Only 1 Million Addresses Hold Whole Coins

If you don’t already own 1 Bitcoin or close to it, the reality is that you probably never will and that might be exactly what Satoshi Nakamoto intended. Currently, only ~1 million wallet addresses hold at least 1 Bitcoin and this milestone is rapidly becoming the exclusive domain of early adopters, institutions, and the wealthy.

In this article, we explore how Bitcoin’s mainstream adoption creates this wealth concentration effect, why the focus on owning “1 whole Bitcoin” might be missing the point entirely, and how Satoshi’s true vision was about democratizing money.

Key Takeaways

-

Only ~1 million wallet addresses globally hold 1+ Bitcoin, with most accumulation happening pre-2017 when BTC was under $1,000.

-

Institutional adoption has accelerated Bitcoin concentration, with companies like Strategy (formerly MicroStrategy) accumulating hundreds of thousands of BTC.

-

Less than 4 million BTC remain theoretically available for retail acquisition after accounting for lost coins, exchanges, and institutional holdings.

-

The obsession with owning “1 whole Bitcoin” may be psychologically arbitrary; fractional ownership could still represent significant wealth in the distant future where one Bitcoin is >$500,000.

-

True whole-coiner numbers may be underestimated due to exchange custody, corporate holdings, and multi-signature wallets masking individual ownership.

Who Is in the Exclusive 1 Bitcoin Club?

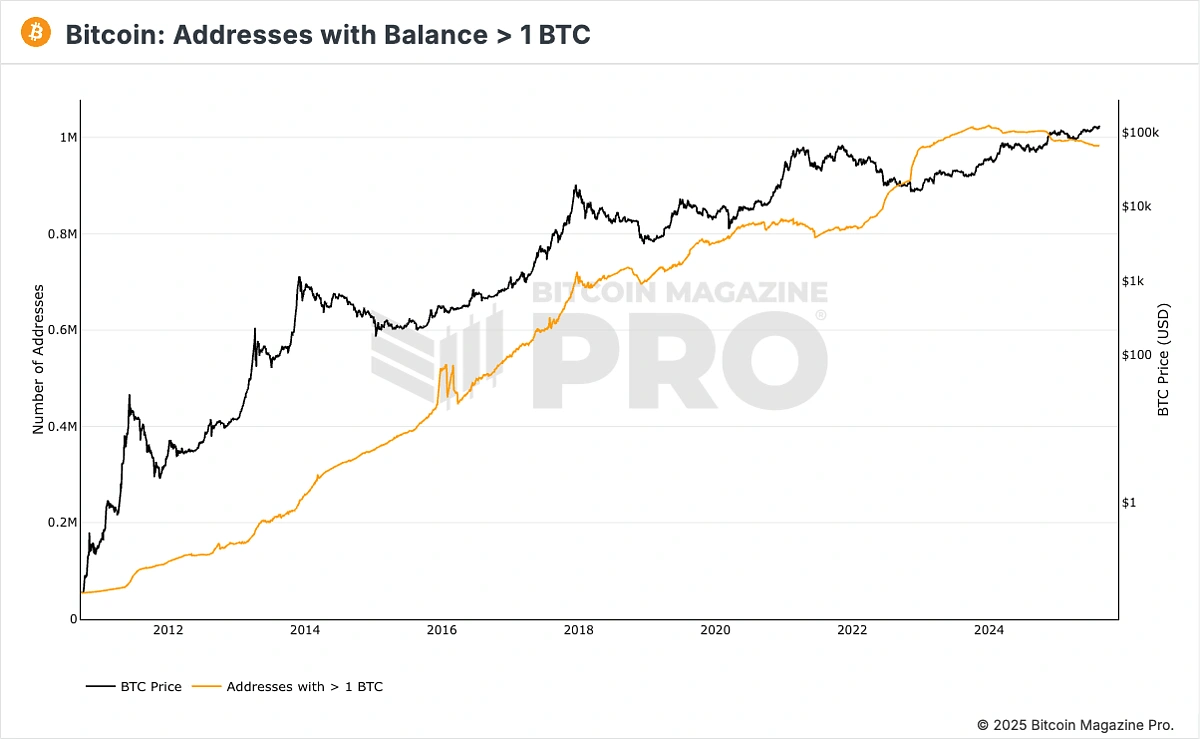

Bitcoin wallet addresses owning more than 1 Bitcoin.

Source: https://www.bitcoinmagazinepro.com/charts/addresses-greater-than-1-btc/

Of the 1 million wallet addresses globally, we can see that most whole coiners accumulated during the pre-2018 era when Bitcoin was significantly cheaper, starting from around $1,000 in early 2017. To better illustrate this, we can divide whole coiners into two distinct time periods.

