What Are Crypto Cards?

Crypto cards include credit, debit, and prepaid cards, which allow holders to spend their digital assets in their everyday life. These cards are typically issued by cryptocurrency exchanges and financial institutions, enabling users to make purchases and even withdraw fiat currency using their digital assets.

Key Takeaways

-

Crypto cards are a type of payment card that allows holders to spend their digital assets — just like fiat money — in their everyday life.

-

There are three main types of crypto cards, and they include debit, credit, and prepaid cards.

-

These cards make it easy to spend cryptocurrency like traditional money, whether online or in physical stores, without needing to manually convert to fiat first.

-

In this article, we’ve curated a list of the top crypto cards in the market, highlighting features, costs, and fee structure.

This article was updated in August by Vera Lim.

While cryptocurrency has a growing presence in the global finance industry over the past decade, these digital assets are yet to be widely adopted and accepted by governments and businesses worldwide.

As a result, it’s not that easy for people to use cryptocurrencies in the real world, which potentially discourages widespread adoption of digital assets. To tackle these challenges, we are seeing the introduction of different solutions to enable users to spend their cryptocurrencies in the real world, including crypto cards.

Types of Crypto Cards

Crypto cards basically eliminate the need to convert cryptocurrency into fiat currency before spending, bridging the gap between digital assets and traditional finance. Now, these cards come in different types; credit, debit, and prepaid. Each type offers unique characteristics, catering to different needs and preferences.

Crypto debit cards, for instance, work by linking directly to a digital asset wallet. When you make a purchase, the card automatically converts the required amount of crypto into fiat currency at the point of sale. This type of card is convenient for everyday spending and can be used both online and in physical stores. Additionally, users can withdraw cash from ATMs that support the card.

Meanwhile, crypto credit cards operate similarly to traditional credit cards except that they offer rewards in cryptocurrency. Users can make purchases and pay off the balance later, earning crypto rewards in the process. These cards often come with benefits, such as cashback, making them an attractive option for those looking to maximize their crypto holdings.

Finally, crypto prepaid cards are another type of crypto cards. It allows users to load specific amounts of cryptocurrency, which are then converted to fiat currency for various purposes. These cards are particularly useful for budgeting, as users can only spend the preloaded amount, thereby helping them manage their finances more efficiently.

How Do Crypto Cards Work?

Crypto cards operate similarly to traditional debit or credit cards. To begin using a crypto card, one must first choose a card service provider and sign up for an account on their platform. This process may involve verifying their identity by providing personal information and necessary documents. This step is especially crucial for complying with Know-Your-Customer (KYC) regulations.

Once the account is created and verified, users can then link their cryptocurrency wallet to the crypto card account. Although some cards come with built-in wallets, users can transfer cryptocurrency from their external wallet to the card’s wallet.

When making purchases physically, users can swipe, insert, or tap their card at the payment terminal. Then, the required amount of cryptocurrency is converted to fiat currency in real-time, ensuring the latest exchange rate. For online shopping, you enter your card details at checkout, and the conversion happens. If you need to withdraw cash, you can use the crypto card at compatible ATMs, with the cryptocurrency converted at the time of withdrawal.

Most notably, crypto cards often come with standard security features such as a PIN, chip, and two-factor authentication (2FA) to ensure the safety of transactions. Additionally, providers monitor transactions for suspicious activity and allow users to freeze their cards immediately, if they are lost or compromised.

Below is a comprehensive list of the top crypto cards, highlighting their various features, offerings, and benefits to users. We’ll start with looking at cards issued by major centralized exchanges and institutions, before looking at some non-custodial card options available.

Coinbase Card: Debit Card With Crypto Rewards

The Coinbase Card is a debit card designed by one of the world’s largest crypto exchanges, allowing users to draw on their Coinbase account crypto balances to make payments in crypto. The crypto card stands out for its ability to turn everyday purchases into crypto rewards.

Features

The Coinbase Card is a Visa debit card that offers several features, including;

-

Support for cryptocurrencies including Bitcoin (BTC), Ether (ETH), and USDC.

-

Earn cashback rewards in the form of cryptocurrencies.

-

Card is valid anywhere Visa debit cards are accepted.

-

Zero spending and annual fees.

