Bitcoin Mempool Overview

Why Do We Need a Bitcoin Mempool?

Mempools are necessary because Bitcoin’s design creates a fundamental mismatch between transaction demand and processing capacity. Bitcoin blocks have limited space and are produced only every 10 minutes on average, but users want to send transactions at any time. Without mempools, transactions would either be lost, or the network would need some other way to handle this timing mismatch. The mempool solves this by providing a waiting area where transactions can be stored until miners can include them in blocks.

If demand for block space exceeds what miners can process, how can users ensure that their transaction is processed in a timely manner? This brings us to our next point which is how a user submits their transaction along with miner incentives to get their transactions through.

How Bitcoin Processes Your Transactions

To understand how users submit their transactions and get them processed in the mempool, let’s follow a Bitcoin transaction from start to finish.

Step 1: Transaction Creation and Broadcasting

When you click “send” in your Bitcoin wallet, several things happen:

-

Your wallet creates a transaction containing details like the recipient’s address, the amount being sent, and a transaction fee (the “tip” you pay to miners).

-

The transaction is digitally signed using your private key (a secret code that proves you own the Bitcoin).

-

The transaction is broadcast to the Bitcoin network, spreading from node to node (network operators) like ripples in a pond. Each node that receives and validates your transaction will add it to its own mempool, where it waits until a miner picks it up for processing.

Step 2: Network Validation

When Bitcoin nodes receive the transaction, they validate it to ensure the authenticity of the transaction. The network verifies that:

-

You actually own the Bitcoin you’re trying to send.

-

You haven’t already spent the same Bitcoin elsewhere (double-spending prevention).

-

The transaction follows Bitcoin’s rules and format (network consensus).

Step 3: Mempool Entry

Once validated, the transaction enters the mempool, where it remains until it’s picked up by miners. Here’s what’s important to understand:

-

Each Bitcoin node has its own mempool—there isn’t one central waiting room, but thousands of individual ones across the network.

-

Mempools sync with each other by sharing transaction information, though they may contain slightly different sets of transactions.

-

Transactions can remain in the mempool for minutes, hours, or even days depending on network conditions and fees.

Step 4: Miner Selection and Block Creation

Miners select unconfirmed transactions from their mempools and fit them into a single Bitcoin block. This process is like a chef selecting orders from the kitchen queue and fitting them onto a single tray.

-

Miners prioritize transactions with higher fees because they earn these fees as payment for their work.

-

Block space is limited – each Bitcoin block can only hold about 1-4 million bytes (units of data size) worth of transactions.

-

Miners compete to solve a mathematical puzzle (proof of work) to earn the right (and a Bitcoin reward) to add their block to the blockchain.

Step 5: Confirmation and Mempool Clearing

When a miner successfully mines a block, the transactions included in that block are cleared from each node’s mempool, updating the blockchain and validating those transactions:

-

The block is broadcast to the entire network for verification.

-

All transactions in that block are confirmed and become part of the permanent Bitcoin blockchain record.

-

These transactions are removed from all mempools across the network.

-

You receive confirmation that your Bitcoin has been sent.

Bitcoin Transaction Priority System

Here’s how Bitcoin’s fee-based priority system works and how users can leverage it to get faster processing.

The Fee Market System

Bitcoin operates on a fee market where users compete for limited block space. Miners prioritize transactions based on factors like transaction fees and size, with transactions with higher fees usually completed faster since miners prioritize them to maximize their profits. This system is why transaction fees can skyrocket during periods of network congestion.

Transaction fees are measured in “satoshis per virtual byte” (sat/vB), where:

-

Satoshis are the smallest unit of Bitcoin (1 Bitcoin = 100,000,000 satoshis)

-

Virtual bytes represent the data size of your transaction

-

Higher sat/vB rates = faster confirmation times

What Determines Transaction Size?

A transaction’s size is not determined by how much BTC it transfers, but by how many inputs, outputs and signatures it has, and which address type it uses.

-

Inputs = the sources of Bitcoin you’re spending (like combining coins from different pockets)

-

Outputs = the destinations (recipient address plus change back to you)

-

Address types = newer address formats like SegWit create smaller transactions

Prioritization Factors

Miners consider several factors when selecting transactions:

-

Fee rate (sat/vB) – the primary factor determining priority.

-

Transaction age – older transactions may get slight preference.

