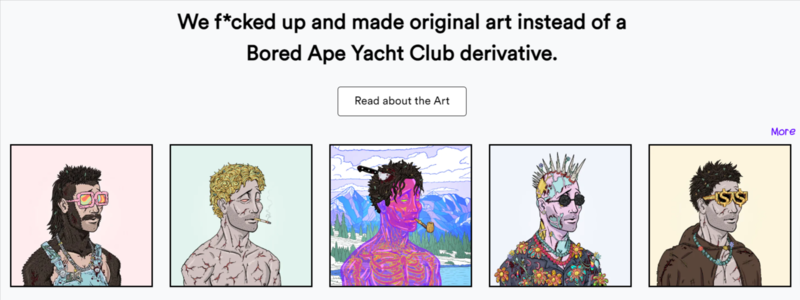

DeGods: Still the Holy Grail?

Source: DeGods

The blue chip of Solana, DeGods is an OG project that recently joined the ranks of the Top 5 NFT projects by market cap. The Top 5 include the likes of Crypto Punks and Bored Ape Yacht Club. In fact, DeGods is the only Solana project featured in the Top 5.

So what makes DeGods hit different? Is it the marketing? The community vibes? Whatever it is, this project is on a different wave.

Maybe it’s got to do with the fact that they never encouraged crypto users to go out and spam for whitelist spots. Instead, DeGods was the first project to offer these spots in the form of bounties.

The bounties produced a plethora of genius marketing material. From one holder trying to convince his mom to buy DeGods to another holder flying out of a plane dressed as a DeGod, the project quickly went viral.

Today, prominent holders include both Solana co-founders as well as rapper Ice Cube. But that’s not the only thing that makes this project special.

DeGods is actually the first deflationary NFT project. Way back when, if anyone tried to sell their DeGod below the floor price, something happened. The sale would trigger what came to be known as the Paper Hands B***H Tax (PHBT).

That’s a 33.3% royalties fee that would be tacked on and redirected to DeDAO. (These royalties have since been removed.) At the time, the sold DeGod would be burned as well, thus decreasing the supply over time.

And if you own an original DeGod, it can be transcended for an art upgrade, into a DeadGod. You need 1000 DUST tokens to achieve transcendence. By the way, you can check out the roadmap below.

Source: DeGods

The founder, Frank, isn’t doxxed, but he obviously cares dearly for the community. I mention this because Frank has recently drawn some controversy after the team’s decision to drop creator royalties from their collections.

I can’t speak for Frank, but I do know a thing or two because I follow the space closely. Marketplaces that have removed creator royalties have been launching on Solana. That’s just the way the market’s been trending for some time, and the writing was on the wall.

If you give sellers the option to remove creator royalties, that’s what they’ll do. After all, royalties aren’t enforceable on-chain.

y00ts: Enter the Controversy

Source: y00ts

Only the DeGods team could have triggered an NFT bull run during a bear market, and they did just that. y00ts, the second project by Frank, was to launch under the newly formed Dust Labs.

Then, once all 15,000 y00ts had been sold pre-reveal, Frank announced that the reveals would be postponed. All the artwork was scrapped, and they announced they would start from scratch.

At around the same time, Magic Eden (ME), the most popular Solana NFT marketplace by trading volume, reversed their position and announced optional creator royalties.

So what happened?

On Crypto Twitter (CT), accusations were thrown around pointing fingers at Frank. Former fans shouted “Collusion!” from the rooftops. Some suspected that Frank knew about ME’s announcement beforehand. That’s why he rushed the y00ts sales to collect all the royalties he could before ME announced it.

Is there any actual evidence? No. It’s circumstantial, at best. And if you follow Frank, you know his commitment to his community and to the ecosystem as a whole.

