This article is brought to you by FBS.

The price history of Bitcoin showcases significant milestones in its rush past $100,000 by the end of 2024. We are now in a market where Bitcoin is fluctuating between $106,000 and $110,000 per coin, which was a moonshot a couple of years ago. Emotions are running high: early bulls are profiting and FOMO (fear of missing out) is present, yet a fear is growing that this amazing bull run is near to having its course run. The question on everyone’s lips on social media and trading floors is “Have we peaked?”

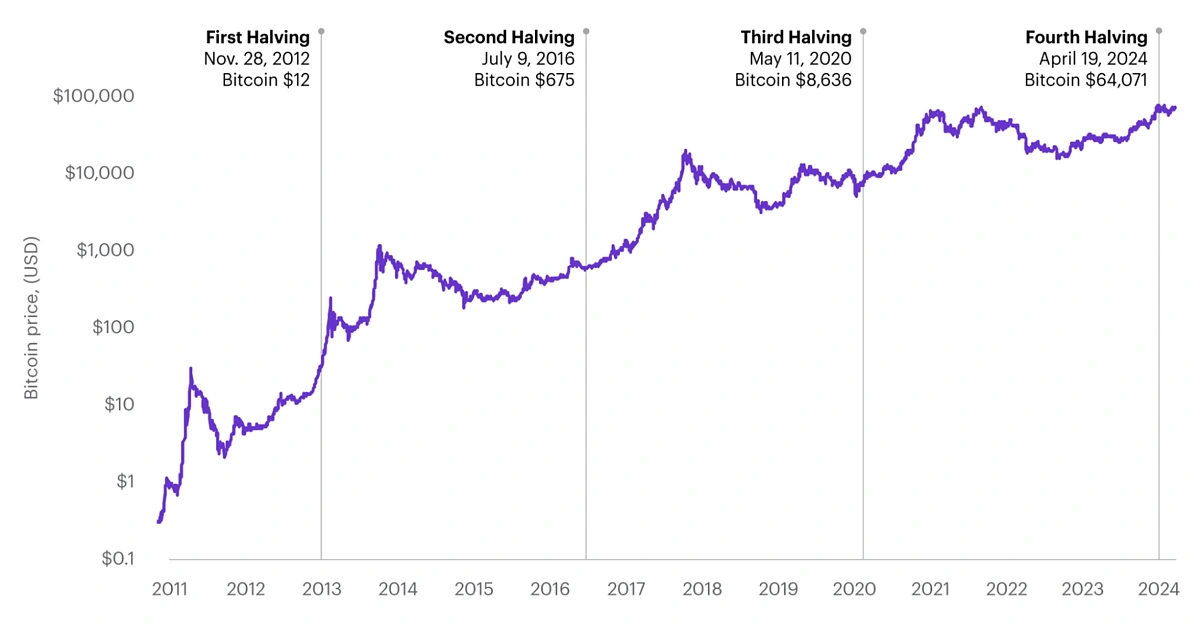

The Historical Blueprint

Most recently, the 2020 halving led to a rally to an all-time high of $69,000 in November 2021, ~18 months afterwards. By comparison, how is 2025? Bitcoin’s fourth halving occurred in April 2024, so mid-2025 places us ~14 months into the usual post-halving boom. True to form, Bitcoin has close to doubled its previous high (breaking $110K vs. $69K last cycle) and is up by a factor of around 7x from the bear-market lows of late 2022. For context, at the same 14-month post-halving point in prior cycles, BTC had risen by around 5–6x off its lows – so this cycle’s run, while extraordinary, is broadly in keeping with Bitcoin’s historical performance. Most significant of all, we are now exactly in the period of time in history when blow-off tops are more likely to happen. Bulls believe that implies a final peak is still probable (perhaps later in 2025), while bears fear the rally might already have peaked too early.

In any case, the four-year cycle rhythm seems to be intact: a strong post-halving bull trend, now reaching its peak. Another historical hint is the way excess in the markets tends to portend cycle tops. In late 2017, retail FOMO was everywhere – Google searches for “Bitcoin” were at record highs and Coinbase was the top-downloaded app on the AppStore, and that became a precursor to the top. Memecoin manias and celebrity crypto endorsement characterized the euphoric peak of the cycle in 2021. Fast forward to 2025: we’re witnessing repeats of all those patterns – from TikTok influencers promoting crypto to manic bidding on digital collectibles – but is it the last flourish or merely mid-cycle excess?

What Does the Data Say?

Notably, the market has disregarded some 5–10% pullbacks that in previous years would have been panic-driven – a sign of robust demand on each retreat. Last week, for instance, Bitcoin dropped from approximately $110K to $102.6K within a few hours on war news before recovering over $106K by day’s end. Volatility is a two-edged sword: that intraday whipsaw wiped out more than $1 billion in leverage (one unfortunate trader lost $200 million on a single leveraged bet) – a reminder that even in a bull market, Bitcoin is not for the faint of heart.

