Gold vs. Bitcoin

Gold is an established a risk-off, safe haven asset for people to store their wealth. However, Bitcoin is a risk-on asset, recognized for its high growth potential and volatile price swings. Many investors hold both – gold for security and Bitcoin for potential growth.

Key Takeaways

-

Fundamental Differences: Gold is a physical commodity with industrial uses and a long history of trust. Bitcoin is a purely digital asset whose trust is based on a decentralized, code-enforced network.

-

Investment Profile: Gold is traditionally viewed as a low-volatility safe haven for capital preservation. Bitcoin is a high-volatility asset offering the potential for significant growth but also carrying higher risk.

-

Unique Risks: Gold’s value is tangible and not dependent on technology, making it resilient in a grid-down scenario. Bitcoin’s digital nature makes it highly portable across borders but dependent on electricity and internet infrastructure.

-

Investor’s Choice: The right choice is not universal. It depends on individual factors, and many investors choose to hold both to balance stability with growth potential.

Gold is a tangible asset with a 5,000-year history, and has been the benchmark for a stable store of value. Today, its reign is disrupted by Bitcoin, a 15-year-old digital asset referred to as “digital gold.” Bitcoin represents a new form of value – one based on mathematics and code.

Both assets are sought after as potential hedges against the devaluation of traditional currencies because of their limited supplies, but they serve different roles in an investment portfolio. The choice between them depends entirely on an investor’s financial goals, risk tolerance, and investment strategy.

What Is Gold?

Gold is a precious metal that has been used as money and a store of value for millennia. Its value is derived from its scarcity, durability, and demand in various sectors, including jewelry, electronics, and as a reserve asset held by central banks worldwide. As an investment, gold is often sought during times of economic uncertainty or inflation, as it tends to hold its value when other assets, like stocks, may decline. Investors can own gold physically (as bars or coins), or gain exposure through financial products like Exchange Traded Funds (ETFs).

What Is Bitcoin?

Bitcoin is a decentralized digital currency created in 2009, in the wake of the global financial crisis. It operates on a technology called a blockchain – a distributed public ledger maintained by a global network of computers. Unlike traditional currencies issued by governments (fiat money), Bitcoin’s supply is not controlled by any central bank and is capped at 21 million coins, making it immune to inflation by design. Its value comes from its digital scarcity, its growing network of users, and its increasing acceptance as a legitimate asset class. Investors can buy Bitcoin on cryptocurrency exchanges or gain exposure through regulated products like spot Bitcoin ETFs.

Gold vs. Bitcoin: A Head-to-Head Comparison

While both assets are considered alternatives to traditional currency, their characteristics differ significantly.