Still, the situation has gotten pretty ugly at times. But I’ll be holding onto my DeGod and my y00t. When we’re down bad, CT tends to get toxic. Let’s see if we’re all frens again when we’re back up. ❤️

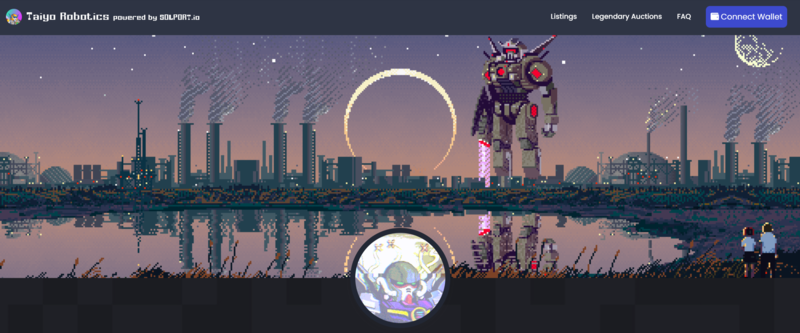

Taiyo Robotics

Source: Taiyo Robotics

It wouldn’t be fair to call Taiyo Robotics an NFT project. It’s way more accurate to call Taiyo an ecosystem. What even many fans of the project don’t know is that Taiyo… is a de-rug.

Story goes, Solport Tom, the founder, had been offering tech solutions to projects. In the midst of it all, he was also working on launching a marketplace called Solport. But after a battle with ME, they decided that the best way forward would be to focus on launchpad services.

Taiyo Robotics was one of Solport’s development clients. Tom’s team was commissioned to create a custom marketplace for assets. But unfortunately, they ended up rugging. Not wanting the bad rep for the Solport community, Tom decided to step in and try to provide value to the Taiyo brand.

The project’s rugged token, SCRAP, was repurposed for Taiyo staking. But unlike most stake-and-forget projects, Tom didn’t stop building from there. With Taiyo Infants, gen2 Taiyo NFTs were born. To get your hands on one, you had to purchase an incubator and reveal yours, or you had to breed them with two parents (gen1).

Now, Tom’s working on something bigger.

Source: Taiyo Pilots

A mint date for the new Taiyo Pilots is imminent. Pilots can consume Taiyo robotics products and get rewarded for engaging in Taiyo activities. These include minting on their minting protocol or buying custom assets from their marketplaces.

In exchange, Pilots can receive Graphite (GP), in addition to other discounts for participating in the ecosystem. Graphite is a new token that’s about to be released. To the best of my knowledge, it’s the only token that’s undergone extensive reviews. These reviews included investors donning serious suits in massive boardrooms with a pitch deck. Not something you see every day in the NFT space.

You’ll be able to stake your Taiyo Gen1 and Gen2 directly for GP—but with a catch. GP can be earned via milestone staking. This innovative staking method involves staking your NFT to accrue more rewards every x number of days.

Feels like… Another Taiyo Win.

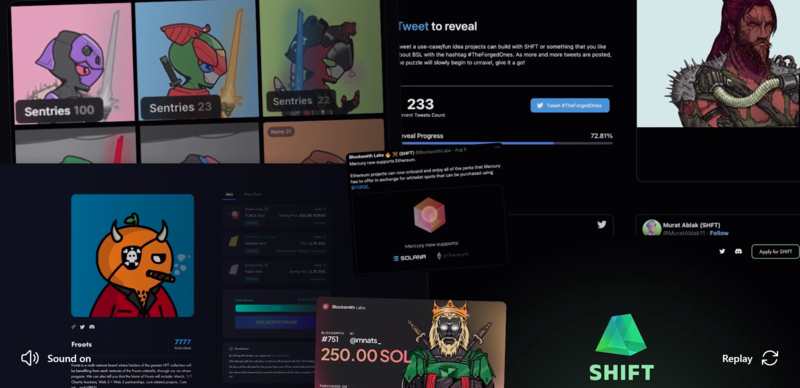

Blocksmith Labs (BSL)