-

Robust security features, like two-factor authentication, card freezing, and PIN change.

-

Available in Europe, the UK, and the US (excluding Hawaii). The rewards program and some features are US-only.

Cost and Fees

The Coinbase Card does not charge annual fees or spending fees, making it a cost-effective option for users. However, network transaction fees (e.g. gas fees) still apply for transferring cryptocurrency off the platform and are always disclosed at the time of the transaction.

Also, fees for buying, selling, or converting cryptocurrencies on Coinbase depend on factors like payment method and order size. While spending with the Coinbase card has no transaction fees, ATM operators may charge fees for withdrawals.

Now, this card offers flexible funding options, allowing users to link their bank accounts or deposit part of their paycheck into Coinbase with zero fees. The setup process is straightforward, with no credit check or requirement to stake assets to become eligible.

Coinbase One Card: Upcoming

The Coinbase One Card is coming in Fall 2025, and is currently in a waitlist phase. This will be a credit card (unlike the above Coinbase Card which is a debit card), issued by First Electronic Bank. The Coinbase One Card will be only available for Coinbase One members, which has a membership cost of $4.99/month or $49.99/year. There is no annual fee, nor foreign transaction fees.

Coinbase One Card users will enjoy the following rewards:

- Base rewards: 2% back in Bitcoin on every purchase

- Tiered rewards: Up to 4% back in Bitcoin based on assets held with Coinbase

- Reward tiers: 2%, 2.5%, 3%, or 4% depending on your Coinbase asset holdings

- Reward currency: All rewards paid in Bitcoin (BTC)

There are additional cardholder benefits as well , including travel insurance and AMEX experiences.

Coinbase One Card vs. Coinbase Card

| Feature | Coinbase Card (Current) | Coinbase One Card (New) |

|---|---|---|

| Card Type | Debit Card | Credit Card |

| Funding Source | Your Coinbase wallet | Credit line |

| Rewards | Up to 4% in various cryptos | Up to 4% in Bitcoin only |

| Membership Required | No | Yes (Coinbase One) |

| Annual Fee | None | None |

| Availability | Currently available in supported regions | Fall 2025 launch for supported regions |