|

|

Gold |

Bitcoin |

|

Asset Class |

Physical Commodity |

Digital Asset |

|

Historical Track Record |

5,000+ years |

~15 years |

|

Volatility |

Low |

High |

|

Scarcity |

Finite, but total supply is unknown; new supply added annually. |

Mathematically fixed at 21 million coins. |

|

Utility |

Jewelry, industrial use, central bank reserve. |

Digital payments, store of value, collateral in DeFi. |

|

Portability & Transfer |

Slow, expensive, and regulated to move physically. |

Fast, global, and can be transferred digitally. |

|

Regulation |

Well-regulated global markets. |

Evolving regulatory landscape worldwide. |

|

Storage |

Requires physical security (vaults, safes). |

Requires digital security (wallets, private keys). |

Volatility

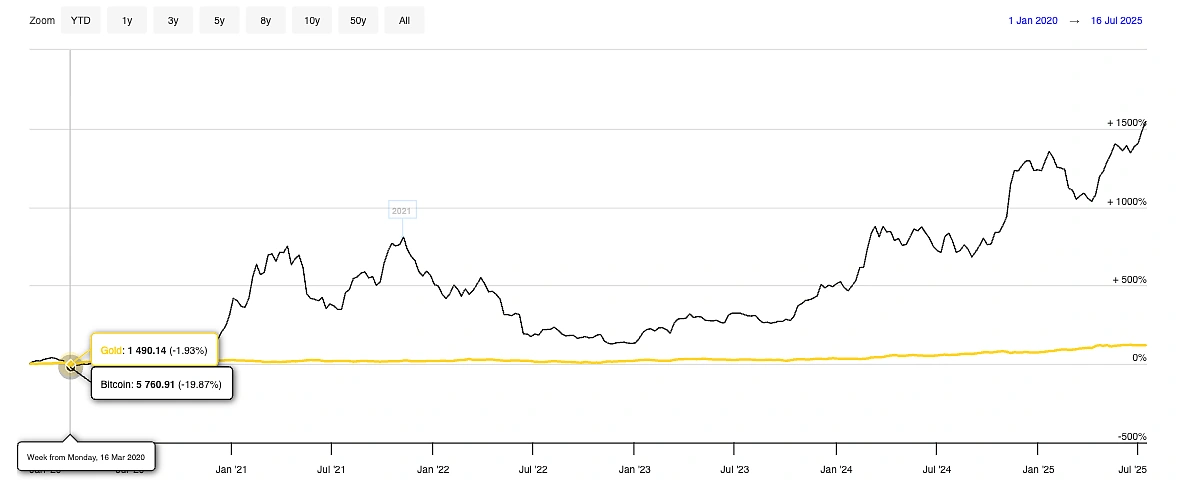

Volatility is the most significant difference between the two. Gold’s price is relatively stable, making it a “risk-off” asset for capital preservation. Bitcoin is famously volatile, with its price capable of dramatic swings in short periods. During the COVID-19 pandemic, for example, gold saw a brief dip followed by a gradual rise, as expected from a traditional safe haven. Bitcoin, however, crashed sharply before rebounding dramatically to new highs, behaving more like a high-growth tech stock than a stable hedge.