Source: Blocksmith Labs

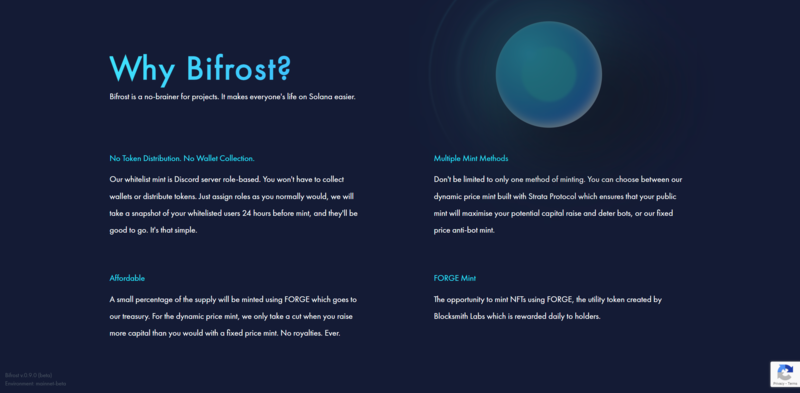

Alex, the founder of Blocksmith Labs (BSL), is a dev who goes by the handle @cryptonent. By the way, he’s the original lead dev for DeGods. BSL has an impressive list of tools they’ve released. And these tools are used throughout the ecosystem.

BSL has a product suite of four tools that makes life easier for NFT projects:

1. Mercury is a whitelist management tool for NFT projects. It also provides a mint calendar with important mint dates. Mercury also includes sections for raffles, auctions, and rewards.

2. Bifrost is BSL’s launchpad. It’s one of the most successful NFT launchpads when you consider some of the launches. Prominent projects that have launched with BSL include Sharx (Sharky.fi) and Froots.

3. Shift is an NFT art upgrade tool that makes it super easy for project owners to manage their art upgrades.

4. Raven is a gamified marketing platform for projects to post bounties in exchange for likes and retweets.

An art upgrade is on the horizon for BSL NFTs. You can upgrade your BSL by paying for the upgrade with FORGE tokens. At present, you can earn 10 FORGE/day by staking your BSL.

Famous Fox Federation

Source: Famous Fox Federation

If you’ve heard of the Famous Fox Federation (FFF), you might mistake them for a gamified profile pic (PFP) project. But their founders are actually some of the most innovative in the space.

Foxydev is… you guessed it, a dev. He’s also one of the straightest shooters you’ll ever meet. You might even think he’s rude because, unlike other founders, he won’t rub your feet to keep you as a holder. If you want to sell, he’ll tell you to sell, dammit.

Here’s a short list of stuff the foxes have created:

– A token marketplace

– A raffle house

– An NFT messaging service

– Marmalade, an art commission marketplace

– FoxyList, where you can bulk-list your NFTs

… and many, many more. Seriously. We’re only scratching the surface.

By the way, you can send your foxes on missions. In exchange, your foxes acquire FAME, which can only be earned via missions. Missions also earn you chests rewards. You can also purchase FAME with FOXY tokens. (Currently, staking your FFF NFT earns you 100 FOXY/day.)

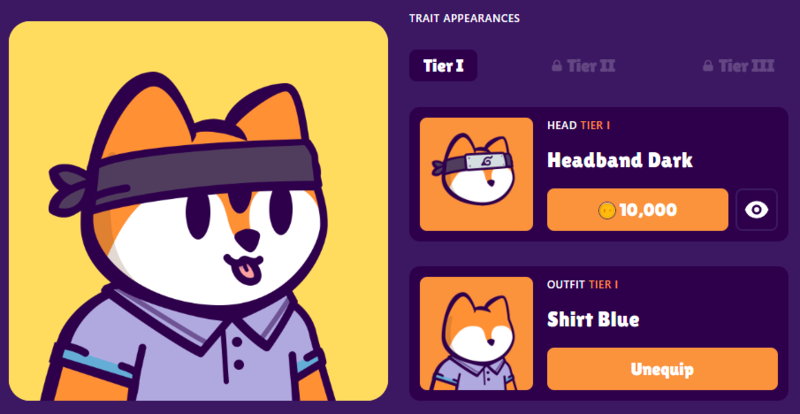

Right now, you can level up your foxes to level 40. That’s when you can unlock special traits that upgrade the artwork of your NFT. Each trait (e.g., a hat or shirt upgrade) costs 10,000 FOXY tokens.

Source: Famous Fox Federation

You can use your FOXY tokens throughout the Foxyverse. The Foxyverse also includes adorable pixelated versions of the original FFF NFTs. These guys are known as the Transdimensional Famous Foxes. You can also buy dens for your foxes, and rooms for your dens, as well as some unique 1:1 art pieces.

It’s a fun OG project, and it looks like it isn’t going anywhere anytime soon.