The explosive growth period: From just 50,000 addresses in early 2010, the number skyrocketed to 700,000 by the end of 2017.

The exclusion period: From 2018 onwards, Only 300,000 new whole-coiner addresses were added over the next 7 years, bringing the total to just over 1 million today.

When Bitcoin crossed $100,000, this means it is 100x more expensive to become a whole coiner than in 2017. Becoming a whole-coiner thus required more capital than most people possess.

We also notice that the amount of whole coiners actually decreased after 2024, coinciding with Bitcoin ETF approval and institutional adoption. We can infer that the recent influx of institutions resulted in greater concentrations of Bitcoin wealth amongst the ultra-wealthy. This explains the decrease in whole coiners, who perhaps are selling their long term profits gained from hodling since pre-2018 to these institutions.

Where Are the Bitcoins?

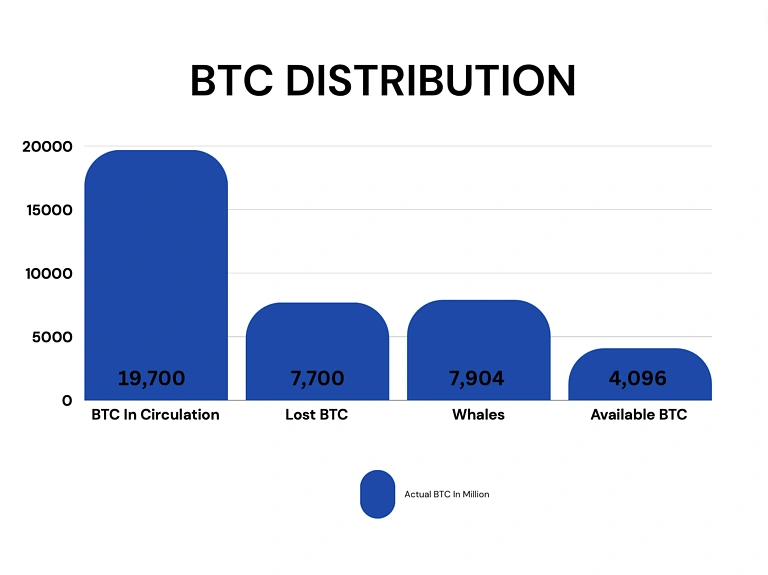

Source: https://www.ccn.com/education/crypto/global-bitcoin-ownership-and-distribution-in-2024/

According to a 2024 study by CCN, of Bitcoin’s then 19.7 million coins in circulation, between lost coins, exchange custody, corporate treasuries, government holdings, and whale accumulation, less than 4 million BTC remain theoretically available for retail acquisition.

The Institutional Tsunami

Compounding the problem is the influx of institutions such as the well known Strategy (formerly MicroStrategy) which further dwindles the available Bitcoin supply.

Michael Saylor’s Strategy managed to grow the firm’s Bitcoin holdings from 70 thousand Bitcoins to over 600 thousand Bitcoins (worth over $76B). Strategy’s market pivot into a Bitcoin treasury firm proved so successful that it triggered a copycat wave across corporate America.

Japanese investment firm MetaPlanet tripled its Bitcoin assets in Q2 2024 alone. MARA Holdings, a Bitcoin mining firm, shifted from pure mining to aggressive accumulation. Even Trump Media & Technology Group joined the treasury Bitcoin trend, following Strategy’s playbook of converting corporate cash into BTC. These aren’t small, speculative purchases; they are billion-dollar institutional buying programs designed to acquire and hold Bitcoin – perhaps indefinitely.

We are Not Early Anymore

Bitcoin Twitter (X) loves the phrase “we’re still early,” but are we really?

In 2010: You could mine Bitcoin on a laptop

In 2013: You could buy meaningful amounts for hundreds of dollars

In 2017: You could still get to 1 BTC for under $20,000

In 2025: You need $100,000+ and you’re competing with institutions with billions in capital.

We’re not early anymore but maybe that’s okay. Maybe it’s about the journey and not the end, the bigger picture here is that the increasing difficulty of becoming a whole coiner has another connotation: Bitcoin price is increasing.

Do You Actually Need to Own One Whole Bitcoin?

Given that we’re no longer early, the obsession with owning 1 Bitcoin might be missing the bigger picture entirely. Bitcoin’s most optimistic price models suggest we’re heading toward a reality where single coins could reach $500,000 or even $1 million. If those projections prove accurate, owning even 0.1 Bitcoin (worth $50,000-$100,000 at those prices) could represent significant wealth.

