What Are Your Chances of Successfully Mining Bitcoin Solo?

Bitcoin mining is now more competitive than ever with difficulty levels exceeding 129 trillion units, the highest it’s ever been. As a solo miner you perhaps have a 1 in 2,800 of being successful, or once every 8 years on average. Despite these odds, there are still reports of successful solo miners in the year 2025. Each lucky solo miner earned hundreds of thousands dollars worth in Bitcoin for each successful attempt.

Key Takeaways

-

For solo miners, mining one Bitcoin requires approximately 860,000 kilowatt-hours (kWh) of electricity.

-

Solo mining success is extremely rare but still possible; recent winners in 2025 have earned block rewards worth $330,000-$373,000.

-

Mining difficulty automatically adjusts every 2,016 blocks (roughly every two weeks) to maintain Bitcoin’s 10-minute block time target.

-

Electricity costs to mine 1 Bitcoin vary dramatically worldwide – from as low as $1,324 in Iran to over $321,112 in Ireland.

-

Current block rewards are 3.125 BTC (reduced by half after the April 2024 halving), worth approximately $350,000-$400,000 at current prices.

Bitcoin Block Rewards: Understanding the Prize

Before diving into the mechanics of mining difficulty, it’s crucial to understand what miners are competing for. Think of Bitcoin mining like a global lottery that runs every 10 minutes, where the winner takes home a substantial prize.

The Halving Effect

Bitcoin has a built-in scarcity mechanism called halving (an event that cuts mining rewards in approximately every four years). When Bitcoin launched in 2009, miners received 50 BTC per block. This reward has been halved multiple times:

-

2009-2012: 50 BTC per block

-

2012-2016: 25 BTC per block

-

2016-2020: 12.5 BTC per block

-

2020-2024: 6.25 BTC per block

-

2024-2028: 3.125 BTC per block (current rate)

The current block reward is 3.125 BTC, worth roughly $373,000 at Bitcoin’s current price level.

The halving creates a deflationary pressure on Bitcoin’s supply, driving scarcity while generally reducing the sell pressure coming from Bitcoin miners.

Bitcoin’s Difficulty Adjustment: The Great Equalizer

Bitcoin’s difficulty adjustment is like an automatic referee that keeps the game fair, regardless of how many players join or leave. Understanding this mechanism is crucial to grasping why Bitcoin mining has become increasingly resource-intensive over time.

How Difficulty Adjustment Works

Imagine Bitcoin as a massive, global puzzle-solving competition where a new puzzle must be solved exactly every 10 minutes. If puzzles start getting solved too quickly (because more miners join), Bitcoin automatically makes the puzzles harder. If they’re solved too slowly (because miners leave), it makes them easier.

The process works like this:

-

Every 2,016 blocks (approximately every two weeks), Bitcoin measures how long the previous 2,016 blocks took to mine.

-

If blocks were mined faster than 10 minutes on average, difficulty increases.

-

If blocks were mined slower than 10 minutes on average, difficulty decreases.

-

The adjustment can be up to 25% in either direction per adjustment period.

This self-regulating mechanism ensures that regardless of whether 1,000 or 1 million miners are competing, new Bitcoin is always created at a predictable rate of roughly 1 new block every 10 minutes.