-

Child-pays-for-parent (CPFP) – When a transaction is stuck due to low fees, the recipient can create a new transaction (the ‘child’) that spends from the stuck transaction (the ‘parent’) using a much higher fee rate. Since miners want to collect the higher fee from the child transaction, they must process both the parent and child transactions together, effectively speeding up the stuck parent transaction.

-

Replace-by-fee (RBF) – Another method that allows users to increase fees on unconfirmed transactions to speed up transaction times.

Network Congestion Effects

During busy periods (like market rallies or major news events):

-

Mempool size increases as more transactions compete for block space.

-

Required fees rise as users bid against each other for faster confirmation.

-

Lower-fee transactions get delayed or may eventually be dropped from mempools.

-

Confirmation times become unpredictable.

Mempool on Other Blockchains

While Bitcoin popularized the mempool concept, other blockchains have implemented their own variations – each with unique characteristics:

Ethereum

Ethereum has its own mempool system where transactions compete for inclusion in blocks. Key differences include:

-

The commonly known “Gas fees” instead of sat/vB for prioritization.

-

Smart contract interactions create more complex transactions, which can be more expensive to process.

-

MEV (Maximum Extractable Value) opportunities where miners can profit by reordering transactions.

-

Pending transaction pools that searchers monitor for arbitrage opportunities.

Solana: The Mempool-less Approach

Solana takes a radically different approach. Unlike networks with limited transactional throughput that attempt to retrofit scaling technologies to address ever-growing mempools, Solana has been engineered since conception with optimizations to enable huge transactional throughput.

Solana doesn’t have an in-protocol memory pool (mempool). Instead, transactions are streamed directly to the current block leader; only they can view the transactions before execution. This creates:

-

Much faster transaction processing with minimal waiting times.

-

Reduced MEV opportunities since there’s no public mempool to monitor.

-

Different fee dynamics with generally lower and more predictable costs.

Other Blockchain Variations

Mempool configurations vary wildly across different protocols and node client configurations:

-

BNB Smart Chain uses a similar model to Ethereum with gas-based prioritization.

-

Polygon offers faster block times but still uses mempool-based transaction ordering.

-

Arbitrum and Optimism (Layer 2 solutions) batch transactions to reduce Ethereum mainnet congestion.

Bitcoin Mempool Tools & Optimization

Understanding the mempool helps you become a more efficient Bitcoin user. Here are practical strategies:

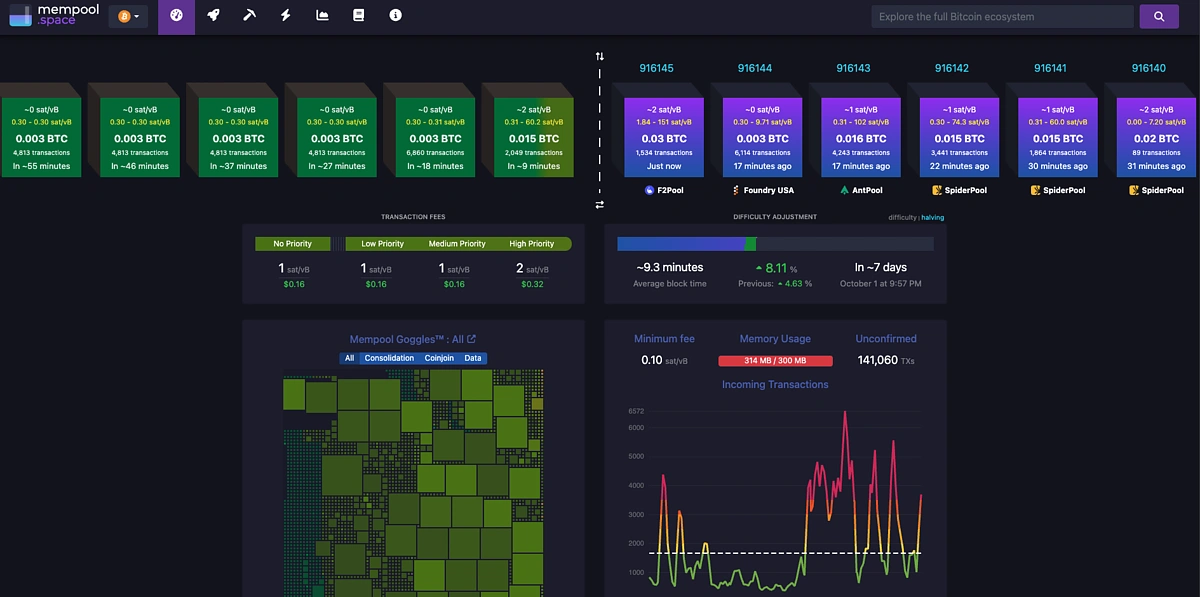

Monitoring Tool: Mempool.space (the popular Bitcoin block explorer)

-

Provides real-time data on mempool size, current fees, and transaction confirmation times.