How to Buy NFTs on Solana

There’s no shortage of secondary marketplaces for NFTs on the Solana chain. Let’s review a few.

Magic Eden

Source: Magic Eden

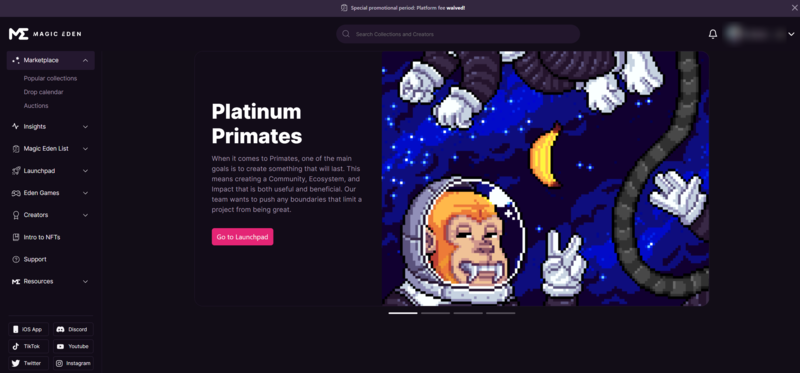

You may have heard of Magic Eden (ME) before this guide. For any Solana NFT newcomer, ME is the most obvious spot to shop for your Solana NFTs. After all, with roughly 90% of the trading volume, ME’s got Solana marketplaces on lockdown.

![]()

Source: Hellomoon.io

It hasn’t been a smooth ride though. As a rapidly growing company, it’s been embroiled in a few controversies outside of the royalty issue. For instance, users have accused the platform of promoting rugs, the most notorious being DegenTown.

HadeSwap

Source: HadeSwap

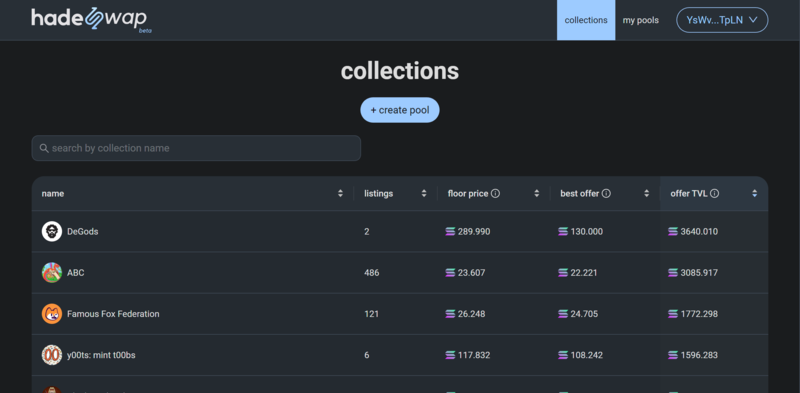

If you’re familiar with Sudoswap on Ethereum, HadeSwap is Sudoswap’s sister on Solana. This means that you can buy into collections over time based on custom bonding curves that you’ve set. You can also sell out of collections the same way. (If you want to dig deeper into how HadeSwap works, check out my article on Sudoswap here.)

In other words, HadeSwap gives you a ton of automation control over your digital assets. Specifically, you can set up three types of pools:

1. A buy pool

2. A sell pool

3. A liquidity pool (LP) for earning fees

When setting up an LP, you select your NFT/s and deposit an equal amount of the NFT’s floor price value into the pool. By providing liquidity to HadeSwap in the form of tokens and NFTs, you’re rewarded with platform fees.

Hadeswap has an NFT collection, by the way. It’s unclear what benefits will accrue to holders of ABC, because apparently it’s a secret. (I love secrets.) That’s what the documentation says, anyway. We’ll just have to wait and see.

ABC is worth checking out. Enjoy using HadeSwap and believe it’s got a future on Solana? If you like kid drawings, ABC looks like the entire collection was drawn by one. It’s a community-driven project, with a fun vibe to boot.