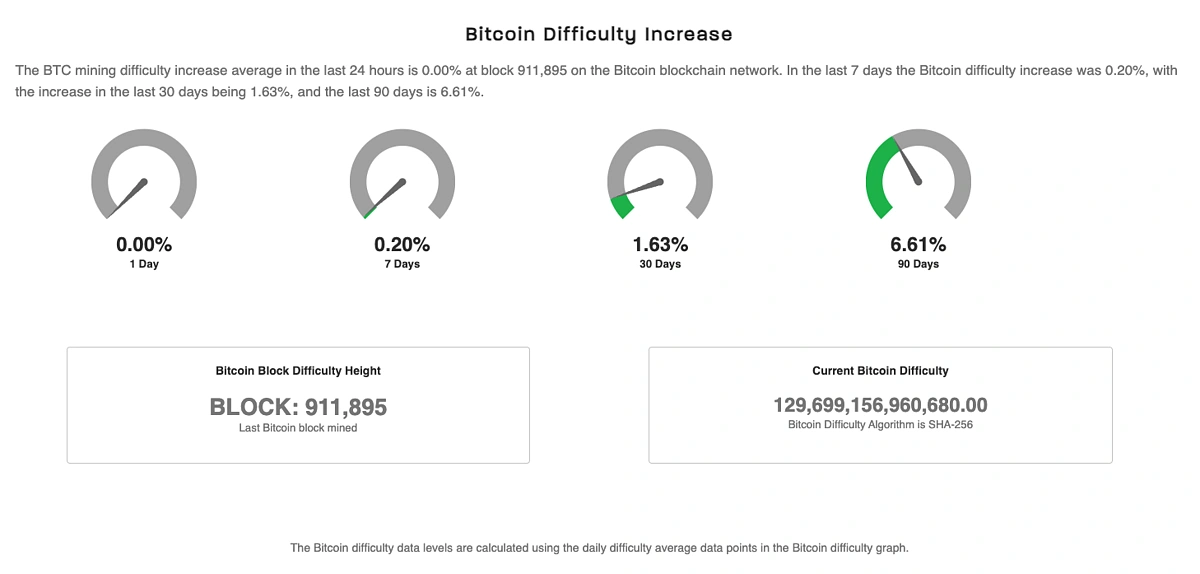

Record-Breaking Difficulty in 2025

According to Coinwarz’s Bitcoin mining difficulty chart, the difficulty set a new historical record at 129.7 trillion units on August 3, 2025, representing a massive increase from previous years. Over the last 30 days, difficulty jumped 1.63%, while over 90 days, the rise amounts to 6.61%.

To put this in perspective, Bitcoin’s difficulty was only around 1 trillion in early 2017. The current difficulty of over 129 trillion means that mining is now over 129 times more computationally challenging than it was just eight years ago.

Why Difficulty Adjustment Drives Resource Requirements

As more miners join the network with more powerful equipment, the difficulty automatically increases to maintain the 10-minute block time. This creates an arms race where miners must constantly upgrade their equipment and increase their computational power just to maintain their chances of winning blocks.

Think of it like this: If you’re competing in a race where the finish line moves further away every time more runners join, you need to constantly get faster just to maintain your chances of winning. This is exactly what drives the massive resource requirements we see in Bitcoin mining today, and explains why it was realistically possible to mine Bitcoin with simple computers back in 2008 but now to have those same chances, you need warehouses filled with specialized computers.

The Resources Needed to Mine Bitcoin Today

Now that you understand why Bitcoin mining has become increasingly difficult, let’s examine the substantial resources required to compete in today’s mining environment. The difficulty adjustment mechanism we just discussed is the fundamental reason why these resource requirements have grown so dramatically.

Hashrate: Your Computational Firepower

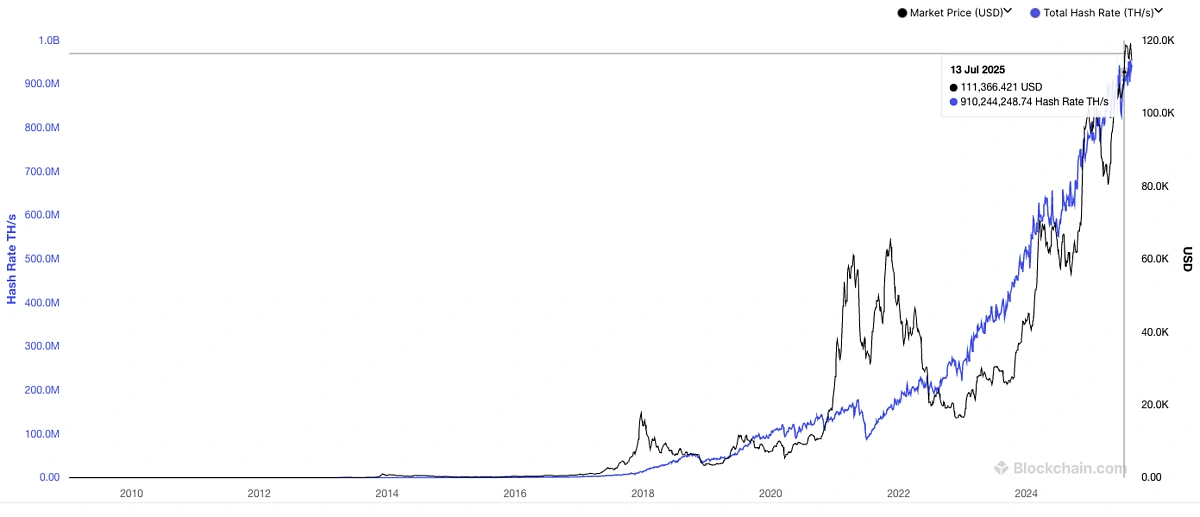

Hashrate (the number of cryptographic calculations your mining equipment can perform per second) is your ticket to the mining lottery. Today, Bitcoin’s network total hashrate has climbed to over 950 exahashes per second (EH/s), surpassing each all time highs, year after year.

Bitcoin’s total network hashrate growth over the years.

