What Are Spot Bitcoin (BTC) ETFs?

Spot Bitcoin (BTC) ETFs are investment funds on traditional stock exchanges that directly hold Bitcoin. This allows investors to gain exposure to Bitcoin using a standard brokerage account without needing to hold or handle the crypto themselves.

Key Takeaways

-

What They Are: Spot Bitcoin ETFs are exchange-traded funds on traditional stock exchanges that let investors gain exposure to Bitcoin through a traditional brokerage account.

-

Historic Approval: On January 10, 2024, the SEC approved 11 spot Bitcoin ETFs after a decade-long regulatory battle, creating the most successful ETF launch in history with $4.6 billion in first-day trading volume.

-

Market Leaders: BlackRock’s IBIT ($86.9B AUM) and Fidelity’s FBTC ($24.4B AUM) dominate the market with 0.25% expense ratios, while Grayscale’s GBTC maintains significant assets despite higher 1.50% fees.

-

Key Benefits: Primary advantages include accessibility through existing brokerage and retirement accounts, SEC regulatory oversight, professional custody eliminating technical challenges, and high liquidity for easy trading.

-

Major Risks: Significant risks include Bitcoin’s inherent price volatility, annual management fees reducing returns, potential tracking errors, and custodian concentration risk with most ETFs relying on Coinbase custody.

-

Tax Advantages: Holding in tax-advantaged accounts like Roth IRAs can eliminate taxes on gains entirely, while taxable accounts benefit from standard capital gains treatment and wash sale rule protections.

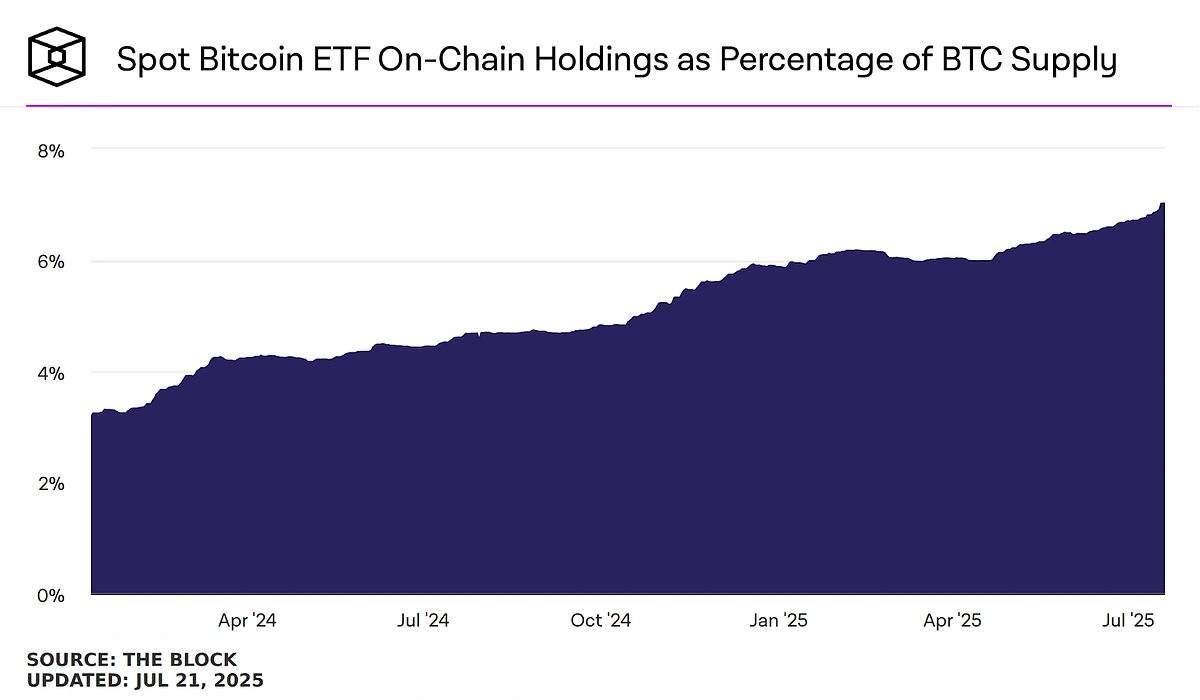

- Market Impact: These ETFs have driven Bitcoin’s 160% price growth since approval, with the top funds collectively holding over 1.29 million Bitcoins (6%+ of total supply) valued at $150+ billion.