Hyperspace.xyz

Source: Hyperspace.xyz

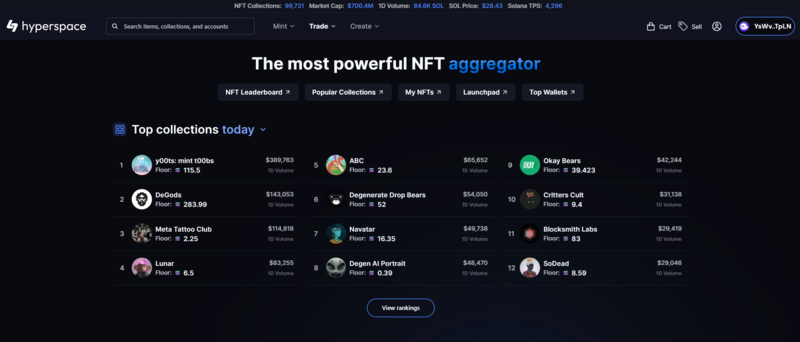

Hyperspace is the NFT marketplace aggregator on Solana. All that means is that it pulls data from all the secondary marketplaces, including automated market makers. That way, you get the “true” market price, instead of the one displayed on any single marketplace. And you can buy direct from Hyperspace. (Zero redirects!)

Hyperspace only charges a reasonable 1% for seller fees. Some users have complained, but come on. The team needs to pay themselves to continue building, right? Another cool thing about the platform is that you never lose custody of your assets. Your NFTs will always remain in your wallet, even after you’ve listed them, until the point of sale.

The platform also allows users to post Collection Bids, where you can post any offer for a collection. On the seller’s side, anyone who needs immediate liquidity can press a button and accept the offer.

Boom. NFT gone. Liquidity now!

Lastly, because Hyperspace is an aggregator, the floor price displayed on the platform is the true floor price. Other platforms, for example, only display the floor price of the NFTs listed on their marketplace.

Not so with Hyperspace.

Did you want to be a janitor growing up? Well, now you can live your dream, baby! Just pick up a broom and start sweepin’ 🧹

Essential NFT Tools on Solana

So far, we’ve looked at a handful of promising OG Solana NFT collections. We’ve also covered marketplaces where you can purchase them. Now let’s go over several indispensable Solana-specific NFT tools to make DYOR easy.

Hellomoon.io

Source: Hellomoon.io

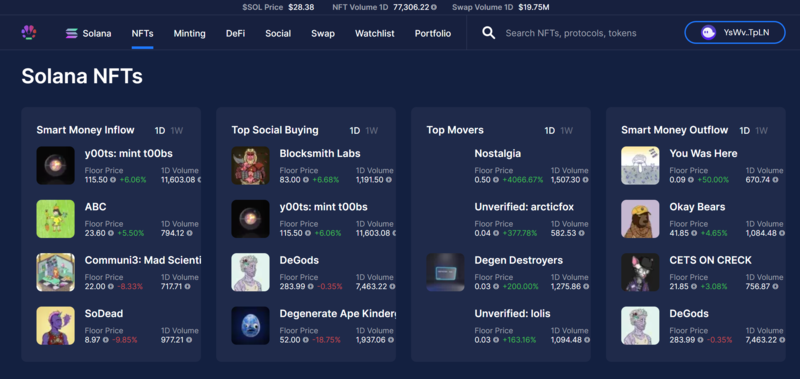

Hellomoon.io is a charting tool for Solana NFTs, but it’s got a bit more to offer than just that. For instance, the homepage dashboard is a treasure trove of data. You get a critical snapshot of which projects are experiencing the most smart money inflows and outflows.

Clicking on the “NFT Ecosystem Analysis” tab below pulls up detailed charts. They include critical metrics like marketplace volume, cumulative unique owners, and weekly buyers vs. sellers.

Once you connect your crypto wallet, you can browse your Solana portfolio too. What’s awesome here is that Hellomoon.io provides you with your P&L percentages, as well as the USD value of your potential earnings and losses.

Sniper Bots

Source: Smart Sea Society

Sniper bots used to be all the rage in 2021. At one point, it seemed that a different sniper project was launching every week. Rarikeys. Smart Sea Society. (Much more than just a sniper bot project, by the way.) Pengsol. Even smaller projects like Saiba Labs have incorporated snipers directly into the Discord.