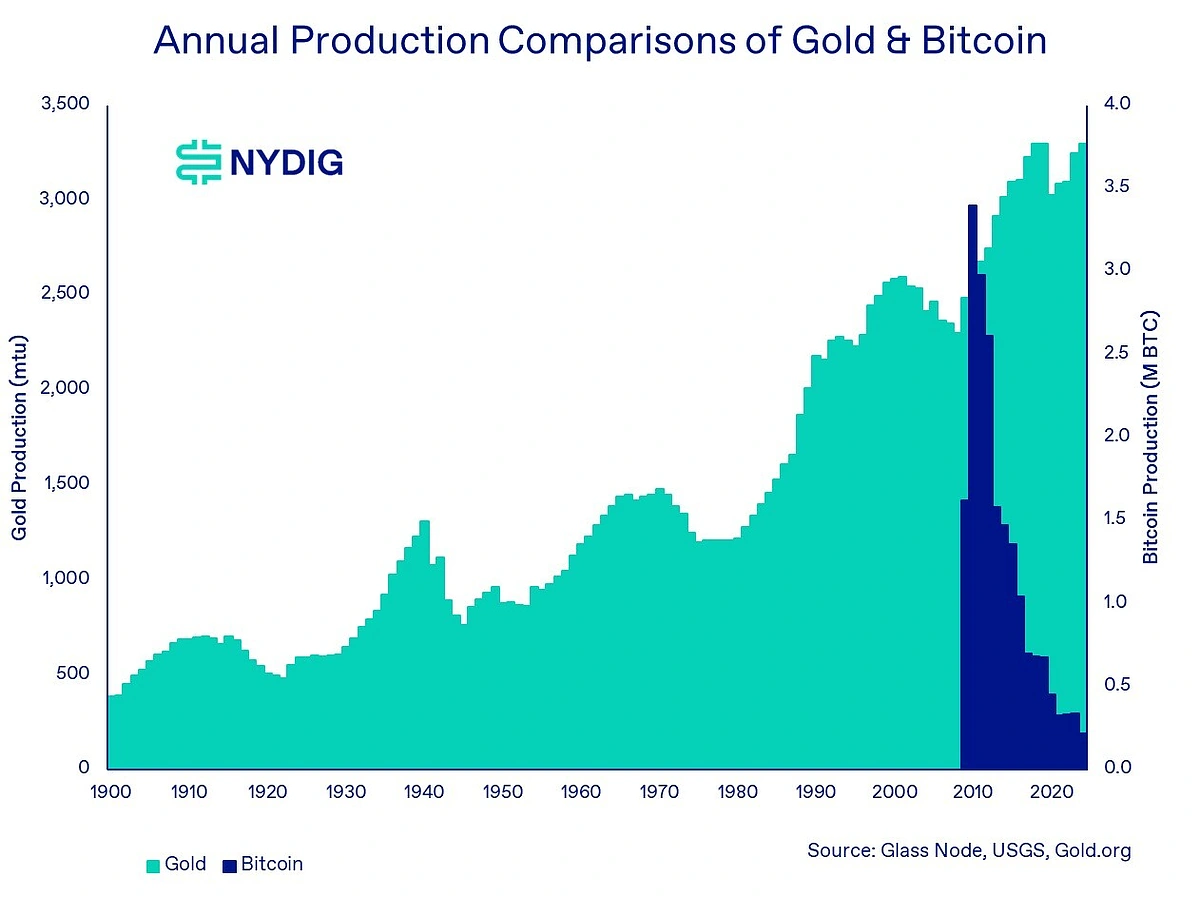

Scarcity and Supply

Both assets are scarce, which underpins their value. Gold’s supply increases by roughly 2% each year through mining, and its total amount in the earth is unknown. Bitcoin’s scarcity is absolute, verifiable, and enforced by code, not geology. Its supply is programmatically capped at 21 million coins, with a predictable issuance schedule. There is no risk of new discoveries or “asteroid mining” suddenly increasing the supply.

Source: NYDIG

Source: NYDIGUtility and Portability

Gold has tangible utility in jewelry, dentistry, and electronics. Its physical nature, however, makes it impractical to transport in large amounts or across borders. Bitcoin’s utility is entirely digital, allowing it to be sent anywhere in the world in minutes.

This digital-physical divide creates different kinds of resilience. In a scenario where you need to flee a country, a memorized Bitcoin seed phrase is infinitely more portable than a gold bar. However, in an extreme grid-down event, like a massive solar flare that knocks out power grids, physical gold that requires no electricity would hold a distinct advantage.

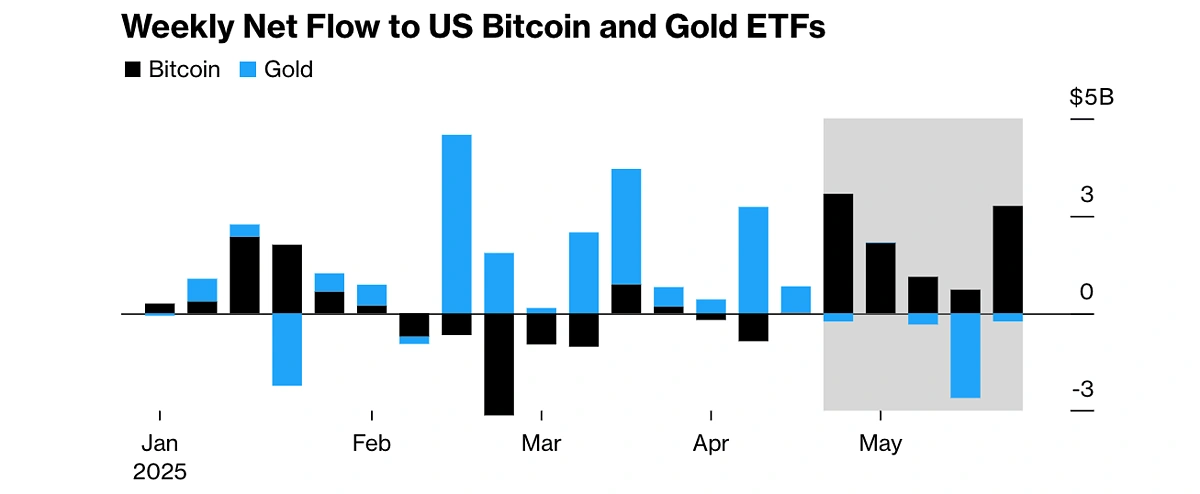

Market Adoption and Liquidity

Both markets are highly liquid. Gold is a universally accepted asset with a long-established global market. Bitcoin’s adoption is newer but growing rapidly. The 2024 approval of spot Bitcoin ETFs in the U.S. was a landmark event, opening the asset to a wave of institutional and retail investment. In less than a year, total assets in Bitcoin ETFs reached approximately $146 billion, about half of the $290 billion held in gold-linked ETFs globally, signaling a significant shift in investor capital.