Spot Bitcoin ETFs are one of the most significant financial innovations in recent years. These investment vehicles have revolutionized how people can gain exposure to Bitcoin through traditional investment channels, marking a historic bridge between cryptocurrency and traditional finance. The market’s reaction was immediate and explosive. The newly approved ETFs saw a combined trading volume of $4.6 billion on their first day and have since collectively become the most popular ETF launch of all time, attracting tens of billions in net inflows.

Understanding What a Spot Bitcoin ETF Is

A spot Bitcoin ETF is an exchange-traded fund that directly holds actual Bitcoin (BTC) as its underlying asset. Unlike other investment products that use derivatives, spot Bitcoin ETFs purchase and securely store real Bitcoin, giving investors direct exposure to Bitcoin’s price movements without the complexity of cryptocurrency exchanges.

The term “spot” refers to the immediate purchase and ownership of the actual cryptocurrency at current market prices. When you invest in a spot Bitcoin ETF, you’re buying shares in a fund that holds real Bitcoin, stored securely by institutional-grade custodians like Coinbase Custody.

Think of the ETF as a “wrapper” around Bitcoin. When you buy shares of a spot Bitcoin ETF like BlackRock’s IBIT, you’re purchasing a small piece of the massive pool of Bitcoin held by the fund. While you don’t own the Bitcoin directly, your share’s value moves in direct correlation with Bitcoin’s real-time price.

The Historic SEC Approval: A Decade in the Making

The approval of spot Bitcoin ETFs represents the culmination of a decade-long regulatory battle. The journey began in 2013 when the Winklevoss twins filed the first application, followed by years of rejections from the SEC.

The breakthrough came in 2022 when Grayscale sued the SEC after their conversion application was denied. A federal court ruled in Grayscale’s favor in 2023, stating the SEC failed to adequately explain why futures-based ETFs were acceptable while spot ETFs were not.

On January 10, 2024, the SEC simultaneously approved 11 spot Bitcoin ETFs, creating an immediate market sensation. These ETFs saw a combined trading volume of $4.6 billion on their first day and have since become the most popular ETF launch in history, attracting tens of billions in net inflows.

How Spot Bitcoin ETFs Work: The Mechanics

Understanding what is a spot bitcoin ETF requires grasping the sophisticated mechanics behind these funds:

Fund Creation and Structure

An ETF issuer like BlackRock or Fidelity creates the fund and partners with Authorized Participants (APs) – large financial institutions that act as market makers. These APs acquire Bitcoin from exchanges or over-the-counter desks to supply the fund.

The Creation and Redemption Mechanism

This complex system keeps ETF prices aligned with Bitcoin’s actual value:

When Demand Rises (Premium Scenario):

-

Strong investor interest pushes the ETF’s market price above its Net Asset Value (NAV)

-

An Authorized Participant spots this premium opportunity

-

The AP delivers cash to the ETF issuer for new shares at NAV price

-

The issuer uses this cash to buy more Bitcoin

-

The AP sells these new shares at the higher market price, capturing profit while increasing supply and pushing the price back toward NAV

When Demand Falls (Discount Scenario): The process reverses, with APs buying cheap shares and redeeming them for the underlying Bitcoin value, eliminating the discount.

Custody and Security

The Bitcoin is stored by institutional-grade custodians with sophisticated security measures. Most ETFs rely on Coinbase Custody, though Fidelity uses its own in-house custody solution.

Spot Bitcoin ETF vs Bitcoin Futures ETF: Critical Differences

Before spot ETFs, investors could only access Bitcoin through futures-based ETFs, but these products work very differently:

Spot Bitcoin ETFs

-

Hold actual Bitcoin as the underlying asset

-

Provide direct price exposure with minimal tracking error

-

No expiration dates or contract rolling requirements

-

Management fees are the primary cost factor

Bitcoin Futures ETFs

-

Hold Bitcoin futures contracts, not actual Bitcoin

-

Must constantly roll expiring contracts to new ones

-

Suffer from “contango” costs when new contracts are more expensive

-

Can experience significant performance drag over time

The SEC initially preferred futures ETFs because they trade on regulated exchanges like the Chicago Mercantile Exchange, but spot ETFs have proven more efficient for investors.