Here’s how a sniper bot works. Say you want a DeGod, but you don’t want to pay 280 SOL for it. You tell yourself, “Someone out there’s got some fat fingers, or is going to want some fast liquidity.”

So maybe you set it to 250. Maybe you set it to 28. Either way, as soon as someone lists it, it’s gone. If you as a human were watching the listings waiting for it to pop up, you’re already too late. The bot is faster than what populates in the graphical user interface.

Traditionally, these sniper bots have been pulling data from secondary markets like ME and the Famous Fox Token Market. But the best sniper would undoubtedly be one that pulls data directly from on-chain.

Who will come out on top with the best sniper bots?

Sharky.Fi

Source: Sharky.Fi

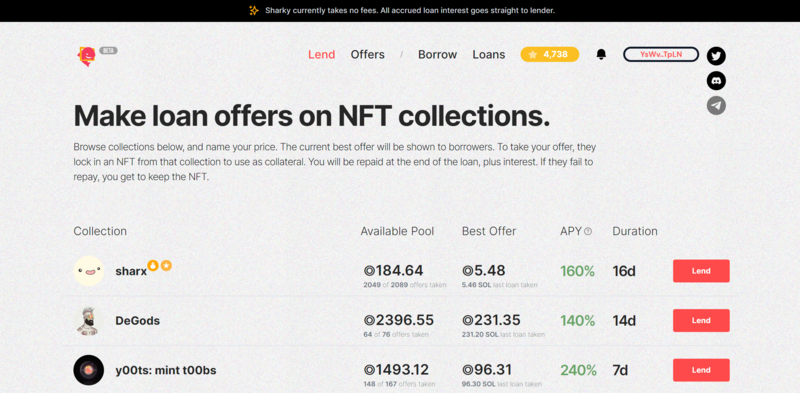

Sharky is an NFT lending protocol, and it’s my favorite tool on this list. If you’ve got even a small amount of capital, you can grow it considerably here by acting as a lender. (We’re talking up to 240% APY for some projects, with weekly to bimonthly payouts!) And as a borrower, you get immediate access to liquidity. Pretty cool, eh?

So what are the risks?

Like every lending protocol, on the borrower’s end, the borrower puts up collateral. But on Sharky.fi, the collateral is NFTs. So let’s say the floor price of an NFT project is 150 SOL. Because the borrower must “over-collateralize” to take out a loan, the loan amount is lower than the floor price.

On Sharky.fi, it works like this. The borrower has access to a list of offer amounts proposed by lenders. The borrower picks the amount they want to borrow, and puts up their NFT as collateral.

What happens when the borrower defaults on their loan? (In other words, what if they’re unable to pay back the full borrowed sum, in addition to the interest, by the deadline?) Then the borrower forfeits their NFT, but they do get to keep the borrowed amount as capital.

If you’re a lender, this is how you play. Once your offer has been accepted, wait until the deadline and collect the sum you’ve lent out, plus interest. Should the borrower default, you get to keep the collateralized NFT at its full value.

Now that’s what I call a win-win.

|

DAOs: A treasure trove for alpha calls Alpha signals (or alpha calls) are buy/sell signals offered to the community by holders of a specific NFT project. Alpha callers are roles designated for this purpose. Some alpha callers are well known in the space—but be careful when you’re listening to calls on CT. These calls tend to be unreliable, and you very well could end up being someone else’s Exit Liquidity. The best place to look for alpha callers is in reputable NFT DAOs. These DAOs are run by popular projects like the ones discussed above. Inside these DAOs, NFT traders, some with deep pockets, trade calls and advice. |

How to Mint Solana NFTs

Source: Blocksmith Labs

You can mint NFTs on Solana in two ways:

1. Use a launchpad

2. Mint directly on the project’s website

There are so many launchpads now. Out of the handful of projects we’ve mentioned, Taiyo Robotics, BSL, and Saiba Labs all have their own launchpads. Minting on a launchpad is easy—and it can be dirt cheap too, if you’re a project holder. Holders can qualify for early mints, as well as discounts.

Contrast this to minting directly on a project’s website. When you go this route, you should take a few precautions. First, make sure that the project is reliable. Launchpads tend to do their due diligence, although rugs have been known to happen. (Scammers be scammin’.)