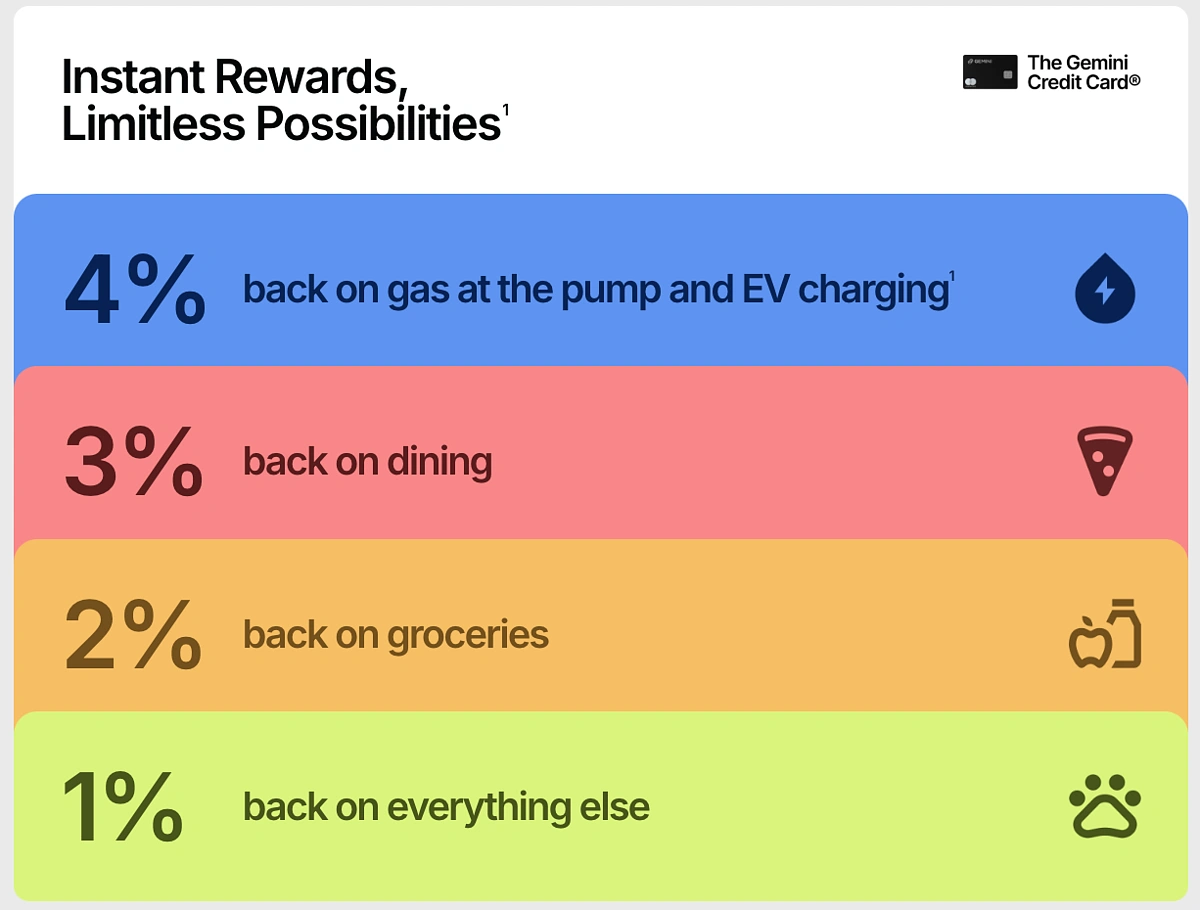

Gemini Credit Card: Up to 4% in Crypto Rewards on Purchases

Gemini’s Mastercard allows cardholders to earn up to 4% back in instant crypto rewards on qualifying purchases. However, as the Gemini Credit Card is a credit card, instead of a debit card like many others on this list, users cannot pay with cryptocurrencies; instead, they’ll have to pay their balance through a linked checking or savings account.

The main draw is the credit card’s instant rewards, which are paid out at time of purchase, allowing users to benefit from any price appreciation from the moment the transaction occurs. Users can select from bitcoin or any of the cryptocurrencies available on Gemini.

Features

-

Crypto rewards are instantly deposited and can be adjusted at any time.

-

The Gemini Credit Card doesn’t feature the credit card number – which can be accessed from the Gemii mobile or web app – for added security.

-

Only available to US-based users at time of writing.

-

Welcome promotion for users approved by 30 June 2025, offering $200 in crypto when users spend $3,000 in their first 90 days.

Cost and Fees

There are no annual fees, no foreign transaction fees, and no exchange fees for crypto rewards. However, at time of writing, the standard variable APR for purchases will range between 17.24% – 29.24% based on creditworthiness, along with a variable APR for cash advances at 30.24%.

Also, the 4% crypto back rewards for gas and EV charging is only available up to $200, after which the rate returns to 1%.

Crypto.com Card: Prepaid Card With Private Jet Perks

The Crypto.com card is another custodial card ideal for users looking to spend or convert their digital assets with ease. Moreover, this crypto card enables users to maximize their cryptocurrency holdings through spending and staking rewards.

Features

The Crypto.com card is a prepaid card that offers several tiers, each with its unique privileges, depending on the amount of CRO (Crypto.com’s native token) staked. These tiers include;

-

Midnight Blue: Ideal for users looking for a simple, no-frills crypto card. No staking is required and offers basic benefits with no rewards on spending.

-

Ruby Steel: Requires staking of 5,000 CRO to 1% back on purchases. Users also enjoy additional benefits like 100% rebate on their Spotify subscription for the first six months.

-

Royal Indigo/Jade Green: Requires staking of 50,000 CRO to earn 2% back on spending. Also, users enjoy 100% rebates on Spotify and Netflix subscriptions for the first six months.

-

Icy White/Frosted Rose Gold: Requires a staking of 500,000 CRO to earn 3% back on purchases and access to Crypto.com Private benefits. Additional benefits include airport lounge access and 100% rebates on subscription services, such as Spotify, Amazon Prime, and Netflix.