Consider the stock-to-flow model, which has historically tracked Bitcoin’s scarcity-driven price appreciation, or the Bitcoin Rainbow Chart, which maps long-term price cycles. Both suggest current prices are still in the early-to-middle phases of Bitcoin’s potential growth curve. If Bitcoin reaches its theoretical ceiling as digital gold or a global reserve asset, today’s “fractional” holdings could be tomorrow’s substantial positions.

The psychological barrier of owning “1 whole Bitcoin” is arbitrary, like insisting you need to own 1 whole share of Berkshire Hathaway at $500,000 instead of being satisfied with fractional ownership. However, this does not mean that it is meaningless to aim to own 1 whole Bitcoin, it is indeed a milestone to hit and one worth celebrating as it is an increasingly exclusive club.

What the Bitcoin Ownership Data Misses

While the path to becoming a whole-coiner grows steeper, several factors could reshape the landscape in retail’s favor in the future.

The Whales Will Need to Sell

Even the biggest Bitcoin holders aren’t immortal, and their strategies aren’t permanent. One day, they will eventually exit the market.

The most recent example is in July 2025, when Galaxy Digital assisted a massive $9 billion exit for a Satoshi-era whale, one of the largest single Bitcoin sales in history. His Bitcoins reportedly then went towards several Bitcoin treasury firms including Strategy, Trump’s media group and more. Putting it into a different perspective, these ancient whales have moved on, passing down the torch of Bitcoin ownership down to the next generation, decentralizing ownership of Bitcoin and furthering Satoshi’s dream of decentralized money.

Corporate treasury strategies also aren’t permanent. Companies like Strategy have turned Bitcoin into their primary business model, but shareholders may eventually demand diversification, profit-taking, or pivots back to core operations. Even Michael Saylor won’t live forever, and his successors may have different appetites for Bitcoin concentration. Who knows? Maybe after the institutions leave, the retail crowd will be the bulk of the next generation of Bitcoin owners.

The Hidden Whole Coiners

The true number of individual whole-coiners may be significantly underestimated due to how Bitcoin is actually held and managed in practice.

Exchange Custody Masking: Millions of Bitcoin sit in exchange wallets that appear as single addresses but represent thousands of individual users. When Coinbase’s wallet shows 1 million Bitcoin, that could represent 100,000 users with 10 Bitcoin each, or 1 million users with 1 Bitcoin each. The on-chain data can’t distinguish between them.

Corporate Treasury Complexity: Public companies like Strategy, Tesla, and Metaplanet hold Bitcoin on behalf of shareholders. A retail investor owning $100,000 worth of MicroStrategy stock effectively owns a fraction of the company’s Bitcoin holdings. These “synthetic whole-coiners” don’t appear in address data but represent real Bitcoin exposure.

Spot Bitcoin ETFs: The same is also true for Bitcoin ETF holders, BlackRock’s IBIT alone has accumulated hundreds of thousands of Bitcoins representing countless individual investors. Those Bitcoins are kept in custodians such as Anchorage Digital and Coinbase Prime , and to the untrained eye, they would also seem as single addresses.

Multi-Signature and Cold Storage: Many sophisticated individual holders split their Bitcoin across multiple addresses for security reasons. Someone with 5 Bitcoin might use 10 different addresses, appearing in the data as small holders rather than a substantial whole-coiner.

The reality is that whole-coiner status may be more accessible than the raw address data suggests, it’s just been institutionalized and abstracted through financial instruments that didn’t exist in Bitcoin’s early days.

Conclusion: The Democratization Paradox

Accumulating 1 Bitcoin has become increasingly difficult for most people, but this scarcity might actually fulfill Satoshi’s original vision.

Bitcoin wasn’t designed to create monopolistic entities hoarding whole coins. It was built for billions of people to participate with small fractions. When global adoption reaches billions of users, owning even 0.01 BTC could represent significant wealth.

The institutions accumulating Bitcoin today aren’t defeating decentralization. They’re accelerating it. We thank the early adopters (pre-2018) for pioneering Bitcoin, institutions are pushing for positive regulation and mainstream acceptance (2024), Who knows? This may pave the way for a truly decentralized future where Bitcoin becomes

“a peer to peer electronic cash system”.

Satoshi Nakamoto, Original Bitcoin Whitepaper, 2008

This article is for educational purposes only and does not constitute financial or investment advice. Cryptocurrency investments carry significant risks, including the potential for total loss of capital. Always conduct your own research and consult with qualified financial professionals before making investment decisions.