-

Visual representations of pending transactions and fee recommendations.

-

Historical data to help you understand typical patterns.

-

Mobile apps for on-the-go monitoring.

Fee Optimization Strategies

-

Check current conditions before sending transactions.

-

Consider the timing of your transaction – weekends and early mornings (UTC) often have lower fees.

-

Batch multiple payments into single transactions when possible.

-

Use SegWit addresses to reduce transaction size (pay lower fees).

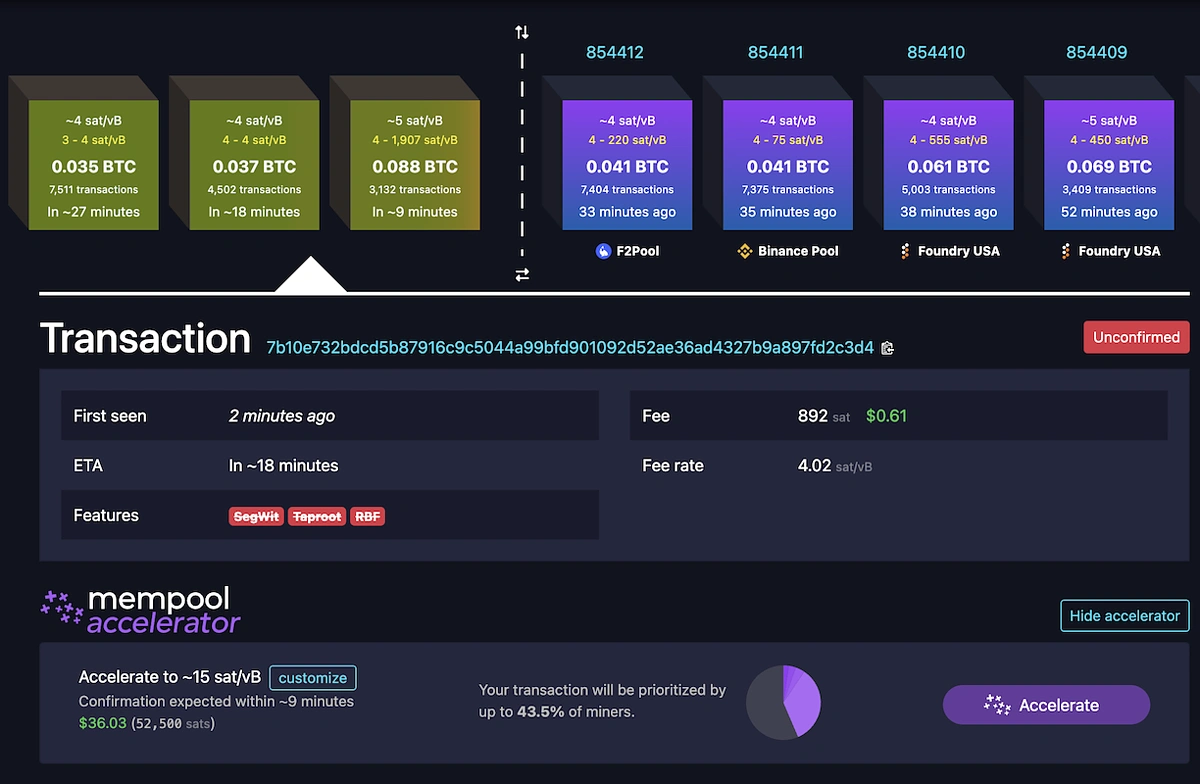

Speed Up Transactions Using Mempool Accelerator

If your Bitcoin transaction is stuck, you may have to tap on the Replace-by-fee (RBF) or Child-pays-for-parent (CPFP) features through your Bitcoin wallet. Alternatively, a much more modern and user-friendly way to speed up your transaction is by using mempool.space’s “Accelerator” feature.