-

Obsidian: Minimum staking of 5,000,000 CRO required. This card gives users access to the most exclusive Crypto.com Private benefits, including higher rewards on Crypto Earn and private jet service perks. Users also enjoy 100% monthly reimbursement on Spotify, Netflix, and Amazon Prime, along with X Premium (for the first 12 months) subscriptions .

All tiers of the Crypto.com card supports different sets of cryptocurrencies, including Bitcoin, Ethereum , and CRO. In addition, the card can be used at various merchants globally where Visa cards are accepted.

Cost and Fees

There are no annual or spending fees, however, there are specific limits on free ATM withdrawals per month. These limits range from $200 USD for Midnight Blue to $1,000 USD for Obsidian. Any withdrawals beyond these limits, or those processed by ATM operators, may incur additional fees.

Users can top up their cards with bank transfers, other credit/debit cards, or cryptocurrency, where all cryptocurrency is converted to fiat currency before being used for purchases or withdrawals. Depending on your location, there may be additional administrative charges when topping up with a credit card. Do also note that users cannot transfer money back to their Fiat wallet after topping up their Crypto.com Visa card. Network transaction fees apply when transferring cryptocurrency off the platform and a 0.1% processing fee is charged for transactions via the Lightning Network.

Bybit Card: Earn Interest on Idle Assets

The Bybit card is a crypto debit card offered by Bybit, a prominent centralized cryptocurrency derivatives trading platform. This custodial crypto card stands out for its plethora of benefits, which comes with zero staking requirements.

Features

The Bybit card is a Mastercard debit card that offers convenient transaction and card management for users through a dashboard on Bybit web and app. This card features;

-

Support for multiple cryptocurrencies, including BTC, ETH, XRP, USDT, and USDC.

-

Loyalty rewards with points redeemable for vouchers and cryptocurrencies, and up to 10% cashback.

-

Auto-Savings function that allows Bybit Card users to earn interest on assets in Flexible Savings, which can be unstaked and spent at any time.

-

Integration with Google and Apple Pay.

-

Only available for users in Australia and European Economic Area (EEA) countries.

Cost and Fees

ATM withdrawals are free for the first 100 EUR/GBP each month, with a 2% fee thereafter. Spending limits are set at 5,000 EUR/GBP daily, 50,000 EUR/GBP monthly, and 250,000 EUR/GBP annually.

BasedApp: Deposit From Solana, Arbitrum, Polygon

BasedApp is a crypto trading platform that allows users to trade spot and perpetual futures on Hyperliquid. It is also a spending platform with a Visa card that allows users to spend their crypto at over 70 million merchants worldwide across 160 countries. Users can deposit USDT, USDC, XSGD, and SOL from Solana, Arbitrum and Polygon into their Based Account (note that this is not a crypto wallet).

Setting up a Based Account requires KYC, and it is a prerequisite for the BasedApp Visa card, as it acts as the bridge between your crypto and the global payment network, automatically converting crypto to fiat when spent at merchants. However, you can’t withdraw your funds from the card upon deposit.

Features

-

Users can deposit USDT, USDC, XSGD, and SOL on Solana, Polygon, and Arbitrum, and make payment using these cryptocurrencies.

-

BasedApp can be added to Google Pay, with Apple Pay coming soon.

The BasedApp Visa card comes in three tiers:

-

The Standard Card has an annual fee of $30, with a $3,000 daily spending limit. It is currently only available in Singapore.

-

The Hype Card will have an annual fee of $100, with most features similar to the Standard Card. Its main differentiator from Standard is that it has a “premium, holographic finish card.”

-

The Gold Card has an annual fee of $1,499, with a daily spending limit of $30,000. It also includes premium benefits including 24/7 concierge service and 8 airport lounge visits per year. It offers USD and SGD settlement, and is available worldwide.

Cost and Fees

Beyond the abovementioned annual fees, Standard and Hype Card users will also incur a 1.5% foreign currency markup, on top of the Visa Exchange Rate. There is also a swap fee of 1% for crypto-to-fiat, and 0.5% for fiat-to-fiat.

For Gold Card, there is an additional $550 fee to maintain Gold+ perks.

Gnosis Pay Card: Self-Custodial Card With Zero Fees

Gnosis Pay is an on-chain spending account connected to a self-custodial crypto wallet. Each of these on-chain accounts come with a Visa debit card, which allows users to spend their digital assets as easily as cash.

