What Is Strategy (MSTR)?

Strategy (formerly MicroStrategy) is a publicly traded (NASDAQ-listed) company that rebranded from a ‘software development company’ to a ‘Bitcoin development company’ in February 2025. It was founded in 1989 and went public in 1998. MSTR is the stock ticker of Strategy.

Key Takeaways

-

Strategy is the largest corporate holder of Bitcoin with over 590,000 BTC on its balance sheet.

-

Michael Saylor steered the company into using BTC as a hedge against inflation and a long-term store of value.

-

Strategy funds its Bitcoin purchases through a mix of methods, including cash reserves, convertible bonds, high-yield debt, ATM equity offerings, and convertible preferred shares.

-

MSTR stock acts as a high-beta proxy for Bitcoin. It offers amplified exposure compared to spot Bitcoin ETFs.

-

The Bitcoin-heavy focus of Strategy comes with major risks, including extreme volatility and heavy debt obligations.

When a 22-year-public-listed company adds BTC to its balance sheet, and its billionaire co-founder preaches the asset like a true Bitcoin maxi, the world takes notice.

That’s exactly what happened with Strategy (formerly MicroStrategy). It operates with a unique dual identity: on one hand, it is a conventional enterprise software firm with a history stretching back to 1989; on the other, in 2020, it transformed itself into the world’s largest public corporate holder of Bitcoin, and rebranded itself as a “Bitcoin development company.” The company’s treasury now holds 597,325 Bitcoins, almost 12 times more than the next company on the list (MARA with 50,000 BTC), and over 2.8% of Bitcoin’s total supply.

Led by its co-founder and Executive Chairman, Michael Saylor, a vocal and influential advocate for Bitcoin, Strategy is building a narrative around BTC as it accumulates the cryptocurrency as its primary treasury reserve asset. From raising debt to fund BTC purchases to declaring itself a “Bitcoin development company,” Strategy has become ground zero for institutional crypto adoption.

But what led to this transformation? Why did a software company turn into Bitcoin’s loudest corporate bull? And what does that mean for the future of finance?

An Overview of Strategy

Strategy (formerly known as MicroStrategy) is a publicly listed company on the NASDAQ that went from a traditional enterprise software provider to a ‘Bitcoin development company’.

Founded in 1989, MicroStrategy was known for its business intelligence (BI) software (B2B software to analyze data and make strategic decisions). It built a loyal customer base in the analytics space and went public in 1998.

Source: The Washington Post

Source: The Washington PostHowever, a major accounting scandal took place in 2000, when the SEC charged the company with civil accounting fraud, finding that it had overstated its revenue and earnings by prematurely recognizing revenue on software deals. The subsequent restatement of its financials caused a collapse in its stock price and brought the company to the edge of bankruptcy.

In August 2020, the company and Saylor made headlines by becoming the first U.S. public company to add Bitcoin to MicroStrategy’s balance sheet with an initial investment of $250 million, adopting the digital asset as its primary reserve. Why that amount? Because $250 million was the planned inflation hedging funds for the company (and it went all-in)!

In January 2025, MicroStrategy adopted fair value accounting for its Bitcoin holdings following the issuance of ASU 2023-08 by the FASB, which means that Bitcoin holdings are now revalued to fair market value at each reporting period, with changes in value recognized in the net income. As a result of this adoption, a cumulative net increase was applied to the opening balance of retained earnings as of January 1, 2025 of $12.7 billion.

Finally, in February 2025, MicroStrategy rebranded to Strategy. The rebranding included a new logo with a stylized B that resembles the Bitcoin logo and the adoption of orange – a color associated with Bitcoin – as its primary brand color, emphasizing its new focus. Now, the company is focusing on the following:

-

Acquiring and holding Bitcoin as a strategic treasury reserve

-

Developing products and services that support Bitcoin adoption

-

Promoting Bitcoin as a long-term store of value.

However, Strategy continues to offer business intelligence tools (like MicroStrategy ONE).

Who Is Michael Saylor

Michael Saylor is the co-founder and Executive Chairman of Strategy (formerly MicroStrategy), and one of Bitcoin’s most influential corporate advocates. About 2 decades after going public, Saylor began re-architecting the company’s entire treasury strategy around BTC, making MicroStrategy one of the largest corporate holders of Bitcoin globally.

Bitcoin was not the fame-catalyst for Saylor. Long before Saylor sailed deep into the Bitcoin ocean, he was known for his contribution at MicroStrategy and as an accomplished author of the book titled “The Mobile Wave: How Mobile Intelligence Will Change Everything.”