Second, review the website address. I’ve been burned before by trying to engage with a malicious smart contract on a misspelled website URL. Lastly, use a burner wallet, and make sure it’s got enough SOL to cover transaction fees.

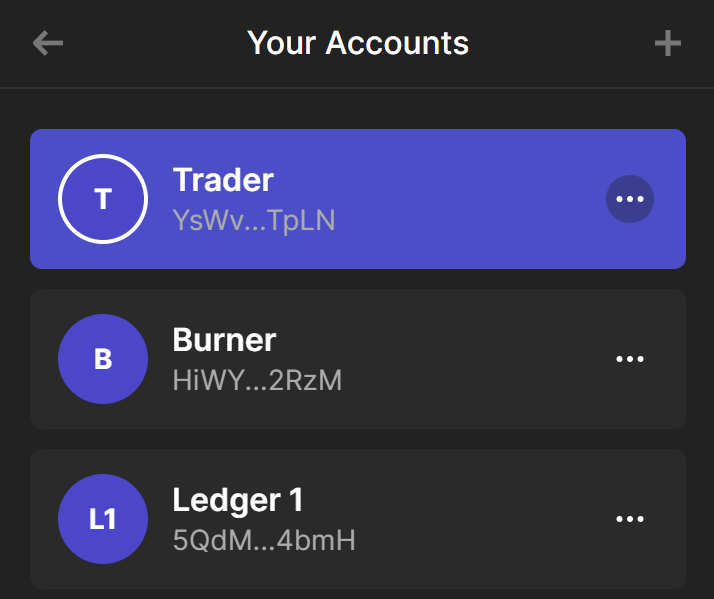

If you don’t know how to create a burner wallet, it’s easy. Here’s how:

1. Open up your Phantom wallet (i.e., the most user-friendly Solana wallet).

2. Click on the top-left icon to reveal a pulldown of your Settings.

Source: Phantom | Unsplash

3. Click on the first option, which is your wallet address.

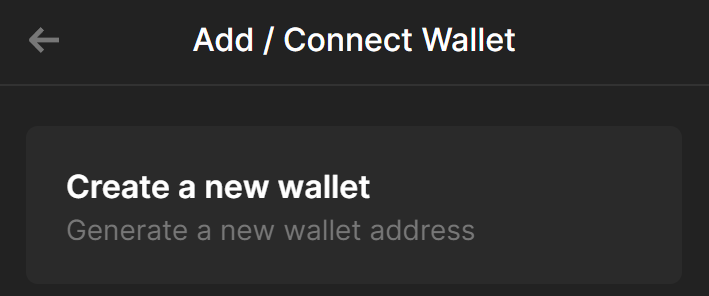

4. On the “Your Accounts” screen, at the bottom of the screen, click on “Add/Connect Wallet”.

Source: Phantom | Unsplash

5. Click “Create a new wallet”.

There you have it. That’s your burner wallet.

Protip: It’s best if you label your wallets so you never mistake one for another. (Can you imagine the calamity waiting to befall you if you mistook your blue-chip wallet for your burner? You could end up losing all your prized and precious NFTs.)

Here’s how you can label your wallet. Repeat the steps above until you reach “Your Accounts” again.

Source: Phantom | Unsplash

But this time, click on the hamburger menu (i.e., the three dots) next to your new wallet address. Once another screen appears, you can click on “Wallet Name” and input your new wallet address. That’s all, folks!

Solana NFTs: Where do we go from here?

Source: Leyre | Unsplash

Will Solana win the NFT game? No one knows for sure. Just a few weeks ago, it seemed like a sure thing. Today, with all these marketplaces duking it out over creator royalties, things couldn’t feel any more bearish.

But there’s light at the end of the tunnel.

When marketplaces are vying for control, they’re forced to innovate. The game is Adapt or Die. And when the dust settles, the most innovative marketplaces will win, those that treat their users and projects with respect. (Projects deserve to be protected, not just end-users including NFT collectors and traders.)

In other words, when marketplaces fight over market share via innovation, the consumer wins. Whether the scenario will play out that way is anyone’s guess, though.

But I do know one thing for sure. Regardless of all the toxicity that can permeate the space sometimes, I started out with NFTs on Ethereum, but Solana still feels like home. ❤️