Features

The Gnosis Pay Card allows users to spend their crypto assets at various Visa merchants worldwide. The crypto card offers the following features.

-

Assets are kept safe in a self-custodial wallet.

-

Card is supported by Monerium, an on-chain fiat infrastructure provider allowing users to pay directly from their blockchain address without any extra fees.

-

OG non-fungible tokens (NFTs) for early adopters.

-

Customizable card with an Ethereum Name Service (ENS) identity.

-

Currently available in over 30 European countries, including the United Kingdom, France, Belgium, Spain.

Cost and Fees

Gnosis Pay Card users enjoy a zero fees policy, I.e. there are no transaction fees, foreign exchange fees, or off-ramping fees. Unlike many other blockchain-based services, the Gnosis Pay card eliminates gas fees, meaning users won’t have to worry about paying for the computational resources to process your transactions. That said, the initial cost to get the card is set at €30.23, albeit with no maintenance or annual fees.

ether.fi Cash: Non-Custodial Cashback Credit Card

A new card to watch in the non-custodial card is ether.fi’s credit card – Cash. Users can load their account with fiat money from their traditional bank account, or any non-custodial wallet. Until July 31, 2025, users can enjoy 3% cashback on all purchases across all card levels.

Features

ether.fi’s Cash acts as a spending account that lets users borrow against and spend their ether.fi balance in the physical world. Unlike other decentralized cards, ether.fi’s Cash is a credit card.

-

Crypto as collateral: Users can borrow against your crypto for credit card purchases, and can soon pay for their card balance with native yields.

-

Spend crypto in the physical world: Accepted anywhere VISA is accepted, with no need to off-ramp or incur transfer fees to use crypto in the real world.

-

Non-custodial: Your crypto assets belong to you, and neither ether.fi nor any third-party can access your keys.

-

Gasless transactions: You don’t have to pay for gas on any transactions using your Cash account.

There are different tiers for card holders based on their loyalty tier:

-

Core: Ideal for users who want to use the card for everyday transactions. Users get 1 free physical card and 3 virtual cards. It has an annual fee of 0.01 ETH, and a spending limit of $20K a day.

-

Luxe: Users who need more cards and require a higher spending limit might find Luxe a better fit for them, as users get 2 free physical cards and 10 virtual cards. It has an annual fee of 0.1 ETH, and a spending limit of $150K per day.

-

Pinnacle: Ideal for users in the crypto space, as it comes with 1 free conference per year. It also comes with 5 free physical cards, and unlimited virtual cards. It has an annual fee of 1 ETH, and a spending limit of $1M per day.

-

VIP: This is by invitation only, with most perks similar to Pinnacle. One standout is that it comes with Ether.fi Ventures Access.

Cost and Fees

Annual fees for ether.fi’s card ranges from 0.01 ETH to 1 ETH, making it one of the more expensive cards to acquire. On the higher tiers, users can enjoy one free conference pass per year. Regardless of your tier, however, there is a fixed 2% fee, a $10K limit, and a limit of 3 withdrawals a day for ATM withdrawals.

There is also a FX rate of 1% across all tiers, which applies if you are using the card for non-US dollar transactions. There are plans to include native EURO support soon.

Solayer: Real-Time On-Chain Processing With InfiniSVM

Solayer’s Emerald Card (Visa) is built on Solayer’s InfiniSVM Layer 1, delivering Visa-level throughput with real on-chain execution. There are no centralized custodians for Solayer’s Emerald card, with all transactions processed on-chain via InfiniSVM.

Users can deposit USDC to spend instantly, or opt into sUSD, a Treasury-backed stablecoin offering 4-5% yield.

Features

-

Direct USDC spending: Spend USDC like cash without converting to fiat first.

-

Non-custodial design: Users can deposit funds, spend USDC globally, and withdraw cash from ATMs without relying on centralised custodians.

-

Flexible funding options: Users can deposit and hold USDC, with the option to convert into sUSD for yield generation.

-

Yield-earning capability: Deposited funds can optionally earn yield through sUSD, which is linked to a 4% synthetic T-bill rate.

-

On-chain rewards program: Emerald Rewards grants users points for every purchase, which can be exchanged for rewards in the future.