Saylor’s Famous ‘Melting Ice Cube’ Analogy

In 2020, as inflation fears rose and interest rates remained low, Saylor famously said, “We realized we were sitting on a $500 million melting ice cube.”

What he meant was that the company was holding cash in a low-interest, inflationary environment which caused it to lose purchasing power over time. So, just like how ice cubes melt and disappear, cash reserves shrink in real value the longer you hold them.

Saylor’s “Bitcoin Standard” Philosophy

The “Bitcoin Standard” is a corporate philosophy (not life). It speaks of a fundamental shift in how companies manage their treasuries and use Bitcoin’s unique properties for financial strength and value creation.

“The Bitcoin Standard means your company becomes attractive to capital.”

Saylor’s philosophy can be summed up as a worldview that sees BTC as the definitive solution to what he perceives as the inherent flaws of traditional fiat currencies. At the core is the belief that traditional corporate finance is broken. He argues that many companies suffer from, in Saylor’s words, “capital toxicity.”

Capital Toxicity

The cash reserves of companies are continuously losing value every year. If a company holds its cash in short-term government bonds, it might earn around 2–3% after taxes. But at the same time, the cost of capital hovers around 10–15%. That means the company is effectively losing around 10% of its money’s value each year just by holding it in safe assets.

This is what Michael Saylor calls a silent drain on the balance sheet.

Now, companies can’t legally invest their treasury in assets like the S&P 500 index, because those are securities. That leaves them with only a few options:

-

Pay it out as dividends

-

Buy back their own stock

-

Or try to acquire another company

And most acquisitions don’t work out because they’re either too expensive or don’t deliver real value. So in reality, these options just give away the capital or waste it.

Why Bitcoin?

“Bitcoin is a bank in cyberspace, run by incorruptible software, offering a global, affordable, simple, & secure savings account to billions of people that don’t have the option or desire to run their own hedge fund.”

Bitcoin is not subject to issues like debt and political manipulation, according to Michael Saylor. Hence, companies benefit from BTC for long-term wealth storage while battling inflation, tariffs, geopolitical instability, monetary debasement, and even sanctions.

For the first time in modern history, companies have access to a capital asset (Bitcoin) that is:

-

Not a security (so it can legally be held on the balance sheet)

-

A scarce, digital commodity with a supply capped at 21 million coins

-

And has historically outperformed the cost of capital.

How Strategy Became a “Bitcoin Development Company”

In August 2020, when Michael Saylor announced that MicroStrategy had acquired 21,454 BTC as a treasury reserve, most assumed it was a one-off marketing stunt or that the hype would gradually fade away with the company eventually selling the asset at a profit. However, what followed was a series of purchases, which brought the company’s holdings to 70,470 BTC by year-end.

Over the next four years, Saylor’s company went on a Bitcoin accumulation frenzy! Strategy took on debt, reshuffled executives, hosted corporate Bitcoin conferences, and more to become the leading narrative shaper of what Saylor considers the most powerful modern-day value creation asset: Bitcoin.

So, what does it mean to become a Bitcoin development company for Strategy?

The first phase of MicroStrategy’s Bitcoin journey was focused on accumulating Bitcoin as a primary treasury reserve asset to hedge against inflation and preserve capital.

Now, as a ‘Bitcoin development company,’ Strategy will actively contribute to, build upon, and create value from the Bitcoin network itself.

Strategy treats Bitcoin as equity, debt as a funding tool, and software as a distribution layer. By doing so, it created an operating model that acts more like a Bitcoin-native institution than a software vendor.

How Does Strategy Pay For Its Bitcoin?

Since 2020, Strategy has spent billions on acquiring Bitcoin.

|

Year |

Amount Spent in USD |

No. of BTC Acquired |

|

2020 |

~$475 million |

70,470 BTC |

|

2021 |

~$2.65 billion |

53,921 BTC |

|

2022 |

~$276 million |

8,109 BTC |

|

2023 |

~$1.90 billion |

56,650 BTC |

|

2024 |

~$21.97 billion |

~257,250 BTC |

|

2025 |

~$8.44 billion |

~126,218 BTC |

There are five major avenues for Strategy to pay for BTC:

-

Cash reserves

-

Convertible bonds

-

High-yield bonds and loans

-

At-the-Market (ATM) equity offerings

-

Convertible preferred shares

1. Cash Reserves

Cash reserves are a company’s available liquid assets, usually held in bank accounts or money market instruments, used to cover operational expenses or emergencies. Strategy used excess cash on its balance sheet (from profits or past savings) to make its first Bitcoin purchases in 2020, before seeking external funding.