Source: https://www.blockchain.com/explorer/charts/hash-rate

For reference:

-

1 megahash (MH/s) = 1 million calculations per second

-

1 terahash (TH/s) = 1 trillion calculations per second

-

1 petahash (PH/s) = 1,000 terahashes per second (1000 TH/s)

-

1 exahash (EH/s) = 1,000 petahashes per second (1000 PH/s)

A modern laptop’s CPU might achieve around 1-10 MH/s (megahashes per second – millions of calculations per second) when mining Bitcoin, giving it essentially zero chance of ever finding a block in today’s competitive environment. In stark contrast, a standard ASIC miner like the Antminer S21 produces 200 TH/s (terahashes per second – 200 trillion calculations per second), making it roughly 20 million times more powerful than a laptop.

Hardware Requirements

Modern Bitcoin mining relies exclusively on ASIC miners (Application-Specific Integrated Circuits), specialized computers designed solely for Bitcoin mining.

Popular models include:

Antminer S19 XP: ~140 TH/s, consuming ~3,010 watts

Antminer S21: ~200 TH/s, consuming ~3,550 watts

WhatsMiner M60S: ~172 TH/s, consuming ~3,400 watts

Think of ASIC miners as purpose-built racing cars, they can’t do anything except mine Bitcoin, but they do it incredibly efficiently compared to general-purpose computers.

The Electricity Challenge

In 2025, as a solo miner, mining a single Bitcoin takes an estimated 860,000 kilowatt-hours (kWh) of electricity. This energy is enough to power about 80 U.S. homes for a year. However, this is a network-wide average, and individual miners’ costs vary dramatically based on their efficiency and electricity rates.

Global Electricity Cost Variations for Solo Miners to Mine 1 Bitcoin (2025):

-

Most Affordable: Iran – $1,324 per Bitcoin (though cryptocurrency mining faces legal restrictions)

-

U.S. Average: Over $107,000 per Bitcoin

-

Most Expensive – Ireland: $321,112 per Bitcoin

The difference is staggering: a miner in Iran could mine over 240 Bitcoins for the same energy cost required to mine just 1 Bitcoin in Ireland.

However, it doesn’t mean that all Bitcoin mining businesses should just relocate to Iran as electricity cost is just one of the considerations. Iran’s power grid for instance, may not actually be equipped to support a commercial mining operation. Furthermore, crypto mining in Iran is technically illegal.

Industrial-Scale Operations

The same electricity rules don’t apply to large scale commercial operations. Major mining companies like Riot Bitcoin pay as little as 2.8 cents per kWh for electricity, compared to residential rates that can exceed 20 cents per kWh. This industrial-scale advantage explains why large mining farms dominate the network.

Professional mining facilities also benefit from:

-

Economies of scale in electricity contracts

-

Optimized cooling systems in suitable climates

-

Direct relationships with equipment manufacturers

-

Specialized maintenance and operational expertise

Riot Platform’s Bitcoin mining facility in Rockdale, Texas.

The Odds of Solo Mining Success

Solo mining in 2025 is essentially playing a lottery where your chances depend on how much computational power you control relative to the entire network. The difficulty adjustment mechanism we discussed earlier directly impacts these odds: As difficulty increases, your chances of success decrease proportionally.

The Mathematical Reality

A miner with one petahash (PH/s) of hashpower has a 1 in 650,000 chance of solving a block every 10 minutes 5. To put this in everyday terms, imagine flipping a coin and getting heads 20 times in a row, that’s roughly the same odds.

Probability Examples:

-

480 GH/s (gigahashes per second) Bitaxe miner: 1 in 1,000,000 chance of finding a block per day.

-

2.3 PH/s setup: About a 1 in 2,800 chance of solving a block every day, or once every 8 years on average.

-

Large industrial farm (100+ PH/s): Multiple blocks per year expected

2025 Solo Mining Success Stories

Despite the astronomical odds, solo miners continue to defy expectations:

July 26, 2025: A solo Bitcoin miner successfully mined block 907283, collecting 3.125 BTC block reward valued at $372,773, plus $3,436 in transaction fees.

July 4, 2025: A solo miner using just 2.3 petahashes solved block 903883 worth $350,000, described as beating “incredible odds”.

August 17, 2025: A solo Bitcoin miner defied the odds, mining block 910,440 through Solo CK Pool and earning $371,000 in rewards.

March 10, 2025: A solo miner using a tiny 480 GH/s Bitaxe pocket rig solved block 887212, earning about $257,963 with odds of 1 in 1,000,000 per day.

The Role of Solo Mining Pools

Many successful solo miners use services like Solo CK Pool, which allows individuals to mine independently while using shared infrastructure. Solo CK Pool lets individuals keep the full block reward if they solve a block independently, and has facilitated 305 solo blocks since its creation.

Solo miners, while few, play an important role in keeping Satoshi Nakamoto’s vision of a decentralized Bitcoin alive.