Cost and Fees

For general users, there is a $75 pre-order fee to secure a spot on the waitlist. However, Genesis airdrop participants only have to pay a $10 activation fee, while community sale participants enjoy free activation and waived application fee. At time of writing, there is no mention of additional monthly or annual fees.

There is also a 1% top-up fee for each deposit. For USD transactions, there is a fee of $0.15, while international payments (or non-USD spend) incur a fee of $0.10 + 1.5%.

MetaMask: Bringing Worldwide Accessibility to the MetaMask Wallet With Mastercard

The MetaMask Card will let users spend their crypto in everyday transactions wherever Mastercard is accepted. Users can designate tokens for their MetaMask wallets and set spending limits, while maintaining complete access to their funds until they complete a transaction. When a transaction takes place, the MetaMask Card will convert available tokens into fiat currency.

The MetaMask Card runs on Linea, a zkEVM Layer 2 that offers lower gas fees and faster transaction processing, enabling instant payments.

Features

-

Supported tokens: Six tokens worldwide – USDC, USDT, wETH, EURe, GBPe, and aUSDC. For US users, USDC and aUSDC are the only supported tokens.

-

Mobile payment integration with Apple Pay or Google Pay.

-

Available in Argentina, Brazil, Colombia, Mexico, Europe (excluding Czechia, Estonia, Latvia and Lithuania), and the UK. On the US side, the early access has ended at time of writing, although there is a waitlist for an upcoming launch.

There are two options for card holders to choose from:

-

Virtual card: This is only a virtual card and is free to use, with users earning 1% crypto cashback in USDC for all eligible transactions. It has a limit of $10,000 per transaction, and $15,000 per day.

-

Metal card: A premium physical metal card that offers exclusive benefits like 3% back on the first $10,000 spent yearly (1% thereafter), higher spending and ATM withdrawal limits, and exclusive access and perks. It has a limit of $20,000 per transaction, and $30,000 per day.

Cost and Fees

For the virtual card, there are no annual or maintenance fees. For the premium Metal card, there is a $199 annual subscription fee.

There are no fees for stablecoins in the cardholder’s local currency, although foreign currency stablecoins incur a 0.5% fee for transactions. DeFi tokens incur no fees up to $1,200 per month, then 0.5%, while other cryptocurrencies like wETH incur a 0.875% fee.

There are also network gas fees, ATM withdrawal fees (2%), and cross-border fees of 1% for Virtual cards (free for Metal).

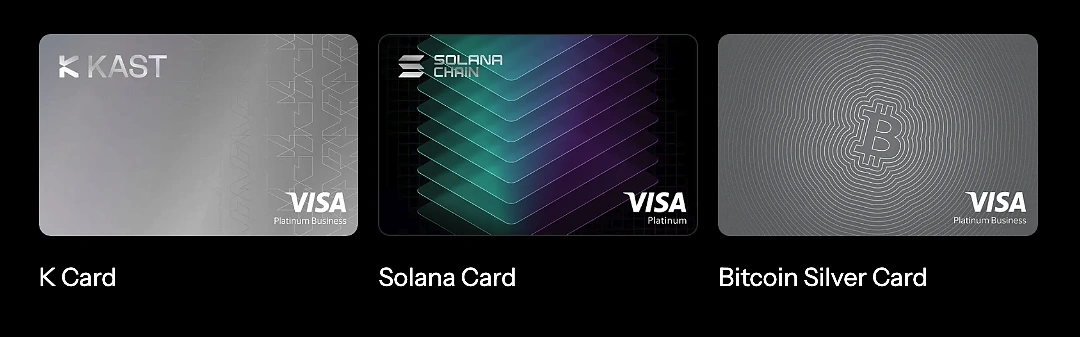

KAST: Multi-Chain Cards with Enhanced SOL Staking Rewards

The KAST Card enables users to spend stablecoins and crypto at over 100 million merchants and ATMs globally without requiring a traditional bank account. Users can create their card in minutes through a 2-3 minute KYC process and start spending instantly. The card automatically converts crypto to fiat at the point of purchase, eliminating the need for pre-conversion or preloading funds.

The KAST Card runs on multiple blockchain networks and offers multi-chain support for flexibility, while providing virtual USD bank accounts that function like traditional banking.