The BTC purchase journey began in August 2020, when it used $250 million of internal operating cash to make its first purchase of 21,454 BTC, followed shortly by another $175 million acquisition in September of that year.

These moves stemmed from concerns about inflation and the idea that “cash was a melting ice cube”. The use of internal funds demonstrated conviction, but purchases slowed as Bitcoin prices rose and internal reserves were exhausted.

2. Convertible Bonds

Convertible bonds have been the cornerstone of Strategy’s external funding strategy. While these bonds pay interest, they let Strategy access cheap financing, as investors are willing to accept low interest rates because of the option to convert into equity when MSTR’s stock outperforms, i.e., essentially self-repaying if all goes well.

By December 2020, Strategy had issued $7.27 billion in convertible debt across several tranches.

-

Dec 2020: $650 million in 0.75% coupon notes.

-

Feb 2021: $1.05 billion in zero-coupon notes.

-

Additional tranches followed in mid-2024, including an $800 million issue at a 2.25% coupon.

By late 2024, Strategy had used convertible bond proceeds to purchase 20,000+ BTC.

3. High‑Yield Bonds and Secured Loans

High-yield bonds (also called junk bonds) are corporate bonds that offer higher interest rates because they carry higher risk. Secured loans are similar but backed by specific collateral, like company assets.

Strategy has occasionally turned to straight debt when convertible bonds weren’t optimal.

-

June 2021: Issued $500 million in senior secured notes at ~6.125% interest.

-

March 2022: Took a $205 million loan from Silvergate Bank, collateralized by Bitcoin itself.

4. At-the-Market (ATM) Equity Offerings

ATM offerings allow a company to sell new shares directly into the open market, at current trading prices, in small increments over time. This gives Strategy a flexible way to raise cash to buy more Bitcoin whenever market conditions are favorable.

Strategy used ATM programs to sell MSTR stock when demand was high, raising billions to buy Bitcoin while limiting dilution.

-

November 2024: Raised $2.03 billion and purchased 27,200 BTC at ~$74,463 per coin.

-

Q1 2025: Opened a $21 billion ATM program, issuing ~301,000 shares that funded 301,335 BTC, simultaneously boosting share price by ~50%.

-

May 2025: Raised $427 million via common and preferred ATMs.

5. Convertible Preferred Shares

Strategy issues convertible notes with a conversion price far above the current stock price (e.g. 35%–50% premium). If MSTR’s stock stays strong (through Bitcoin’s success), bondholders may later convert to equity, effectively giving Strategy interest-free capital.

Convertible preferred shares are a type of equity security that pays a fixed dividend and can be converted into common stock under specific conditions. They sit between bonds and common shares in terms of risk and rights.

The high-yield preferred stocks essentially target income-seeking investors. STRD, STRK, and STRF series were issued:

-

$1 billion raised via STRD at 10% dividends, used to buy 10,100 BTC (~$1.05 billion)

-

Additional preferred stock ATMs in March and May 2025 raised $67.9 million (STRK) and $10.4 million (STRF)

These securities carry yields up to 11.5%, which attracted both praise for their accretive nature and scrutiny over sustainability, given Strategy’s limited core revenue (~$463 million annually).

Comparing MSTR Stock with BTC and Spot Bitcoin ETFs

“MSTR” often surfaces as an answer for investors looking for an asset that is conventional but still want exposure to Bitcoin’s price performance (particularly the upside). Why? Because the correlation between MSTR price and BTC price is noteworthy.