Market Impact: How Spot Bitcoin ETFs Changed Everything

The introduction of spot Bitcoin ETFs created several profound market effects:

Institutional Adoption Gateway

These ETFs served as a regulated entry point for conservative institutional capital. Public filings reveal entities like the State of Wisconsin pension plan and major advisory firms have allocated significant capital to Bitcoin through these vehicles.

Supply and Demand Dynamics

Daily purchases from major ETFs like BlackRock’s IBIT and Fidelity’s FBTC often outpaced new Bitcoin creation by miners by factors of 5 to 10. This effect was amplified by the April 2024 Bitcoin Halving, which cut new Bitcoin supply in half.

Price Performance

Bitcoin’s price has grown by 160% since the first spot Bitcoin ETFs were approved, reaching multiple all-time highs.

At the time of writing, the top spot Bitcoin ETFs collectively hold over 1.29 million Bitcoins, representing over 6% of the total Bitcoin supply valued at over $150 billion.

Leading Spot Bitcoin ETFs: The Competitive Landscape

The race for assets has been intense. Here’s a look at the landscape.

|

iShares Bitcoin Trust (IBIT) |

Fidelity Wise Origin Bitcoin Fund (FBTC) |

Grayscale Bitcoin Trust (GBTC) |

Bitwise Bitcoin ETF (BITB) |

ARK 21Shares Bitcoin ETF (ARKB) |

|

|

Issuer |

BlackRock |

Fidelity |

Grayscale |

Bitwise |

ARK Invest / 21Shares |

|

Expense Ratio |

0.25% (waived to 0.12% on first $5B for 12 months) |

0.25% (waived until Aug 1, 2024) |

1.50% |

0.20% |

0.21% |

|

AUM (July 2025) |

~$87.5 Billion |

~$24.6 Billion |

~$22 Billion |

~$6.2 Billion |

~$6.1 Billion |

|

Avg. Daily Volume |

Very High (~$2B+) |

High (~$1B+) |

Moderate (~$141M) |

Moderate (~$2M) |

Moderate (~$2M) |

|

Custodian |

Coinbase Custody |

Fidelity Digital Assets (In-house) |

Coinbase Custody |

Coinbase Custody |

Coinbase Custody |

|

Unique Feature |

Backed by the world’s largest asset manager; highest liquidity. |

Vertically integrated with in-house custody; strong retail brand. |

Longest track record (since 2013); established but high-fee. Launched Grayscale Bitcoin Mini Trust with lowest fees at 0.15%. |

Offered by a crypto-native index fund specialist. |

Actively managed by a well-known tech investor. |

Benefits of Investing in Spot Bitcoin ETFs

Spot Bitcoin ETFs offer several compelling advantages that make Bitcoin investing more accessible and convenient for traditional investors.

Unmatched Accessibility and Convenience

The primary advantage is accessibility through existing brokerage accounts and tax-advantaged retirement accounts like Traditional or Roth IRAs. This eliminates the technical hurdles of cryptocurrency exchanges, digital wallet management, and private key security.

Regulatory Oversight and Security

These SEC-regulated products trade on national exchanges and undergo regular audits. The underlying Bitcoin is held by institutional-grade, regulated custodians, providing investor protection absent in many unregulated exchanges.

Deep Liquidity and Efficiency

Large ETF issuers and active Authorized Participants ensure extremely liquid markets, allowing investors to easily buy and sell positions with minimal price impact.

Portfolio Diversification Benefits

Bitcoin has historically shown low correlation to traditional asset classes like stocks and bonds, potentially enhancing a portfolio’s risk-adjusted returns with a small allocation.

Tax Advantages

Holding these ETFs in tax-advantaged accounts like Roth IRAs can eliminate taxes on gains entirely. Outside these accounts, they’re subject to standard capital gains treatment with wash sale rule protections.

Understanding the Risks and Considerations

While spot Bitcoin ETFs provide significant benefits, investors must carefully evaluate and consider several key risks before investing.

Inherent Bitcoin Volatility

The ETF structure doesn’t insulate investors from Bitcoin’s famous volatility. You must have high risk tolerance and be prepared for substantial potential losses.

Management Fees Impact

Annual management fees range from 0.15% to 1.50%, directly reducing returns over time. While most newer ETFs charge 0.19% to 0.25%, these fees compound over years.