How to Invest in Gold and Bitcoin

Both assets are accessible to retail investors through various channels.

Gold

-

Physical Bullion: Buying gold bars or coins provides direct ownership but requires secure storage.

-

Gold ETFs: These funds track the price of gold and trade on stock exchanges, offering exposure without the need to hold the physical metal.

-

Tokenized Gold: Tokenization can help move gold on-chain as tokens, which can be exchanged and traded instantaneously at a negligible cost while the underlying gold remains secure with a custodian.

Bitcoin

-

Cryptocurrency Exchanges: Platforms like Coinbase or Binance allow users to buy Bitcoin directly. This requires setting up a digital wallet for storage.

-

Bitcoin ETFs: Approved in 2024, spot Bitcoin ETFs like BlackRock’s IBIT allow investors to gain exposure to Bitcoin’s price through a standard brokerage account.

Risks and Considerations

Every investment carries risks, and gold and Bitcoin are no exception.

Gold’s Risks

-

Storage and Security: Physical gold is vulnerable to theft and requires secure, often costly, storage solutions.

-

Counterparty Risk: Gold ETFs and other paper gold products carry counterparty risk, meaning the value of the investment depends on the solvency of the issuing institution.

-

Lower Returns: While stable, gold typically offers lower returns compared to higher-risk assets like stocks or Bitcoin.

Bitcoin’s Risks

-

Extreme Volatility: Bitcoin’s price can experience rapid and severe fluctuations, posing a significant risk of loss.

-

Regulatory Uncertainty: The global regulatory framework for digital assets is still developing. New laws or restrictions could negatively impact Bitcoin’s price and accessibility.

-

Technological Dependence: Bitcoin relies on electricity and the internet to function. In a catastrophic, long-term power outage, accessing or transacting with Bitcoin would be impossible.

-

Security (Self-Custody): If you hold your own Bitcoin, you are solely responsible for securing your private keys. If lost, your funds are irrecoverable.

The Bottom Line

Neither gold nor Bitcoin is universally “better.” The right choice depends on your personal financial situation, investment goals, and tolerance for risk.

-

Choose Gold if: You are a conservative investor focused on wealth preservation, seeking a stable asset to hedge against economic uncertainty, and prioritize a long, proven track record.

-

Choose Bitcoin if: You have a higher risk tolerance, are seeking significant long-term growth, and are comfortable with volatility and the complexities of a new technology.

Many investors opt for a blended approach, holding gold for its stability and allocating a smaller portion of their portfolio to Bitcoin for its growth potential. Before making any investment decisions, it is advisable to conduct thorough research and consider consulting a financial advisor.

Frequently Asked Questions (FAQs)

Is Gold or Bitcoin a better hedge against inflation?

Both are considered potential hedges against inflation due to their limited supply. Gold has a long history of preserving value during periods of currency devaluation. Bitcoin is a newer asset, but its mathematically fixed supply makes it an attractive alternative for many investors concerned about inflation.

What are the tax implications?

In the U.S., the IRS treats both gold and Bitcoin as property. Gold is often taxed as a “collectible” at a higher capital gains rate. Bitcoin sales are typically subject to standard capital gains taxes. Tax laws vary by jurisdiction, so it is best to consult a local tax professional.

What is the environmental impact of Bitcoin vs. Gold?

Gold mining is an extractive industry with a significant environmental footprint, including deforestation and water contamination. Bitcoin mining is energy-intensive, but the industry is increasingly utilizing renewable and otherwise wasted energy sources (like flared gas). The environmental debate for both is complex and ongoing.

Disclaimer: This article is only for informational purposes and should not be taken as financial advice. Always do your own research before undertaking any investment.