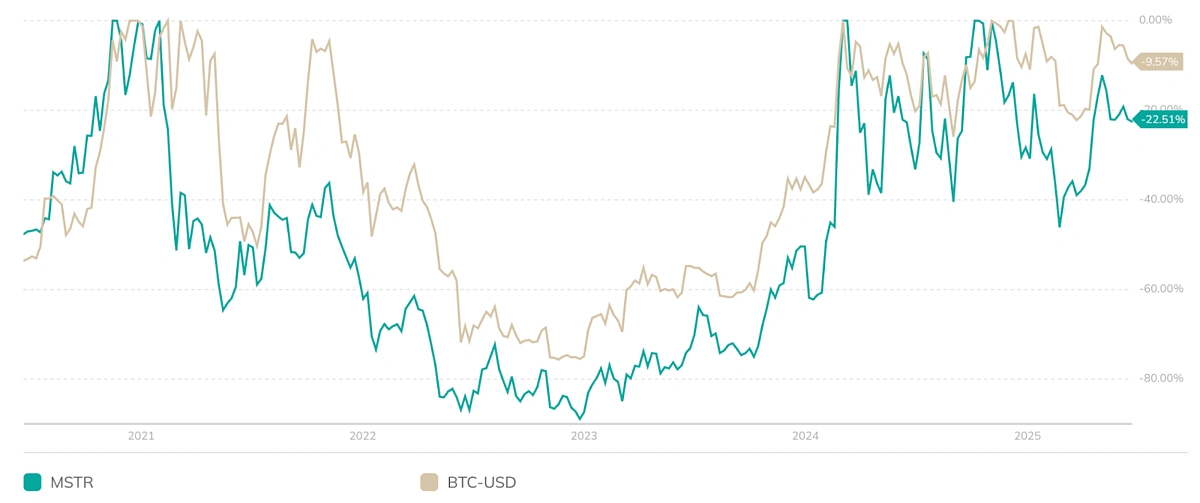

Strategy’s stock price tends to follow Bitcoin’s price trend very closely, but with increased volatility.

For investors who are eyeing only Bitcoin’s price appreciation without holding crypto directly, spot Bitcoin ETFs are a better option. MSTR’s tracking is looser and it can trade at a substantial premium or discount to its underlying Bitcoin holdings, and it tends to overshoot or undershoot BTC on any given day. Over time, MSTR and BTC’s trajectories are directionally similar, but MSTR’s volatility is higher.

Compared to BTC, MSTR tends to have a beta of ~2. “Beta” measures how volatile a stock is compared to the overall market or another asset. So if Bitcoin goes up 10%, the price of MSTR tends to go up by 20% (2x of BTC because it has a beta of 2). However, while offering potential outsized returns, it also comes with corresponding higher risk, as we’ll see below.

Let’s explore this further.

Note that these metrics are based on historical price performance. Past performance does not guarantee future results. CoinGecko does not provide any financial advice.

MSTR and BTC Price Comparison

MSTR stock is highly correlated with Bitcoin’s price but with amplified volatility.

It often behaves as a leveraged proxy for Bitcoin. What that means is when Bitcoin rises, MSTR tends to rise more in percentage terms, and when Bitcoin falls, MSTR often falls more. For instance, year-to-date in 2025, MSTR returned roughly 25–34% vs Bitcoin’s 13–18% gain.

During the late 2020 through 2021 bull run, MicroStrategy’s stock went from around $120 in mid-2020 to over $1,200 by early 2021 (a ~10x increase), far outpacing Bitcoin’s roughly 5–6x rise in that span.

And in the 2022 crypto crash, MSTR crashed about 83% from its peak, slightly more than Bitcoin’s ~68% decline.

Source: PortfoliosLab

Source: PortfoliosLabSince Strategy added BTC to its balance sheet, MSTR has functioned as a high-beta Bitcoin proxy, often outperforming Bitcoin on the upside and underperforming on the downside.

MSTR and Spot Bitcoin ETFs Comparison

A spot Bitcoin ETF like IBIT is designed to closely track Bitcoin’s price minus a small fee. So, while ETFs offer near-perfect tracking of Bitcoin’s price, MSTR offers something different: amplification.

For investors who want clean, passive exposure to Bitcoin’s price movement with no surprises, spot BTC ETFs are an excellent choice. Unlike MSTR, a spot Bitcoin ETF;

-

Holds Bitcoin 1:1

-

Tracks the price near-perfectly

-

Charges a small annual fee (typically <1%)

-

Doesn’t dilute or take on debt

MSTR is more of a conviction play. It’s a bet on Michael Saylor and the thesis that Bitcoin is a treasury standard.

Risks and Criticisms of Strategy’s Bitcoin Focus

Since its transformation from MicroStrategy into Strategy, the company has emerged as the most aggressive corporate accumulator of Bitcoin.

While this pivot has earned it praise from crypto believers and a place in institutional portfolios, it comes with three serious risks that investors and analysts cannot ignore:

-

Volatility from Bitcoin

-

Debt-financed BTC accumulation

-

Drifting away from the original business

Bitcoin Volatility

Bitcoin remains one of the most unstable financial assets in circulation. Strategy’s decision to allocate the majority of its treasury into Bitcoin means its balance sheet is effectively tethered to daily crypto market swings.

While the abovementioned adoption of ASU 2023-08 now measures gains and losses from change in the fair value of Bitcoin recognized in net income at each reporting period, Strategy recorded an unrealized fair value loss on digital assets of $5.9 billion during the first three months of 2025, although this might change since Bitcoin just recorded a new all time high in July 2025.