BTCUSD, H4

Supporting this price resilience is a record wave of on-chain and institutional inflows. This year’s debut of several US spot Bitcoin ETFs has turned investment flows into a prevailing market driver. US spot Bitcoin ETFs recorded $5.3 billion of inflows over just three weeks this spring, with maybe $4+ billion of “real” net new buying after stripping out hedge-fund arbitrage trades, according to Standard Chartered. In short, Wall Street now has direct access to Bitcoin, and the funds are flowing in. The assets held by Bitcoin ETFs have ballooned to $131 billion – a staggering number considering that these products did not even exist a year ago.

BlackRock, Fidelity, and Franklin Templeton each now have Bitcoin funds on their books, and even Trump Media & Technology Group (that Trump) have submitted a plan to launch a spot Bitcoin & Ether ETF this month. Meanwhile, sentiment in the markets is creeping up towards euphoric – though short of actually hitting the fever pitch of a final top, some argue. The widely followed Crypto Fear & Greed Index stands at 68, squarely in “Greed” territory. That’s up from the 50s a month ago and indicates a market that’s hopeful if not quite yet in outright mania.

(For context, the 70–80s were reached at late 2021’s peak, which was a sign of excessive greed).

Distributionally, large holders (“whales”) have been net accumulators in 2025, and notably public companies now hold ~3.2% of all circulating Bitcoin – a testament to the strong hands taking BTC on as a reserve asset. But signs of froth are also beginning to emerge. The very speed of this rally – Bitcoin is up about 150% year-to-date and more than 600% from the lows of the last bear market – has sent some technical indicators into overbought territory. By some metrics, BTC is as far above trend as it was in late 2017. The AI-based sentiment indices and prediction markets are sending mixed signals.

In brief, the evidence tells a story of muted optimism and unpredictability – a market near potential peak euphoria, but not unequivocally in bubble terrain.

Geopolitics, Regulation, and Wildcards

There is no Bitcoin cycle that takes place in a void – macro and geopolitical factors are progressively influencing this digital asset boom. Such a case in point played out just days ago: an escalation in tensions between Israel and Iran rattled markets worldwide and crypto as well. When reports of escalating airstrikes emerged on June 13, Bitcoin promptly fell ~3% on the day. Those speculators who had been hoping BTC would act as “digital gold” in such a crisis were reminded that there are days when it still tends to act like a risk-on asset. As the classic safe haven asset gold rallied to near record highs (up ~1.3% on the day) and equities fell only moderately (S&P 500 down 0.4%), Bitcoin was more impacted by the risk-off trade, highlighting its ongoing sensitivity to fear in the general market. The moral of the story: geopolitical wild cards such as war can introduce sudden volatility, but so far in 2025 have yet to derail the bull trend – only injecting additional drama into Bitcoin price fluctuations.

On the regulatory front, we are witnessing a dramatic turn of fortunes from hostility to cautious acceptance, and this could be a double-edged sword for Bitcoin’s market cycles. In the United States, lawmakers are debating the GENIUS Act, a landmark stablecoin regulation bill (an acronym for “Guiding and Establishing National Innovation for US Stablecoins”). Crypto business interests hail this as a tremendous win that would legitimize crypto dollars and reduce systemic risks.

Meanwhile, on the other side of the Atlantic, the EU’s MiCA regulations (Markets in Crypto-Assets) have already come into force in 2024/2025, making Europe the first continent to have a complete crypto rulebook. MiCA imposes requirements on everything from stablecoin reserves (live as of June 2024) to the licensing of crypto firms (by Jan 2025). Regulation in general – formerly an existential risk – is now more of a tailwind in this cycle, lessening FUD (fear, uncertainty, doubt) and welcoming big players in.

On top of policy, political wildcards are plentiful, none more attention-grabbing than Donald Trump’s resurgence as a Bitcoin booster. Re-elected in 2024 (on a strongly pro-crypto platform), President Trump has changed the US government’s approach to Bitcoin from wary to strategically embracing. In March, he signed an executive order for the establishment of a US Bitcoin Strategic Reserve – similar to the oil reserve – as a hedge against dollar debasement.

This is a sea change from a few years ago and has fueled bullish sentiment that “Bitcoin is here to stay” as a financial asset class. It has also created a narrative that countries scrambling to accumulate Bitcoin reserves could send prices even higher – a far cry from regulatory crackdowns expected during earlier cycles.

What Comes Next?

Where are we going – a melt-up to new highs, or a slow rollover into the next bear market?

🔺 The Bull Case

Most market commentators and investors think that Bitcoin’s euphoric finale has yet to come. They believe that multiple bullish drivers remain in play and that historic cycle timing suggests a later 2025 peak, not a mid-year one. Standard Chartered – which infamously called $100K BTC by 2024 – now believes even $120K was conservative, based on the torrential inflows into Bitcoin funds. The bank’s analysts established a fresh year-end 2025 price target of $200,000 for Bitcoin, suggesting almost double the present price. Other prominent bulls echo this confidence: Cathie Wood’s ARK Invest still HODLs its bitcoin exposure, and Wood once again articulated a $1 million long-term bull thesis (by 2030) and suggested even a shorter-term trip to the $150K–$200K range is possible if there is a “blow-off phase” in this cycle.