Features

-

Supported tokens: USDC, USDT, and USDe with multi-chain compatibility across various blockchain networks.

-

Mobile payment integration with Apple Pay and Google Pay.

-

Global availability in over 150 countries (excluding India and China due to regulatory restrictions).

-

Unlimited spending limits: No daily transaction limits, with ATM withdrawal allowance up to $20,000 per day.

-

SOL staking integration: Earn up to 21% APY through KAST validator with 0% commission + 100% MEV kickback.

-

KAST Points Program: Earn points on every transaction for potential future airdrops and rewards.

KAST offers two distinct card categories:

Regular KAST Cards:

-

Standard (K Card): Free option with 4% rewards on all spending in 2025 and earn KAST points on staked SOL.

-

Premium (X Card): $1,000/year with 8% rewards, 2x KAST points on staked SOL, and premium metal card.

-

Limited (Founders Edition): $5,000 one-time payment with 8% rewards, VIP concierge access, 2x KAST points on staked SOL, and no recurring fees.

Solana Cards (with enhanced SOL staking benefits):

You must stake SOL with the KAST validator in your Solana wallet and connect your Solana wallet to the Solana Card.

-

Solana Card (Standard): Free with 4% rewards on all card spend, earn KAST points on staked SOL, and receive 3.5-7% APY.

-

Solana Illuma (Premium): $1,000/year with 8% rewards on all card spend, 2x KAST points on staked SOL, and receive 7-14% APY.

-

Solana Gold: $10,000/year with 12% on all card spend, VIP concierge access, earn 3x KAST points on staked SOL, and receive 14-21% APY. There is also Solana Solid Gold, which is by invite only. Most of the benefits are the same as Solana Gold.

Bitcoin Cards

-

Bitcoin Silver Card: Free with 4% rewards on card spend and earn KAST points on staked SOL.

-

Bitcoin Black Card: $1,000/year with 8% rewards on all card spend and 2x KAST points on staked SOL.

Cost and Fees

Annual fees range from free for regular Standard cards ($2 in certain countries) to $10,000 for Solana Gold.

Transaction fees include ~0% crypto-to-fiat conversion costs (among the lowest in the industry) and a 2% foreign transaction fee for international purchases.

ATM fees are notably higher: 5% for local withdrawals and 10% for international ATM usage, with no free withdrawal allowances offered. Network gas fees are minimal and variable depending on the blockchain used.

Comparing The Top Crypto Cards

|

Crypto Card |

Type |

Annual Fees |

ATM Withdrawal Fees |

| Coinbase | Debit | None | None. ATM operator fees may apply |

|

Gemini |

Credit |

None, but there is APR for purchases and cash advances |

No details disclosed |

|

Crypto.com |

Prepaid |

None |

Limited free withdrawals. Subsequent fees depend on the card tier |

|

Bybit |

Debit |

None |

Free for first 100 EUR/GBP each month, 2% fee thereafter |

|

BasedApp |

Debit |

$30 (Standard), $100 (Hype), $1,499 (Gold) |

No details disclosed |

|

Gnosis Pay |

Debit |

€30.23 initial cost, no annual fees |

None |

|

ether.fi Cash |

Credit |

0.01 – 1 ETH |

Fixed 2% fee, $10K limit, and 3 withdrawals a day |

|

Solayer Emerald |

Debit |

No annual fees mentioned |

No details disclosed for ATM fees |

|

MetaMask |

Debit |

None (Virtual), $199 (Metal) |

2% ATM withdrawal fees |

|

KAST Regular Cards |

Debit |

Free – $10,000 (depending on tier) |

$3 + 2% local, $3 + 2% (+2% FX) international |

Final Thoughts

Crypto cards offer an easy and seamless way to manage and spend digital assets, similarly with regular payment cards in traditional finance. These cards provide users with convenience, enhanced security, and unique benefits, including cashback rewards, staking options, and subscription packages. That said, choosing a suitable crypto card can be a complex decision-making process involving a few relevant considerations, such as taxes, custody, flexibility, regulations, and more.

Always do your own research before choosing any crypto cards or staking any digital assets. This article is only meant for informational purposes and should not be taken as financial advice.