Why Do People Still Solo Mine?

Given the terrible odds, why do people continue solo mining? Several factors drive this decision:

Philosophical Reasons: Some miners believe in supporting Bitcoin’s decentralization by operating independently rather than joining large pools.

Lottery Mentality: Solo mining is still mostly a lottery, unless you control tens of PH/s, which is unrealistic for a non-commercial operation. However, those who already have an existing ASIC miner may wish to try their luck at this lottery for leisure.

Tax and Investment Strategy: The benefit of BTC mining is the ability to depreciate 100% of the hardware costs and potentially create powerful tax offsets.

Geographical/Industrial Advantage: Some users are perhaps able to access cheap/free electricity, which makes joining this lottery viable or less costly.

Overall, the general consensus is that Bitcoin mining is now mostly a commercial operation involving warehouses, electricity deals and potentially involving the government in the future as Bitcoin adoption grows.

Conclusion: The Reality of Modern Bitcoin Mining

Bitcoin mining in 2025 represents a fascinating paradox. On one hand, the network has never been more secure or robust, with difficulty reaching record levels and professional operations investing billions in infrastructure. On the other hand, solo miners still occasionally strike digital gold, earning hundreds of thousands of dollars in single transactions.

Solo Bitcoin mining in 2025 is extremely difficult and economically challenging for most individuals. Success requires either exceptional luck, access to extraordinarily cheap electricity, or both. While the dream of striking digital gold remains alive, the reality is that Bitcoin mining has largely evolved into an industrial-scale enterprise.

For most people interested in Bitcoin, buying and holding the cryptocurrency directly offers better risk-adjusted returns than solo mining. However, for those with cheap electricity, efficient hardware, and a high risk tolerance, solo mining remains an intriguing, if improbable, path to potentially massive rewards.

The stories of recent solo mining successes serve as powerful reminders that in Bitcoin’s decentralized network, individual participation still matters. While the odds are stacked against solo miners, they’re not zero and in Bitcoin, that mathematical possibility keeps the dream alive.

This article is for educational purposes only and is not financial advice. Cryptocurrency mining involves significant financial risks, including the potential for total loss of invested capital. Before engaging in any mining activities, conduct thorough research, and only invest what you can afford to lose. Mining profitability depends on numerous factors including Bitcoin prices, electricity costs, hardware efficiency, and network difficulty, all of which can change rapidly and unpredictably.

Frequently Asked Questions

-

Can the average person mine Bitcoin?

While technically possible as a solo miner, it is very unlikely with lottery-like chances. However, an average person with a few ASIC miners can consider joining a mining pool – where individuals pool their mining resources together and share the rewards with each other. Mining pools can be a viable option for an average person to mine Bitcoin without fully subjecting themselves to the Bitcoin mining lottery.

-

What’s the difference between solo mining and pool mining?

Solo mining: You keep 100% of block rewards (currently 3.125 BTC) but have extremely low odds of success.

Pool mining: You combine hashrate with other miners and share rewards proportionally. You get smaller, regular payouts but much more predictable income. Most miners choose pools for steady returns.

-

How long does it take to mine 1 Bitcoin?

This depends entirely on your hashrate. With a 2.3 PH/s setup, you’d find a block (earning 3.125 BTC) approximately once every 8 years on average assuming mining difficulty remains constant (though in reality, difficulty typically increases over time).

-

Can I mine Bitcoin with my laptop?

No, not anymore, because of the difficulty adjustment feature of the Bitcoin network, Bitcoin mining has become an industrialized process that now involves specialized computers known as ASIC miners. Regular computers can no longer feasibly compete with ASIC miners, even those lucky recent solo miners used specialized ASIC mining equipment.

-

How much money is needed to mine 1 Bitcoin?

The cost varies dramatically by location and setup.

Equipment: A decent ASIC miner costs $2,000-$15,000 each

Electricity: Ranges from $1,324 in Iran to $321,112 in Ireland for 1 BTC

U.S. average: Over $107,000 in electricity costs alone

These electricity costs assume solo mining. Pool miners face different economics with smaller, more frequent payouts.

-

How much electricity is needed to mine 1 Bitcoin?

Approximately 860,000 kilowatt-hours (kWh) in 2025, enough to power about 80 U.S. homes for a year.

These electricity costs assume solo mining. Pool miners face different economics with smaller, more frequent payouts.

-

Is Bitcoin mining profitable in 2025?

Profitability is largely dependent on various factors such as your electricity costs, hardware efficiency, Bitcoin’s price and network difficulty. If enough of these factors are in your favor, Bitcoin mining will be profitable for you. Generally speaking, those with economies of scale such as public mining firms like Riot are profitable in 2025 according to their publicly available balance sheets.