BCTUSD, Weekly

In the Weekly timeframe, BTCUSD has reached the Fibonacci Golden Pocket and is testing DEMA and TEMA, which only confirms the strength of this level.

-

If the bulls do gain the upper hand, it could start to rise towards $155,000 (261.8 Fibonacci), and may even go further to $210,000 (361.8 Fibonacci).

Bulls also contend the macro environment is set to get even more benign. If the US Federal Reserve begins to cut interest rates later in 2025 (as inflation is currently under control), the liquidity boom could propel speculative assets like Bitcoin to new heights. As Coinbase noted in a research report, Bitcoin tends to do well when US growth is robust and crypto-friendly policy progresses – exactly what we have now with an AI-driven stock market boom and Congress taking action on crypto legislation. All of this lays the groundwork for what some refer to as a “blow-off top”: a quick run, possibly to the $150K–$180K range (or more) within a few weeks or months, fueled by euphoric greed. In short, the bull scenario says June 2025 is not the peak, but a sheer slope on the path to a greater peak later in the year.

The rhyming of historical trends (~17 months from halving peak) and underlying tailwinds currently both favor the notion that a “final surge” may be imminent.

🔻 The Bear Case

On the other hand, there is a growing clamor of analysts warning that Bitcoin’s bull cycle is beginning to appear worn out and that cycle fatigue is setting in.

Their argument: a lot of the good news is priced in, speculative excesses are building, and macro risks loom, so $110K may have been the cycle top – or if not, that any upside from here will be modest before gravity sets in. Let’s take a look at some of these signals of froth that bears are monitoring:

-

Excessive enthusiasm & celebrity hype: When a sitting US President (Trump) is peddling meme coins and boasting about crypto profits – and when even ostensibly conservative businesses are making outsized crypto bets – contrarians start to worry. Such a windfall, facilitated by policy bias, has the smell of late-stage bubble behavior and moral red flags. The last time we saw political figures so openly aligned with crypto (do you recall 2021’s Bitcoin-salary mayor and athlete antics), there was a crash.

-

Corporate FOMO & treasury risks: The rush of companies adopting Bitcoin treasury strategies, favorable initially, might prove to be a trap. Most of those 61 companies that purchased recently did so at or close to all-time highs. As Reuters reports, if Bitcoin dropped below $90,000, almost half of the positions of those companies would be in the red (having lost money on their BTC purchases). If the price falls low enough, it may trigger panicked selling or liquidity crunches, a Charles Schwab analysis cautioned.

-

Macro and liquidity concerns: The overall economic environment, while broadly positive now, may change in ways that would damage Bitcoin. The bull run has coincided with disinflation and an end to Fed rate hikes – a veritable Goldilocks era for risk-on assets. However, if inflation surprises to the upside (maybe as a result of an oil shock from geopolitical stress) or the Federal Reserve indicates tighter policy once again, Bitcoin may see headwinds. Further, global liquidity is meant to peak at some point during Q3 2025, in the view of some macro strategists, as major central banks finally drain pandemic-era excess liquidity. Previous crypto booms have been driven by excess liquidity and easy money; however, when that reverses, the hangover starts (see Bitcoin’s decline in 2022 when the Fed was tightening).

BTCUSD, Weekly

However, if the bullish cycle ends and BTCUSD bounces off the resistance area, we can expect a correction!

-

With a rebound from 161.8 Fibonacci, Bitcoin may fall to $82,000 and possibly even further to $70,000.

If the bears are correct, what we will witness won’t be an end-of-the-world meltdown but a deep retracement – possibly 30-50% losses (not unheard of for high-flying Bitcoin) – that sends BTC back to, say, the $70K–$80K area. If a full-blown bear market materializes, it could even go lower.

Conclusion

Whether Bitcoin’s peak comes next week or fizzles out through the end of the year, the moral of the story remains the same: exact-timing a peak is a gambler’s game, not an investor’s edge. Think of the market in cycles, not in a linear fashion. If you’re already well into profit, it may be wise to take a cut home, rebalance, and reduce your downside so that a 50% drawdown won’t derail your plans. And if you’re late to the party, avoid leverage-driven FOMO; there will be other chances after the mania ends. Markets favor the prepared – liquidity available, mental stamina to maintain quality positions, and a clear strategy for when sentiment reverses from greed to fear. History demonstrates that survivors of bear cycles are those that prosper in the subsequent bull. So contain emotions, stick to fundamentals, and accept volatility as the price of longer-term involvement.

This article is by FBS analysts and is not intended to serve as investment or financial advice. Always do your own research before investing in any cryptocurrency.