Debt-Financed BTC Accumulation

Strategy raised billions through convertible notes, junk bonds, and even collateralized loans, all to buy more Bitcoin. This financial engineering creates a leveraged Bitcoin exposure that is powerful in bull runs, but dangerous when fear takes over.

If Bitcoin declines sharply, the company still owes interest and principal on its obligations. In a liquidity crunch, it could be forced to sell Bitcoin at a loss (precisely what its strategy, pun unintended, aims to avoid). So, leverage magnifies both the upside and downside.

The Valuation of MSTR Stock

The company’s market capitalization frequently trades at a significant premium to the net asset value (NAV) of its Bitcoin holdings, where the market values the company for more than the BTC it actually owns.

Jim Chanos, one of the most famous short sellers in history, argues that there is no rational justification for a company that primarily holds Bitcoin to be worth substantially more than the Bitcoin it holds, as it is more logical for an investor to buy a spot ETF or Bitcoin directly instead of paying the MSTR premium.

However, Saylor’s argument is that critics overlook Strategy’s use of Bitcoin-backed financial instruments, which he claims justifies the premium at which the company trades.

Drifting Away from Original Business

Once a respected business intelligence software firm, Strategy has relegated its core product to the background. Software revenue still exists, but the market no longer values it.

Investors now treat Strategy as a Bitcoin proxy, not a tech company. This shift may attract crypto-aligned capital, but it alienates traditional enterprise investors and limits diversification. If the Bitcoin thesis falters, the company has little left to fall back on.

Conclusion

By all indications, Strategy will continue adding to its Bitcoin trove. Michael Saylor has consistently signaled that the company will keep acquiring Bitcoin, using any available cash flows or raised capital.

If favorable conditions persist (and dilution is moderate), Strategy could end 2025 with well over 600,000 BTC, according to an analysis by CCN.

Over the long term, Saylor’s oft-stated vision is for Strategy to “hodl” Bitcoin indefinitely. So voluntary selling of core holdings is not expected; at most, small strategic sales (like the 2022 tax loss harvest of 704 BTC) or hedges might occur, barring a crisis.

“Never. No. We’re not sellers. We’re only acquiring and holding bitcoin, right? That’s our strategy.”

FAQs

Is Strategy the same as MicroStrategy?

Yes. Strategy is the new name for MicroStrategy, reflecting the company’s transformation from a business intelligence software firm into a Bitcoin-focused enterprise.

Has MicroStrategy changed its name to Strategy?

Yes. In February 2025, MicroStrategy officially rebranded as Strategy, in a display of deeper commitment to Bitcoin as its core strategic asset and business focus.

What kind of company is MSTR?

MSTR (Strategy’s stock ticker) represents a publicly traded company that operates as a Bitcoin holding and development firm with a legacy business in enterprise analytics software. Today, it is best known as the largest corporate holder of Bitcoin and is often used by investors as a leveraged proxy for Bitcoin exposure.

Is Strategy still a software company?

Technically, yes, but software now represents a small portion of its revenue and public identity. The company is primarily valued for its Bitcoin strategy.

What are STRD, STRK, and STRF stocks?

These are tickers for different series of convertible preferred stock issued by Strategy. They are hybrid securities that pay a high, fixed dividend to investors and can be converted into common stock under certain conditions. They represent a newer, more complex tool the company uses to raise capital to buy more Bitcoin.

What are STRD, STRK, and STRF stocks?

These are tickers for different series of convertible preferred stock issued by Strategy. They are hybrid securities that pay a high, fixed dividend to investors and can be converted into common stock under certain conditions. They represent a newer, more complex tool the company uses to raise capital to buy more Bitcoin.

What happens to Strategy if Bitcoin’s price crashes?

Strategy could face significant impairment losses, stock declines, and difficulty servicing its debt if BTC crashes and stays low for an extended period.

How does fair value accounting affect Strategy’s earnings?

Effective January 1, 2025, Strategy adopted new fair value accounting rules. This means it can now report both unrealized gains and losses on its Bitcoin holdings in its quarterly earnings reports. Previously, it could only report impairment losses. This change does not alter the underlying economics but leads to extremely volatile reported earnings that are directly tied to Bitcoin’s price fluctuations during a given quarter.

Where does Strategy store its Bitcoin?

Strategy uses institutional-grade custody providers (e.g., Coinbase Prime) and multi-signature cold wallets for secure storage.

What is Strategy’s average cost basis for Bitcoin?

The company’s average cost per BTC is nearly $68,459 as of April 28, 2025, based on all purchases since 2020, according to Strategy’s website.