Tracking Error Potential

ETF performance may not perfectly mirror Bitcoin’s price due to management fees, transaction costs, and operational frictions, though market makers typically keep these minimal.

Custodian Concentration Risk

The heavy reliance on Coinbase as the primary custodian for most ETFs creates systemic risk. Unlike bank deposits or brokerage securities, the underlying Bitcoin isn’t insured by FDIC or SIPC.

Trading Hours Limitations

Bitcoin trades 24/7, but ETFs only trade during standard market hours. Significant overnight or weekend price movements create “gap risk” when you cannot trade.

How to Invest in Spot Bitcoin ETFs: Step-by-Step Guide

Investing in spot Bitcoin ETFs is designed to be as straightforward as purchasing any stock through your existing brokerage account.

Step 1: Choose Your Brokerage

Most major online brokers offer spot Bitcoin ETFs with zero commission fees. Consider:

-

ETF availability (all 11 approved ETFs)

-

Account types (especially self-directed IRAs)

-

Platform usability

-

Hidden fees

Step 2: Fund Your Account

Link your bank account and initiate an electronic transfer (ACH) to fund your brokerage account.

Step 3: Place Your Order

-

Search for your chosen ETF using its ticker symbol (IBIT, FBTC, ARKB, etc.)

-

Choose between Market Order (current price) or Limit Order (maximum price control)

-

Enter the number of shares or dollar amount

-

Review and confirm your trade

Tax Implications and Retirement Planning

Spot Bitcoin ETFs offer significant tax advantages:

Tax-Advantaged Accounts

-

Roth IRA: Gains are completely tax-free upon withdrawal in retirement

-

Traditional IRA: Tax-deferred growth with deductions on contributions

-

401(k): Availability depends on employer plan options (currently rare)

Taxable Accounts

-

Subject to standard capital gains taxes

-

Benefit from wash sale rule protections

-

Receive standard 1099 forms for simplified reporting

The Future of Spot Bitcoin ETFs

The success of spot Bitcoin ETFs has opened doors for additional cryptocurrency investment products. Following Bitcoin ETF approvals, the SEC has approved spot Ethereum ETFs, with more ETF applications pending for various digital assets including Solana (SOL) and XRP.

This trend suggests growing regulatory acceptance and the potential for a comprehensive suite of cryptocurrency ETFs, further bridging traditional finance with the digital asset ecosystem.

Conclusion

Understanding what is a spot bitcoin ETF is crucial for modern investors considering cryptocurrency exposure. These revolutionary investment vehicles represent a fundamental paradigm shift, validating Bitcoin as a legitimate asset class while providing regulated, accessible exposure through familiar investment channels.

The historic approval and explosive growth of spot Bitcoin ETFs have created a bridge between traditional finance and the cryptocurrency world, unlocking vast new capital and enabling mainstream participation without technical barriers. However, like all investments, they carry significant risks and potential investors are recommended to do their own research and consider their risk tolerance.

Frequently Asked Questions (FAQ)

-

Do I own actual Bitcoin when I buy shares in a Spot Bitcoin ETF?

No, you own shares representing a claim on Bitcoin held by the fund. This provides economic exposure without custody responsibilities.

-

Which Spot Bitcoin ETF has the lowest fees?

As of mid-2025, several ETFs offer very low expense ratios. Grayscale Bitcoin Mini Trust’s BTC (0.15%), Franklin Templeton’s EZBC (0.19%) and Bitwise’s BITB (0.20%) are among the cheapest, though fees can change.

-

Can a Spot Bitcoin ETF go to zero?

Yes. The value of the ETF is derived directly from the price of Bitcoin. If the price of Bitcoin were to fall to zero, the value of the ETF shares would also fall to zero. The ETF structure does not protect an investor from the price risk of the underlying asset.

-

Is it better to buy a Bitcoin ETF or Bitcoin directly?

It depends on your goals and technical comfort. The ETF offers unparalleled convenience, security through regulated custodians, and access via tax-advantaged retirement accounts like an IRA. Direct ownership provides 24/7 trading, the ability to use your Bitcoin in DeFi applications, and no ongoing management fees, but it requires you to be responsible for the security of your own assets.

-

Why do the US ETFs use a “cash-create” model instead of “in-kind”?

The SEC mandated the cash-create model for U.S. ETFs, requiring cash delivery rather than direct Bitcoin transfers, likely for regulatory oversight reasons.