How to Use Mempool Accelerator

-

Go to Mempool.space, key in your Bitcoin wallet address.

-

Find the transaction ID (TXID) of your stuck transaction, and click into it to check on its transaction status.

-

After confirming that the transaction is stuck, or if the confirmation time is unsatisfactory, you can proceed to speed up the transaction.

-

Click the “Accelerate” button.

-

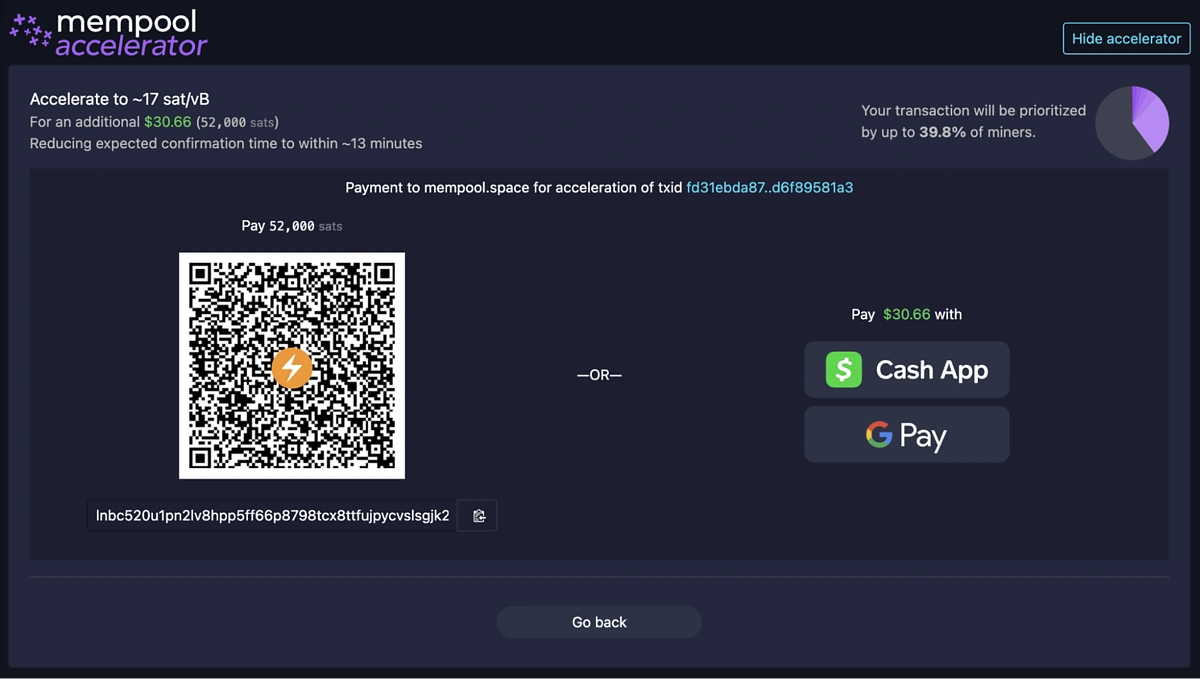

You will be prompted with several payment options to accelerate your transaction, either through a Lightning Network payment or through Google/Apple Pay.

Source: https://www.rhett.blog/mempool-accelerator/

Source: https://www.rhett.blog/mempool-accelerator/ -

After payment is confirmed, your transaction is accelerated and more likely to be picked up by other Bitcoin miners.

Conclusion

The Bitcoin mempool is a crucial component that enables the world’s largest cryptocurrency network to process millions of transactions securely and efficiently. By understanding how transactions flow from your wallet into the mempool, get prioritized by miners, and ultimately become confirmed on the blockchain, you can make more informed decisions about fees and timing.

Whether you’re a casual Bitcoin user wanting to avoid overpaying for transactions or a developer building applications on top of Bitcoin, understanding the mempool helps you navigate the network more effectively. As Bitcoin continues to mature, the mempool will remain central to how the network manages transaction flow and maintains its decentralized, trustless operation. By thinking of it as a digital waiting room with clear priority rules, you can better understand and work with this essential piece of Bitcoin’s infrastructure.

This article is for educational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk, and you should always do your own research before making any financial decisions. Transaction fees and mempool conditions can change rapidly, so always check current network conditions before sending Bitcoin transactions.